For each of the last four years, I have looked at NameBio reported domain sales in a number of extensions. The data reflects the situation just after the close of the year. While some sales for the year get reported late, by using a consistent procedure from year to year, the trends should not be significantly biased.

This report is based on 150,400 sales recorded for 2022 in NameBio, with an average price of $1178, and a total dollar volume of just over $177 million.

Over all extensions, 2022 saw a slight dip in both number of sales, down 0.3%, with total sales dollar volume, down 0.9%. Keep in mind that this is a comparison to 2021, which was a very strong year. If we compare to 2020 or 2019, 2022 was higher by both measures.

Many sales, particularly retail sales, are not reported in NameBio. They may be from venues with no reported data, private sales, or sales subject to NDA. Almost all registries no longer report premium sales.

A higher percentage of wholesale transactions are recorded in NameBio, and the mix of wholesale and retail means that one should interpret average prices, and trends in number of domains sold, with caution.

To maintain consistency with past reports, I counted all sales of $100 and up. That means many wholesale acquisitions are included. The total dollar volume is dominated by the higher-price retail sales, so a different cutoff would not influence that much. However, the number of sales is very different if one uses a higher cutoff price.

Since the average price is very sensitive to a few large sales, and the number of sales is strongly influenced by wholesale transactions, the total dollar volume is probably the best indicator of overall strength.

I did computations for 78 different extensions, although not all results were significant enough to be reported here.

.COM

If we consider

.NET

The number of sales recorded in NameBio for

.ORG Keeps Growing

The

There were just over twice as many

.INFO

While the market for

.BIZ

Another legacy extension,

.PRO

The

Country Code Extensions Drop

Country code extensions had very strong years in 2020 and 2021, but, overall, suffered a pullback in 2022. There were 3.3% fewer sales in country code extensions reported in NameBio in 2022 compared to 2021. The total dollar volume was down by 24.8%. That needs to be placed within a multiyear picture, however.

Some of the more important individual country code extensions are covered below.

.IO Number Up, Dollar Volume Down

The

.CO Lags

The past few years have seen great sales in

Not Much Change In .TV

The

With GoDaddy having taken over managing the extension, it will be interesting to see what unfolds in 2023. I took an in-depth look at the extension recently in the NamePros Blog: The TV Extension: Sales, History, Pricing, Use.

Reported .VC Sales Down

The

.DE Dips, But Still Strong

One of the strongest national country-code domain extensions is Germany’s

.ME Drops

The

.IT Up

Italy’s

.EU Up

The

.IN Dollar Volume Up

India’s

Great Year For .TO

The repurposed

Growth In .CC

The repurposed

Those investing in the extension should research carefully the type of names that sell, as many, not all, of the sales are in numerics. Last year, I took at a look at what sells in the extension: A Close Look At The CC Domain Extension.

.AI Fell In 2022

At least in terms of NameBio-reported sales, the

.CO.UK Mixed

The

.GG Still In Wings

The

.US Zooms

The

Many National Country Code Extensions Down

While numbers are small in most cases, and perhaps not very significant, the dollar volume year-over-year was down in a number of national extensions including

This is somewhat surprising, as other measures, such as registrations and renewal rates, show strong adoption and use in many of the national country codes. It is likely that reporting of aftermarket sales is very inefficient in some of these extensions.

New Domain Extensions

Taken as a whole, aftermarket sales of new domain extensions were up 84.9% in number, from 2055 sales in 2021 to 4725 in 2022. The dollar volume was up 43.2%, to about $7.3 million in 2022. Since 2021 was already a strong year in new extensions, this further increase was impressive. I show the four-year pattern in dollar volume below.

