- Impact

- 493

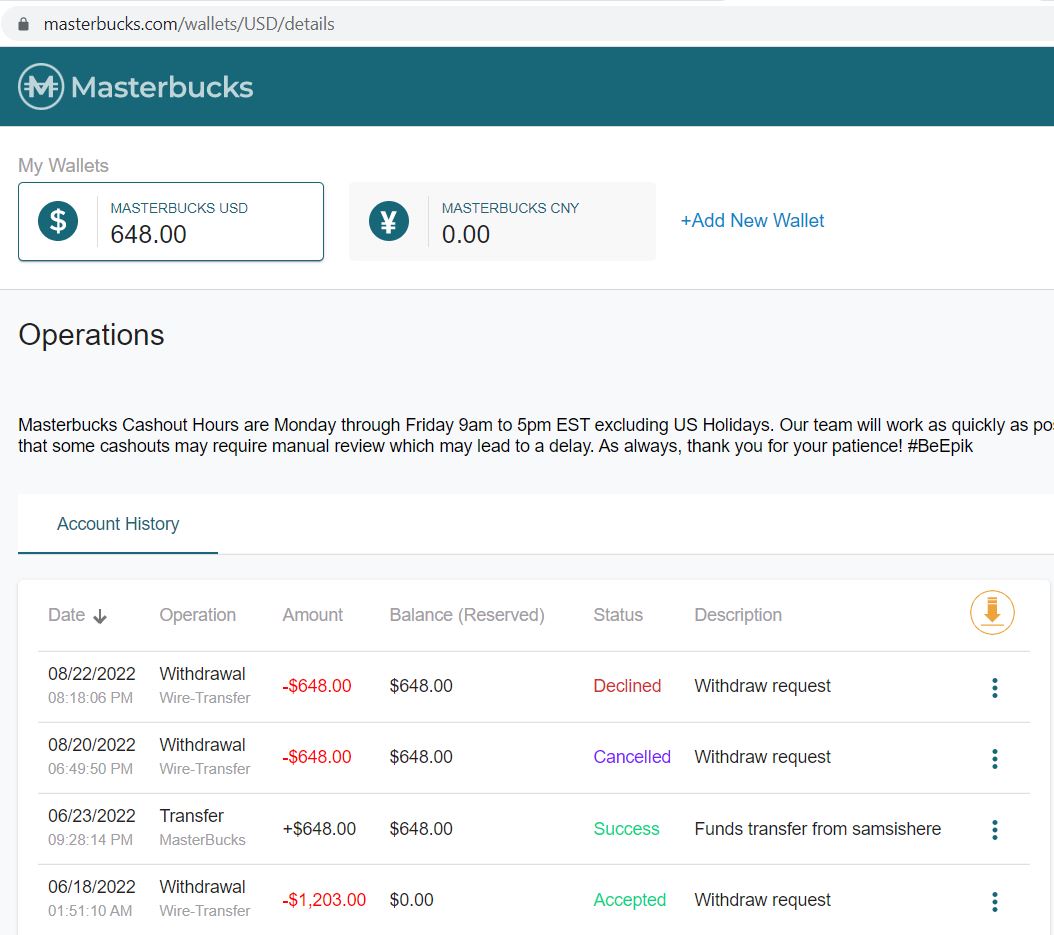

It happened on 23rd Aug 2022 and this matter lasted almost one month without any process. Masterbucks.com declined my fund withdrawal and disabled the button of fund withdrawal. And I contacted Epik.com and got no further action even if Rob Monster got involved in it for two weeks. All the time I was told in email by management review.

What is wrong with Epik.com? Do you think it is normal to disable fund withdrawal? How can I get back my fund from Epik.com? Thanks for your suggestion.

What is wrong with Epik.com? Do you think it is normal to disable fund withdrawal? How can I get back my fund from Epik.com? Thanks for your suggestion.