The more accurately we can predict the future, the better position we are in as domain investors. With that in mind, I sought views on: How Do You Think 2023 Will Be In Domain Investing?

That discussion thread included a poll on overall optimism or pessimism about domain name investment in 2023. In addition, it sought responses (up to 3 each) on the following:

Investors Remain Optimistic

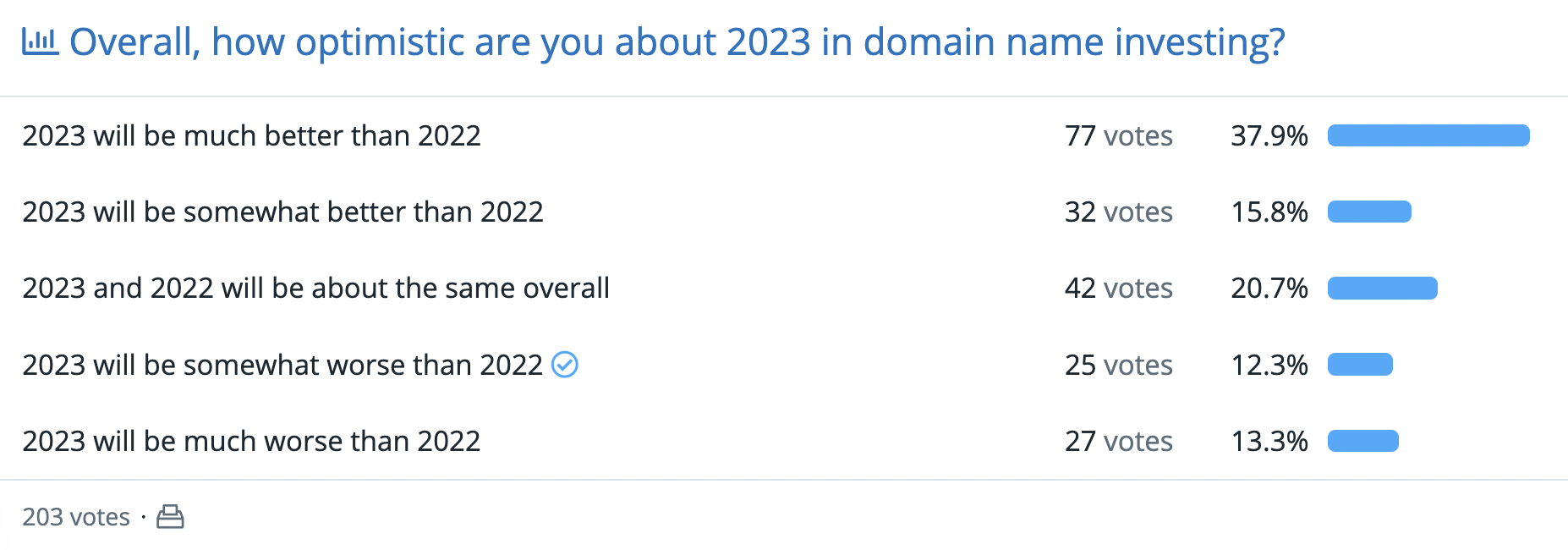

Despite a somewhat muted final half of 2022, most investors remain bullish on prospects for the year ahead. At time of writing, just over 200 had voted in a NamePros poll, with 38.1% believing 2023 will be much better than 2022, and another 15.7% saw the year ahead as somewhat better. Just over 12% felt the year ahead will be much worse than 2022.

I asked a similar question in a Twitter poll. In the Twitter poll, 43.2% of the 44 respondents feeling that 2023 will be stronger than 2022, and only 6.8% seeing the year ahead as much weaker.

TLDs On Rise

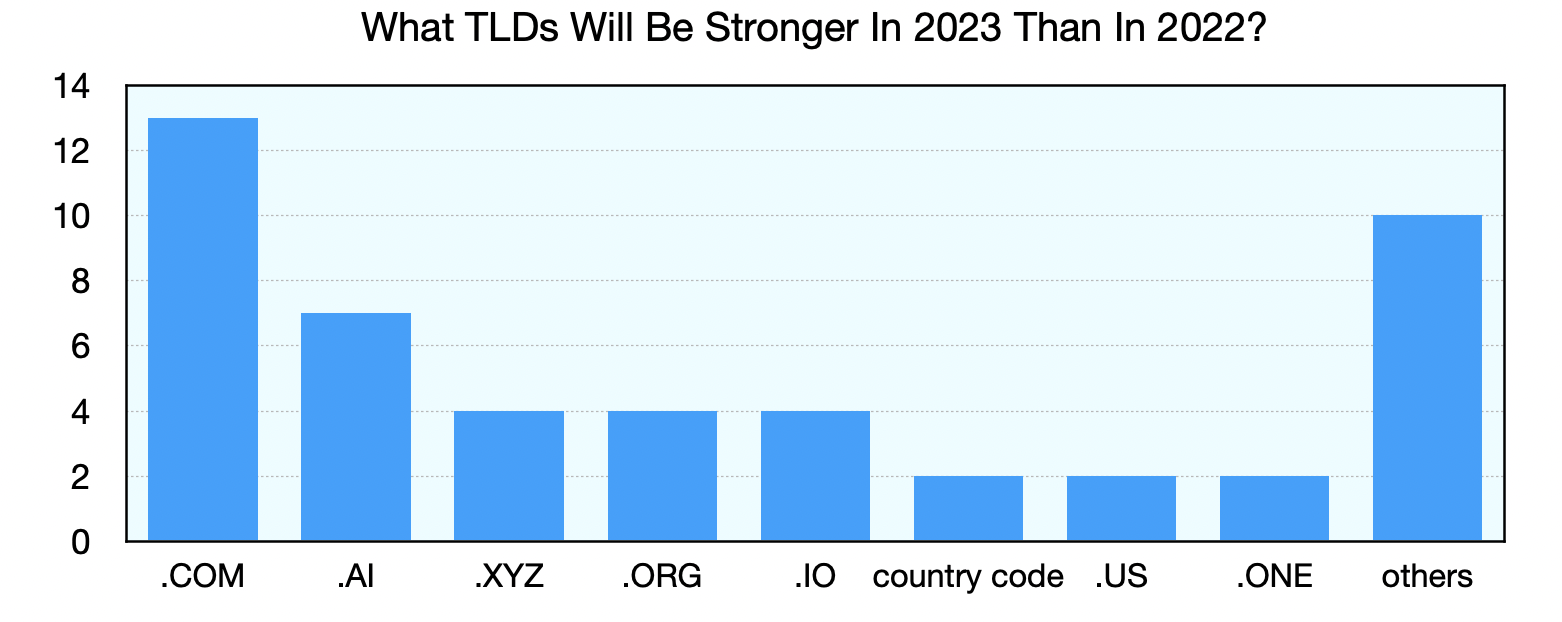

I asked investors to predict which extensions would have a stronger 2023 than 2022. Note that I was looking for changes, not a statement of overall strength. Few doubt that .com will remain the dominant extension for many years, but will it get even stronger?

I went through the responses, both here and from Twitter, tallying the number of times each extension was mentioned. Investors were most positive about .com, .ai, .org and .xyz . I show below all TLDs that received 2 or more votes.

Other extension mentioned a single time include .app, .cc, .cloud, HNS, .in, .link, .network, .to, .today, and .vc.

TLDs That May Decline

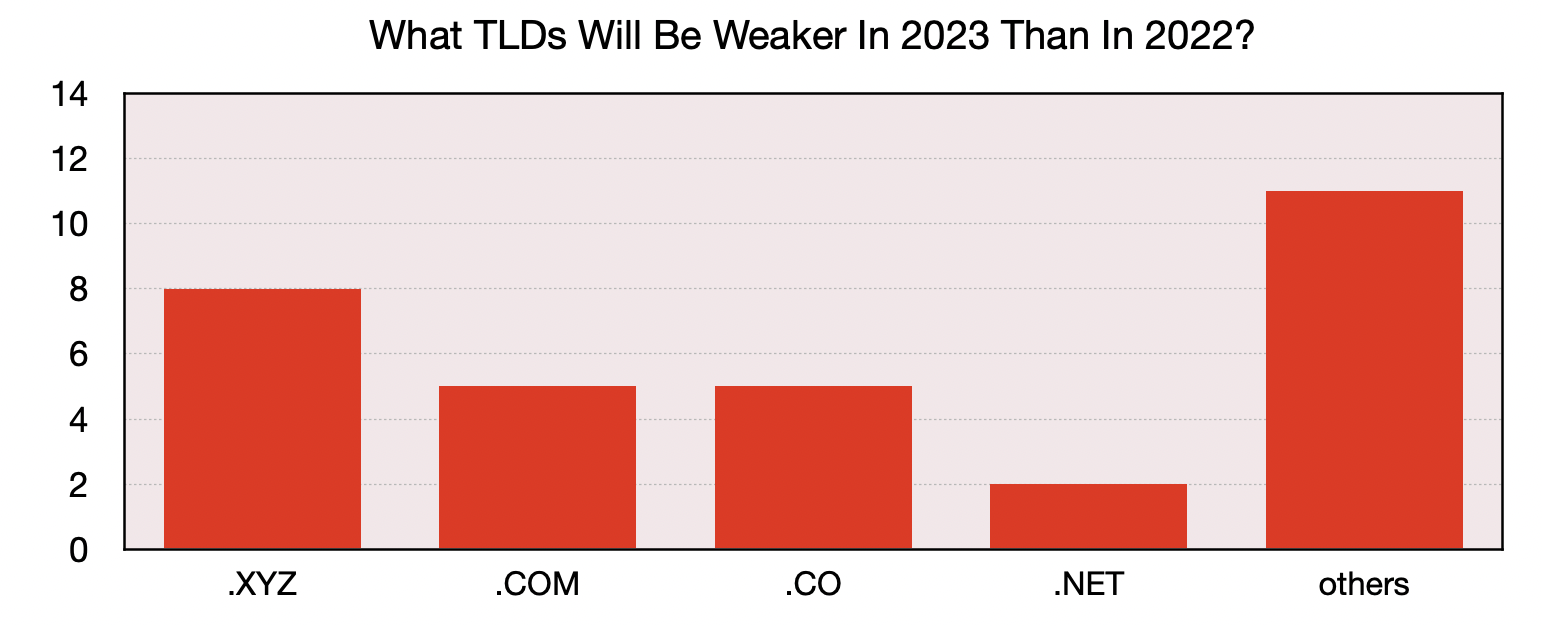

I also asked investors to pick up to three TLDs that they felt may decline in 2023. Again, this was looking at relative trends, not overall importance of that TLD in the market. The most mentioned as likely to decline were .xyz, .co, and .com.

It should be stressed that some of the same extensions were in both the stronger and weaker lists, reflecting diversity in views. Many extensions received a single vote in the weaker poll.

Will The Strength Be In Country Codes?

While stressing that he was commenting on overall domain strength, and not specifically the aftermarket, @jmcc offered reflections on what he sees for the quarters ahead. He monthly tracks a large number of TLDs, and produces the HosterStats site, so has a strong base for his opinions.

Strong Sectors

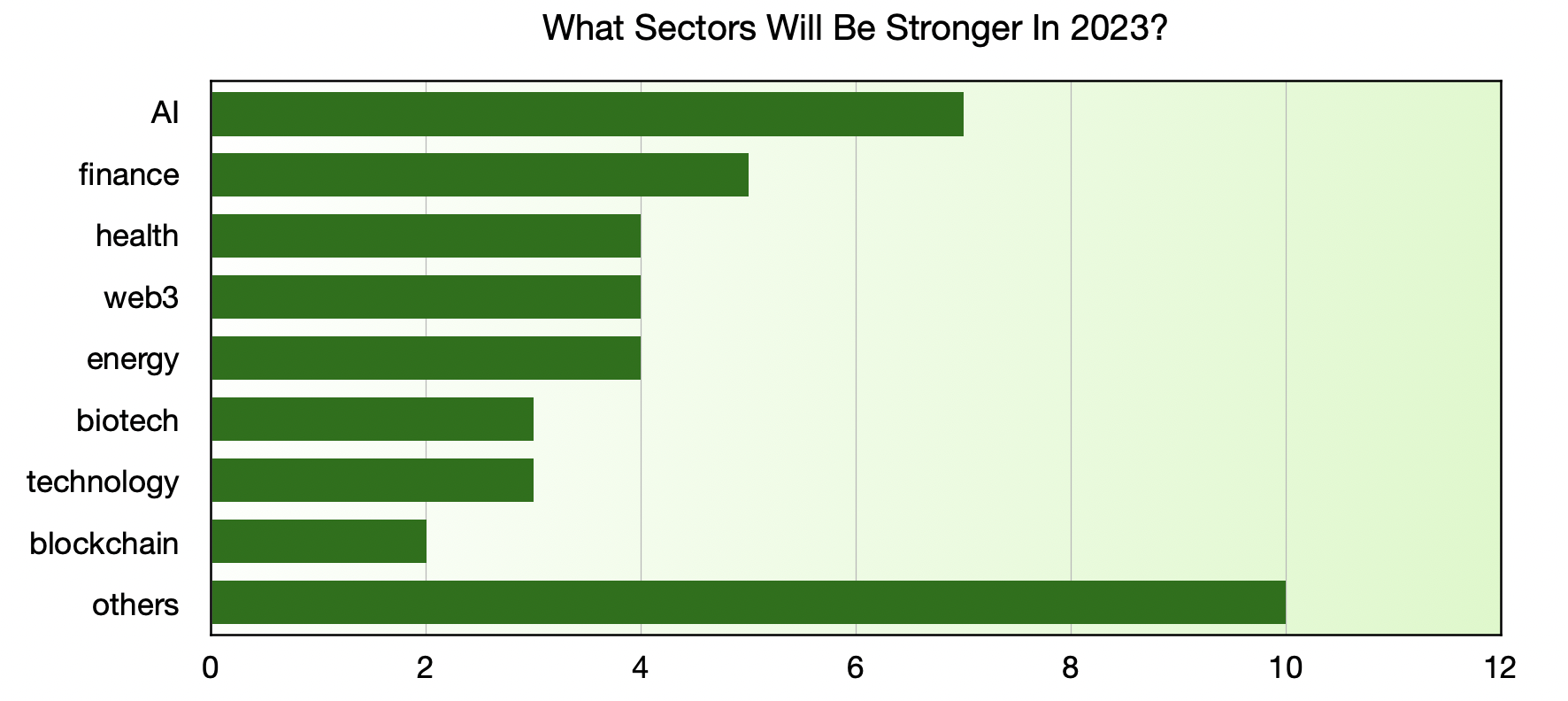

I asked investors to predict sectors that will be strong in the year ahead. Not surprisingly, artificial intelligence was most mentioned, with web3, finance, energy, health and biotech also popular.

In addition to the sectors shown on the graph, others mentioned as likely to be strong in 2023 included advanced materials, automation, cannabis, climate, electric vehicle, insurance, property, science, smart devices and travel. Clearly there is some overlap between certain sectors.

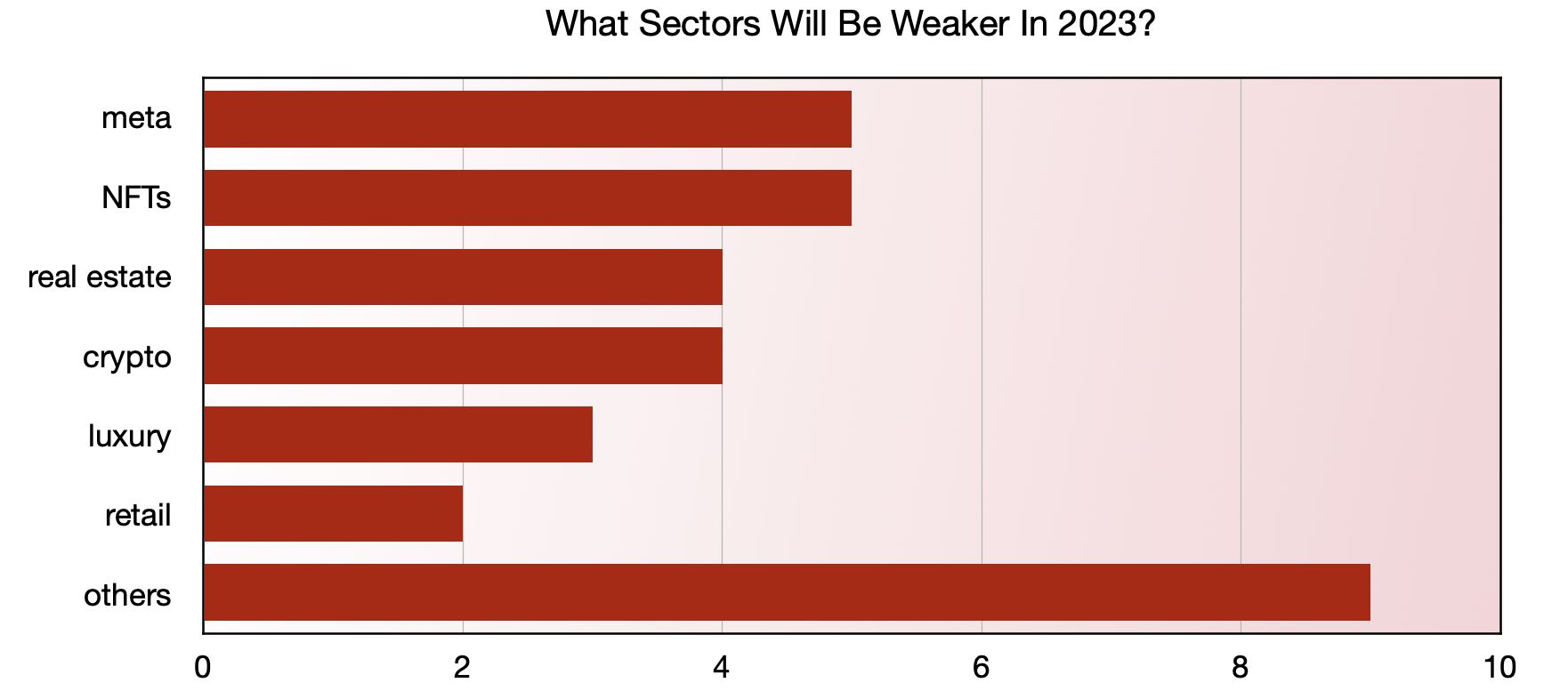

Weak Sectors

The most mentioned weak sectors were meta, NFTs, real estate, luxury items and crypto.

A number of other sectors were mentioned a single time.

Best Performing Part Of Market

Based on a relatively small number of responses, 6 saw the lower end as the best performer, 5 felt it would be the top end, and 4 selected middle. However, 3 felt the lower end would be the weakest performer, so signifient diversity in opinion.

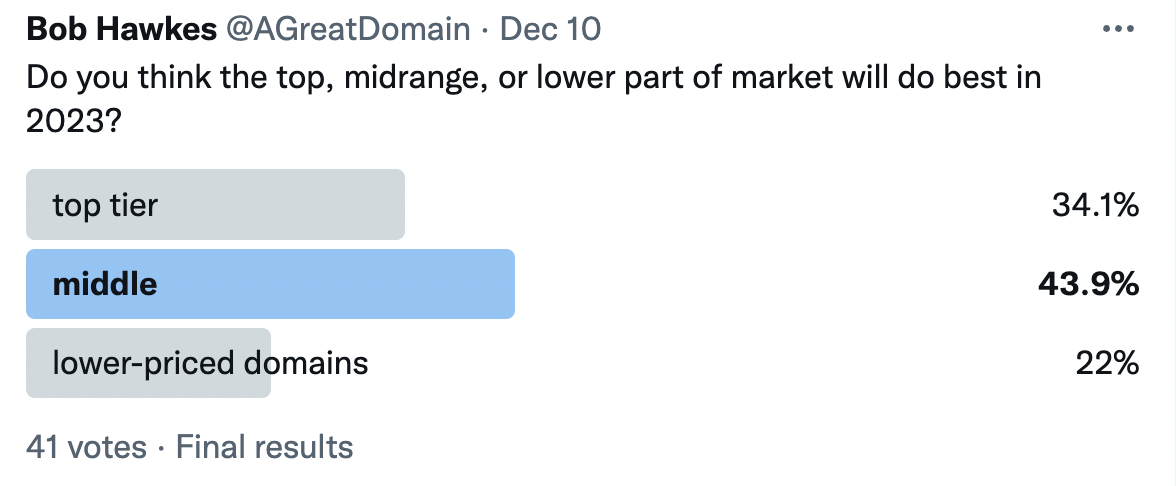

I also conducted a poll on Twitter asking which part of the market investors felt would have the strongest 2023. That poll received 41 responses, with results shown below.

While all portions of the market received support, about 44% felt the middle of the market would perform best.

@JudgeMind offered this comment:

The Economy And Domain Names

With massive government debt, high inflation in many countries, conflict and political fragmentation, climate change impacts, disruptions in supply chains, crypto concerns, falling equity value for the tech giants, massive layoffs in some tech sectors, and other disruptions of various types, the world is an uncertain place right now.

How will this impact domain names? Several respondents commented on what they saw happening. @AEProgram sees it this way:

@poweredbyme sees a lengthy economic crisis, with the next few years all worse than the preceding in domain names investment.

A few commented that the coming year may see opportunities for acquisitions by those who have funds to invest, such as this from @.X.:

What Type Of Names Will Be Sought?

@Mkt Sales Leads offered the following opinion,

Look Back At Predictions For 2022

I summarized investor Predictions for 2022 in Domain Investing about a year ago. At that time, investors were even more optimistic of the year ahead, with 46.3% predicting 2022 would definitely be stronger than 2021, and another 22.3% feeling it would probably be better.

Respondents felt the economy was the biggest potential concern, and that is even more true today.

Final Thoughts

Keep in mind that some of the results in this article are based on a relatively small number of responses.

Please vote in the associated poll on what TLDs you plan to invest in during 2023. You may vote for up to 4 extensions. If you have major investment plans for something not on the list, mention that in the comments.

You can read the full set of comments from the How Do You Think 2023 Will Be In Domain Investing? NamePros discussion. Thank you once more to all who voted and commented.

Feel free to comment below with your thoughts on any aspect of the year ahead in domain name investing.

As this is my last NamePros Blog article in 2022, I wanted to thank all of you who read and interacted with the articles over the year. I truly appreciate your support, suggestions and interactions. Best wishes for a successful 2023.

Perhaps a fitting way to end this article is this quotation from the late Peter Drucker:

That discussion thread included a poll on overall optimism or pessimism about domain name investment in 2023. In addition, it sought responses (up to 3 each) on the following:

- What TLDs do you think will be much stronger in 2023?

- Which TLDs will be much weaker in 2023?

- What sectors or niches will have a great 2023?

- What sectors or niches will have a poor 2023?

- Do you think top, middle or lower end of retail market will do best in 2023?

Investors Remain Optimistic

Despite a somewhat muted final half of 2022, most investors remain bullish on prospects for the year ahead. At time of writing, just over 200 had voted in a NamePros poll, with 38.1% believing 2023 will be much better than 2022, and another 15.7% saw the year ahead as somewhat better. Just over 12% felt the year ahead will be much worse than 2022.

I asked a similar question in a Twitter poll. In the Twitter poll, 43.2% of the 44 respondents feeling that 2023 will be stronger than 2022, and only 6.8% seeing the year ahead as much weaker.

TLDs On Rise

I asked investors to predict which extensions would have a stronger 2023 than 2022. Note that I was looking for changes, not a statement of overall strength. Few doubt that .com will remain the dominant extension for many years, but will it get even stronger?

I went through the responses, both here and from Twitter, tallying the number of times each extension was mentioned. Investors were most positive about .com, .ai, .org and .xyz . I show below all TLDs that received 2 or more votes.

Other extension mentioned a single time include .app, .cc, .cloud, HNS, .in, .link, .network, .to, .today, and .vc.

TLDs That May Decline

I also asked investors to pick up to three TLDs that they felt may decline in 2023. Again, this was looking at relative trends, not overall importance of that TLD in the market. The most mentioned as likely to decline were .xyz, .co, and .com.

It should be stressed that some of the same extensions were in both the stronger and weaker lists, reflecting diversity in views. Many extensions received a single vote in the weaker poll.

Will The Strength Be In Country Codes?

While stressing that he was commenting on overall domain strength, and not specifically the aftermarket, @jmcc offered reflections on what he sees for the quarters ahead. He monthly tracks a large number of TLDs, and produces the HosterStats site, so has a strong base for his opinions.

The .COM is going to have a rough few quarters in 2023 because some of the discounted regs used to lessen the impact of Covid registrations washing out of the zone in 2022 will be up for renewal and most will drop. This will lead to a spike in deletions in Q1/early Q2 possibly above the normal Ghost of Christmas Past drop. A lot of low-end/highly speculative .COM regs will be dropped.

The .ORG has been outperforming .NET. It helps that it has little of the baggage of .NET and it resembles the ccTLDs in terms of renewals.

The .BIZ and .INFO have been struggling throughout 2022 and things may not improve for them. The increased renewal fees have seen businesses reconsidering their .BIZ and .INFO registrations.

It is important to add that he is talking about the traditional national country codes, not the repurposed generic ones.The big threat to .COM will not come from the new gTLDs or the talks about a new round of gTLDs. It quite clearly will come from the ccTLDs. From 2019 to 2022, the momentum in the market shifted to the ccTLDs and many ccTLDs now get double, or more, the number of new registrations each month than .COM in their countries. That increasing inward focus in ccTLDs will affect the resale price of domain names in those ccTLDs. The problem is that newbie domainers not understanding that ccTLD sales and naming dynamics are different will lose money by applying the old .COM rules on pricing to ccTLDs.

Repurposed ccTLDs (.tv, .io, .co, .cc, .ai) will be caught between a rock and a hard place if the worst of a market shift happens between .COM and the ccTLDs.

Strong Sectors

I asked investors to predict sectors that will be strong in the year ahead. Not surprisingly, artificial intelligence was most mentioned, with web3, finance, energy, health and biotech also popular.

In addition to the sectors shown on the graph, others mentioned as likely to be strong in 2023 included advanced materials, automation, cannabis, climate, electric vehicle, insurance, property, science, smart devices and travel. Clearly there is some overlap between certain sectors.

Weak Sectors

The most mentioned weak sectors were meta, NFTs, real estate, luxury items and crypto.

A number of other sectors were mentioned a single time.

Best Performing Part Of Market

Based on a relatively small number of responses, 6 saw the lower end as the best performer, 5 felt it would be the top end, and 4 selected middle. However, 3 felt the lower end would be the weakest performer, so signifient diversity in opinion.

I also conducted a poll on Twitter asking which part of the market investors felt would have the strongest 2023. That poll received 41 responses, with results shown below.

While all portions of the market received support, about 44% felt the middle of the market would perform best.

@JudgeMind offered this comment:

Mid-quality names priced below typical pricing and great quality names will thrive.

The Economy And Domain Names

With massive government debt, high inflation in many countries, conflict and political fragmentation, climate change impacts, disruptions in supply chains, crypto concerns, falling equity value for the tech giants, massive layoffs in some tech sectors, and other disruptions of various types, the world is an uncertain place right now.

How will this impact domain names? Several respondents commented on what they saw happening. @AEProgram sees it this way:

The pandemic drove the revenues up of many companies that offer services for people starting their own business (GoDaddy, Fiverr, Wix, Shopify and many others). The layoffs will do the same. Layoffs will continue and that means more people will try going on their own. Even those not laid off, will start becoming more serious about going on their own.

He also went on to comment on some ways domainers could effectively respond.The crypto and stock market downturn is hurting a lot of people too. A lot of people are realizing that a better route for them to make money is selling a product or service. This is great for domains.

Offering payment plans for domains will become more important. People have a lot less money then they did a year ago and the recent credit card debt data confirms how bad things are. As domainers we should try to be as flexible as possible with potential buyers right now.

@poweredbyme sees a lengthy economic crisis, with the next few years all worse than the preceding in domain names investment.

We will see the worst economic crisis in history in somewhere between 2025 and 2029.After the seeing worst, we will enter to a new age with largest economic wealth and improvements in all areas of life in history.

A few commented that the coming year may see opportunities for acquisitions by those who have funds to invest, such as this from @.X.:

I think it (2023) will be a buyers market.

What Type Of Names Will Be Sought?

@Mkt Sales Leads offered the following opinion,

The average startup will look for affordable .io, .co, .org and sensible brandable .com names in the $1k to $5k range until the day they get their millions in funding for their unicorn one word .com.

Look Back At Predictions For 2022

I summarized investor Predictions for 2022 in Domain Investing about a year ago. At that time, investors were even more optimistic of the year ahead, with 46.3% predicting 2022 would definitely be stronger than 2021, and another 22.3% feeling it would probably be better.

Respondents felt the economy was the biggest potential concern, and that is even more true today.

Final Thoughts

Keep in mind that some of the results in this article are based on a relatively small number of responses.

Please vote in the associated poll on what TLDs you plan to invest in during 2023. You may vote for up to 4 extensions. If you have major investment plans for something not on the list, mention that in the comments.

You can read the full set of comments from the How Do You Think 2023 Will Be In Domain Investing? NamePros discussion. Thank you once more to all who voted and commented.

Feel free to comment below with your thoughts on any aspect of the year ahead in domain name investing.

As this is my last NamePros Blog article in 2022, I wanted to thank all of you who read and interacted with the articles over the year. I truly appreciate your support, suggestions and interactions. Best wishes for a successful 2023.

Perhaps a fitting way to end this article is this quotation from the late Peter Drucker:

Let’s all create something great in 2023.The bеѕt wау tо predict уоur future іѕ tо create it.