The rise in new extensions was largely driven by

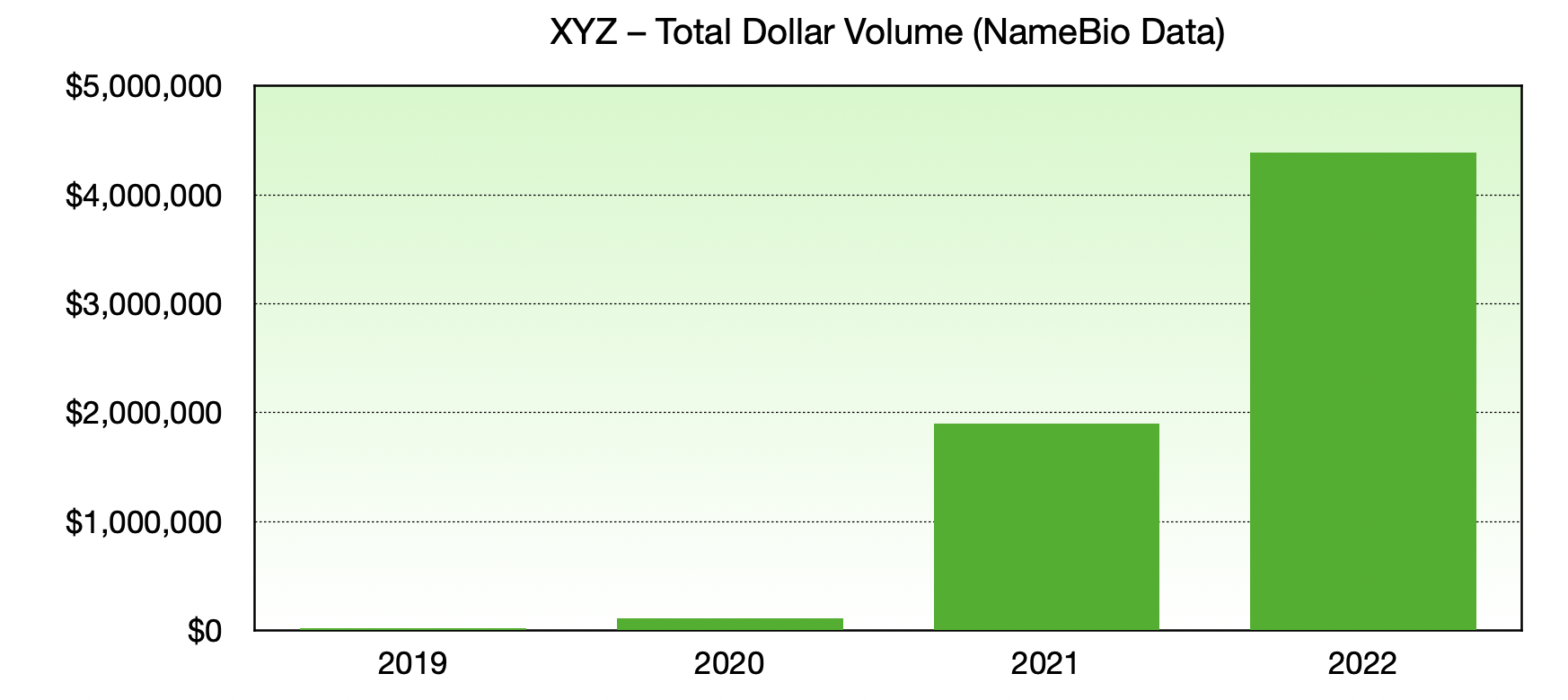

XYZ Surge Continues

The number of NameBio reported

The average price was $2733 in 2022, higher than any of the legacy extensions.

The sales volume in

To put the 2022 dollar volume in perspective,

.ART Growth Stalls

A year ago, it seemed that the

.APP Up

The

.CLUB Falters

The

.ONE

There are still not many reported sales in

.WORLD

Is

Other new extensions showing dollar volume growth in 2022 included

.COM Domination

The dominance of

Taken as a whole, country codes account for 5.9% of the total number of domain sales, and 7.8% of total dollar volume.

Combined, new extensions represent 3.1% of all domain sales, although a higher percentage, 7.8%, by dollar volume.

Notes And Limitations

It is important to keep the following points in mind.

If you want to read the similar report from a year ago, here is the link: 2021: Domain Name Sales Very Strong.

Keep in mind that this was a look at the year in total. In most segments of the market, the first half of 2022 was stronger than the second half. A majority of investors are predicting that 2023 will be better than 2022. In a year’s time we will see if they were right.

This is personally one of my favourite posts each year. While numbers and trends alone do not tell you what to invest in, I think it is interesting to look at the sales data, including changes from the previous year. Each year trends emerge that I would not have predicted.

My sincere thanks for NameBio. The superb interface makes it easy to do an analysis such as this one using their data. Thank you. I just analyze and present the data – NameBio do the hard work.

This report is based on 150,400 sales recorded for 2022 in NameBio, with an average price of $1178, and a total dollar volume of just over $177 million.

Over all extensions, 2022 saw a slight dip in both number of sales, down 0.3%, with total sales dollar volume, down 0.9%. Keep in mind that this is a comparison to 2021, which was a very strong year. If we compare to 2020 or 2019, 2022 was higher by both measures.

Many sales, particularly retail sales, are not reported in NameBio. They may be from venues with no reported data, private sales, or sales subject to NDA. Almost all registries no longer report premium sales.

A higher percentage of wholesale transactions are recorded in NameBio, and the mix of wholesale and retail means that one should interpret average prices, and trends in number of domains sold, with caution.

To maintain consistency with past reports, I counted all sales of $100 and up. That means many wholesale acquisitions are included. The total dollar volume is dominated by the higher-price retail sales, so a different cutoff would not influence that much. However, the number of sales is very different if one uses a higher cutoff price.

Since the average price is very sensitive to a few large sales, and the number of sales is strongly influenced by wholesale transactions, the total dollar volume is probably the best indicator of overall strength.

I did computations for 78 different extensions, although not all results were significant enough to be reported here.

.COM

If we consider

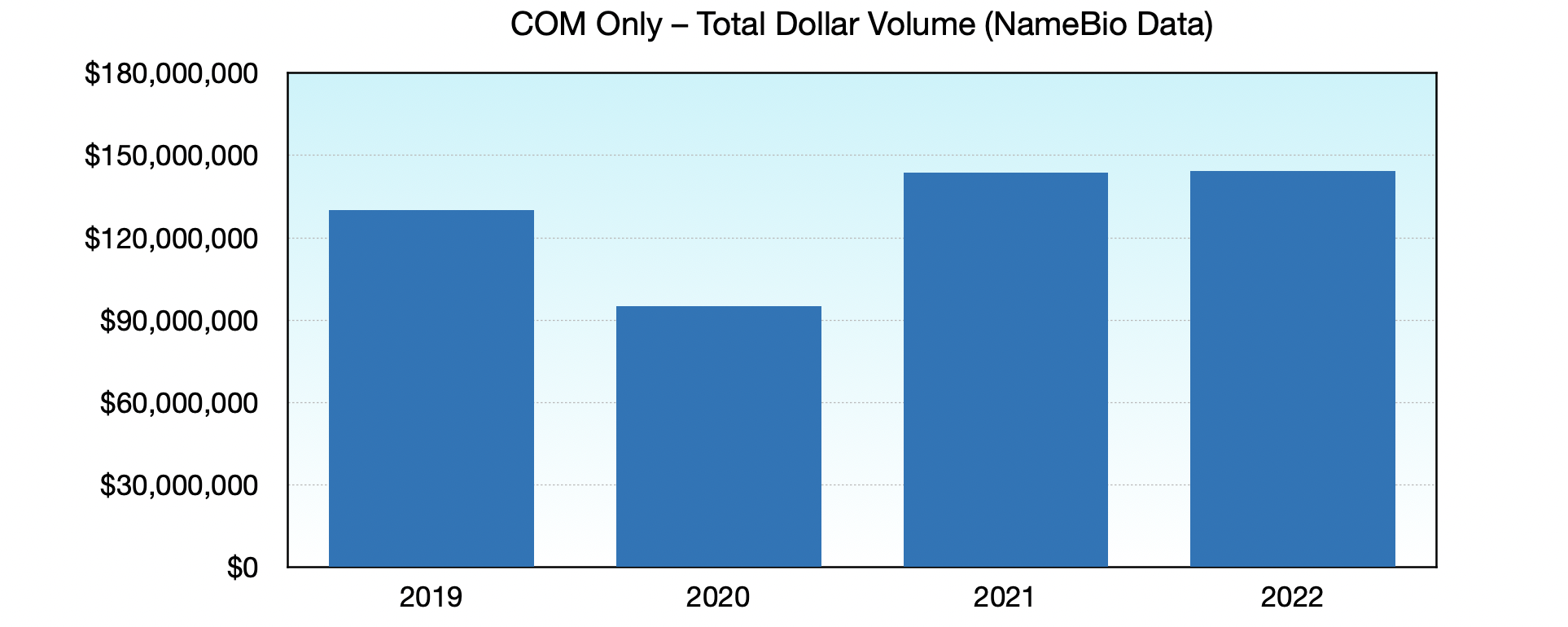

.com only, the number of reported aftermarket sales decreased by 2.9% in 2022 compared to 2021. A slightly higher average price, $1156 vs $1119 in 2021, meant that the dollar volume increased 0.3%. Shown below is the total sales dollar volume for .com only by year..NET

