Each July I take a look at domain name sales from the first six months of the year, comparing to the similar period from the preceding year. Taken across all extensions, 2021 is off to a roaring start, with the number of sales up 27.6% compared to the first-half of 2020. The sales dollar volume is up even more, 46.5%. The average sales price is also up, almost 14.8%.

COM Remains King

The

The average

There was a 45.2% increase in dollar volume for

Prices Strong in NET

While there are far fewer sales reported in

While it is surprising that the average price of

Higher ORG Sales Volume than NET

All of the metrics were up for 2021 compared to 2020 in the

The trend seen in previous years held, with significantly higher dollar volume in

Little Change in INFO

The

Slow Sales but Higher Prices for BIZ

The first six months of 2021 were slow in the

Country Code Domains Roar

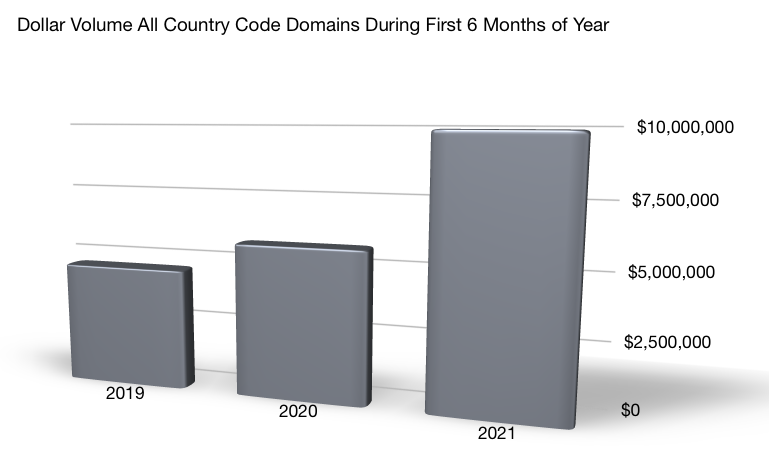

There was strong growth in country code extensions as a whole, with 16.9% increase in number sold, 48.2% increase in average price, and a 73.2% increase in dollar volume, when compared to 2020.

The graph below shows the dramatic growth in country code dollar volume.

Average prices remain significantly higher in country code domain sales compared to legacy extensions, with the 2021 average price $2371. I look at data for specific country code extensions below.

IO Prices and Volume Accelerate

After staying relatively constant during the first six months of 2020 and 2019, in 2021 dollar volume in

CO Sales Skyrocket

Not to be left out, the

Trends in Other Generic Country Code Extensions

I tracked a number of other country codes, with results for some of the extensions considered largely generic presented below.

While some of the following extensions find limited generic use, most are used primarily within the country.

When we compare the first six months of 2021 to the similar period of 2020 for new domain extensions, the so called new gTLDs, the number of sales is up by 54.4%, but the sales dollar volume is up only 6.0%. That is because the average price per sale dropped to $1902 in the first six months of 2021. While that is still significantly higher than any of the legacy extensions, it is down from the $2772 average for the first-half of 2020.

Here is a look at the picture for several individual new extensions.

Great Period for Major Sales

The first-half of 2021 saw significantly more major sales with 55 sales above $100,000, including 10 sales above $500,000. By comparison, during the same period in 2020 there were 30 sales above $100,000 but just one sale above $500,000. In 2020 6 of the 7 sales above $500,000 occurred in the second-half of the year.

In the first-half of 2021, 42 of the 55 sales above $100,000 were in

The Fine Print

The data for this study came from the NameBio database, and does not include all domain name sales.The impact of which venues report to NameBio is important to keep in mind.

The 2021 data were accessed July 1, 2021. It is likely that the actual numbers for the six month period will be slightly higher, due to reporting delay for some sales. I accessed on the same date for last year’s report, however, so the results across years are consistent.

NameBio reported sales are a mix of wholesale and retail transactions. This mix is particularly troublesome for average prices, where one is computing an average based on two different populations. Also, some extensions have strong wholesale markets while in others almost all reported sales are retail.

Apparent conclusions may not always be correct. For example, if the number of sales in an extension go up, it might mean that there is increasing interest in the extension. However, alternatively it could reflect lagging interest, resulting in liquidation of holdings.

For some of the extensions covered, the actual number of sales is small and therefore changes may simply reflect statistical fluctuation rather than authentic trends.

Here are links to the NamePros Blog articles for the similar report in previous years.

So what changes are happening in the domain market in 2021 from your perspective? Please share in the comments section.

Sincere thanks to NameBio for the amazing domain sales resource used for this analysis.

COM Remains King

The

.com extension accounted for 86.7% by number of all sales. By dollar volume, 76.8% of all sales were .com during early 2021, compared to 79.3% for the first six months of 2020.The average

.com sales price for the 6-month period of 2021 was $973, up about 11.2% from 2020. That rather low average price reflects that the majority of .com sales in the NameBio database are wholesale acquisitions, rather than retail sales.There was a 45.2% increase in dollar volume for

.com sales during the first part of 2021.Prices Strong in NET

While there are far fewer sales reported in

.net compared to .com, just 1673 versus 65,300, .net still accounted for more than $2.4 million in sales during the six-month period. The dollar volume for .net was up by 52.4%, driven by a surprisingly high average price of $1439. The number of sales in .net was down 6.3%.While it is surprising that the average price of

.net was so much higher than .com, I think it mainly reflects that the ratio of wholesale to retail transactions is higher in .com. It is possible that there was some release of high quality .net names as investors concentrated on other extensions.Higher ORG Sales Volume than NET

All of the metrics were up for 2021 compared to 2020 in the

.org extension. The number of sales was up 9.6%, the average price up 15.9% and the sales dollar volume up 27.1%.The trend seen in previous years held, with significantly higher dollar volume in

.org than .net. In the first six months of 2021 .org accounted for about $3.464 million in NameBio-recorded sales, compared to $2.407 million in .net sales.Little Change in INFO

The

.info extension sales don’t make up much of the aftermarket pie, just 162 sales during the 6-month period of 2021, a drop of 13.4%. The average price was up, but still just $528. That helped the dollar volume in the extension to edge up 7.6% when compared to 2020.Slow Sales but Higher Prices for BIZ

The first six months of 2021 were slow in the

.biz extension, with only 41 sales recorded in NameBio, compared to 64 during the same period of 2020. The average price was a surprisingly robust $1442 in 2021, compared to just $538 in the first half of 2020, and about the same in 2019. The dollar volume was up 71.7% in .biz compared to 2020.Country Code Domains Roar

There was strong growth in country code extensions as a whole, with 16.9% increase in number sold, 48.2% increase in average price, and a 73.2% increase in dollar volume, when compared to 2020.

The graph below shows the dramatic growth in country code dollar volume.

Average prices remain significantly higher in country code domain sales compared to legacy extensions, with the 2021 average price $2371. I look at data for specific country code extensions below.

IO Prices and Volume Accelerate

After staying relatively constant during the first six months of 2020 and 2019, in 2021 dollar volume in

.io sales was up about 378%. The average price was up 219%, to $2471 in 2021.CO Sales Skyrocket

Not to be left out, the

.co extension also had a stellar year. The average sales price of $2758 was up 87.5%, while the number of sales more than doubled compared to the first six months of 2020. As a result, the sales dollar volume in .co was up by a factor of about 4.4.Trends in Other Generic Country Code Extensions

I tracked a number of other country codes, with results for some of the extensions considered largely generic presented below.

.aisales grew slowly, with dollar volume almost constant.- The

.ccaverage price was down to $859, compared to $1449 in 2020, so sales volume was also down. It should be pointed out, however, that the average price in 2021 was almost identical to 2019 in this extension. - The

.ggextension finds use in gaming. If we compare the first 6 months of 2019, 2020 and 2021, the number of sales has grown from 6 to 76 to 138. As a result, sales volume was up 375% in.gg. - The number of sales in

.lywas down compared to both 2019 and 2020, although the sales volume did manage to increase by 35%. - The number of sales in

.mewas down, but the average price per sale increased to $1476. As a result the sales volume was up 81% during the first six months of 2021 compared to the similar period of 2020. - A strong average sales price of $3012 in

.tvhelped propel the sales volume to a threefold increase. - The

.vcextension, popular in the venture capital community, has grown from almost no aftermarket sales two years ago to more than $175,000 in volume during the first six months of 2021. The average sales price in.vcwas a very healthy $2544 in 2021, compared to just $321 during the similar period of 2020.

While some of the following extensions find limited generic use, most are used primarily within the country.

- While the number of NameBio-reported sales in

.cncontinues to be low, the average sales price in 2021 was a surprising $8134. - While the number of sales in

.co.ukwas almost constant, and the average price per sale was still very strong at $5524, that was down slightly from the similar period in 2020. The first level.ukextension just had 13 reported sales during the period, down from 2020. - Germany’s

.deextension is always one of the top performers in the world, and it had a particularly strong first half of 2021. The number of reported sales was up 53% and the dollar volume up 42.7%. The average price per sale was down slightly, but still very strong at $4391. - The future seems bright for India’s

.in, with a much stronger average sales price of $2403 in 2021. As a result dollar volume was up 18%. - The

.usextension was up 43% in number of sales and 43.6% in average price. Dollar volume in the extension approximately doubled during the first six months of 2021 compared to the similar period in 2020. The 2021 average price in.uswas $1245.

When we compare the first six months of 2021 to the similar period of 2020 for new domain extensions, the so called new gTLDs, the number of sales is up by 54.4%, but the sales dollar volume is up only 6.0%. That is because the average price per sale dropped to $1902 in the first six months of 2021. While that is still significantly higher than any of the legacy extensions, it is down from the $2772 average for the first-half of 2020.

Here is a look at the picture for several individual new extensions.

- Sales of

.appdropped in both number and average price, so the reported sales volume of $143,174 is down 50% from similar period of 2020. It should be stated, though, that the average sales price of $4211 in.appwas still one of the highest of any extension. - The

.clubextension had a good start to 2021, with the number of sales and the dollar volume both more than doubling the figures for the same period of 2020. There was little change in average price, at $2552 in 2021. - In terms of the new extensions, 2021 definitely appears to be the year of

.xyz. The number of sales quadrupled compared to 2020, while the average price more than doubled, to $2990 in 2021. As a result, the total dollar volume during the first six months went from $31,400 in 2020 to $313,950 in 2021.

Great Period for Major Sales

The first-half of 2021 saw significantly more major sales with 55 sales above $100,000, including 10 sales above $500,000. By comparison, during the same period in 2020 there were 30 sales above $100,000 but just one sale above $500,000. In 2020 6 of the 7 sales above $500,000 occurred in the second-half of the year.

In the first-half of 2021, 42 of the 55 sales above $100,000 were in

.com. The country codes accounted for 9 of the major sales, while .net and .org had 2 each.The Fine Print

The data for this study came from the NameBio database, and does not include all domain name sales.The impact of which venues report to NameBio is important to keep in mind.

The 2021 data were accessed July 1, 2021. It is likely that the actual numbers for the six month period will be slightly higher, due to reporting delay for some sales. I accessed on the same date for last year’s report, however, so the results across years are consistent.

NameBio reported sales are a mix of wholesale and retail transactions. This mix is particularly troublesome for average prices, where one is computing an average based on two different populations. Also, some extensions have strong wholesale markets while in others almost all reported sales are retail.

Apparent conclusions may not always be correct. For example, if the number of sales in an extension go up, it might mean that there is increasing interest in the extension. However, alternatively it could reflect lagging interest, resulting in liquidation of holdings.

For some of the extensions covered, the actual number of sales is small and therefore changes may simply reflect statistical fluctuation rather than authentic trends.

Here are links to the NamePros Blog articles for the similar report in previous years.

So what changes are happening in the domain market in 2021 from your perspective? Please share in the comments section.

Sincere thanks to NameBio for the amazing domain sales resource used for this analysis.