- Impact

- 845

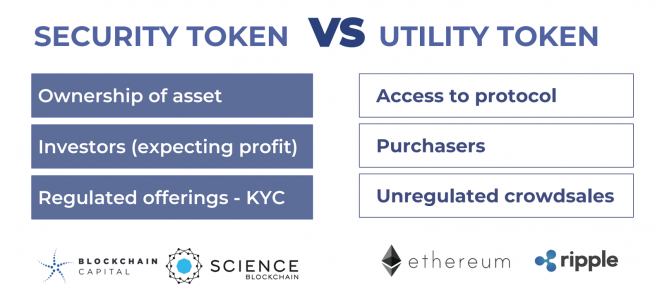

The SEC will mandate Security Tokens, It's easy to see why.

For those that are still struggling to understand the concept i'll explain in a way you can understand.

Example:

Utility Token - Namepros generate a utility token ICO that can be used on the forum no ownership, unregulated, back by nothing, thin air investment. Maybe you can use it to purchase things on the forum, fundamentally who gives a shit.

Security Token - Namepros generate a security token which holds 10 Top Domains *NP defines a top domain as (No domains under $1000 resale value) You can invest it in, you can profit from it, It's regulated and has governance.

In my eyes this is as clear as day how this can work - furthermore you don't need a 10k page whitepaper to understand as it's backed by a security.

Any aspiring domain fund mangers you can now begin on polymath network and raise capital for your investments. The only question remains, Can you provide a ROI for your investors.

I'll invest $1k into the first good portfolio with a clear history of P/L

https://tokenstudio.polymath.network/

For those that are still struggling to understand the concept i'll explain in a way you can understand.

Example:

Utility Token - Namepros generate a utility token ICO that can be used on the forum no ownership, unregulated, back by nothing, thin air investment. Maybe you can use it to purchase things on the forum, fundamentally who gives a shit.

Security Token - Namepros generate a security token which holds 10 Top Domains *NP defines a top domain as (No domains under $1000 resale value) You can invest it in, you can profit from it, It's regulated and has governance.

In my eyes this is as clear as day how this can work - furthermore you don't need a 10k page whitepaper to understand as it's backed by a security.

Any aspiring domain fund mangers you can now begin on polymath network and raise capital for your investments. The only question remains, Can you provide a ROI for your investors.

I'll invest $1k into the first good portfolio with a clear history of P/L

https://tokenstudio.polymath.network/