The number of sales recorded in NameBio for

.net was up 10.2%, but a significantly lower average price ($865 vs. $1278), meant that the total sales dollar volume was down 25.4%, although that was when compared with a relatively strong 2021..ORG Keeps Growing

The

.org extension is on a slow but steady increase, year by year. When we compare 2022 with 2021, the .org number of sales was up 14.1%, while sales dollar volume was up 19.5%. As we see below, that is a consistent pattern over the last few years.There were just over twice as many

.org sales compared to .net, accounting for about 2.5x the dollar volume..INFO

While the market for

.info is much smaller, just 441 sales recorded in NameBio over the year, the number of sales was up 10.8% compared to 2021, and the dollar volume up 50%. It still only accounts for only about $282,000 in sales..BIZ

Another legacy extension,

.biz, was modestly up, 5.1% in number of sales and 4.1 % in dollar volume, but that was based on only 83 sales recorded in NameBio over the year..PRO

The

.pro extension had a good year, with number of sales more than doubling, 53 in 2021 to 118 in 2022, and the dollar volume up 35.1% year-over-year.Country Code Extensions Drop

Country code extensions had very strong years in 2020 and 2021, but, overall, suffered a pullback in 2022. There were 3.3% fewer sales in country code extensions reported in NameBio in 2022 compared to 2021. The total dollar volume was down by 24.8%. That needs to be placed within a multiyear picture, however.

Some of the more important individual country code extensions are covered below.

.IO Number Up, Dollar Volume Down

The

.io extension has become the most important generic country code extension. When we compare 2022 to 2021, the number of sales was up 21.3%, but the dollar volume was down 43.6%. The total dollar volume for the year, at least that recorded in NameBio, was about $2.3 million. Rising renewal costs post challenges to long-term holding of names with low anticipated sell-through rates..CO Lags

