The first six months of 2022 resulted in 76,000 NameBio-listed domain sales of $100 or more, accounting for a dollar volume of just over $84 million.

That is an increase of 0.9% in number of sales compared to the same six months of 2021, and a 4.1% increase in dollar volume.

In this article I look at how different extensions fared. In all cases I compare the first six months of 2022 with the same period for 2021 and earlier years.

COM Continues To Dominate

The dollar volume in

The number of

The

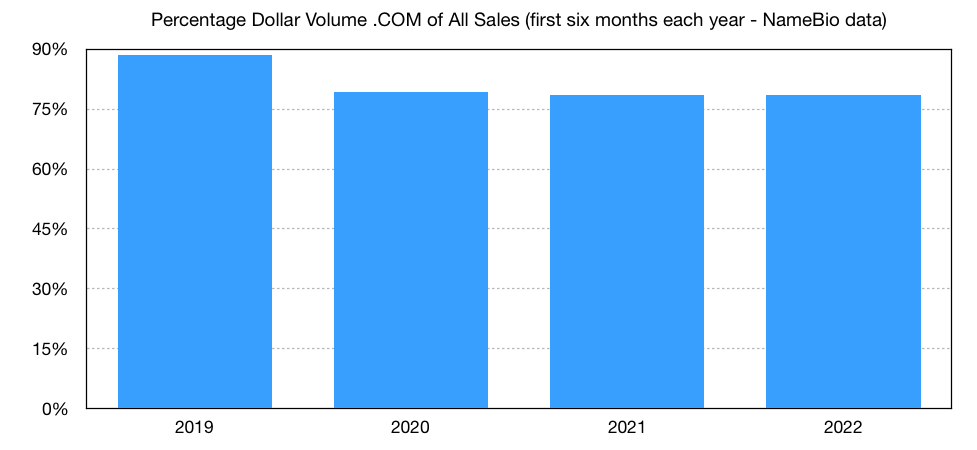

That has not changed much over the last four years, as the graph below indicates. The huge voice.com sale skewed the data for 2019.

The

NET Dips To Traditional Levels

The first six months of 2021 were great in the extension, but

The dollar volume drop was due to a significant decrease in average price in the extension, from $1439 during the first half of 2021, to $894 in the same period from 2022.

As for

ORG Keeps Rolling

The modest but steady increase in

The average sales price in

The number of

Country Codes Stumble

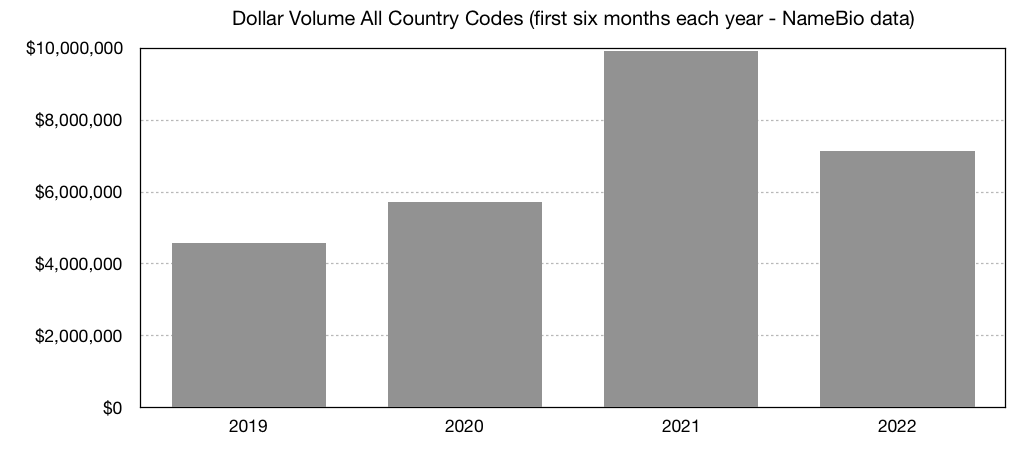

Country code domain names had a spectacular 2021, but that momentum reversed during the first six months of 2022.

Taken as a whole, country code extensions were just slightly down in number of sales, but down by almost 28% in average price and sales volume.

We should put that in perspective, however, as the sales volume was higher than in the first six months of 2019 or 2020, as indicated in the following graph.

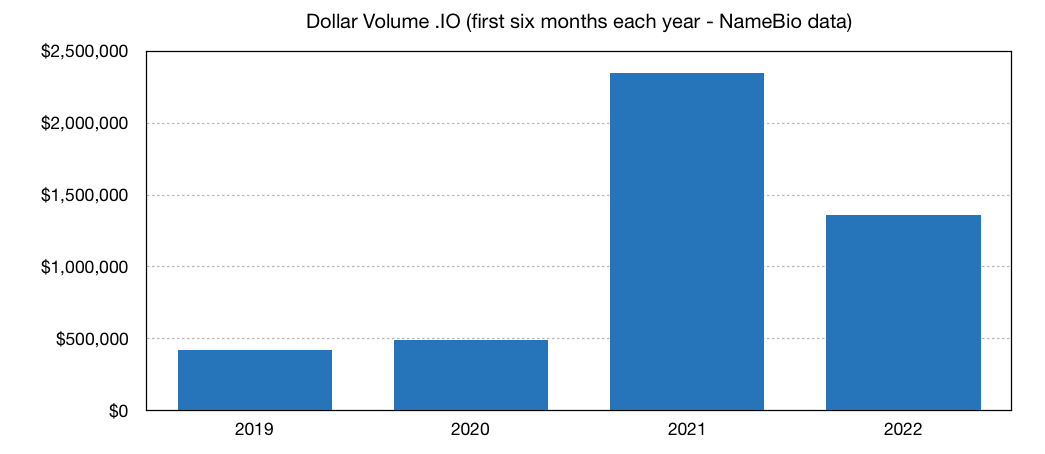

IO Average Price Down

A big part of the reason that country codes fell in sales volume was a drop in

The sales dollar volume in

It should be kept in mind that a decrease in the overall average price does not necessarily mean that retail prices in the extension are decreasing.

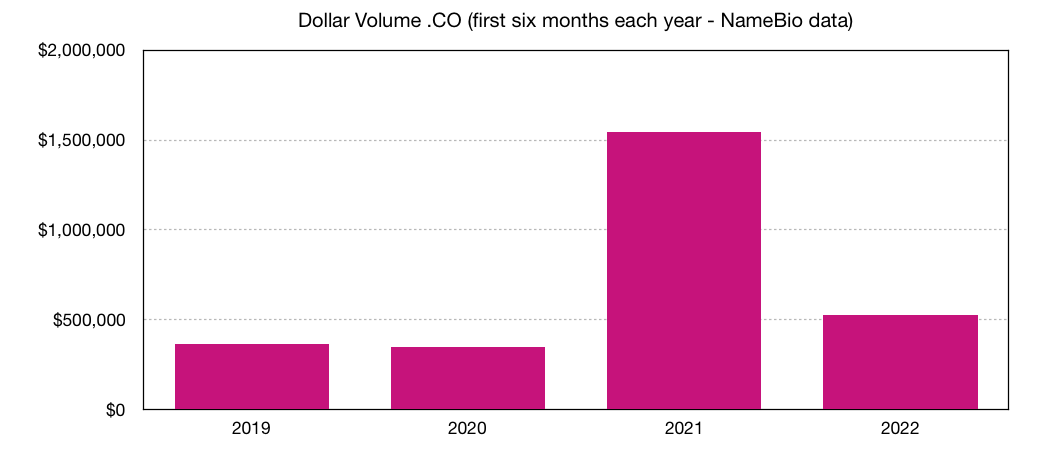

CO Decline

The decline was even more dramatic in the

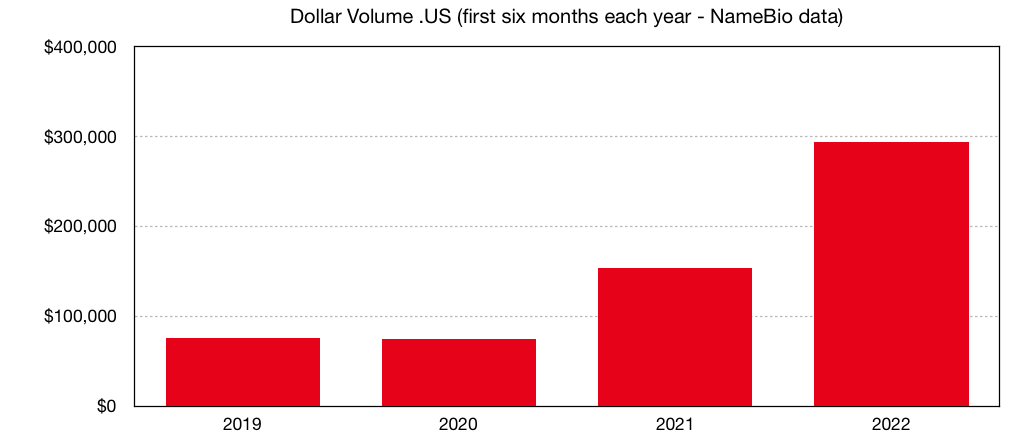

US Sales Up

One country code extension that bucked the downward trend was

As the following graph shows, the uptick in

Other Country Code Extensions

I tracked many other country code extensions, and here are comments for some not mentioned earlier. Note that in many cases the number of sales is relatively small, so the apparent trends may not be statistically significant.

New Extensions Surge

While the average price of new gTLD extensions was down slightly in 2022, to a still healthy $1830, that was more than made up by a surge in number of NameBio-reported sales. There were almost 3 times as many reported sales during the first six months of 2022 compared to the same period of 2021. As a result, sales dollar volume was up 265% for new gTLDs as a whole. The trend over the four years is shown in the graph below.

New extensions accounted for just over $4.8 million in sales volume over the six month period.

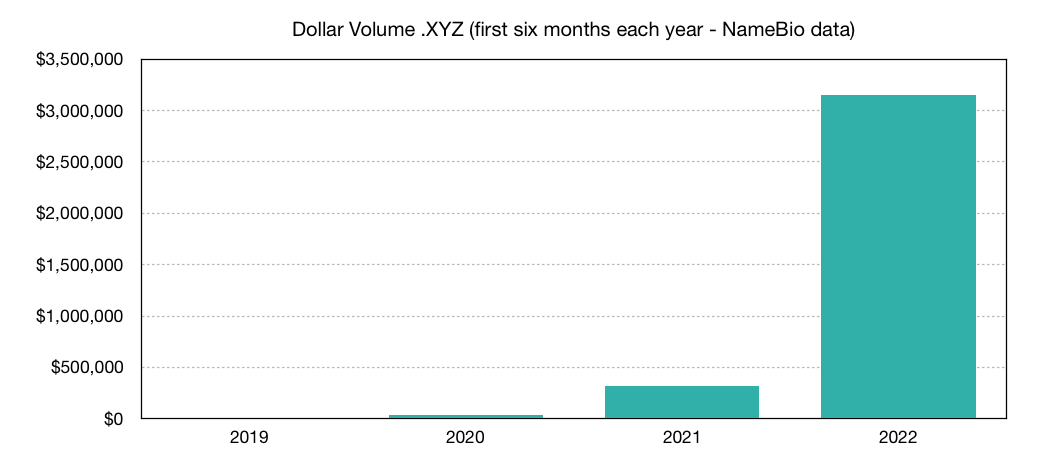

XYZ Grows 10x Each Year

Much of the growth in new gTLDs was in

As a result,

It seems unlikely that

Other New Extensions

While

Other Extensions

Here are notes for a few TLDs not mentioned earlier.

Average Prices

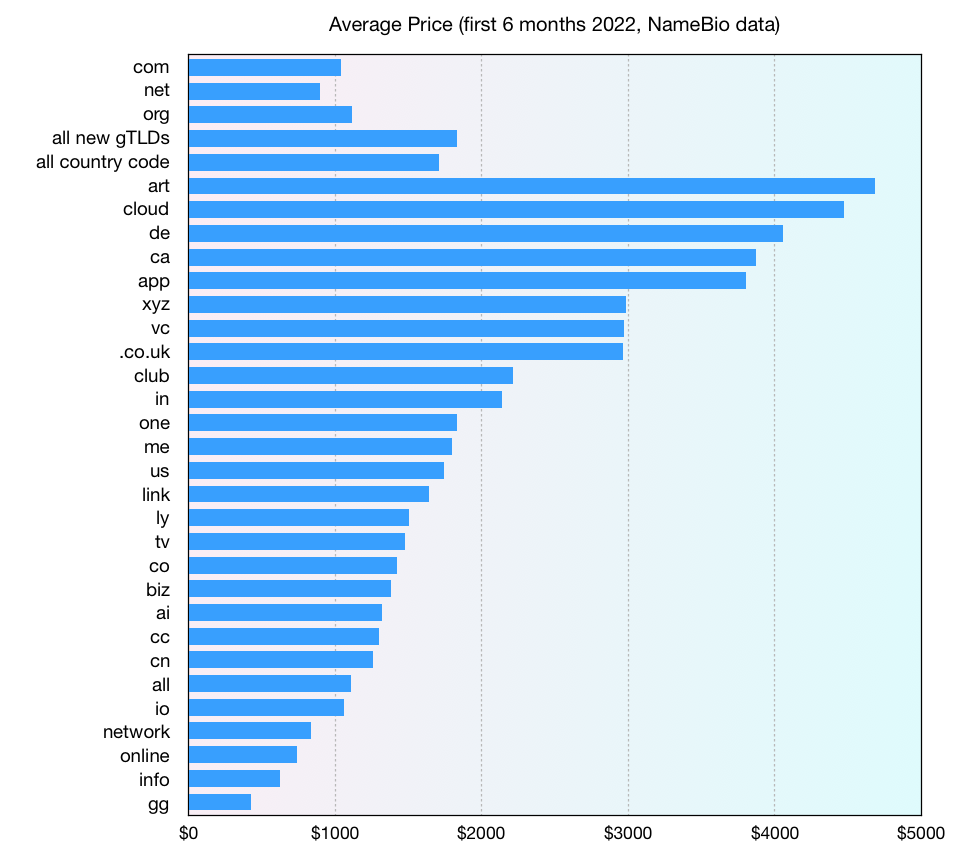

I collected the average prices for the first six months of 2022 in the following graph.

At first glance, the average price information will seem surprising. Many new and country code extensions have substantially higher average prices than

But the average price picture is misleading when using NameBio data. That is because there are substantially more wholesale acquisitions in the legacy extensions, with many trades for each retail sale. That drags down the average price. In the country codes and new extensions, without a well-developed and reported wholesale market, the reported sales are dominated by retail sales.

Keep In Mind

It is important to keep in mind that by no means all domain name sales are reported in NameBio.

NameBio reports a higher percentage of wholesale transactions than retail. As wholesale prices have risen, there is probably a higher percentage of wholesale transactions reflected in recent years.

The ratio of number of NameBio-reported wholesale to retail sales varies with extension. As noted earlier, this means one must be cautious when comparing average prices across extensions.

Also, a relatively small number of high-value sales can have a big impact on average prices.

It is hard to know if there are significant differences between extensions in the fraction of sales that are reported in NameBio. There probably are to some degree.

Over the years, what gets reported in NameBio has changed. That impacts the data.

Rising wholesale prices have pushed more wholesale transactions about the $100 that appear in the NameBio record available without a subscription.

Keep in mind that for some extensions the number of sales in a six month period is relatively small, introducing considerable statistical uncertainty in results.

I collected the data right at the end of the six month period. That means sales reported later, but that occurred during the six month period, will not have been included. Therefore, you may find slightly different data if you later check NameBio. Since I was consistent in how I did this in 2019, 2200, 2221 and 2222, however, there should not be a systematic bias.

Past Years

This is the fourth analysis of the first six months of the year. Here are links to the previous articles:

Please share in the discussion what you conclude from the data.

Thanks to Namebio, an amazing resource for investigation of domain name sales data.

That is an increase of 0.9% in number of sales compared to the same six months of 2021, and a 4.1% increase in dollar volume.

In this article I look at how different extensions fared. In all cases I compare the first six months of 2022 with the same period for 2021 and earlier years.

COM Continues To Dominate

The dollar volume in

.com alone was up slightly, from 63.5 million in 2021 to $66.1 million in 2022.The number of

.com sales was down slightly, but that was more than made up by a 7.3% rise in average price.The

.com extension continues to have the majority of all domain sales. In 2022 .com accounted for 78.5% of all sales by dollar volume, and 83.3% by number of sales.That has not changed much over the last four years, as the graph below indicates. The huge voice.com sale skewed the data for 2019.

The

.com average sales price edged upward, to $1044 in 2022. The average price is deceptive, since it is a combination of retail sales along with a many more wholesale transactions. Clearly, the retail-only average price would be substantially higher.NET Dips To Traditional Levels

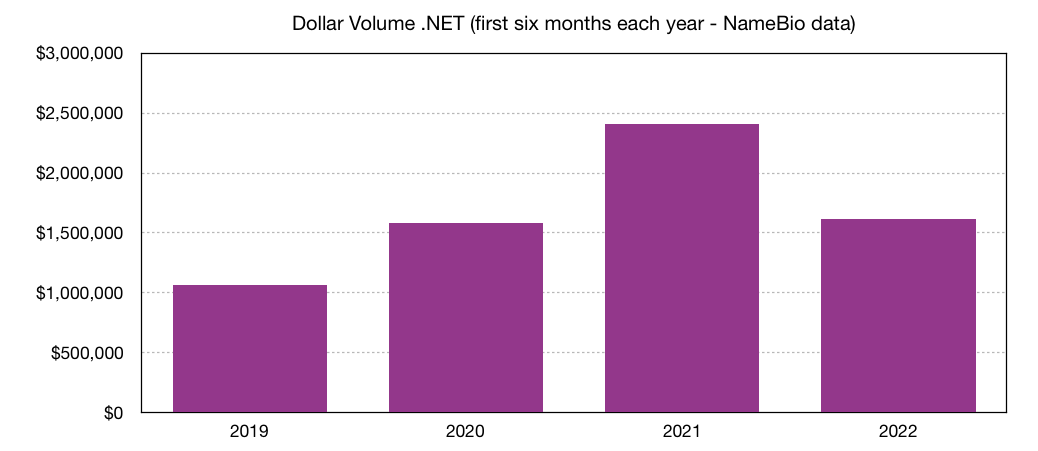

The first six months of 2021 were great in the extension, but

.net sales volume dropped 33% in 2022. As the following graph shows, that decrease moved the extension back to the levels of recent years.The dollar volume drop was due to a significant decrease in average price in the extension, from $1439 during the first half of 2021, to $894 in the same period from 2022.

As for

.com, the average price is misleading, as there are many more wholesale than retail transactions.ORG Keeps Rolling

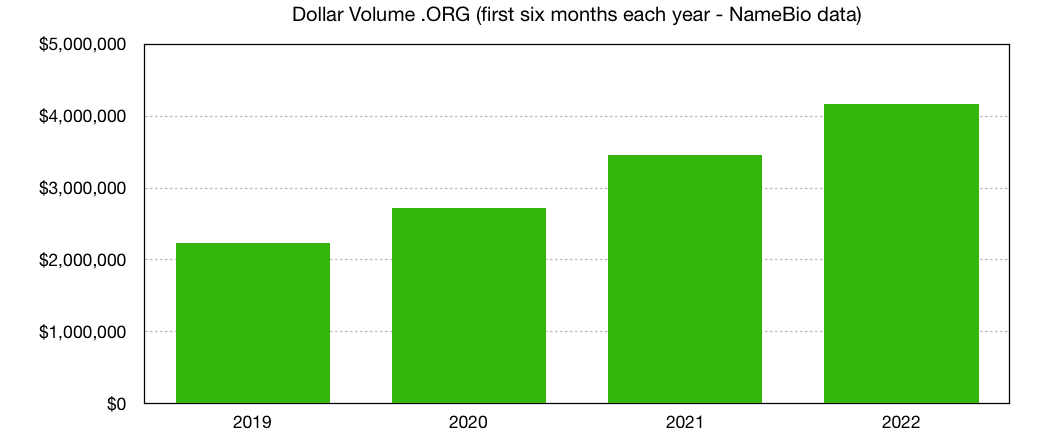

The modest but steady increase in

.org sales sometimes goes unnoticed. As the graph below indicates, the dollar volume in .org has steadily increased in recent years, accounting for $4.2 million in .org sales during the first six months of 2022.The average sales price in

.org, $1118 during the first half of 2022, was higher than .com and significantly higher than .net.The number of

.org domain names sold was up by just under 16% compared to the same months in 2021.Country Codes Stumble

Country code domain names had a spectacular 2021, but that momentum reversed during the first six months of 2022.

Taken as a whole, country code extensions were just slightly down in number of sales, but down by almost 28% in average price and sales volume.

We should put that in perspective, however, as the sales volume was higher than in the first six months of 2019 or 2020, as indicated in the following graph.

IO Average Price Down

A big part of the reason that country codes fell in sales volume was a drop in

.io. Although the number of .io sales was up about 35%, a 57% drop in average price resulted in a 42% drop in sales volume.The sales dollar volume in

.io dropped from $2.3 million during the first six months of 2021, to about $1.4 million in the first half of 2022. However, the country code sales volume in the first six months of 2022 was still several times higher than the first 6 months of 2019 or 2020, as the graph below shows.It should be kept in mind that a decrease in the overall average price does not necessarily mean that retail prices in the extension are decreasing.

CO Decline

The decline was even more dramatic in the

.co extension, which dropped 34% in number of sales, 48% in average price, and 66% in sales dollar volume.US Sales Up

One country code extension that bucked the downward trend was

.us, that saw a 37% rise in the number of sales, 40% higher average prices, and a sales dollar volume 92% above the same period in 2021.As the following graph shows, the uptick in

.us began in 2021, and intensified in 2022.Other Country Code Extensions

I tracked many other country code extensions, and here are comments for some not mentioned earlier. Note that in many cases the number of sales is relatively small, so the apparent trends may not be statistically significant.

.deis always one of the best performers, and that remained the case in early 2022 with a $4056 average price and $1.4 million sales dollar volume in the six month period. While down 19% from a strong 2021, the dollar volume is higher than 2019 or 2020.- The

.meextension was down almost 28% in number of sales, but up just under 22% in average price, so down about 12% in sales volume. The average price during the first six months of 2022 was $1797. - The

.tvextension had an increase of just over 45% in number of sales, but a drop of more than 50% in average price, so sales dollar volume was down about 29%. The average price was still $1477 in 2022, and was only down when compared to a very strong 2021. - The

.vcextension, popular among venture capital firms, was down slightly in dollar volume, but the average price increased to $2973. - Reported sales in

.gg, a country code that appeals to the gaming community, seem dominated by investor acquisitions, with an average sales price of only $430, down significantly from the previous year. - The

.ccextension approximately doubled sales dollar volume in the first months of 2022 compared to the same period in 2021, although that is somewhat lower than 2020. The average price grew by 51% in 2022, to $1298. - The

.aiextension, popular for artificial intelligence, was down in number of sales, up in average price to $1317, and down about 44% in sales dollar volume when compared to the first six months of 2021. - There was not a lot of change in the

.lyextension, somewhat popular as a branding alternative, with sales dollar volume down 7.1%. - The picture was mixed, but generally down, in other national country code extensions. The UK’s

.co.ukwas down 46% in sales volume, China’s.cndown 42%, India’s.indown 41%, and Canada’s.caup 1% in dollar volume, although based on a small number of sales. Most of these extension have high average sales prices.

New Extensions Surge

While the average price of new gTLD extensions was down slightly in 2022, to a still healthy $1830, that was more than made up by a surge in number of NameBio-reported sales. There were almost 3 times as many reported sales during the first six months of 2022 compared to the same period of 2021. As a result, sales dollar volume was up 265% for new gTLDs as a whole. The trend over the four years is shown in the graph below.

New extensions accounted for just over $4.8 million in sales volume over the six month period.

XYZ Grows 10x Each Year

Much of the growth in new gTLDs was in

.xyz. The growth in dollar volume was spectacular, going from just $3340 during the first six months of 2019, increasing by a factor of about 10 to $31,400 in the same period of 2020, followed by another increase by 10 to $314,000 in 2021, and a growth of about ten times once more to almost $3.2 million in dollar volume during the first six months of 2022.As a result,

.xyz went from representing only 0.2% of overall new gTLD sales volume in 2019, to 23.6% in 2021, and now 65.2 % of all new extension sales volume.It seems unlikely that

.xyz can keep growing at this rate, and the last month has had a lower rate of reported high-value .xyz sales.Other New Extensions

While

.xyz accounted for much of the growth in new extension sales, a few others played roles in that surge. Here are comments on some other new gTLDs that I tracked.- Supposedly driven by the interest in NFTs, the

.artextension had a superb first six months of 2022, growing from 1 sale in early 2021 to 45 in 2022, accounting for just over $210,000 in sales dollar volume. - The

.networkextension had taken off in 2021, going from just 1 and 0 NameBio-reported sales in 2019 and 2021, to 26 reported sales during the first six months of 2021 and 38 sales in the first six months of 2022. The cryptocurrency and web3 emphasis on networks probably accounts for the increase. There was about $32,000 in.networksales volume during the first six months of 2022. .clouddoes not account for many sales, but they are at good average prices, $4468 in 2022..appremains one of the most solid new extensions. The number of sales was up 85%, although down almost 10% in average price. As a result sales dollar volume in the extension was up 67% during the first six months of 2022..clubis another solid performer, although the sales volume was down almost 60% in 2022, mainly due to a drop in number of sales.- The number of sales are small, but a few other new extensions I tracked were

.online, up 25% in dollar volume;.linkdown 29%; and.oneup 120%, although based on less than $13,000 in sales volume.

Other Extensions

Here are notes for a few TLDs not mentioned earlier.

.bizhad more sales, and was up 3% in sales dollar volume. The extension accounted for just under $61,000 in sales volume during the six month period.- The

.infoextension was up almost 48% in dollar volume, representing $126,000 in reported domain sales over the six month period.

Average Prices

I collected the average prices for the first six months of 2022 in the following graph.

At first glance, the average price information will seem surprising. Many new and country code extensions have substantially higher average prices than

.com and other legacy extensions. For example, the average .app 2022 sales price was $3802, the average .ca $3872, .de at $4056, .cloud at $4468, .art at $4685. This compares to a .com average sales price of $1044, or .net at $894. Even extensions like .biz at $1384 had a substantially higher price than the legacy extensions in 2022.But the average price picture is misleading when using NameBio data. That is because there are substantially more wholesale acquisitions in the legacy extensions, with many trades for each retail sale. That drags down the average price. In the country codes and new extensions, without a well-developed and reported wholesale market, the reported sales are dominated by retail sales.

Keep In Mind

It is important to keep in mind that by no means all domain name sales are reported in NameBio.

NameBio reports a higher percentage of wholesale transactions than retail. As wholesale prices have risen, there is probably a higher percentage of wholesale transactions reflected in recent years.

The ratio of number of NameBio-reported wholesale to retail sales varies with extension. As noted earlier, this means one must be cautious when comparing average prices across extensions.

Also, a relatively small number of high-value sales can have a big impact on average prices.

It is hard to know if there are significant differences between extensions in the fraction of sales that are reported in NameBio. There probably are to some degree.

Over the years, what gets reported in NameBio has changed. That impacts the data.

Rising wholesale prices have pushed more wholesale transactions about the $100 that appear in the NameBio record available without a subscription.

Keep in mind that for some extensions the number of sales in a six month period is relatively small, introducing considerable statistical uncertainty in results.

I collected the data right at the end of the six month period. That means sales reported later, but that occurred during the six month period, will not have been included. Therefore, you may find slightly different data if you later check NameBio. Since I was consistent in how I did this in 2019, 2200, 2221 and 2222, however, there should not be a systematic bias.

Past Years

This is the fourth analysis of the first six months of the year. Here are links to the previous articles:

Please share in the discussion what you conclude from the data.

Thanks to Namebio, an amazing resource for investigation of domain name sales data.