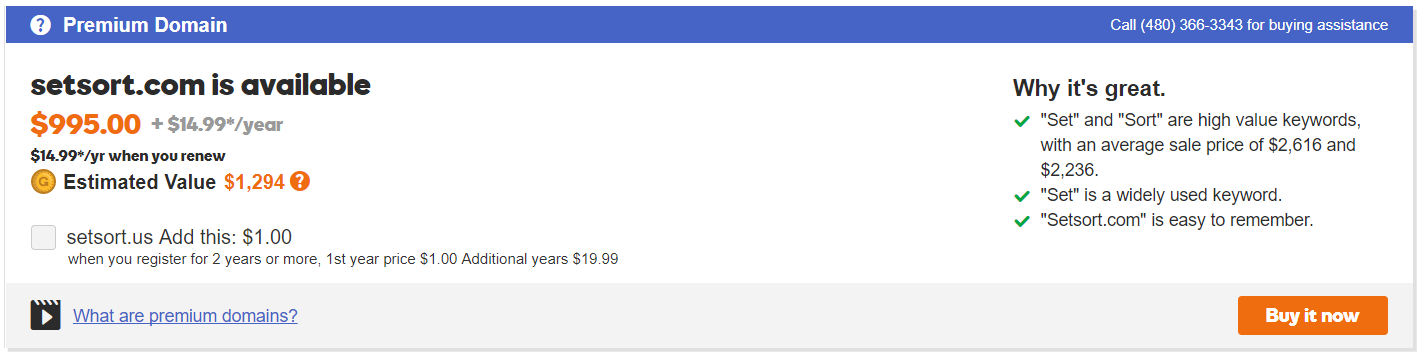

It looks like GoDaddy has rolled out a new display when you search for names in their search bar. I think it only applies to names that are in Afternic, and maybe GD Premium.

I think I like it. They're trying to sell the name by quoting their own estimated value and making some automated points about the name on the right.

They should be able to tell real quick if it's helping or hurting sales rate.

I think I like it. They're trying to sell the name by quoting their own estimated value and making some automated points about the name on the right.

They should be able to tell real quick if it's helping or hurting sales rate.

Last edited: