Bloomberg: A Funny Thing Happened on the Way to the Stock Market Record

read more (Bloomberg)

Are Negative Interest Rates Pumping Up Bubbles?

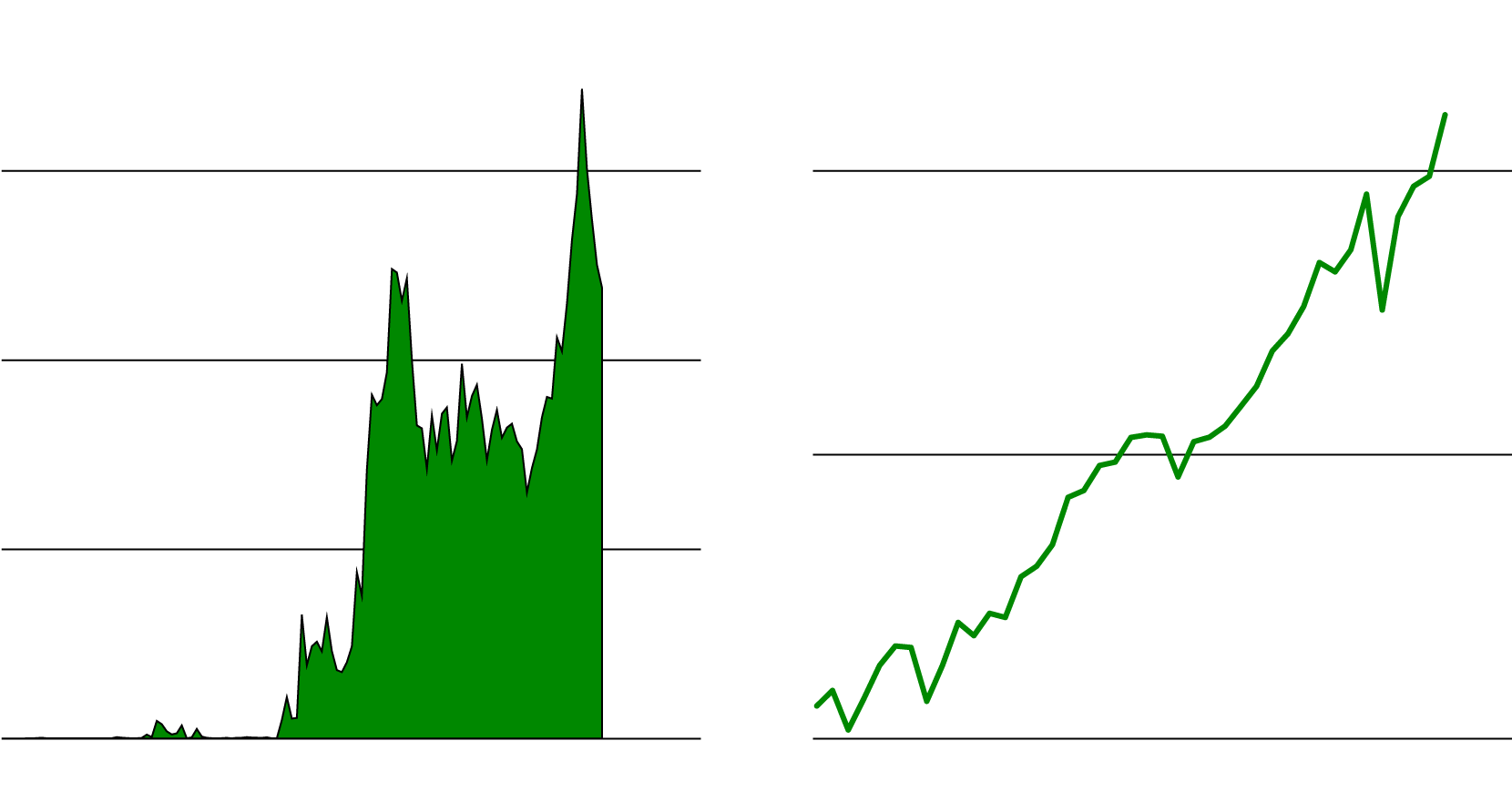

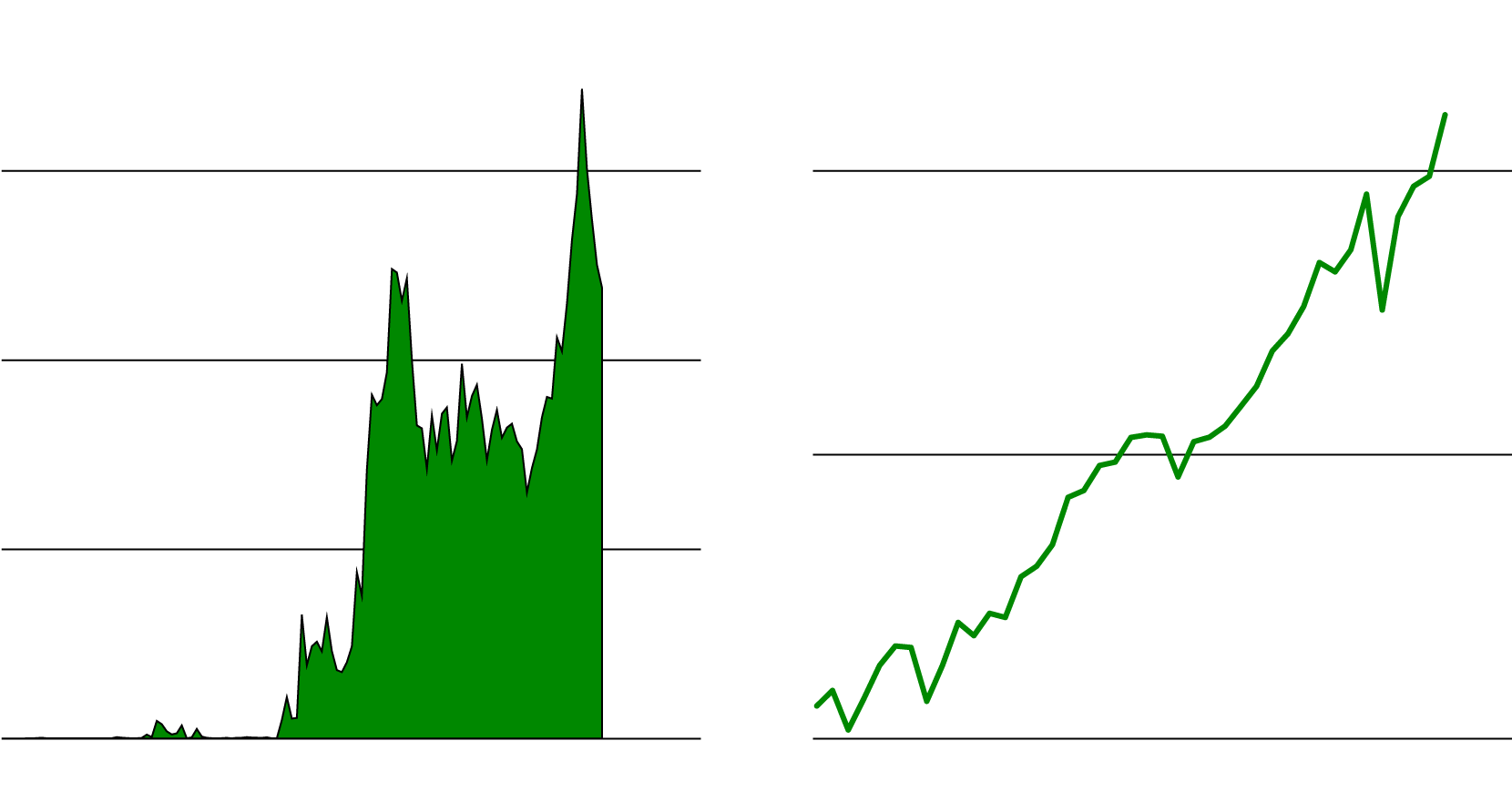

As rates fell below zero in Europe and Japan, U.S. stock markets soared.

Investors get edgy when asset prices are down, but they should be more concerned at times like now, when prices have gone up, up, and up. Through Dec. 17 the S&P 500 index has gained 27% this year. The market feels as frothy as the top of a nutmeg cappuccino.

“We enter the next decade with interest rates at 5,000-year lows, the largest asset bubble in history, a planet that is heating up, and a deflationary profile of debt, disruption, and demographics,” Michael Hartnett, chief equity strategist for BofA Global Research, wrote in a recent note.

There’s a bigger issue here than whether stock and bond prices are too high. The more serious question is whether the economies of the U.S. and other wealthy nations can no longer grow without producing destabilizing bubbles—spikes in asset prices unjustified by fundamentals. Or, worse yet, whether the bubbles themselves are crucial to generating economic growth.

The circumstantial evidence for a dysfunctional relationship between economies and bubbles is troubling.

read more (Bloomberg)

read more (Bloomberg)

Are Negative Interest Rates Pumping Up Bubbles?

As rates fell below zero in Europe and Japan, U.S. stock markets soared.

Investors get edgy when asset prices are down, but they should be more concerned at times like now, when prices have gone up, up, and up. Through Dec. 17 the S&P 500 index has gained 27% this year. The market feels as frothy as the top of a nutmeg cappuccino.

“We enter the next decade with interest rates at 5,000-year lows, the largest asset bubble in history, a planet that is heating up, and a deflationary profile of debt, disruption, and demographics,” Michael Hartnett, chief equity strategist for BofA Global Research, wrote in a recent note.

There’s a bigger issue here than whether stock and bond prices are too high. The more serious question is whether the economies of the U.S. and other wealthy nations can no longer grow without producing destabilizing bubbles—spikes in asset prices unjustified by fundamentals. Or, worse yet, whether the bubbles themselves are crucial to generating economic growth.

The circumstantial evidence for a dysfunctional relationship between economies and bubbles is troubling.

read more (Bloomberg)