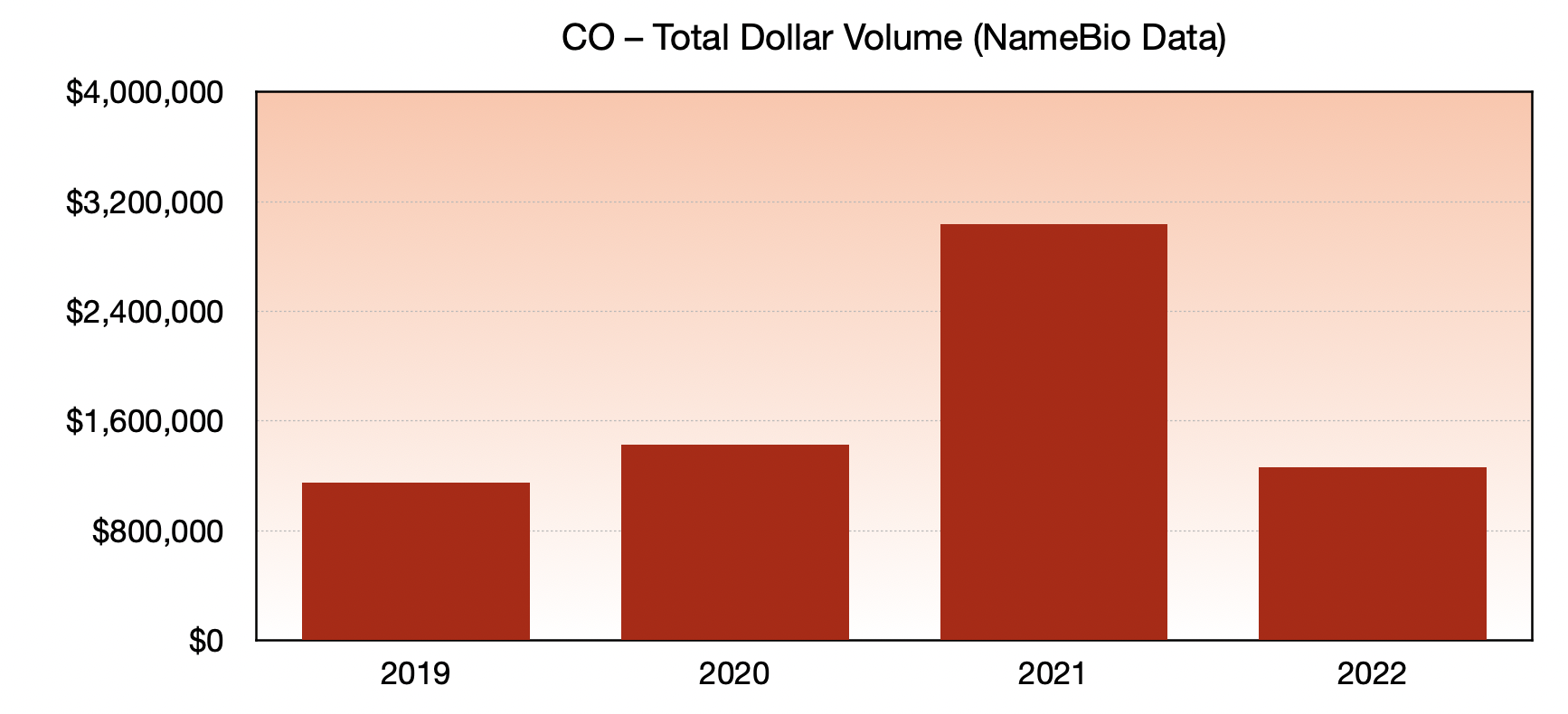

The past few years have seen great sales in

.co, but the momentum faltered in 2022. The number of .co sales was down 36.6%, and the dollar volume down 58.4%. That is partly due to a great 2021, as the multiyear graph below indicates.Not Much Change In .TV

The

.tv extension had bounced back in 2021, and held that increase for the most part in 2022, with sales volume up 13.7%, and sales numbers approximately constant. Sales in .tv accounted for just over $509,000 total, in NameBio-reported 2022 sales.With GoDaddy having taken over managing the extension, it will be interesting to see what unfolds in 2023. I took an in-depth look at the extension recently in the NamePros Blog: The TV Extension: Sales, History, Pricing, Use.

Reported .VC Sales Down

The

.vc extension had begun to grow in 2020, and had a stellar 2021. At least in terms of NameBio-reported sales, that momentum was lost in 2022. Compared to 2021, sales volume was down 24.6%, and number of sales down 41.9%. There were 100 NameBio-reported sales in the extension, down from 172 the previous year. One of the key sellers and brokers in .vc does not report sales to NameBio, though, so the full picture could be different..DE Dips, But Still Strong

One of the strongest national country-code domain extensions is Germany’s

.de. The number of sales in .de dipped by 8.4% in 2022 compared to 2021, and the sales dollar volume fell 19.9%. While the average price of $3783 was still solid, that was down from the previous year..ME Drops

The

.me extension saw number of sales drop 17.4% year-over-year, and sales dollar volume was down 22.3%, to about $292,000 total..IT Up

Italy’s

.it is both a strong national country code, and useful for English language expressions across the dot. Although only 54 NameBio-recorded sales in 2022, that was up 42% in number of sales, and 199% higher in sales dollar volume..EU Up

The

.eu extension only had 87 NameBio-reported sales for 2022, but that was up from 61 in the previous year. The dollar volume was up 19.3% year-over-year. The extension accounted for about $292,000 total sales for the year..IN Dollar Volume Up

India’s

.in is home to a strongly expanding economy, and, as a bonus, the extension is potentially useful for English language expressions across the dot. While still fewer than 100 NameBio sales reported in the extension in 2022, a drop of 24.4%, the dollar volume was up 31.8% year-over-year, buoyed by a very healthy average price of $4071.Great Year For .TO

The repurposed

.to domain extension had a stellar 2022, with number of sales up 46.8% and sales volume up 86.3%. That may be partly due to more complete reporting, but is still impressive. The 2022 sales volume of about $622,000 was higher than such well known country codes as .tv, .me, .it, .eu, and .gg.Growth In .CC

The repurposed

.cc extension doesn’t get the attention it perhaps deserves. The 327 NameBio-reported sales in the extension in 2022 accounted for about $352,000 in dollar volume. The dollar volume was up 80.1%, while number of sales up 25.8%.Those investing in the extension should research carefully the type of names that sell, as many, not all, of the sales are in numerics. Last year, I took at a look at what sells in the extension: A Close Look At The CC Domain Extension.

