Darpan Munjal of SquadHelp has been sharing great data insights on brandable domain names. I reached out to him for permission to summarize the data, and to get additional information.

As Darpan wrote in 2021,

Power Words

Great brands often contain power words. Here are sell-through rates (STR) for a selection of power words based on more than 100,000 premium domain name listings at SquadHelp.

While the differences between many of these are slight, possibly not statistically significant, the set does offer ideas for those seeking to broaden and refine the lists they use in searching expiring and expired names.

I wondered whether they started with a set of word choices, and Darpan clarified the process:

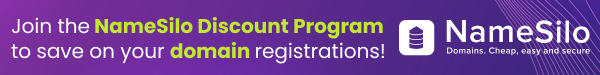

Sell-Through Rates for Different TLDs

While the majority of SquadHelp premium names are

I wondered if the results might be explained by differences in selection criterion for the premium marketplace for different TLDs, so I asked Darpan about that.

SquadHelp accept some

Is .IO Just For Tech?

There is a widespread view that

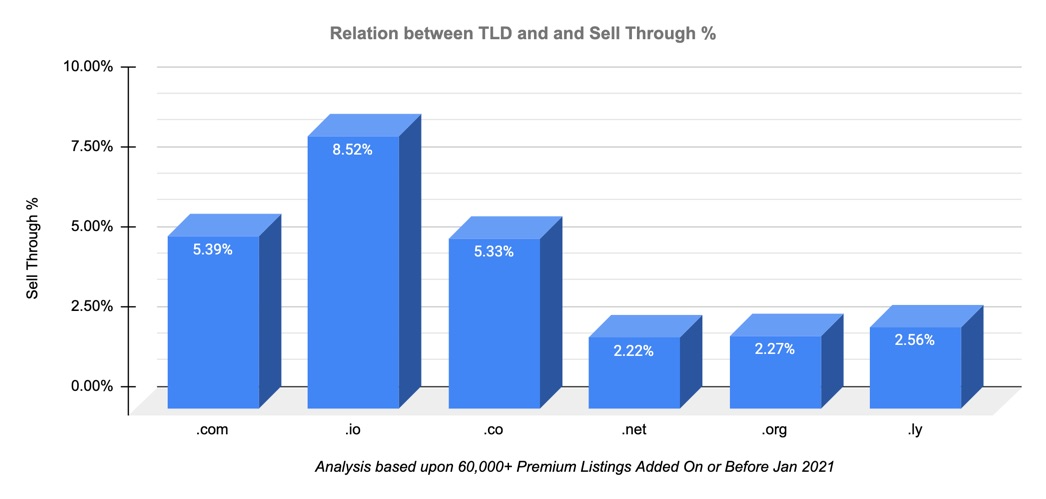

Popular Beginnings

If we look at words that are effective first words in two-word names, we have the results shown below, based on 50,000 premium names added to SquadHelp prior to June 2000.

While some of these results are expected, I was surprised to see terms like bold and bright were not more popular.

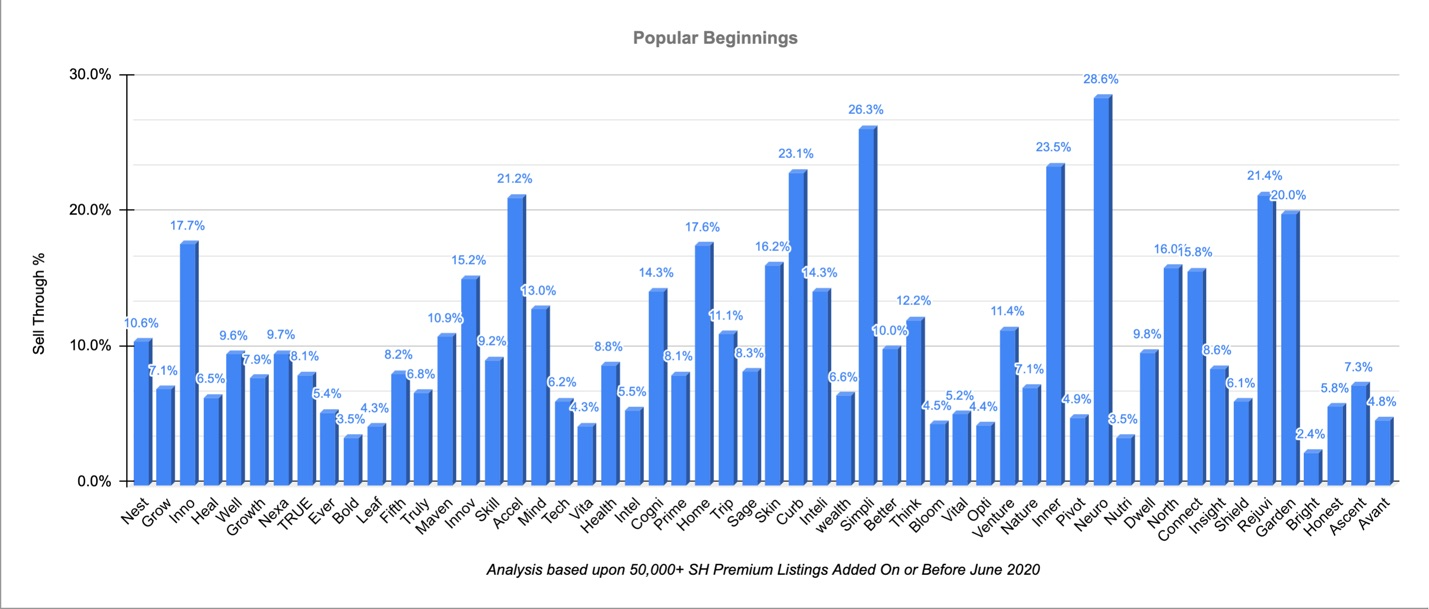

Terms Tech Startups Like

SquadHelp looked at STR for different terms just among those who selected the category technology in their name search. The results indicate that blue was the top term for tech startups, with a much higher STR than terms like labs or smart.

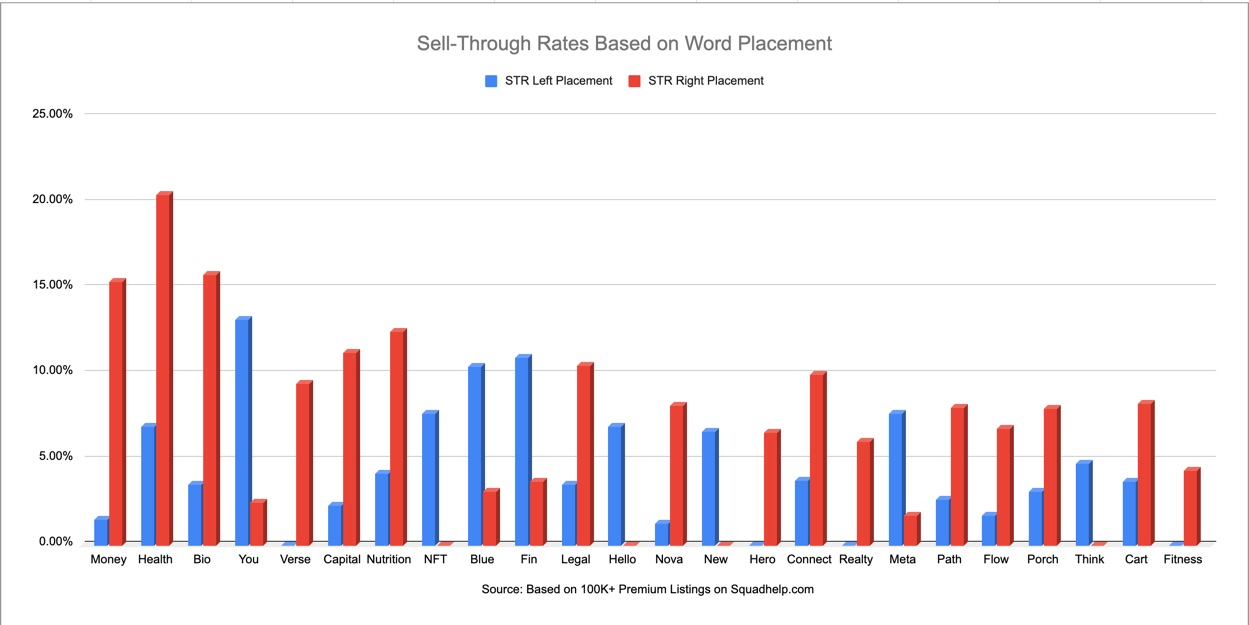

Better Left or Right?

Certain words, such as colors, meta and you are far more effective as the starting term, while other terms, such as health, money, verse and legal, are favoured as the second term.

Colors

Colors are frequently used in brands. The NamePros Blog considered colors as brands earlier this year. Part 1 looked at NameBio-recorded sales, listings at BrandBucket, and how frequently colors appear in company names, for some of the more important colours. In Part 2 I looked at the psychological aspects of colors as brands, and data for some additional colors suggested by NamePros readers.

It turns out we missed the color with the highest STR, at least as measured by SquadHelp STR, aqua. Note also that coral did very well in the rankings.

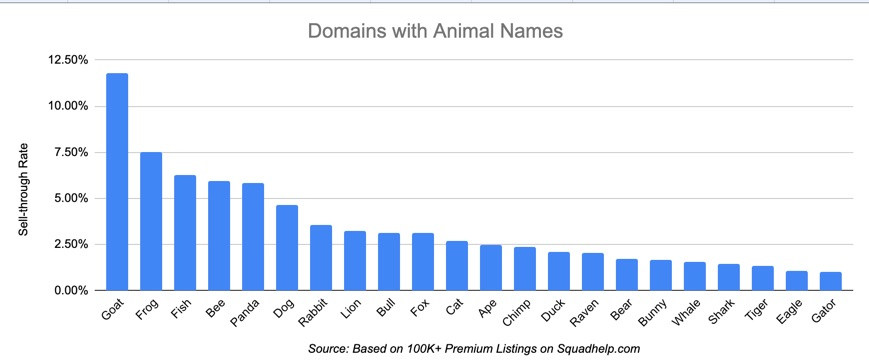

Animals

SquadHelp also looked at brand names that include an animal term. There were definite surprises, with goat, frog and fish leading in STR.

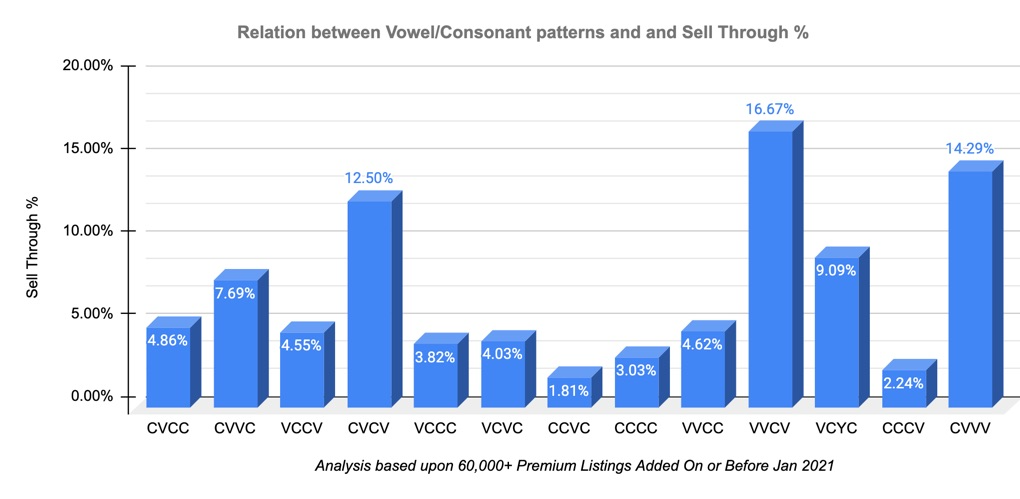

4-Letter Structure

Those who invest in 4-letter domain names prefer certain patterns of vowels (V) and consonants (C). It turns out that the STR varies a lot, with CVCV, VVCV and CVVV favoured.

Predicting Success – Number of TLDs

Domain investors often use number of TLDs as a screening mechanism when acquiring names. It turns out SquadHelp data supports this as a useful metric, with a name taken in 5 or more TLDs about 3x as likely to sell, compared to one taken only in a single TLD.

How STR Was Calculated

The results presented above all used sell-through rates. It is important to keep in mind that not all data was from same period, so one must be cautious in conclusions based on absolute values. As Darpan explained,

How Buyers Search

As domain investors, we expect that potential buyers will type the name into an URL, and arrive at our lander. Research at SquadHelp indicated in many cases that is not the case.

An Analytical Tool

For those with SquadHelp accounts, the Deep Keyword Analytics tool is helpful for evaluating potential acquisitions and wondering if they would be good candidates for the SquadHelp premium marketplace.

The tool is fast and easy to use: simply type in a root word, and it will give you sell-through rates for names based on that term, and also a competition analysis showing how many current listings with that keyword are on the site.

Final Thoughts

There are many other insights in the SquadHelp data. For example, names that get 5 or more loves in a naming contest, but are not chosen, have a much higher sell-through rate, more than 4x when compared to names that received no loves in a naming contest.

Domain investors often wonder whether number inquiries is a meaningful indicator for a sale. After one takes out visits from bots and other sellers, SquadHelp research indicated that:

It turns out a scheduled price increase, that shows on the listing for a period prior to the actual increase, is more effective than a discount in converting lookers into buyers. Since you can use either with SquadHelp White Label sites, this is a useful insight.

While some of the results shown here may be unique to SquadHelp, since each brandable marketplace has a certain clientele, the data insights offer much to think about as investors aim to increase the performance of their portfolios.

The following advice and caution from Darpan is important to keep in mind.

Data can help us become more successful as domain sellers. If you want to see future data insights, follow Darpan Munjal on Twitter.

One More Thing – Negotiation Checklist

Presentations at Apple Events by the late Steve Jobs were famous for the “one more thing” reveals near the end of the presentation. For the one more thing, I wanted to mention Darpan Munjal’s Negotiation Checklist. That article offers advice on everything from should you accept the first offer to deadlines, price drops, and much more.

Sincere thanks to Darpan Munjal and SquadHelp for sharing the data and insights with NamePros readers.

As Darpan wrote in 2021,

So let’s have a look at a selection of data from SquadHelp. Keep in mind that these refer to brandable names.Data and analytics can play a huge role in maximizing the sell-through rates for domains.

Power Words

Great brands often contain power words. Here are sell-through rates (STR) for a selection of power words based on more than 100,000 premium domain name listings at SquadHelp.

While the differences between many of these are slight, possibly not statistically significant, the set does offer ideas for those seeking to broaden and refine the lists they use in searching expiring and expired names.

I wondered whether they started with a set of word choices, and Darpan clarified the process:

We analyzed the entire pool of keywords which had a minimum number of sales in order to ensure that the data we are looking at is not influenced by too much noise. We then picked the most popular terms or words which generated the highest level of sales, and included the top 15-25 in our analysis. So in summary, the data in these charts should represent the most popular words for their respective categories.

Sell-Through Rates for Different TLDs

While the majority of SquadHelp premium names are

.com, SquadHelp do offer premium domains in a variety of TLDs. Somewhat surprisingly .io has a higher STR than .com, and .co is almost the same as .com.I wondered if the results might be explained by differences in selection criterion for the premium marketplace for different TLDs, so I asked Darpan about that.

We typically only accept one-word.ionames or some very strong two-word.ionames. As a result, the total pool of listed domains in.ioextension is much smaller than.com. Similarly, the number of sales as an absolute number is much smaller in comparison to.com. However, given the more stringent acceptance criteria, the STR for.ionames is much higher than what we see in.com. In general, though, we are seeing a significant increase in interest for strong one-word tech-focused.iodomains.

SquadHelp accept some

.xyz domain names for their premium marketplace, and I wondered if there was sufficient sales to conclude anything about that TLD.The pool of data available for.xyznames is much smaller, which is why it was not included in STR calculation. We did see a significant increase in demand for one-word.xyzdomains in the web3 and crypto space, but the demand is a bit lower than before, given the recent uncertainty in the crypto and NFT space.

Is .IO Just For Tech?

There is a widespread view that

.io is just for technology-related businesses. While there is no doubt that the early traction in .io was predominantly in tech, how true is that currently? SquadHelp looked at the question, finding that while 60% of .io sales were for crypto, gaming or web3, there were sales in many other sectors as shown.Popular Beginnings

If we look at words that are effective first words in two-word names, we have the results shown below, based on 50,000 premium names added to SquadHelp prior to June 2000.

While some of these results are expected, I was surprised to see terms like bold and bright were not more popular.

Terms Tech Startups Like

SquadHelp looked at STR for different terms just among those who selected the category technology in their name search. The results indicate that blue was the top term for tech startups, with a much higher STR than terms like labs or smart.

Better Left or Right?

Certain words, such as colors, meta and you are far more effective as the starting term, while other terms, such as health, money, verse and legal, are favoured as the second term.

Colors

Colors are frequently used in brands. The NamePros Blog considered colors as brands earlier this year. Part 1 looked at NameBio-recorded sales, listings at BrandBucket, and how frequently colors appear in company names, for some of the more important colours. In Part 2 I looked at the psychological aspects of colors as brands, and data for some additional colors suggested by NamePros readers.

It turns out we missed the color with the highest STR, at least as measured by SquadHelp STR, aqua. Note also that coral did very well in the rankings.

Animals

SquadHelp also looked at brand names that include an animal term. There were definite surprises, with goat, frog and fish leading in STR.

4-Letter Structure

Those who invest in 4-letter domain names prefer certain patterns of vowels (V) and consonants (C). It turns out that the STR varies a lot, with CVCV, VVCV and CVVV favoured.

Predicting Success – Number of TLDs

Domain investors often use number of TLDs as a screening mechanism when acquiring names. It turns out SquadHelp data supports this as a useful metric, with a name taken in 5 or more TLDs about 3x as likely to sell, compared to one taken only in a single TLD.

How STR Was Calculated

The results presented above all used sell-through rates. It is important to keep in mind that not all data was from same period, so one must be cautious in conclusions based on absolute values. As Darpan explained,

The STR for the analysis uses a simplified calculation (total domains sold in a given period divided by the total domains listed over the same period). Since the data was computed and shared at different times over the last one to two years, I do not recommend using the absolute STR values. However, it can be used as a relative metric to compare the performance of different keywords or search terms.

How Buyers Search

As domain investors, we expect that potential buyers will type the name into an URL, and arrive at our lander. Research at SquadHelp indicated in many cases that is not the case.

Based upon our recent study, when a buyer is interested in a name, they are four times more likely to Google the term, rather than to type in a browser URL box to see what comes up. Therefore, an SEO optimized lander which ranks in Google search results should be an important priority to maximize exposure.

An Analytical Tool

For those with SquadHelp accounts, the Deep Keyword Analytics tool is helpful for evaluating potential acquisitions and wondering if they would be good candidates for the SquadHelp premium marketplace.

The tool is fast and easy to use: simply type in a root word, and it will give you sell-through rates for names based on that term, and also a competition analysis showing how many current listings with that keyword are on the site.

Final Thoughts

There are many other insights in the SquadHelp data. For example, names that get 5 or more loves in a naming contest, but are not chosen, have a much higher sell-through rate, more than 4x when compared to names that received no loves in a naming contest.

Domain investors often wonder whether number inquiries is a meaningful indicator for a sale. After one takes out visits from bots and other sellers, SquadHelp research indicated that:

- For domains that received 2+ visits from the same user, there was a 45% increase in STR.

- For domains that received 3+ visits from the same user, the increase in STR was 68%.

- For domains with 4+ visits from the same user, the STR more than doubled, a 108% increase.

It turns out a scheduled price increase, that shows on the listing for a period prior to the actual increase, is more effective than a discount in converting lookers into buyers. Since you can use either with SquadHelp White Label sites, this is a useful insight.

While some of the results shown here may be unique to SquadHelp, since each brandable marketplace has a certain clientele, the data insights offer much to think about as investors aim to increase the performance of their portfolios.

The following advice and caution from Darpan is important to keep in mind.

It is important to note that while STR data can provide insights into which words or terms are more popular, ultimately the word synergy and the overall brandability of domain name is extremely important in determining the likelihood of a sale. For example, in case of two word domains, the second word must have a strong synergy with the first word to make it a powerful brand name. Combining two random words just because they have a high sell-through rate individually does not necessarily make the combined word attractive to buyers.

Data can help us become more successful as domain sellers. If you want to see future data insights, follow Darpan Munjal on Twitter.

One More Thing – Negotiation Checklist

Presentations at Apple Events by the late Steve Jobs were famous for the “one more thing” reveals near the end of the presentation. For the one more thing, I wanted to mention Darpan Munjal’s Negotiation Checklist. That article offers advice on everything from should you accept the first offer to deadlines, price drops, and much more.

Sincere thanks to Darpan Munjal and SquadHelp for sharing the data and insights with NamePros readers.

Last edited: