- Impact

- 1,877

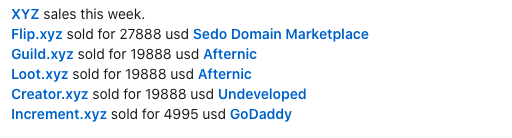

When I look at sales from DNgear, I can't believe my eyes. Someone doing 5-figure sales in .xyz is something I could never believe. I still can't! And yet she does it all the time. Now, I do understand that she must have invested half a million dollars to build a portfolio that is generating 5-figures every month but still. Here are some of here sales from this week:

I read a post on NamePros that .xyz was running a promo for $0.01 per domain name and someone purchase 10,000 domain names for $100, thinking that even 1 sale would make the investment profitable. But that sale never happened.

Now I don't know what those 10,000 names were, but even the poorest investor would have a slight chance and 1 sale if the extension had some value. And here we are, seeing DNgear doing rounds after rounds of sale.

This brings me to the topic of the day:

She is a visionary just like Rick Schwartz was, during his time, scooped up some good names and held them for 20 years. Now DNgear did the same thing in 201x and 2020s by identifying an extension, identifying some value she can offer, making a big bet and making it a reality!! Same was done by Mike Mann! A big bet. And big bet requires confidence and belief!

There are things that these visionaries do, which makes them take such a bet! I think it is more than research. Not sure what it is but something sets them apart. And the sales are just a by-product.

What is your opinion on this?

I read a post on NamePros that .xyz was running a promo for $0.01 per domain name and someone purchase 10,000 domain names for $100, thinking that even 1 sale would make the investment profitable. But that sale never happened.

Now I don't know what those 10,000 names were, but even the poorest investor would have a slight chance and 1 sale if the extension had some value. And here we are, seeing DNgear doing rounds after rounds of sale.

This brings me to the topic of the day:

She is a visionary just like Rick Schwartz was, during his time, scooped up some good names and held them for 20 years. Now DNgear did the same thing in 201x and 2020s by identifying an extension, identifying some value she can offer, making a big bet and making it a reality!! Same was done by Mike Mann! A big bet. And big bet requires confidence and belief!

There are things that these visionaries do, which makes them take such a bet! I think it is more than research. Not sure what it is but something sets them apart. And the sales are just a by-product.

What is your opinion on this?