.AI Fell In 2022

At least in terms of NameBio-reported sales, the

.ai extension fell year-over-year, both in number of sales and sales dollar volume. This was surprising, as most see a bright future for the extension. The number of sales was down 39.3%, and dollar volume down 23.0%. There were 720 reported sales in the extension for the year, with a total dollar volume of almost $883,000..CO.UK Mixed

The

.co.uk extension saw 32.7% more sales, but dollar volume dropped 7.1%, based on 142 sales with a total volume of $510,000. There were also 20 NameBio-reported 2022 sales in the .uk extension..GG Still In Wings

The

.gg extension is popular among a number of domain investors, with obvious application to the gaming community. However, it continues to lag in terms NameBio-reported retail sales. In 2022 there were 229 reported sales, a number investment acquisitions, totalling about $209,000. The number of reported .gg sales is down 25.9%, while the dollar volume down 19.5%..US Zooms

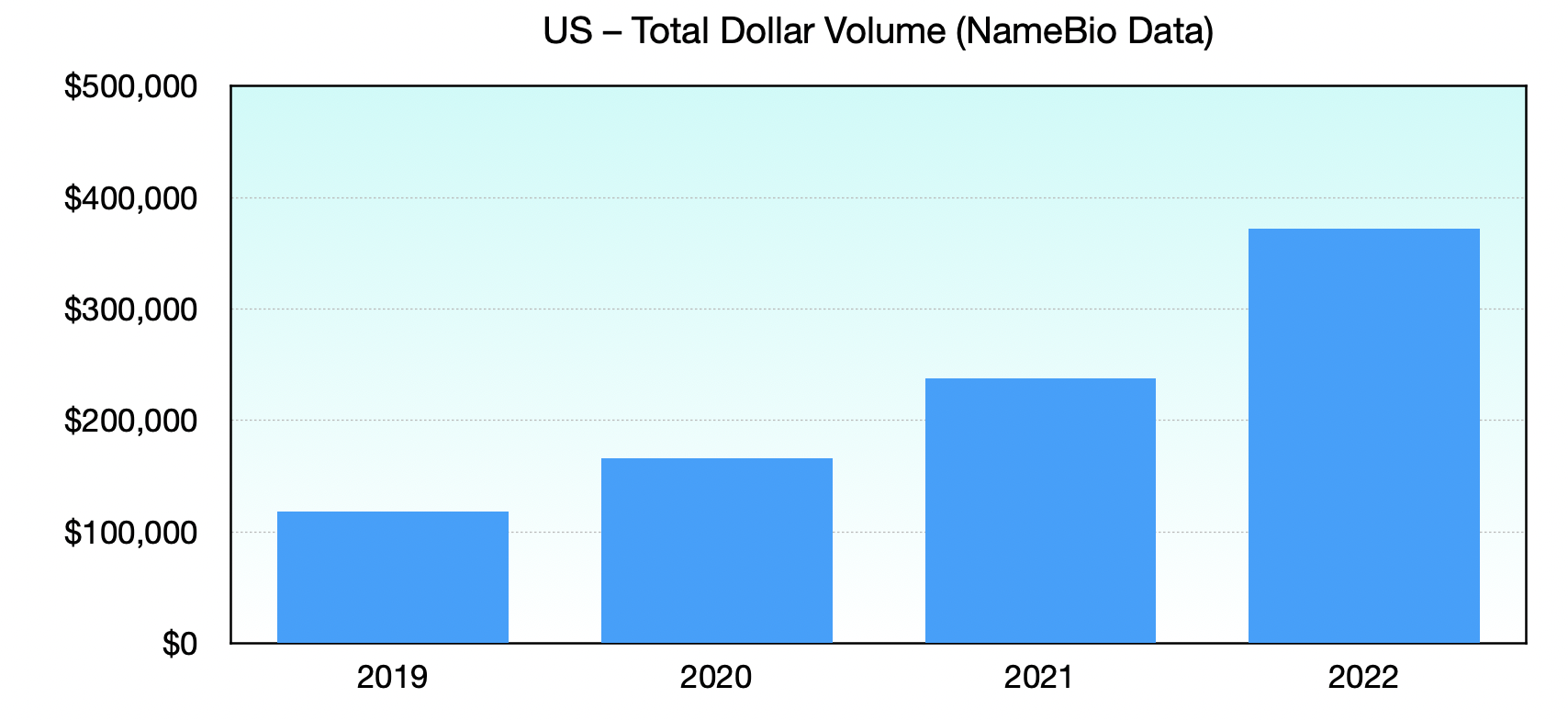

The

.us extension had a great 2022. The number of sales was up 30.5%, while dollar volume was up even more, 56.2%. NameBio-reported sales in the extension accounted for almost $372,000 in total. The average sales price was a very healthy $1260. The four-year trend for NameBio-reported .us is shown below.Many National Country Code Extensions Down

