On NamePros, and on social media, a number of investors have mentioned that the last month or so has seen a significant downturn in the domain name aftermarket, both in terms of retail sales and in offers or inquiries.

For example, long-term investor @elmoney started the discussion Recession of Sales and Inquiries.

In this article, I report on investor polls, wholesale and retail sales data, and extract guidance about how investors might respond.

What Do People Think?

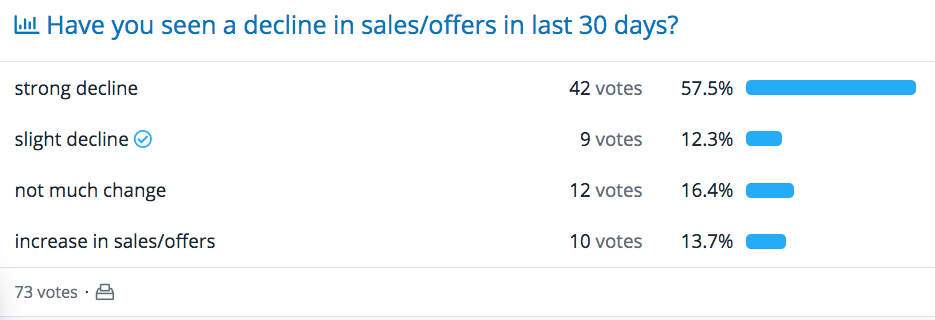

I posted a poll asking Are Things Slower In The Aftermarket?, obtaining the results shown below.

About 54% of NamePros respondents reported a sharp decline in sales and offers during the past month, although nearly 14% saw an increase over the same period.

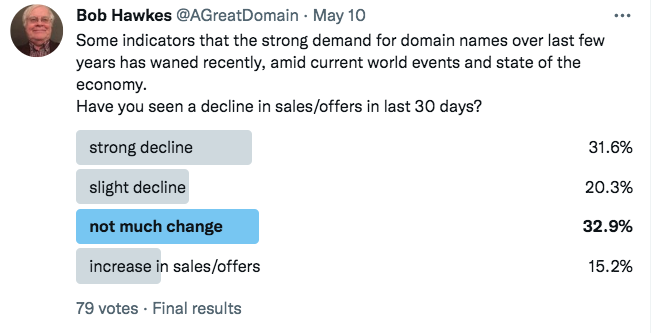

I posed a similar question on Twitter, obtaining the results shown below.

In the Twitter poll, while slightly more than half saw a decline, only 32% would characterize it as a sharp decline.

What Does The Data Say?

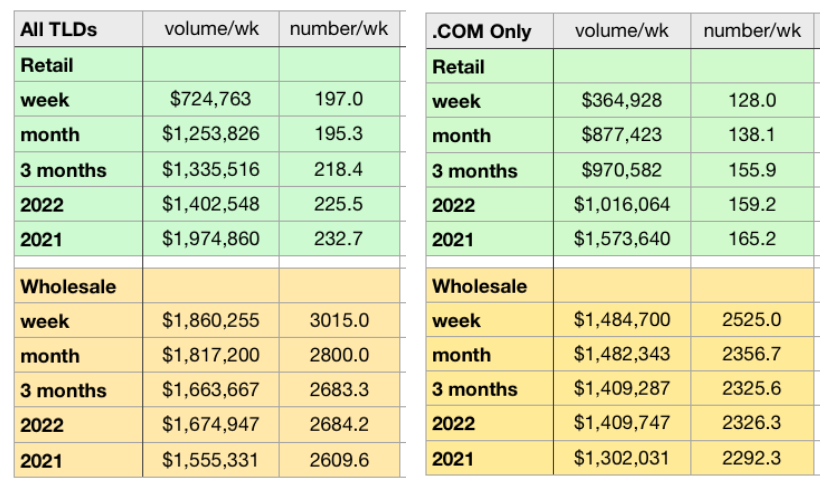

While it is significant that so many are seeing a decline, I wanted to back it up with actual sales data. On May 14, 2022, I used NameBio to look at sales numbers and volumes for the preceding week, month, 3-month period, 2022 so far, and 2021.

Rather than look at all data, I only considered certain sales venues according to whether they are predominantly wholesale or retail.

For venues representative of mainly retail sales, I used sales reported from Sedo, BuyDomains, DomainMarket and individual private sellers. While a few investor acquisitions happen at these venues, most will be retail sales.

For wholesale, I included ParkIO, Sav, GoDaddy auctions, NameJet, DropCatch and Dynadot. While the division is not perfect, most sales at these venues are probably investor acquisitions.

Keep in mind that the numbers and volumes reported are by no means the entire retail and wholesale markets, but rather a representative sample based on certain sales venues.

The results for all extensions are shown on the left below. All data has been converted to weekly numbers.

Compared to 2021 data, retail sales numbers are off 6.1% during the past 3 months, and off 16.1% during the past month.

Average retail prices have dropped, however, so the sales dollar volumes have declined more significantly. The past 3 months are down 32.4% in retail dollar volume compared to 2021, while over the last month the retail volume is down 36.5%.

The very low dollar volume in the last week is mainly due to a low average price, rather than a low number of retail sales. It is probably simply a statistical fluctuation, since one or two high-value sales can strongly impact a weekly figure.

The picture is very different for wholesale transactions. Both numbers and dollar volumes are up compared to 2021. Over the past month wholesale sales are up 7.3% by number, and up 16.8% by dollar volume, due to slowly but steadily increasing average prices. There is no indication that investors have slowed their acquisition rate yet.

It is important to keep in mind that these are for only a small part of the total retail market. The actual market may be down more, or less. Also, 2021 was a particularly good year for domain name sales, so some decrease from those highs is perhaps to be expected.

The

The picture is not much different, although the dollar volume decrease is a bit more pronounced for

On the wholesale side, the rate of

Possible Reasons For Downturn

While many sectors of the economy struggled over the last two years, the domain name aftermarket has seen excellent returns. Existing businesses saw the need for a stronger digital footprint, and many digital-only startups emerged as well. It is only natural that the strong growth rate could not extend forever, and some slowing of the elevated domain name sales of the last two years was to be expected.

But there is more to the story than that. The war shows no signs of resolution, and that has brought significant economic uncertainty and disruption and fragmentation of the global economy.

The return to near pre-pandemic commerce and social activity has lessened the need for digital solutions, and yet the pandemic continues to threaten a smooth economic and health recovery.

The stock markets, particularly technology stocks, are down well over 20%, and that has created uncertainty for both individuals and businesses.

Many who invest in startups and domain names also invest in cryptocurrencies and NFTs, both of which have seen even sharper downturns. The coupling of the markets may account for some of the domain market downturn. Certainly there are anecdotal reports of sales falling through due to significant drops in cryptocurrency valuations.

Inflation is at the highest level in decades, and businesses wary of increasing costs may be less likely to make branding upgrades at this time. Perhaps even more important for the domain market, there may be hesitation among potential startup owners as a result of both inflation and interest rates.

The rise of decentralized name systems pose some threat to the centrally regulated ICANN and country-code traditional naming systems. Decentralized names have suffered a far greater fall during the last month. While that might be good for centralized domain names, it is possible that they were instead dragged down by the decentralized volatility.

No one knows how long most of these factors will impact the domain market. It is quite possible that another era of strong domain name sales is just around the corner, but it is also possible that the decline will be lengthy and deep.

Nevertheless, it is best to be prudent, and we discuss some specific steps in the next section.

How To Respond

Especially during tough economic times, it is critical to prioritize: protect your most valuable assets. This might be a good time to go through your entire portfolio and decide which names are in your ‘definitely keep’ group.

If you have made a significant sale lately, this is a good time to retain some cash for future needs and to renew in advance your highest quality domain names.

Those who are in a solid position financially may find good opportunities for acquisitions if the wholesale market weakens, not that the wholesale data yet shows that happening.

It is important to follow business trends. Some of the niches that were strong in 2020 and 2021 may no longer be the right places to invest, and some hard-hit sectors may see a bounce back as the economy emerges from the pandemic.

The best domain names will always find buyers, so in uncertain times it is important to stress quality.

Clearly the best path forward will depend on your own individual circumstances.

Sound Advice From Twiki

@twiki is a NamePros member who sells domains frequently, and also generously contributes to the NamePros community through detailed commentaries. This week he speculated on the downturn and how to respond.

First, he commented on how quickly the downward trend had emerged:

He follows that with advice on how to respond. Here are some key points, but read his full post, and the comments by others, to place the ideas in context.

At lower sell-through rates and weaker prices, as he points out, the math may not be profitable without changes.

You also want to reduce the bill for renewals, and that means:

While you may want to continue to acquire names, be very selective.

It is natural to try to get sales flowing again, and perhaps see price reductions as a way to achieve that. @twiki argues against thinking that way.

Other points he makes are to watch the business and domain markets carefully, and to respond accordingly. Read his full post for supporting arguments and additional points.

Share Your Views

What do you think?

Thanks to all who voted or commented in the polls. Thanks also to NameBio for a superb interface that makes analyses such as the one reported here easy to carry out. Special thanks to @twiki for sharing valuable reflections about the downturn.

For example, long-term investor @elmoney started the discussion Recession of Sales and Inquiries.

In this article, I report on investor polls, wholesale and retail sales data, and extract guidance about how investors might respond.

What Do People Think?

I posted a poll asking Are Things Slower In The Aftermarket?, obtaining the results shown below.

About 54% of NamePros respondents reported a sharp decline in sales and offers during the past month, although nearly 14% saw an increase over the same period.

I posed a similar question on Twitter, obtaining the results shown below.

In the Twitter poll, while slightly more than half saw a decline, only 32% would characterize it as a sharp decline.

What Does The Data Say?

While it is significant that so many are seeing a decline, I wanted to back it up with actual sales data. On May 14, 2022, I used NameBio to look at sales numbers and volumes for the preceding week, month, 3-month period, 2022 so far, and 2021.

Rather than look at all data, I only considered certain sales venues according to whether they are predominantly wholesale or retail.

For venues representative of mainly retail sales, I used sales reported from Sedo, BuyDomains, DomainMarket and individual private sellers. While a few investor acquisitions happen at these venues, most will be retail sales.

For wholesale, I included ParkIO, Sav, GoDaddy auctions, NameJet, DropCatch and Dynadot. While the division is not perfect, most sales at these venues are probably investor acquisitions.

Keep in mind that the numbers and volumes reported are by no means the entire retail and wholesale markets, but rather a representative sample based on certain sales venues.

The results for all extensions are shown on the left below. All data has been converted to weekly numbers.

Compared to 2021 data, retail sales numbers are off 6.1% during the past 3 months, and off 16.1% during the past month.

Average retail prices have dropped, however, so the sales dollar volumes have declined more significantly. The past 3 months are down 32.4% in retail dollar volume compared to 2021, while over the last month the retail volume is down 36.5%.

The very low dollar volume in the last week is mainly due to a low average price, rather than a low number of retail sales. It is probably simply a statistical fluctuation, since one or two high-value sales can strongly impact a weekly figure.

The picture is very different for wholesale transactions. Both numbers and dollar volumes are up compared to 2021. Over the past month wholesale sales are up 7.3% by number, and up 16.8% by dollar volume, due to slowly but steadily increasing average prices. There is no indication that investors have slowed their acquisition rate yet.

It is important to keep in mind that these are for only a small part of the total retail market. The actual market may be down more, or less. Also, 2021 was a particularly good year for domain name sales, so some decrease from those highs is perhaps to be expected.

The

.com extension dominates the market, so I also looked at results for that extension only, with results shown on the right above.The picture is not much different, although the dollar volume decrease is a bit more pronounced for

.com. Over the past month .com retail sales numbers are down 16.4% compared to 2021, while retail dollar volume is down 44.2%.On the wholesale side, the rate of

.com acquisitions continues to grow slowly, as do average prices paid. As a result the wholesale .com dollar volume is up 13.8% over the past month compared to 2021, although the number of sales is up just 2.8%.Possible Reasons For Downturn

While many sectors of the economy struggled over the last two years, the domain name aftermarket has seen excellent returns. Existing businesses saw the need for a stronger digital footprint, and many digital-only startups emerged as well. It is only natural that the strong growth rate could not extend forever, and some slowing of the elevated domain name sales of the last two years was to be expected.

But there is more to the story than that. The war shows no signs of resolution, and that has brought significant economic uncertainty and disruption and fragmentation of the global economy.

The return to near pre-pandemic commerce and social activity has lessened the need for digital solutions, and yet the pandemic continues to threaten a smooth economic and health recovery.

The stock markets, particularly technology stocks, are down well over 20%, and that has created uncertainty for both individuals and businesses.

Many who invest in startups and domain names also invest in cryptocurrencies and NFTs, both of which have seen even sharper downturns. The coupling of the markets may account for some of the domain market downturn. Certainly there are anecdotal reports of sales falling through due to significant drops in cryptocurrency valuations.

Inflation is at the highest level in decades, and businesses wary of increasing costs may be less likely to make branding upgrades at this time. Perhaps even more important for the domain market, there may be hesitation among potential startup owners as a result of both inflation and interest rates.

The rise of decentralized name systems pose some threat to the centrally regulated ICANN and country-code traditional naming systems. Decentralized names have suffered a far greater fall during the last month. While that might be good for centralized domain names, it is possible that they were instead dragged down by the decentralized volatility.

No one knows how long most of these factors will impact the domain market. It is quite possible that another era of strong domain name sales is just around the corner, but it is also possible that the decline will be lengthy and deep.

Nevertheless, it is best to be prudent, and we discuss some specific steps in the next section.

How To Respond

Especially during tough economic times, it is critical to prioritize: protect your most valuable assets. This might be a good time to go through your entire portfolio and decide which names are in your ‘definitely keep’ group.

If you have made a significant sale lately, this is a good time to retain some cash for future needs and to renew in advance your highest quality domain names.

Those who are in a solid position financially may find good opportunities for acquisitions if the wholesale market weakens, not that the wholesale data yet shows that happening.

It is important to follow business trends. Some of the niches that were strong in 2020 and 2021 may no longer be the right places to invest, and some hard-hit sectors may see a bounce back as the economy emerges from the pandemic.

The best domain names will always find buyers, so in uncertain times it is important to stress quality.

Clearly the best path forward will depend on your own individual circumstances.

Sound Advice From Twiki

@twiki is a NamePros member who sells domains frequently, and also generously contributes to the NamePros community through detailed commentaries. This week he speculated on the downturn and how to respond.

First, he commented on how quickly the downward trend had emerged:

A month ago in a post I was saying I expect a good year in domain sales. Then April came and .... poof! I was wrong – the downtrend came suddenly and much sooner than I expected.

He follows that with advice on how to respond. Here are some key points, but read his full post, and the comments by others, to place the ideas in context.

At lower sell-through rates and weaker prices, as he points out, the math may not be profitable without changes.

The problem we have is, the math will not work out anymore for many domainers. The solution for this? Get better names, even if pricier. Improve the overall quality of your domains.

You also want to reduce the bill for renewals, and that means:

Don’t renew your questionables. Those names which you aren't 100% sure will be sold someday. If they don't sell before renewal, let them drop.

While you may want to continue to acquire names, be very selective.

Reduce your buying. This is the worst time to hoard domains. Cut from the list all those that are questionable and stick only to the top ones. Same applies to what you renew - only renew your top ones. The less junk you have, the better off you will be.

It is natural to try to get sales flowing again, and perhaps see price reductions as a way to achieve that. @twiki argues against thinking that way.

Don’t steeply reduce prices. And don't panic. If you decrease your prices right now, you will likely lose overall. The market is used with these price levels and the problem is not one of affordability, but one of demand.

Other points he makes are to watch the business and domain markets carefully, and to respond accordingly. Read his full post for supporting arguments and additional points.

Share Your Views

What do you think?

- Are we in for an extended period of domain market downturn?

- What sectors or niches do you think will weather the storm best?

- Have you personally seen a recent downturn?

- What steps do you plan to personally take to address the situation?

Thanks to all who voted or commented in the polls. Thanks also to NameBio for a superb interface that makes analyses such as the one reported here easy to carry out. Special thanks to @twiki for sharing valuable reflections about the downturn.

Last edited: