One measure of domain name sales success is the sell-through rate (STR). For your own portfolio, that is simply the number of domain names that sell in a time period, usually one year, divided by the average number of domain names for sale during that period, and expressed as a percentage. For example, if you have an average of 400 domain names listed for sale, and sell 6 during the year, that would be a STR of 1.5%.

The key problem with STR is deciding which sales to include and which to exclude. For example, if I acquire a domain name for $100, then sell it to another domainer for $110, do I include that? What if I liquidated it at $75? What if I sell it for $300? A few small sales can significantly change the STR without having much impact on the bottom line for the investor. If one uses only sales above a certain dollar figure, the threshold used may significantly influence the STR.

In this article I introduce a new metric, the Dollar Volume Per Listing (DVPL), that is not as sensitive to small sales.

The Dollar Volume Per Listing – DVPL

The Dollar Volume Per Listing, DVPL, is simply the total dollar volume of sales during a time period, usually one year, divided by the number of listings in the portfolio. For example, if a domain investor has a portfolio of 500 domain names, and total sales for the year of $20,000, the DVPL will be $40.

If the DVPL is less than your average renewal cost per domain name, you are losing money. When acquisition costs are included, you can lose money even if DVPL is higher than holding costs.

While DVPL does not take into account factors such as how much you paid to acquire the domain names, DVPL does provide a measure that is dominated by the number and value of major sales, not the number of small sales.

DVPL effectively combines both the STR and the average price, both of which are important.

I combined these factors, looking at the ratio with renewal cost, in the NamePros Blog article A Look At How Different Domain Extensions Sell. DVPL is a simpler metric to accomplish the same thing.

Industry-Wide DVPL

It is your own DVPL that matters, but it can also be informative to look at DVPL on an industry-wide basis, both to see how you are doing compared to other investors, and to see if certain extensions or sectors/niches are, overall, doing better.

To calculate the industry-wide DVPL, you need to know two numbers: the total dollar sales volume, and the number of names actively listed for sale. NameBio is our best source for dollar volume, although it must be stressed that many sales are not reported. Perhaps 20% of retail sales are listed. A higher percentage of wholesale transactions are included, since the main auction sites are scanned.

I used the average of the 2022 and 2021 dollar volumes from my start of year analyses. See the 2022 analysis here, while the 2021 analysis is found in this article. Since these are start-of-year points in time, they slightly underestimate the sales volume, since some sales get added later.

Dofo scans most of the important marketplaces, and can provide the number of names actively listed for sale. It will miss private marketplace listings, as well as some of the marketplaces.

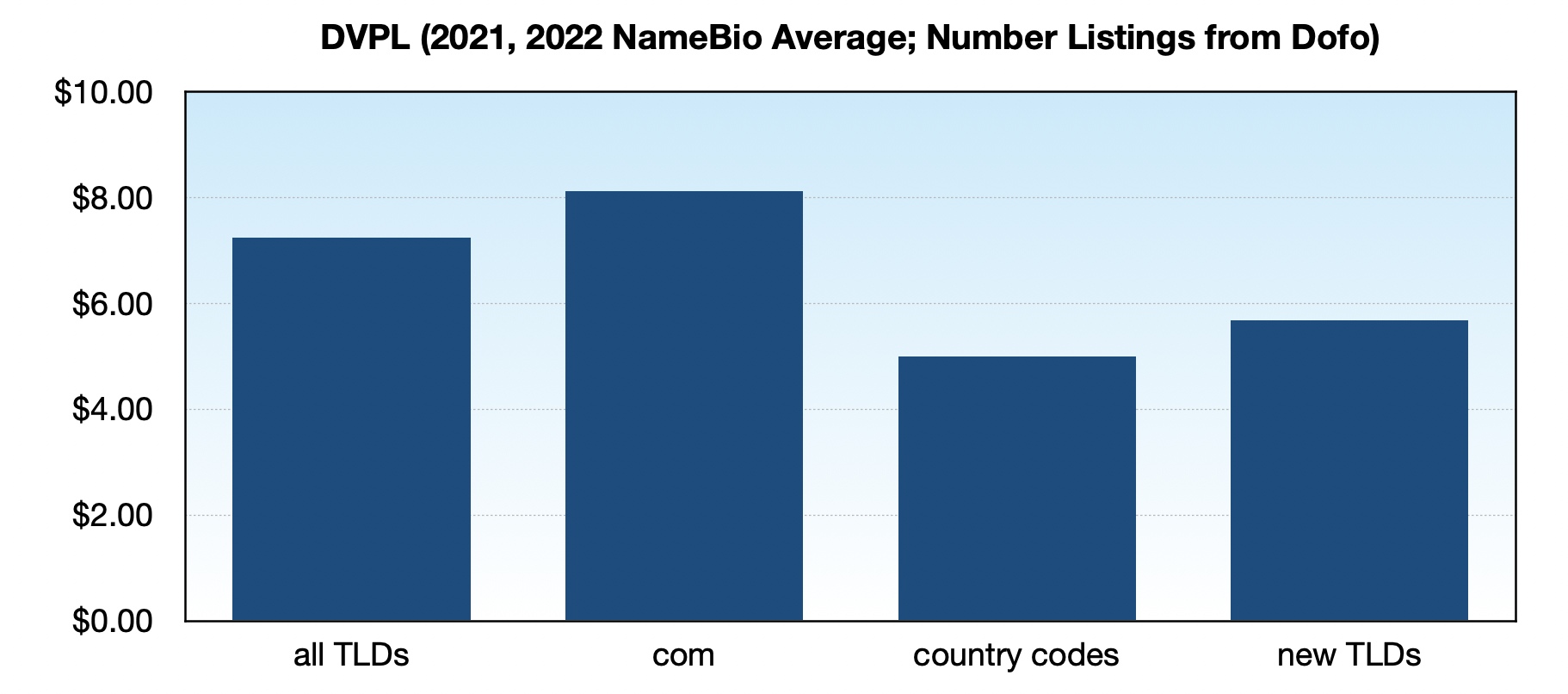

Dofo estimated this week that 24,551,868 domain names are actively for sale, across all TLDs, while the average NameBio dollar volume for the past two years is $177,935,000. These combine to an apparent industry wide DVPL of $7.25 across all extensions.

If we assume that possibly 80% of dollar volume is missing from NameBio, and perhaps 40% of listings absent from Dofo, that would suggest an overall correction of order of 2. However, NameBio uses the gross sales price, ignoring any commission, so that should be taken into account. If we assume an average commission of 20%, perhaps the overall correction is 1.6x. The corrected industry average DVPL, CDVPL, would be about $11.60, not very different from annual holding cost.

In the rest of the article, I will use the apparent DVPL, since it is relative values that we are mainly interested in. You can apply the correction factors mentioned above, or your own, if you want to estimate the actual DVPL.

You Need To Be Better Than Average

While the corrected value might suggest that if you were average you could pull off a slight profit, remember that I have not taken into account the acquisition price for the domain names, nor any other costs that you incur, or value on the money you have tied up in domain names.

You need to be significantly better than the ‘average’ person selling domain names in order to not lose money.

Industry-Wide DVPL for Major Legacy TLDs

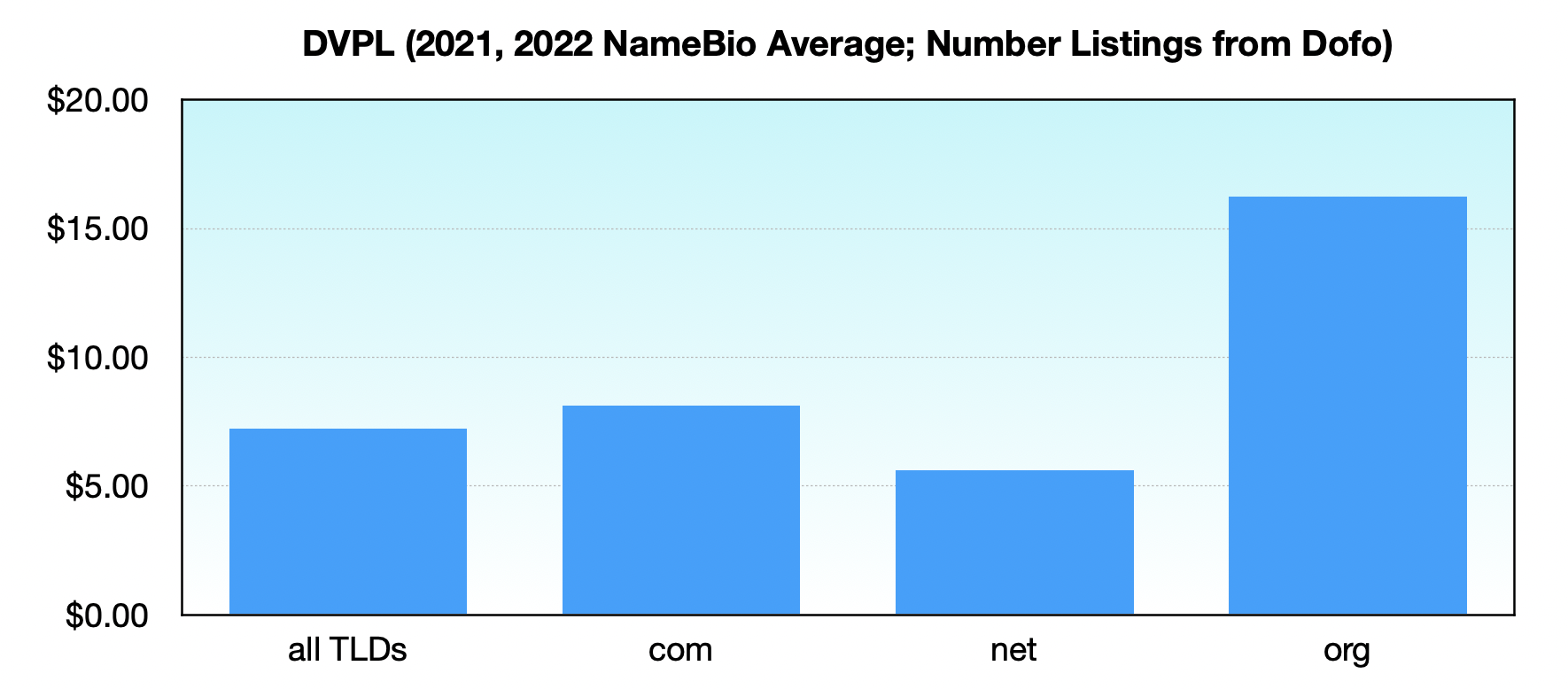

The graph below shows the DVPL for the major legacy extensions.

Since .net has more names listed for sale than .org, 669,953 versus 453,965, but substantially lower dotal dollar volume, the .org DVPL, $16.24, is significantly higher than the .net, $5.61. Interestingly, it is also significantly higher than .com industry-wide DVPL of $8.11.

The Minor Legacy TLDs

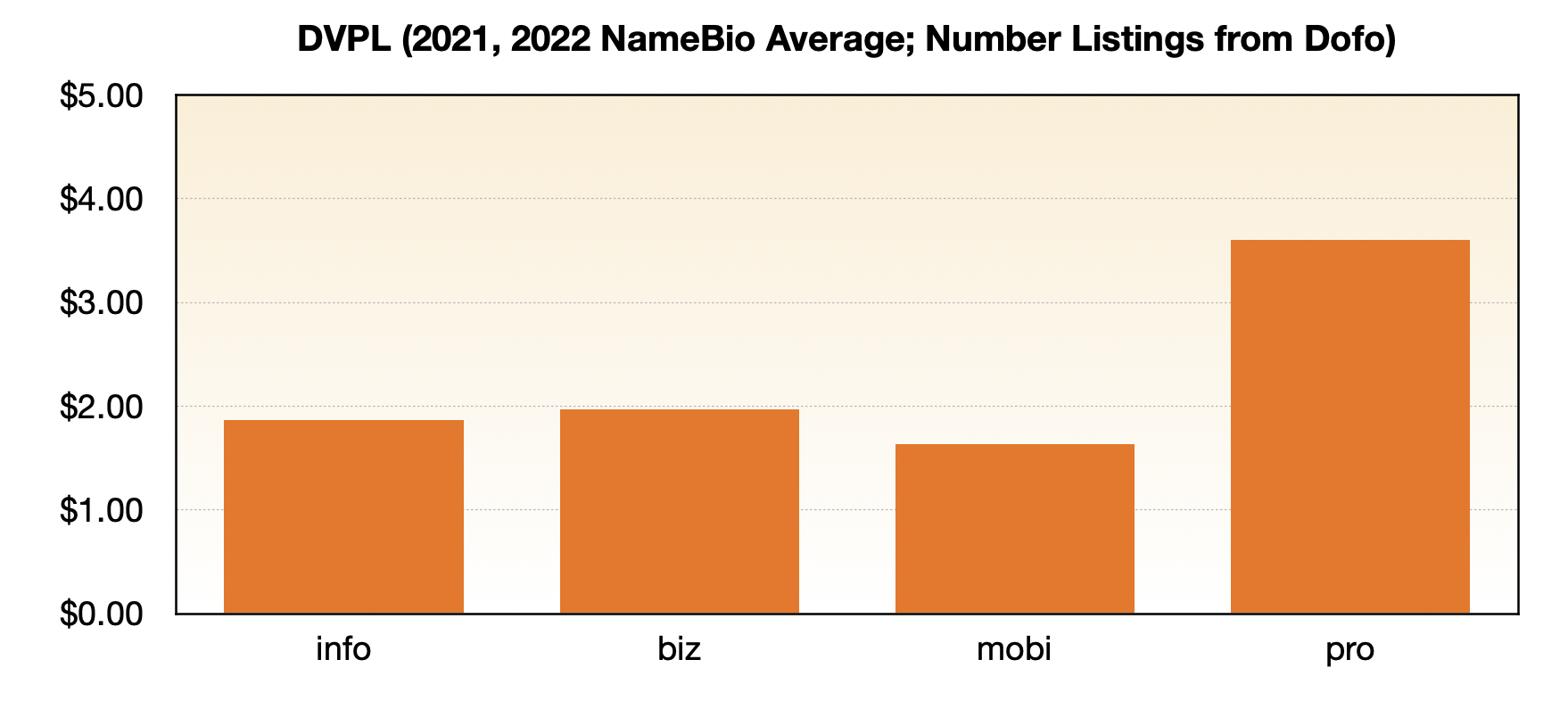

Shown below are DVPL values for several of the other older TLDs. All are well below their annual renewal cost, and at or below even the discounted first year registration. For example, .info has a DVPL of just $1.87. As you go through the graphs below, note that the scale is different on each graph.

Country Code Extensions

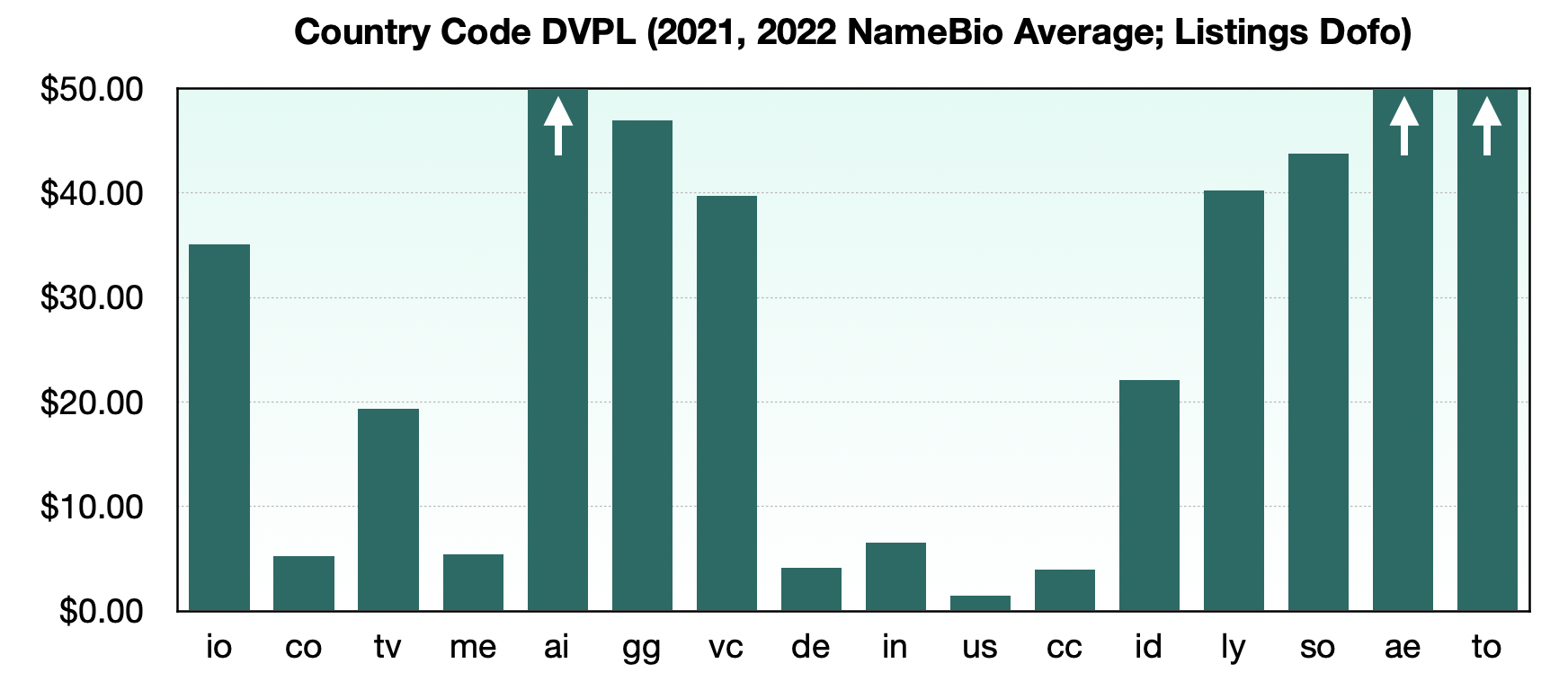

I next looked at a number of country code extensions.

Extensions with solid DVPL values include .ai at $66.58, .tv at $19.39, .io at $35.06, .vc at $39.74, .gg at $46.96, .ly at $40.26, and .so at $43.74. It should be noted that in most of the above the annual renewal is also higher.

There were a few country code extensions with very high DVPL, such as .ae at $102.48. Note that in some cases, like .ae, this is based on small number statistics, with only 2761 domains listed for sale according to Dofo.

Both .ai and .to have high DVPL values, $66.58 and $181.57 respectively. There are specific auction sites for these extensions, and that may help elevate the DVPL, since there is better reporting, and sales can happen even without that name being listed on a marketplace covered by Dofo.

While the .us extension has been significantly growing in sales volume, there are also a large number listed for sale. As a result, the DVPL is a surprisingly low $1.45.

Top place, though, goes to an extension that most domain investors don’t have in their portfolio. Ethiopia’s .et clocked in at the highest DVPL among the country codes, $1360.63! This was driven by a few high domain hack sales, and a very low number of domains in this extension listed on marketplaces. Note that some marketplaces do not handle the extension.

New Extensions

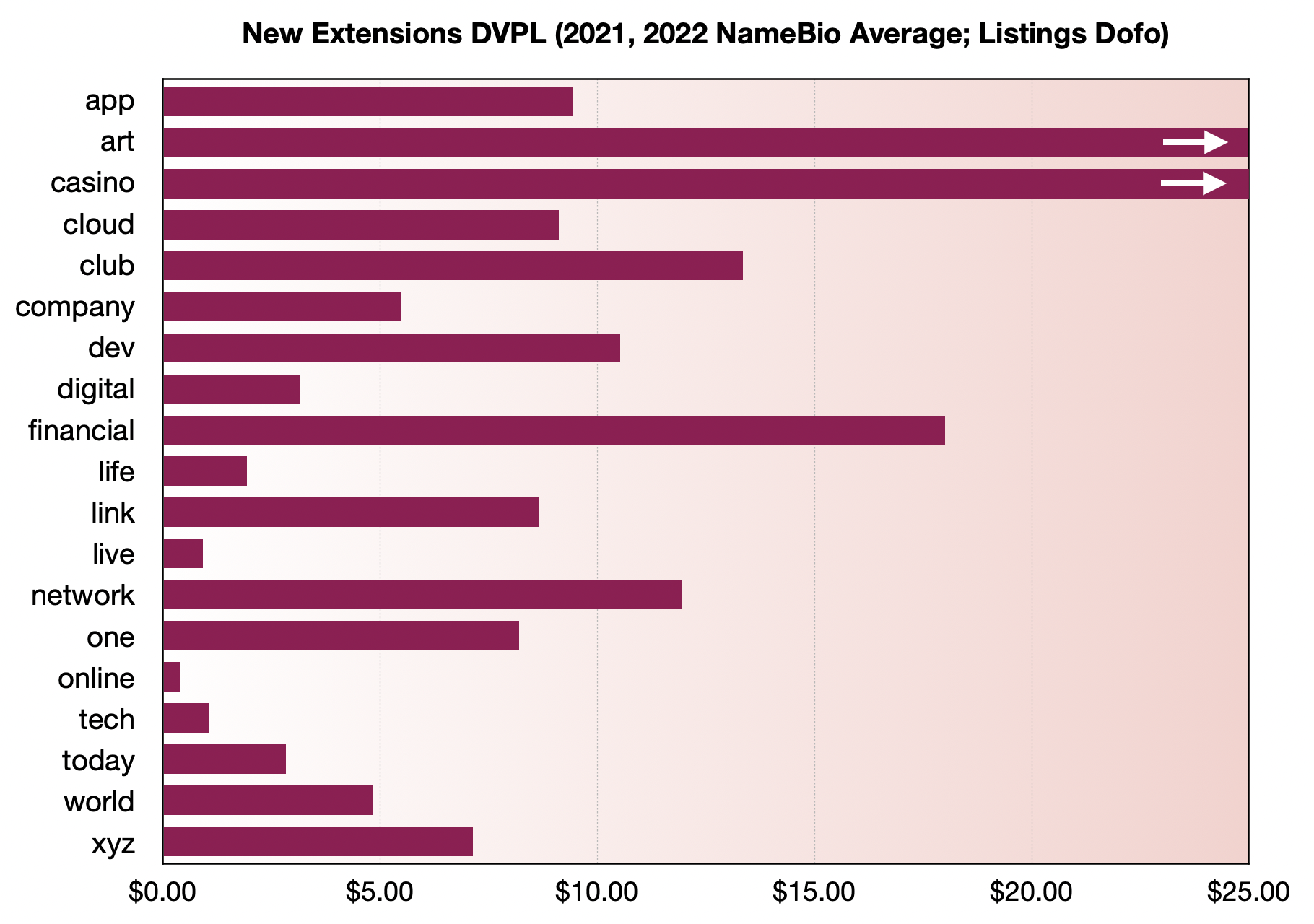

Shown below are the DVPL values for a number of new extensions held by some domain name investors.

While .xyz averaged more than $3.1 million per year in aftermarket sales the last two years, there are also a lot registered and listed for sale, just over 441,000 according to Dofo Advanced Search. This results in a DVPL of $7.13 for .xyz, not much different than the entire domain market, and a bit below the current renewal rate for the extension.

Also not much different than its renewal rate, was .app at a DVPL of $9.45.

While off the graph scale, the .art extension was in first place of the new extensions that I studied, with a DVPL of $213.32. Keep in mind that the interest in .art from 2021 has waned due to the NFT and cryptocurrency setbacks in the second half of 2022, and also that these are relatively small number statistics, with just 1785 .art domains listed according to Dofo.

The .casino extension was also strong, at $37.53 DVPL, but based on even fewer names listed for sale.

The .club extension had quite a few listings, almost 36,000, and a DVPL of $13.35. Of course the extension was stronger in 2021, and that year is included in the sales volume data.

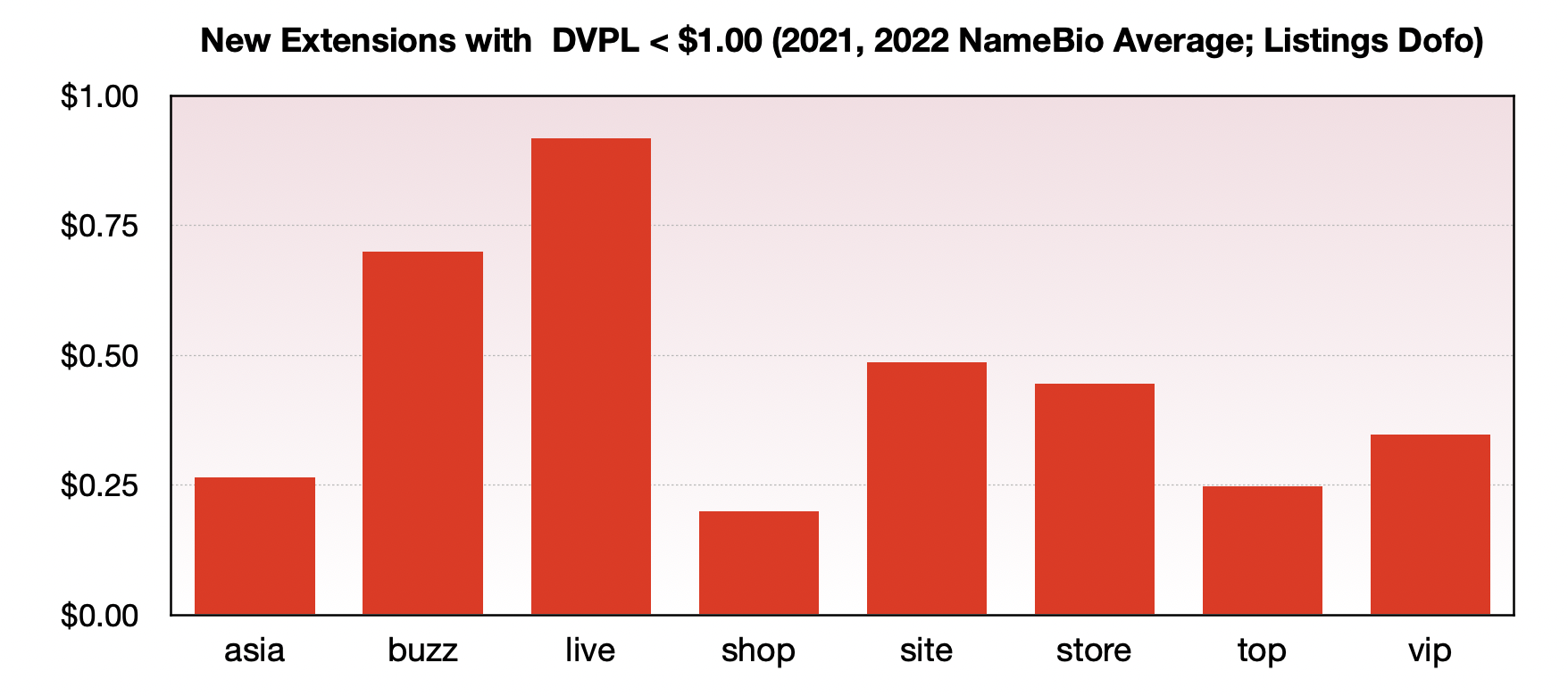

If It’s Cheap Enough, It’s A Deal, Right?

Wrong. At least according to DVPL values for a number of extensions.

Shown below are DVPL values for new extensions that were at $1.00 or less. These same extensions tend to have deep first-year discounting. The DVPL values are most of the time less than even these discounted first year rates, and well below the regular renewal rates.

I am not saying you can never make money with these TLDs, but because they are priced so low for the first year, there are many listed for sale, compared to the few that sell, and investors are keen to sell before renewal, so price cuts are common. It is a tough market.

A few TLDs with deep first year discounting did have average or better DVPL values, though.

The Big Picture

Dofo does not have the equivalent of selecting all country codes or all new extensions that we have in NameBio. What I did do was to compute an average for the 35 new gTLDs and 34 country codes that I computed DVPL. This represents the majority of listed names in each category.

Final Thoughts

While I found this an interesting mathematical investigation, I would not place too much weight on industry-wide DVPL values. Many of the results may be influenced by factors such as Dofo and NameBio coverage, where certain extensions get listed, and variations due to small number statistics.

The key thing is the quality of the domain name. A high DVPL value does not mean every name in that TLD has any value. You can make money in various parts of the market, but it is also very easy to lose money.

These numbers emphasize that doing as well as the average person with domains listed for sale is not enough to make any significant profit. The majority of domain investors probably lose money.

If you are in domain investing to make money, you need to a take the time to perfect your skills, put in the hard work, be smart and disciplined.

I think the most important potential for DVPL is when applied to your own portfolio. If each year calculate DVPL, simply comparing your sales volume with the average number of domain names in your portfolio that year. Track the DVPL from year to year, to see whether the quality of your portfolio is improving or getting worse.

For those with large and diverse portfolios, it may make sense to calculate different annual DVPL values for different parts of your portfolio, for example for brandable, exact match or geo names, or for specific extensions.

Farewell and Sincere Thanks to Dofo

This analysis would have been impossible without Dofo. There is no other tool that allows you to easily search the majority of marketplaces to answer questions such as, how many names are currently listed for sale in this TLD.

Dofo can also help you answer other questions, such as: How are domain investors pricing their domain names?

Unfortunately, Dofo is shutting down February 2023. You can read reactions from NamePros members in this discussion started by @MadAboutDomains, and add your own note of appreciation.

@Macit, the founder and CEO of Dofo outlined the reasons that they were shutting down in this post.

I will miss Dofo. I think it is a service that is needed, a way to direct potential buyers to where a certain domain name is for sale. With differential domain name pricing becoming more prevalent, and the places domain names are sold more diverse, the need becomes greater for a service like Dofo.

Dofo was, at the same time, a great resource for domain investors and analysts. With Dofo Advanced Search you could answer questions such as how many domain names that include NFT are currently listed for sale, and what is the breakdown in asking prices.

I still remember the joy when I discovered Dofo for the first time, and realized I finally had the ability to compare the number of domain names that sold, or at least publicly-recorded sales, with the number that were currently listed for sale.

Domain name investing is an art, but also a science. On the science side, probability plays a key role, and Dofo made many probability estimates possible.

Thank you Dofo. Best wishes as you apply your technology to new applications.

The key problem with STR is deciding which sales to include and which to exclude. For example, if I acquire a domain name for $100, then sell it to another domainer for $110, do I include that? What if I liquidated it at $75? What if I sell it for $300? A few small sales can significantly change the STR without having much impact on the bottom line for the investor. If one uses only sales above a certain dollar figure, the threshold used may significantly influence the STR.

In this article I introduce a new metric, the Dollar Volume Per Listing (DVPL), that is not as sensitive to small sales.

The Dollar Volume Per Listing – DVPL

The Dollar Volume Per Listing, DVPL, is simply the total dollar volume of sales during a time period, usually one year, divided by the number of listings in the portfolio. For example, if a domain investor has a portfolio of 500 domain names, and total sales for the year of $20,000, the DVPL will be $40.

If the DVPL is less than your average renewal cost per domain name, you are losing money. When acquisition costs are included, you can lose money even if DVPL is higher than holding costs.

While DVPL does not take into account factors such as how much you paid to acquire the domain names, DVPL does provide a measure that is dominated by the number and value of major sales, not the number of small sales.

DVPL effectively combines both the STR and the average price, both of which are important.

I combined these factors, looking at the ratio with renewal cost, in the NamePros Blog article A Look At How Different Domain Extensions Sell. DVPL is a simpler metric to accomplish the same thing.

Industry-Wide DVPL

It is your own DVPL that matters, but it can also be informative to look at DVPL on an industry-wide basis, both to see how you are doing compared to other investors, and to see if certain extensions or sectors/niches are, overall, doing better.

To calculate the industry-wide DVPL, you need to know two numbers: the total dollar sales volume, and the number of names actively listed for sale. NameBio is our best source for dollar volume, although it must be stressed that many sales are not reported. Perhaps 20% of retail sales are listed. A higher percentage of wholesale transactions are included, since the main auction sites are scanned.

I used the average of the 2022 and 2021 dollar volumes from my start of year analyses. See the 2022 analysis here, while the 2021 analysis is found in this article. Since these are start-of-year points in time, they slightly underestimate the sales volume, since some sales get added later.

Dofo scans most of the important marketplaces, and can provide the number of names actively listed for sale. It will miss private marketplace listings, as well as some of the marketplaces.

Dofo estimated this week that 24,551,868 domain names are actively for sale, across all TLDs, while the average NameBio dollar volume for the past two years is $177,935,000. These combine to an apparent industry wide DVPL of $7.25 across all extensions.

If we assume that possibly 80% of dollar volume is missing from NameBio, and perhaps 40% of listings absent from Dofo, that would suggest an overall correction of order of 2. However, NameBio uses the gross sales price, ignoring any commission, so that should be taken into account. If we assume an average commission of 20%, perhaps the overall correction is 1.6x. The corrected industry average DVPL, CDVPL, would be about $11.60, not very different from annual holding cost.

In the rest of the article, I will use the apparent DVPL, since it is relative values that we are mainly interested in. You can apply the correction factors mentioned above, or your own, if you want to estimate the actual DVPL.

You Need To Be Better Than Average

While the corrected value might suggest that if you were average you could pull off a slight profit, remember that I have not taken into account the acquisition price for the domain names, nor any other costs that you incur, or value on the money you have tied up in domain names.

You need to be significantly better than the ‘average’ person selling domain names in order to not lose money.

Industry-Wide DVPL for Major Legacy TLDs

The graph below shows the DVPL for the major legacy extensions.

Since .net has more names listed for sale than .org, 669,953 versus 453,965, but substantially lower dotal dollar volume, the .org DVPL, $16.24, is significantly higher than the .net, $5.61. Interestingly, it is also significantly higher than .com industry-wide DVPL of $8.11.

The Minor Legacy TLDs

Shown below are DVPL values for several of the other older TLDs. All are well below their annual renewal cost, and at or below even the discounted first year registration. For example, .info has a DVPL of just $1.87. As you go through the graphs below, note that the scale is different on each graph.

Country Code Extensions

I next looked at a number of country code extensions.

Extensions with solid DVPL values include .ai at $66.58, .tv at $19.39, .io at $35.06, .vc at $39.74, .gg at $46.96, .ly at $40.26, and .so at $43.74. It should be noted that in most of the above the annual renewal is also higher.

There were a few country code extensions with very high DVPL, such as .ae at $102.48. Note that in some cases, like .ae, this is based on small number statistics, with only 2761 domains listed for sale according to Dofo.

Both .ai and .to have high DVPL values, $66.58 and $181.57 respectively. There are specific auction sites for these extensions, and that may help elevate the DVPL, since there is better reporting, and sales can happen even without that name being listed on a marketplace covered by Dofo.

While the .us extension has been significantly growing in sales volume, there are also a large number listed for sale. As a result, the DVPL is a surprisingly low $1.45.

Top place, though, goes to an extension that most domain investors don’t have in their portfolio. Ethiopia’s .et clocked in at the highest DVPL among the country codes, $1360.63! This was driven by a few high domain hack sales, and a very low number of domains in this extension listed on marketplaces. Note that some marketplaces do not handle the extension.

New Extensions

Shown below are the DVPL values for a number of new extensions held by some domain name investors.

While .xyz averaged more than $3.1 million per year in aftermarket sales the last two years, there are also a lot registered and listed for sale, just over 441,000 according to Dofo Advanced Search. This results in a DVPL of $7.13 for .xyz, not much different than the entire domain market, and a bit below the current renewal rate for the extension.

Also not much different than its renewal rate, was .app at a DVPL of $9.45.

While off the graph scale, the .art extension was in first place of the new extensions that I studied, with a DVPL of $213.32. Keep in mind that the interest in .art from 2021 has waned due to the NFT and cryptocurrency setbacks in the second half of 2022, and also that these are relatively small number statistics, with just 1785 .art domains listed according to Dofo.

The .casino extension was also strong, at $37.53 DVPL, but based on even fewer names listed for sale.

The .club extension had quite a few listings, almost 36,000, and a DVPL of $13.35. Of course the extension was stronger in 2021, and that year is included in the sales volume data.

If It’s Cheap Enough, It’s A Deal, Right?

Wrong. At least according to DVPL values for a number of extensions.

Shown below are DVPL values for new extensions that were at $1.00 or less. These same extensions tend to have deep first-year discounting. The DVPL values are most of the time less than even these discounted first year rates, and well below the regular renewal rates.

I am not saying you can never make money with these TLDs, but because they are priced so low for the first year, there are many listed for sale, compared to the few that sell, and investors are keen to sell before renewal, so price cuts are common. It is a tough market.

A few TLDs with deep first year discounting did have average or better DVPL values, though.

The Big Picture

Dofo does not have the equivalent of selecting all country codes or all new extensions that we have in NameBio. What I did do was to compute an average for the 35 new gTLDs and 34 country codes that I computed DVPL. This represents the majority of listed names in each category.

Final Thoughts

While I found this an interesting mathematical investigation, I would not place too much weight on industry-wide DVPL values. Many of the results may be influenced by factors such as Dofo and NameBio coverage, where certain extensions get listed, and variations due to small number statistics.

The key thing is the quality of the domain name. A high DVPL value does not mean every name in that TLD has any value. You can make money in various parts of the market, but it is also very easy to lose money.

These numbers emphasize that doing as well as the average person with domains listed for sale is not enough to make any significant profit. The majority of domain investors probably lose money.

If you are in domain investing to make money, you need to a take the time to perfect your skills, put in the hard work, be smart and disciplined.

I think the most important potential for DVPL is when applied to your own portfolio. If each year calculate DVPL, simply comparing your sales volume with the average number of domain names in your portfolio that year. Track the DVPL from year to year, to see whether the quality of your portfolio is improving or getting worse.

For those with large and diverse portfolios, it may make sense to calculate different annual DVPL values for different parts of your portfolio, for example for brandable, exact match or geo names, or for specific extensions.

Farewell and Sincere Thanks to Dofo

This analysis would have been impossible without Dofo. There is no other tool that allows you to easily search the majority of marketplaces to answer questions such as, how many names are currently listed for sale in this TLD.

Dofo can also help you answer other questions, such as: How are domain investors pricing their domain names?

Unfortunately, Dofo is shutting down February 2023. You can read reactions from NamePros members in this discussion started by @MadAboutDomains, and add your own note of appreciation.

@Macit, the founder and CEO of Dofo outlined the reasons that they were shutting down in this post.

I will miss Dofo. I think it is a service that is needed, a way to direct potential buyers to where a certain domain name is for sale. With differential domain name pricing becoming more prevalent, and the places domain names are sold more diverse, the need becomes greater for a service like Dofo.

Dofo was, at the same time, a great resource for domain investors and analysts. With Dofo Advanced Search you could answer questions such as how many domain names that include NFT are currently listed for sale, and what is the breakdown in asking prices.

I still remember the joy when I discovered Dofo for the first time, and realized I finally had the ability to compare the number of domain names that sold, or at least publicly-recorded sales, with the number that were currently listed for sale.

Domain name investing is an art, but also a science. On the science side, probability plays a key role, and Dofo made many probability estimates possible.

Thank you Dofo. Best wishes as you apply your technology to new applications.