While numbers are small in most cases, and perhaps not very significant, the dollar volume year-over-year was down in a number of national extensions including

.ae, .ca, .ch, .cn, .es, and .jp, among others. In some of these cases, the number of sales was up, but the total volume down.This is somewhat surprising, as other measures, such as registrations and renewal rates, show strong adoption and use in many of the national country codes. It is likely that reporting of aftermarket sales is very inefficient in some of these extensions.

New Domain Extensions

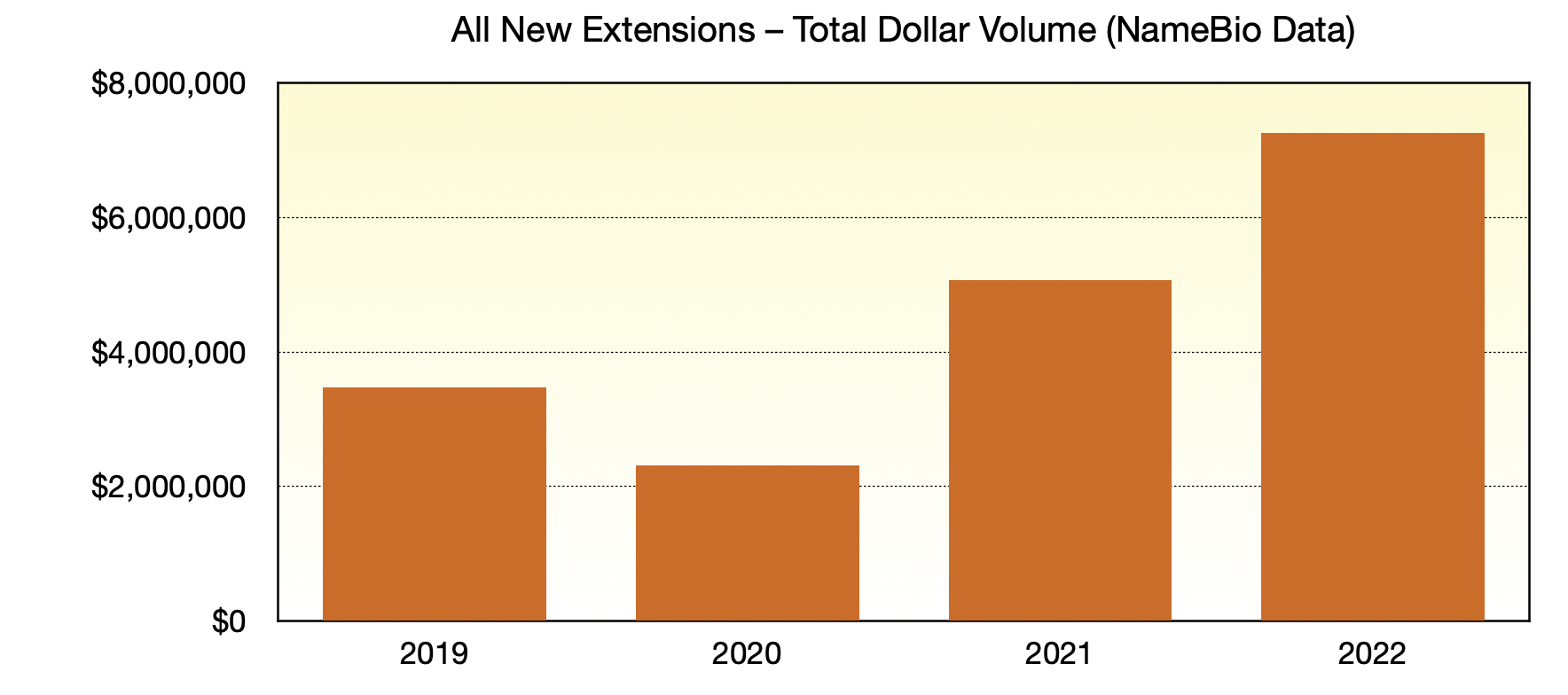

Taken as a whole, aftermarket sales of new domain extensions were up 84.9% in number, from 2055 sales in 2021 to 4725 in 2022. The dollar volume was up 43.2%, to about $7.3 million in 2022. Since 2021 was already a strong year in new extensions, this further increase was impressive. I show the four-year pattern in dollar volume below.

The rise in new extensions was largely driven by

.xyz. Many other new extensions that I tracked were down in dollar volume, including .link, .life, .network, .online and .top. Some of these had increases in number of sales, but not total dollar volume. In the sections below I look at a few new extensions individually.XYZ Surge Continues

The number of NameBio reported

.xyz sales went from 563 in 2021 to 1607 in 2022, an increase of 185.4%, although a number of those were investor acquisitions.The average price was $2733 in 2022, higher than any of the legacy extensions.

The sales volume in

.xyz increased by 131.3%. in 2022. The total sales volume was just shy of $4.4 million. The sales volume trend for .xyz is shown below.To put the 2022 dollar volume in perspective,

.xyz volume was significantly more than .net, and more than .io and .co combined..ART Growth Stalls

A year ago, it seemed that the

.art extension was poised for significant growth. Probably due to problems in the NFT world, in 2022 the number of sales in .art was down 3.8% and the dollar volume down 16.5%. If interest in NFTs and art in general picks up again, keep an eye on this extension..APP Up

The

.app extension has been one of the better performers, and in 2022 the number of sales was up 103.7% and the dollar volume up 22.9%. The extension accounted for just over $436,000 total in 2022, and the average price was $2003..CLUB Falters

The

.club extension dropped 51.4% in number of sales, and fell 68.2% in sales dollar volume. The rise in .club over the past few years was probably largely due to the popularity of Clubhouse..ONE

There are still not many reported sales in

.one, just 29 in 2022, but the number of sales and the dollar volume both more than doubled from the previous year. The extension significantly increased renewal rates during the past year. Will be interesting to see how that plays out for the extension. The rates are still not much above the legacy extension rates..WORLD

Is

.world a sleeper extension? It grew from just 5 reported sales in 2020, to 79 in 2021 and 135 in the most recent year. Dollar volume was up substantially, more than tripling, although keep in mind based on small number statistics.Other new extensions showing dollar volume growth in 2022 included

.dev, .today, .site, .live and .financial..COM Domination

The dominance of

.com continues. The .com extension accounted for 83.0% of sales by number, and 81.4% by dollar volume. For comparison, in 2021, .com was responsible for 85.2% of sales, and 80.5% of dollar volume.Taken as a whole, country codes account for 5.9% of the total number of domain sales, and 7.8% of total dollar volume.

Combined, new extensions represent 3.1% of all domain sales, although a higher percentage, 7.8%, by dollar volume.

Notes And Limitations

It is important to keep the following points in mind.

- Sales from some key parts of the market, such as the brandable marketplaces, are not included in NameBio. Most sales from Afternic and Dan are also not reported. If all retail sales were included, some trends might change significantly.

- While an increase in sales volume is usually regarded as a positive, it is possible that it is a reflection of investors deciding to liquidate their long-term holdings in that extension.

- Their company reports indicate many millions of dollars in premium new extension sales by registries that are not included in NameBio.

- Keep in mind these are numbers as reported just after year close. Some sales are reported to NameBio well after the date of the sale. Because I followed the same procedure each year, there should not be a systematic bias in trends.

- In some cases, the numbers reported in an extension are relatively small. Therefore percentage changes may not be significant.

If you want to read the similar report from a year ago, here is the link: 2021: Domain Name Sales Very Strong.

Keep in mind that this was a look at the year in total. In most segments of the market, the first half of 2022 was stronger than the second half. A majority of investors are predicting that 2023 will be better than 2022. In a year’s time we will see if they were right.

This is personally one of my favourite posts each year. While numbers and trends alone do not tell you what to invest in, I think it is interesting to look at the sales data, including changes from the previous year. Each year trends emerge that I would not have predicted.

My sincere thanks for NameBio. The superb interface makes it easy to do an analysis such as this one using their data. Thank you. I just analyze and present the data – NameBio do the hard work.

Last edited: