- Impact

- 17,389

As many of you know, I'm constantly confronting and challenging people about how the math behind their portfolio will not lead them to profits. When I do so it's because I actually DO THE MATH as opposed to many who just blindly guestimate.

Obviously when it comes to domaining there's as much art as their is science. Having a few years under your belt might not make you an industry expert, but at least at that point after making several sales you're able to generalise and categorise domains well enough to make approximate long-term averages ... and from that we can then develop a detailed portfolio projection based on math.

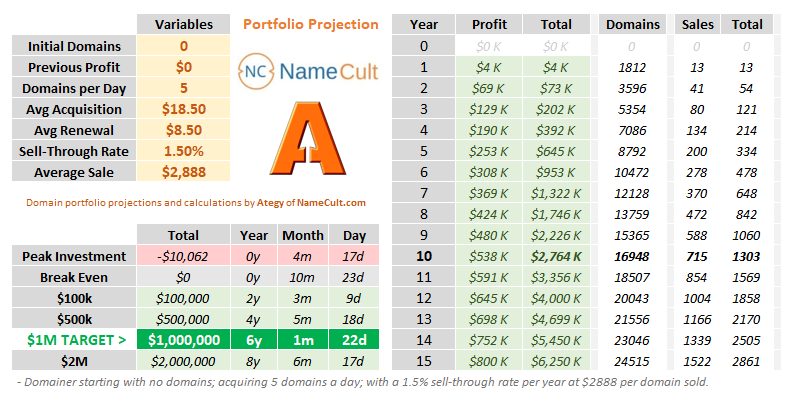

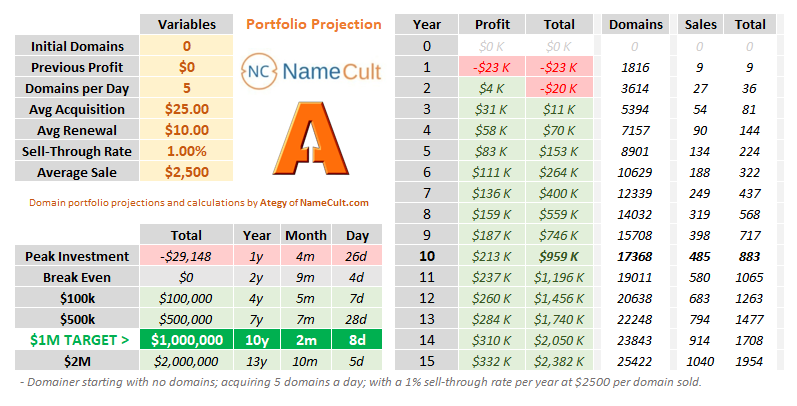

I've posted more details as well as charts with actual numbers over at NameCult. but just as a bonus for NamePros members, here are the raw numbers behind a couple of projections discussed in the article.

If you'd like me to post a personalised alternate projection based on your own variables (or numbers you're curious about), then please post in the comments at NameCult or in the following NamePros thread.

https://www.namepros.com/threads/get-your-1-000-000-domaining-path.1175267/#post-7614555

Full article ... [Namecult]

Example #1: $1,000,000 in 6 Years.

Example #2: $1,000,000 in 10 Years.

Original article: http://namecult.com/turning-10000-into-1000000-in-6-years-of-domaining/

Obviously when it comes to domaining there's as much art as their is science. Having a few years under your belt might not make you an industry expert, but at least at that point after making several sales you're able to generalise and categorise domains well enough to make approximate long-term averages ... and from that we can then develop a detailed portfolio projection based on math.

I've posted more details as well as charts with actual numbers over at NameCult. but just as a bonus for NamePros members, here are the raw numbers behind a couple of projections discussed in the article.

If you'd like me to post a personalised alternate projection based on your own variables (or numbers you're curious about), then please post in the comments at NameCult or in the following NamePros thread.

https://www.namepros.com/threads/get-your-1-000-000-domaining-path.1175267/#post-7614555

Full article ... [Namecult]

Example #1: $1,000,000 in 6 Years.

Example #2: $1,000,000 in 10 Years.

Original article: http://namecult.com/turning-10000-into-1000000-in-6-years-of-domaining/

Last edited: