- Impact

- 18,389

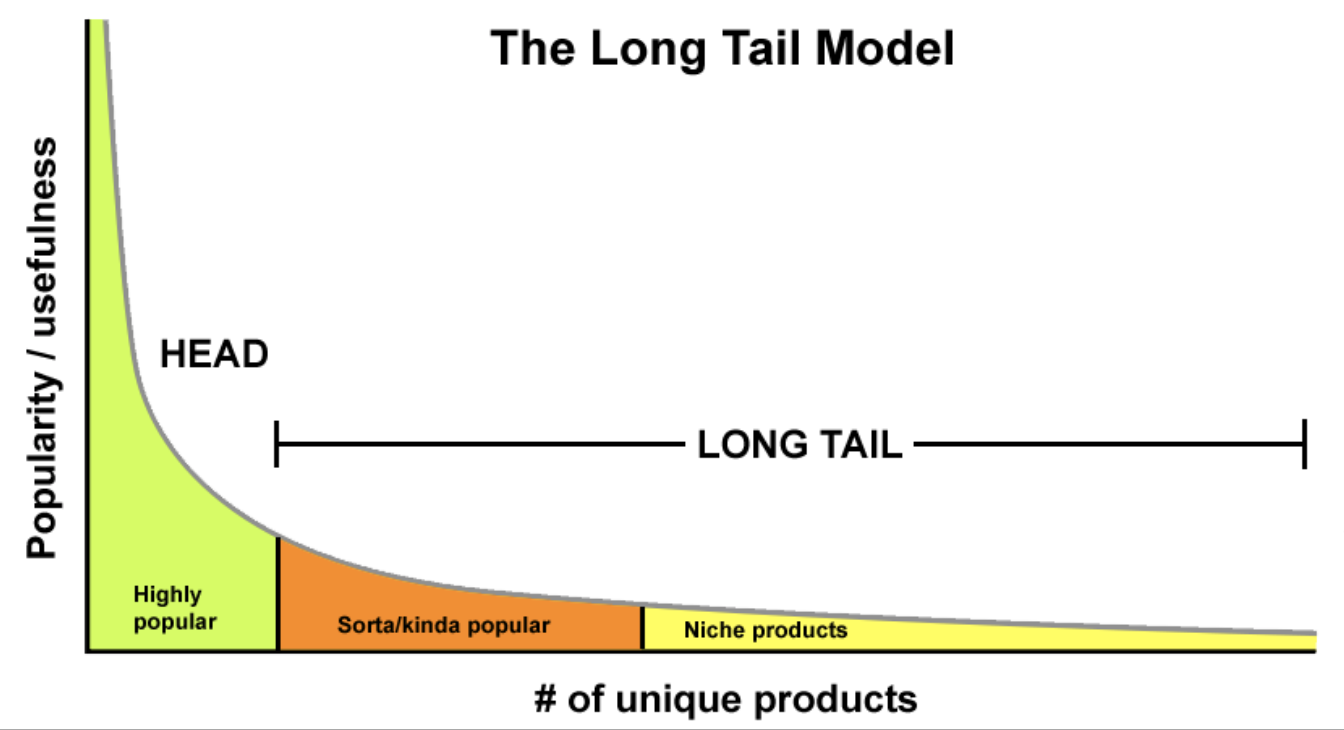

Some of you will be familiar with the term "The Long Tail". It is perhaps one of the most famous articles ever written in Wired Magazine back in its hey-day. Chris Anderson is the visionary author. The old classic can be found here: https://www.wired.com/2004/10/tail/

What exactly do I mean by "Long Tail" Domains

There is a finite but knowable universe of people who will value the domain name TampaGolfLessons.com. If you can find them and engage them good chance that they value them for some price that allows them to earn a return from switching from what they use now to something better.

To illustrate, these are classic :"long tail" domains:

The Barrier to entry to become a Domain Broker is effectively zero

Why I think it matters to domainers is this: the super-brokers might not have any interest in brokering a 3 figure domain or a 4 figure domain because of the size of prize is too low, even at a 20% commission. Some brokers won't even take on a domain for less than 6 figures, again due to small size of prize.

On the other hand, in some parts of the world, notably in emerging markets, many people have more time and intellect, than they have money or domains. Nevertheless, they absolutely do have much to offer the domain industry by using their time and talent to connect supply with demand.

As we look ahead to the next phase of domaining, I foresee an explosion of Domain Name Brokers. The long-time brokers might perhaps dreading this day because they will up against a dual squeeze:

1. Godaddy, the aspiring monopolist, now has 1 million owned and operated domain names that they will be eager to sell through their channel to a vast retail customer base with a brokerage team who will be under pressure to add value and have access to a large proprietary data set about who buys what domains.

2. Emerging markets are about to serve up an absolute explosion of independent Name Brokers, who can make use of a fast-expanding array of free tools for finding who owns what domains, and can use secure ways to clear those transactions, e.g. through marketplaces and escrow services.

So what is a Boostrapping Domain Broker to do?

The good news is that brokering domains is a capital-efficient way for emerging market participants to bootstrap their way into an industry, even with little or no capital.

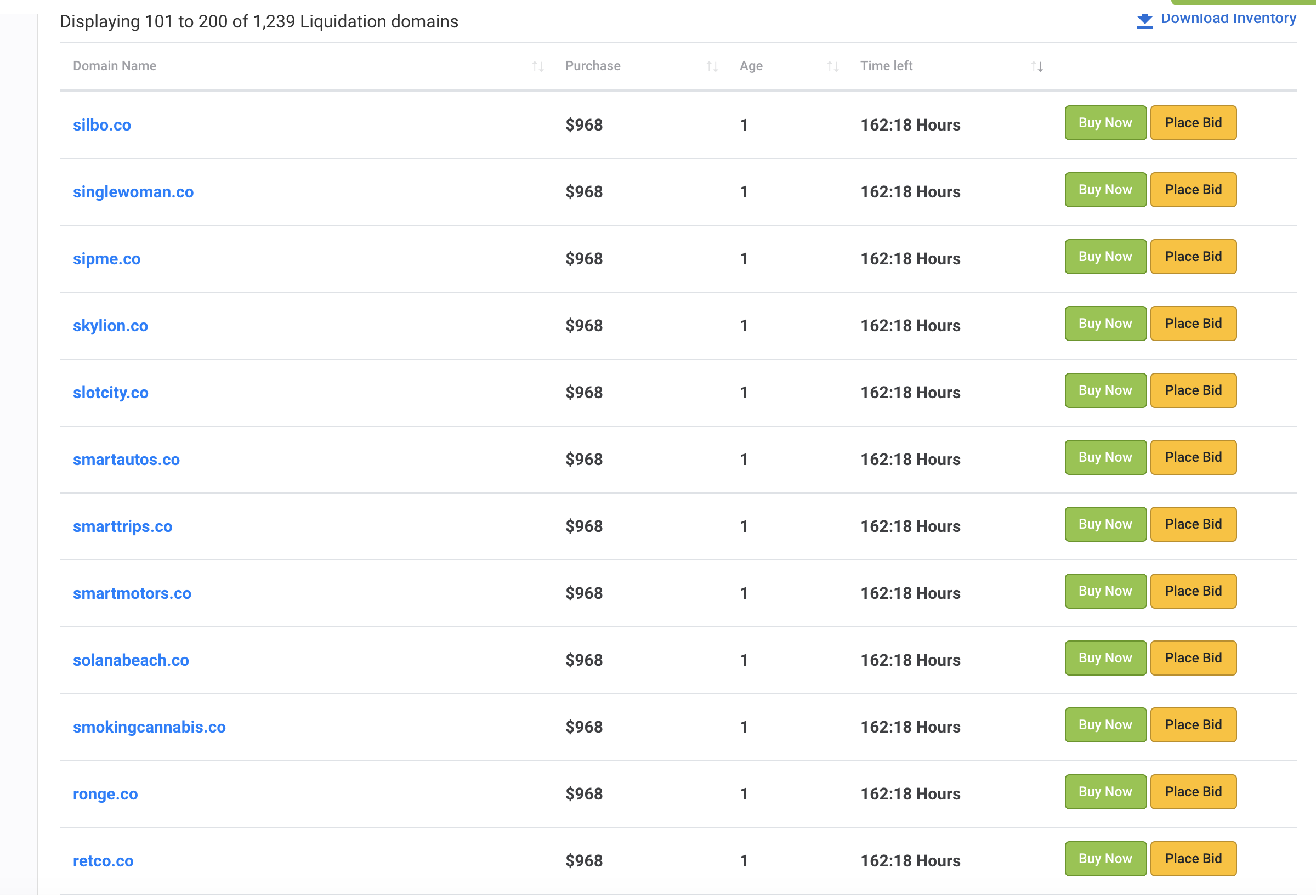

One way to get started might be to leverage a domain liquidation service - go find a domain that is newly listed, and try to find a buyer for that domain before the reverse auction ends. After all, the price keeps coming down while your prospective buyers can be bid up.

Many people might look at domain liquidation services on the last day, looking for expiring auctions to find the bargains. However, the contrarian move is a bit different and that is to look at the new arrivals, and not just for the mispriced domains but I think more importantly for the bootstrapper, the arbitrage opportunities.

Examples:

We plan to add a "Escrow" feature right inside of our domain liquidation service so that domain flippers can essentially send a domain into escrow, cover the transfer fee, and then have a short window to make good on their purchase. If they fail to make good, the auction resumes and the broker is out their transfer fee.

Looking ahead, we have larger ideas for how a fast-expanding pool of domain brokers could leverage a domain brokerage platform. Will share more on that if folks are interested in the topic.

Why a massive increase in the number of brokers is good news for (almost) everyone

The really great news for domain owners is that there will be a vast supply of highly energetic people who will be able to help connect supply with demand, and to get more supply into the hands of end-users. The end result of this is more liquidity in the domain economy, and higher retail prices for quality inventory.

What exactly do I mean by "Long Tail" Domains

There is a finite but knowable universe of people who will value the domain name TampaGolfLessons.com. If you can find them and engage them good chance that they value them for some price that allows them to earn a return from switching from what they use now to something better.

To illustrate, these are classic :"long tail" domains:

The Barrier to entry to become a Domain Broker is effectively zero

Why I think it matters to domainers is this: the super-brokers might not have any interest in brokering a 3 figure domain or a 4 figure domain because of the size of prize is too low, even at a 20% commission. Some brokers won't even take on a domain for less than 6 figures, again due to small size of prize.

On the other hand, in some parts of the world, notably in emerging markets, many people have more time and intellect, than they have money or domains. Nevertheless, they absolutely do have much to offer the domain industry by using their time and talent to connect supply with demand.

As we look ahead to the next phase of domaining, I foresee an explosion of Domain Name Brokers. The long-time brokers might perhaps dreading this day because they will up against a dual squeeze:

1. Godaddy, the aspiring monopolist, now has 1 million owned and operated domain names that they will be eager to sell through their channel to a vast retail customer base with a brokerage team who will be under pressure to add value and have access to a large proprietary data set about who buys what domains.

2. Emerging markets are about to serve up an absolute explosion of independent Name Brokers, who can make use of a fast-expanding array of free tools for finding who owns what domains, and can use secure ways to clear those transactions, e.g. through marketplaces and escrow services.

So what is a Boostrapping Domain Broker to do?

The good news is that brokering domains is a capital-efficient way for emerging market participants to bootstrap their way into an industry, even with little or no capital.

One way to get started might be to leverage a domain liquidation service - go find a domain that is newly listed, and try to find a buyer for that domain before the reverse auction ends. After all, the price keeps coming down while your prospective buyers can be bid up.

Many people might look at domain liquidation services on the last day, looking for expiring auctions to find the bargains. However, the contrarian move is a bit different and that is to look at the new arrivals, and not just for the mispriced domains but I think more importantly for the bootstrapper, the arbitrage opportunities.

Examples:

We plan to add a "Escrow" feature right inside of our domain liquidation service so that domain flippers can essentially send a domain into escrow, cover the transfer fee, and then have a short window to make good on their purchase. If they fail to make good, the auction resumes and the broker is out their transfer fee.

Looking ahead, we have larger ideas for how a fast-expanding pool of domain brokers could leverage a domain brokerage platform. Will share more on that if folks are interested in the topic.

Why a massive increase in the number of brokers is good news for (almost) everyone

The really great news for domain owners is that there will be a vast supply of highly energetic people who will be able to help connect supply with demand, and to get more supply into the hands of end-users. The end result of this is more liquidity in the domain economy, and higher retail prices for quality inventory.

Last edited by a moderator: