Over the past five years the average price for domain name sales listed in the NameBio database is about $1473, compared to $1306 for year 2019 alone. In the first part of this series I looked at domain name sales volume, while this time I look at average price trends.

I start by considering apparent average prices, that is simply the average of all sales over $100 listed in the NameBio database for different domain extensions and time periods. It is important to keep in mind that these only reflect the venues that report sales information to NameBio.

NameBio-reported domain sales are a mix of wholesale and retail sales. This can mask true trends. For example, if more wholesale acquisitions are in the database for a certain time interval, the average price may trend down, even though the actual retail prices are going up.

In the last part of this report I extract a subset of NameBio sales data to get a handle on retail-only price trends. The all-time average retail sales price is probably of the order of $6400.

Legacy Extensions

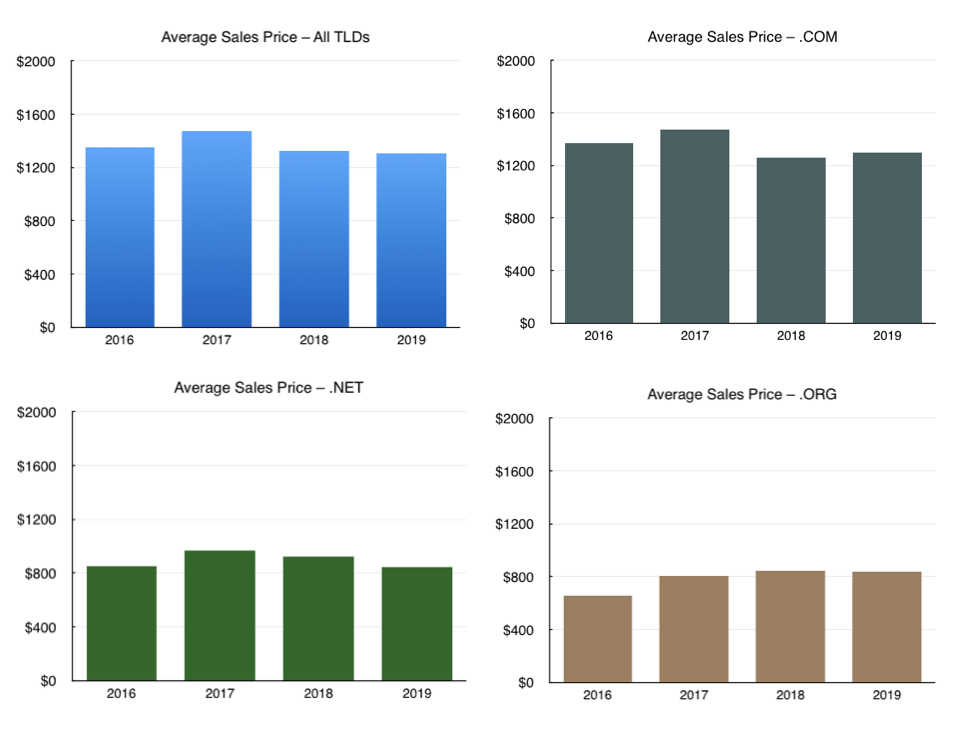

The graph below looks at apparent price trends for all domain extensions, as well as individually for each of the major legacy extensions,

The main trend is one of relatively constant prices. Note that the sale of

The average prices for

With the same price scale as used for the legacy trend graphs, I had a look at the four-year trend in four different country code extensions.

The

As mentioned in Part 1,

The

The

The scale I used for the legacy domain extension graphs was insufficient for average prices for some extensions. Keep in mind that the graphs below have a maximum price of $6000, compared to just $2000 in the earlier graphs.

The

While sales volume is up in

The

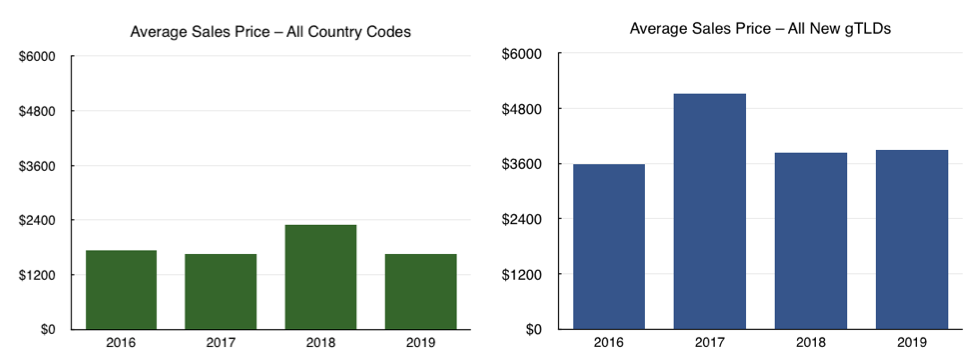

All Country Code and All New gTLDs

If we lump together all country codes, the price trend is fairly constant year-to-year, and not much different from the average value for

If we take all new extensions, the average price is significantly higher than in the legacy extensions, and is fairly constant over the four years in the graph. These sales are a mix of registry and domain investor sales, however.

Retail Sales

As wholesale prices have edged upward, more and more retail sales are included within the publicly-available NameBio database. This is simply because more acquisitions are now above $100 in value.

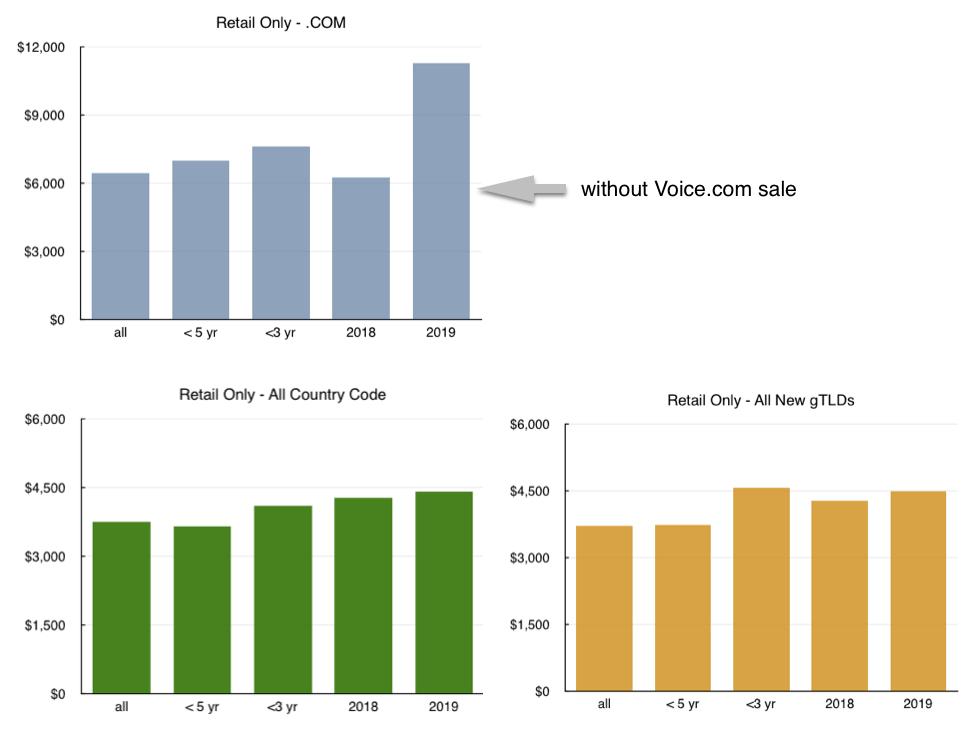

To try to get a sense of how retail pricing is changing, I restricted the venues in a NameBio search to sales from the following venues: private, Sedo, BuyDomains, Uniregistry, NamePull, Domain Market and Afternic. While not every sale at these venues is a retail sale, the vast majority should be. Some retail sales do take place at other venues. With this selection of venues, only 5.1% of the overall

Since I had not recorded sales from just these venues from 2016 and 2017, I could only readily present 2019 and 2018 data by year. I also include data from the three and five most recent years as a group, and for all time.

At first glance it looks like 2019 was a great year for

Without the

The

It should be kept in mind that actual retail sales, in all cases, are probably substantially less since, except in auctions, Sedo only report to NameBio sales of $2000 and above, unless individually reported by seller. Also, Uniregistry only report their top-value sales, as is true for several of the other retail venues.

Other Extensions

I had a look at price trends for numerous other extensions. I report on some of them below.

Notes:

Nothing in this report should be considered domain investment advice, and is offered for educational information only. If any information in this report is important for investment decisions, you should independently verify the data.

Thank you once more to Michael Sumner of NameBio, for creating and maintaining the domain sales data resource used for this analysis.

I start by considering apparent average prices, that is simply the average of all sales over $100 listed in the NameBio database for different domain extensions and time periods. It is important to keep in mind that these only reflect the venues that report sales information to NameBio.

NameBio-reported domain sales are a mix of wholesale and retail sales. This can mask true trends. For example, if more wholesale acquisitions are in the database for a certain time interval, the average price may trend down, even though the actual retail prices are going up.

In the last part of this report I extract a subset of NameBio sales data to get a handle on retail-only price trends. The all-time average retail sales price is probably of the order of $6400.

Legacy Extensions

The graph below looks at apparent price trends for all domain extensions, as well as individually for each of the major legacy extensions,

.com, .net and .org. Keep in mind that these are not retail-only prices, but rather a mix of wholesale and retail sales.The main trend is one of relatively constant prices. Note that the sale of

voice.com for $30 million significantly influences the 2019 average. If that single sale was removed, the .com average price would be about $277 less.The average prices for

.net and .org are less than for .com, but have remained relatively stable, although .net has been edging down since 2017..IO, .ME, .CC and .USWith the same price scale as used for the legacy trend graphs, I had a look at the four-year trend in four different country code extensions.

The

.IO extension, after rising for several years, was down in average price in 2019.As mentioned in Part 1,

.ME has had a strong 2019 in sales volume. Most of that is due to an increase in number of sales, rather than average prices, however. Prices in the extension have remained relatively constant.The

.CC extension is trending upward in average prices.The

.US extension is down in 2019 compared to 2018, although not a huge change from the four-year average..CO, .TV, .AI and .DEThe scale I used for the legacy domain extension graphs was insufficient for average prices for some extensions. Keep in mind that the graphs below have a maximum price of $6000, compared to just $2000 in the earlier graphs.

The

.DE and .TV extensions both showed strong, and relatively constant, pricing over the four years.While sales volume is up in

.AI, it is surprising that the average price has gone down significantly in that extension over the last two years. I think this is primarily due to a change in expiration sales, resulting in more wholesale acquisitions within the sales.The

.CO sales price pattern is strong, and seems to be edging upward in recent years.All Country Code and All New gTLDs

If we lump together all country codes, the price trend is fairly constant year-to-year, and not much different from the average value for

.COM presented earlier.If we take all new extensions, the average price is significantly higher than in the legacy extensions, and is fairly constant over the four years in the graph. These sales are a mix of registry and domain investor sales, however.

Retail Sales

As wholesale prices have edged upward, more and more retail sales are included within the publicly-available NameBio database. This is simply because more acquisitions are now above $100 in value.

To try to get a sense of how retail pricing is changing, I restricted the venues in a NameBio search to sales from the following venues: private, Sedo, BuyDomains, Uniregistry, NamePull, Domain Market and Afternic. While not every sale at these venues is a retail sale, the vast majority should be. Some retail sales do take place at other venues. With this selection of venues, only 5.1% of the overall

.COM sales are considered retail, accounting for about 5550 sales in 2019.Since I had not recorded sales from just these venues from 2016 and 2017, I could only readily present 2019 and 2018 data by year. I also include data from the three and five most recent years as a group, and for all time.

At first glance it looks like 2019 was a great year for

.COM average retail prices, but that is deceptive. In such a relatively small group of sales, the voice.com sale has a huge impact. I show with the arrow the average price if that single sale was excluded.Without the

voice.com sale, it appears that while retail prices in .COM are relatively constant, not much different from the 2018 average of $6243, and the all-time average price of $6455.The

.COM average retail price is higher than either the new domain extension or overall country code average retail prices, although not by a huge factor. In 2019 the new extension retail prices averaged $4495 and the country codes $4413, compared to a voice-sale extracted value of just under $5900 in .COM.It should be kept in mind that actual retail sales, in all cases, are probably substantially less since, except in auctions, Sedo only report to NameBio sales of $2000 and above, unless individually reported by seller. Also, Uniregistry only report their top-value sales, as is true for several of the other retail venues.

Other Extensions

I had a look at price trends for numerous other extensions. I report on some of them below.

- While edging downward,

.INFOprices are overall fairly constant. 2017 was the best year for that extension, at an average of $851, up from $396 in 2016. The average prince in 2018 at $650. and slightly down at $604 in 2019. .APPprices are strong, from $4261 in 2018 to $6121 in 2019.- While

.XYZhad a poor year volume wise in 2019, there was not much difference in average prices between 2018 at $1408 and 2019 at $1331. - Some of the country code extensions with smaller numbers of sales had the highest average sales prices. For example, in 2019 the average sales price for Australia’s

.com.auwas $40,900! - Canada’s

.caalso had a strong average price of $9318 in 2019, and $7127 in 2018. - The

.UKextension was up sharply in sales volume in 2019, and that was partly due to a relatively robust average sales price of $1936. However, that average price is lower by more than a factor of two compared to.CO.UKin the same year that averaged $4213. - The

.LYextension is used in many domain hacks. Prices have been fairly steady, ranging from a high of $566 in 2017 to a low of $414 in 2016. The average in 2019 was $470. - Although the volume of sales in

.GGis up in 2019, average prices are not, dropping from $1679 in 2018 to $835 in 2019. That is probably influenced by many more wholesale acquisitions, however. - The average price for

.BIZdomain sales in 2019 was $462, down substantially from the $925 in 2018, although only slightly down from the average sales prices in that extension in 2016 and 2017.

Notes:

Nothing in this report should be considered domain investment advice, and is offered for educational information only. If any information in this report is important for investment decisions, you should independently verify the data.

Thank you once more to Michael Sumner of NameBio, for creating and maintaining the domain sales data resource used for this analysis.

Last edited: