The headlines continue to be dominated by the health risks associated with the COVID-19 virus, along with the economic impact of pandemic mitigation steps.

NamePros members have discussed the pandemic itself, the ethics of holding coronavirus domain names, whether the demand for domain names will change, and a multitude of other pandemic-related topics.

In this article, I look at how an individual domain name investor might respond in these uncertain times.

Assess Your Personal Financial Situation

While some NamePros members are full-time domain investors, for many, their primary income sources are other businesses, jobs or investments.

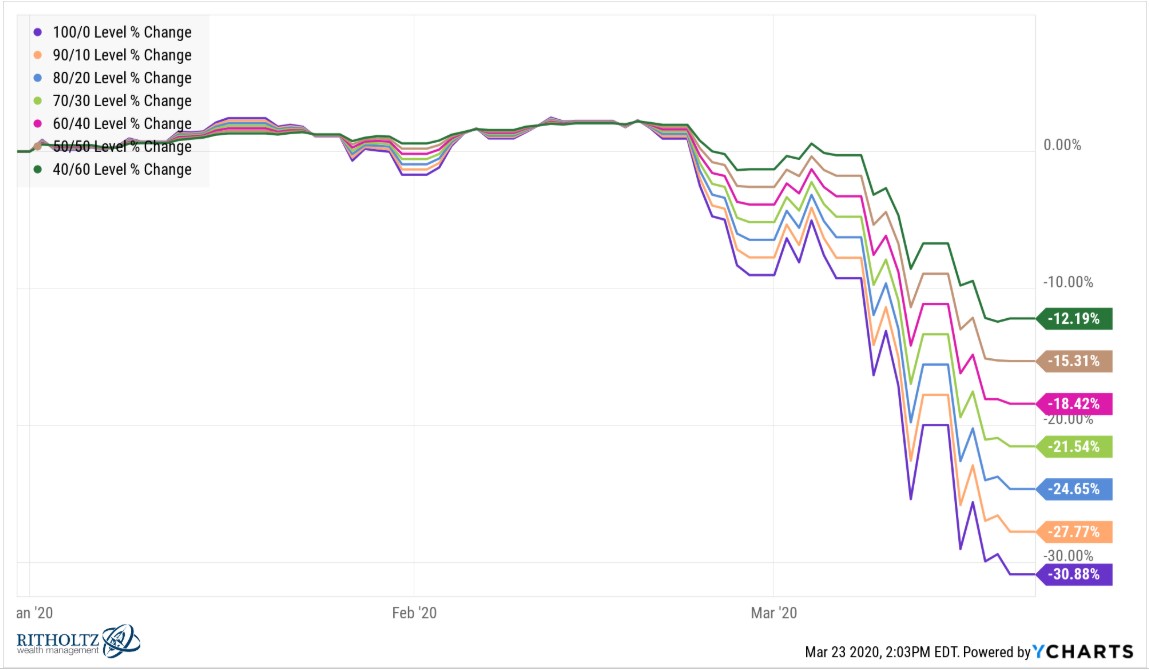

Businesses that were thriving just a month ago, may now be shuttered and in danger of failing. Jobs that seemed secure a few weeks ago, may have ended or be in danger. Investments in equities and bonds have lost, in just a few weeks, gains made over multiple years. Investments in real estate, are suddenly less liquid.

This may mean that instead of putting domain name profits back into domain investments, some will be looking to take money out of their domain portfolio for basic living expenses. Also, whereas in the past there was a cushion of revenue from other sources to cover renewals and other costs, that may no longer be the case.

The first step is to assess your personal financial situation, and decide what money, if any, needs to be taken out of your domain portfolio.

Expected Domain Related Expenses

Based on your sales in recent years, estimate probable domain sales revenue. Incorporate a safety factor for the uncertain business climate.

Calculate the renewal costs, both in total for the year, and by month due. You may already be using a service that gives you this information. Also, include all other domain-related costs such as hosting, subscriptions, etc.

Put in realistic, but conservative, estimates for any on-going revenue from domain-related activities such as monetized parking, affiliate relationships, consulting, advertising, etc.

Considering all of this, decide whether you need to sell a portion of your domain name portfolio. If so, see the next section regarding setting priorities. If not, you may regard the coming year as a buying opportunity and a time to enhance your portfolio.

Set Priorities

I find it personally helpful to divide the portfolio into three groups: definitely renew, let go at end of year (or sell before), or uncertain.

Factors that can be considered include number of inquiries, trends, number and value of offers, traffic, comparable recent sales, etc.

Remember to look forward to what areas may be stronger in the coming years, as covered in the next section.

Even a modest return from sales of unwanted domain names, may help you protect the names you definitely want to keep.

Don’t panic and sell domain names that should be retained. However, an emphasis on the quality of your portfolio will help protect what is important.

Don’t rush into this. Make your tentative priority list, set it aside for a few days, then return, perhaps after additional research, and see if your opinions have changed.

What Areas Will Be Strong?

Numerous articles have been written on the topic of what businesses will emerge stronger after the pandemic. For example, this article at TheConversation indicates that eCommerce, video conferencing, streaming, and delivery services will be among the winners, while travel, traditional retail, in-person entertainment and sports will be among the likely losers.

Most agree that we will see more remote offering of services, such as education and training, medical, therapy, advising, etc.

Additional possible shifts in domain demand are expressed in the thread started by Doron Vermaat on whether the coronavirus will increase demand for domain names.

New Zealand business expert Dr. Michael Lee studied what types of business are likely to succeed or fail in the post-virus world. He considers each business according to its placement on two axes. One axis indicates how time synchronized is the product or service offered by that business. The other axis looks at how localized in place is the service.

Sensitivity to physical distancing and personal health will probably live on long past the pandemic. Businesses that can serve customers at various places, including remotely, and on a flexible time schedule, will be more capable of ensuring appropriate distancing.

Using this system, Dr. Lee rated each type of business into thrive, survive or dive. Venue entertainment and sports were placed in the dive category, since they are both localized and time-specific. On the other hand, online education and electronic commerce should thrive, due to no limits on time or place.

Domain investors may find it helpful to categorize the niche represented by each of their domains as thrive, survive or dive. That should not be the only consideration on whether to retain the domain name, however.

Your Time Resources

Changes in personal circumstances may mean that you have additional time to put into presentation of your domain names, research and development. Last week Tom outlined how to view this as an opportunity, and what steps to take to make best use of your extra time.

Think Like an End User

Opinions vary significantly on the domain resale market outlook for the next 6 to 12 months. Some see a downturn in domain name sales, while others, such as Rob Monster, feel that there will be a boom as people have more digital lives and those who lost jobs start new online ventures.

In a discussion about whether this is a good time for outbound, most expressed the view that it is not. Business owners are stressed about just having their business survive, and in most cases are not going to be receptive to a cold contact.

Keep in mind that those who are purchasing domain names, perhaps for small digital service startups, will nonetheless be wary about the overall financial climate. With reasonable prices, and monthly payment plan options, or other forms of compensation, more sales may be completed.

All of this can be summarized by think like an end-user, or at least try to consider the end-user perspective. Be sensitive to the financial pressures and uncertainty of your potential buyers.

Finally, because of the rapidly changing business climate, it makes sense to close sales as expeditiously as possible. This may impact what payment options you accept and prefer.

Share Your Views

I also wanted to draw your attention to Keith DeBoer Domain Market Booms and Busts. Although written about a year and a half ago, this is the perfect time to read it.

I hope readers will share in the comments section their personal views on the health of the domain business, how the pandemic has affected their domain name operations, and what changes in types of domain names they see going forward. While it is perhaps too soon to say, I would also welcome views on the change, if any, yet seen in recent domain demand.

I would like to acknowledge numerous people from the industry, both NamePros members and others, whose views and ideas helped inform this article. Special thanks to Michael Cyger for the idea of starting with a look at ongoing expenses. This article is for informational purposes and should not be considered financial or investment advice.

NamePros members have discussed the pandemic itself, the ethics of holding coronavirus domain names, whether the demand for domain names will change, and a multitude of other pandemic-related topics.

In this article, I look at how an individual domain name investor might respond in these uncertain times.

Assess Your Personal Financial Situation

While some NamePros members are full-time domain investors, for many, their primary income sources are other businesses, jobs or investments.

Businesses that were thriving just a month ago, may now be shuttered and in danger of failing. Jobs that seemed secure a few weeks ago, may have ended or be in danger. Investments in equities and bonds have lost, in just a few weeks, gains made over multiple years. Investments in real estate, are suddenly less liquid.

This may mean that instead of putting domain name profits back into domain investments, some will be looking to take money out of their domain portfolio for basic living expenses. Also, whereas in the past there was a cushion of revenue from other sources to cover renewals and other costs, that may no longer be the case.

The first step is to assess your personal financial situation, and decide what money, if any, needs to be taken out of your domain portfolio.

Expected Domain Related Expenses

Based on your sales in recent years, estimate probable domain sales revenue. Incorporate a safety factor for the uncertain business climate.

Calculate the renewal costs, both in total for the year, and by month due. You may already be using a service that gives you this information. Also, include all other domain-related costs such as hosting, subscriptions, etc.

Put in realistic, but conservative, estimates for any on-going revenue from domain-related activities such as monetized parking, affiliate relationships, consulting, advertising, etc.

Considering all of this, decide whether you need to sell a portion of your domain name portfolio. If so, see the next section regarding setting priorities. If not, you may regard the coming year as a buying opportunity and a time to enhance your portfolio.

Set Priorities

I find it personally helpful to divide the portfolio into three groups: definitely renew, let go at end of year (or sell before), or uncertain.

Factors that can be considered include number of inquiries, trends, number and value of offers, traffic, comparable recent sales, etc.

Remember to look forward to what areas may be stronger in the coming years, as covered in the next section.

Even a modest return from sales of unwanted domain names, may help you protect the names you definitely want to keep.

Don’t panic and sell domain names that should be retained. However, an emphasis on the quality of your portfolio will help protect what is important.

Don’t rush into this. Make your tentative priority list, set it aside for a few days, then return, perhaps after additional research, and see if your opinions have changed.

What Areas Will Be Strong?

Numerous articles have been written on the topic of what businesses will emerge stronger after the pandemic. For example, this article at TheConversation indicates that eCommerce, video conferencing, streaming, and delivery services will be among the winners, while travel, traditional retail, in-person entertainment and sports will be among the likely losers.

Most agree that we will see more remote offering of services, such as education and training, medical, therapy, advising, etc.

Additional possible shifts in domain demand are expressed in the thread started by Doron Vermaat on whether the coronavirus will increase demand for domain names.

New Zealand business expert Dr. Michael Lee studied what types of business are likely to succeed or fail in the post-virus world. He considers each business according to its placement on two axes. One axis indicates how time synchronized is the product or service offered by that business. The other axis looks at how localized in place is the service.

Sensitivity to physical distancing and personal health will probably live on long past the pandemic. Businesses that can serve customers at various places, including remotely, and on a flexible time schedule, will be more capable of ensuring appropriate distancing.

Using this system, Dr. Lee rated each type of business into thrive, survive or dive. Venue entertainment and sports were placed in the dive category, since they are both localized and time-specific. On the other hand, online education and electronic commerce should thrive, due to no limits on time or place.

Domain investors may find it helpful to categorize the niche represented by each of their domains as thrive, survive or dive. That should not be the only consideration on whether to retain the domain name, however.

Your Time Resources

Changes in personal circumstances may mean that you have additional time to put into presentation of your domain names, research and development. Last week Tom outlined how to view this as an opportunity, and what steps to take to make best use of your extra time.

Think Like an End User

Opinions vary significantly on the domain resale market outlook for the next 6 to 12 months. Some see a downturn in domain name sales, while others, such as Rob Monster, feel that there will be a boom as people have more digital lives and those who lost jobs start new online ventures.

In a discussion about whether this is a good time for outbound, most expressed the view that it is not. Business owners are stressed about just having their business survive, and in most cases are not going to be receptive to a cold contact.

Keep in mind that those who are purchasing domain names, perhaps for small digital service startups, will nonetheless be wary about the overall financial climate. With reasonable prices, and monthly payment plan options, or other forms of compensation, more sales may be completed.

All of this can be summarized by think like an end-user, or at least try to consider the end-user perspective. Be sensitive to the financial pressures and uncertainty of your potential buyers.

Finally, because of the rapidly changing business climate, it makes sense to close sales as expeditiously as possible. This may impact what payment options you accept and prefer.

Share Your Views

I also wanted to draw your attention to Keith DeBoer Domain Market Booms and Busts. Although written about a year and a half ago, this is the perfect time to read it.

I hope readers will share in the comments section their personal views on the health of the domain business, how the pandemic has affected their domain name operations, and what changes in types of domain names they see going forward. While it is perhaps too soon to say, I would also welcome views on the change, if any, yet seen in recent domain demand.

I would like to acknowledge numerous people from the industry, both NamePros members and others, whose views and ideas helped inform this article. Special thanks to Michael Cyger for the idea of starting with a look at ongoing expenses. This article is for informational purposes and should not be considered financial or investment advice.