This week I take a look at how average prices, numbers of domains sold, and sales dollar volumes in 2020 compared to the previous year. I used the NameBio data for the analysis, looking at sales of $100 and more. Keep in mind that by no means all sales are in NameBio, and the reported sales are a mix of wholesale acquisitions by domain name investors and retail sales to end users. This analysis is based on over 151 million dollars in sales volume in 2020.

The Big Picture

If we look across all extensions, there were more sales in 2020 than in 2019, about 127,500 versus 108,800, but the average price dropped from $1389 to $936. As a result, the dollar sales volume went down by 21% in 2020. Keep in mind that the average price is a mix of two populations, wholesale and retail sales.

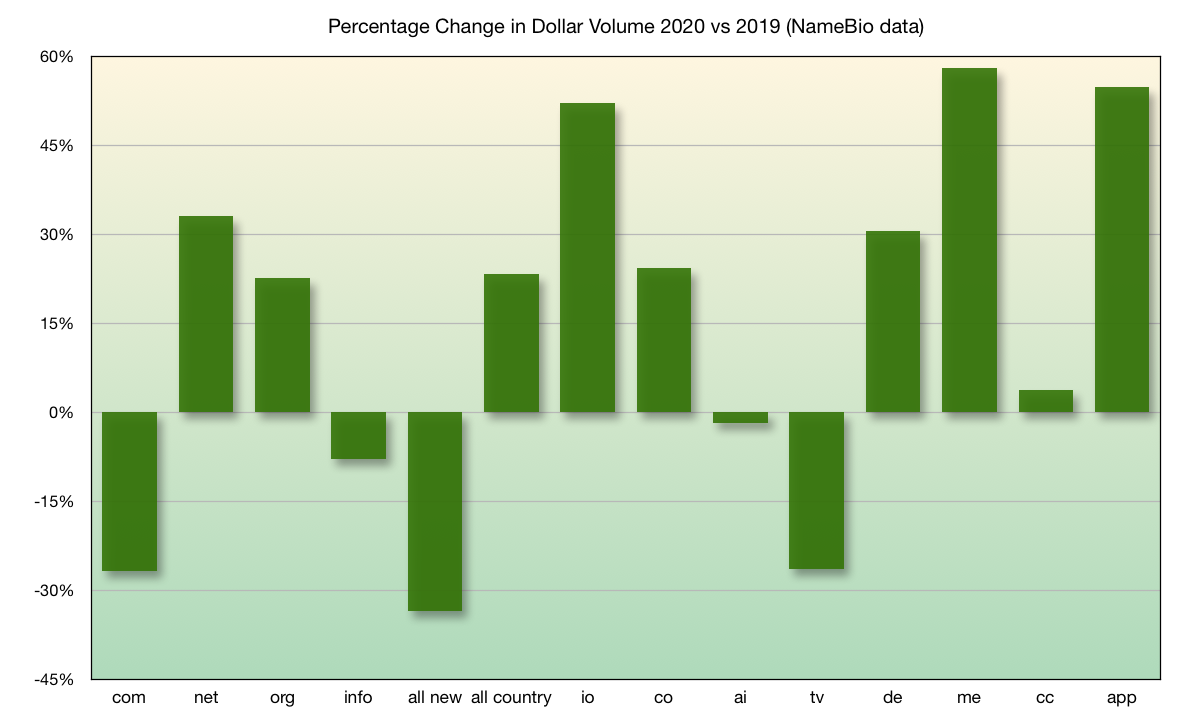

While the average price is very sensitive to a few large sales, and the number of sales may be strongly influenced by an increase in wholesale transactions, some view the total dollar volume a better indicator of strength. I look at individual extensions in more detail below, but here are the percentage changes from 2019 to 2020 in the dollar volume for some of the key top level domains, TLDs.

While some of these changes may seem dramatic, keep in mind that it is just from one year to the next, and by no means all sales are in NameBio. In several of the categories, while the average price and sales volume are down, the number of domain names sold actually increased strongly. This was true for

Sales in

If we consider

The average price is heavily influenced by major sales. There were fewer high-value sales in 2020 – just one over $1 million, and 3 others over $500,000, at least as reported in NameBio.

Looking at all aftermarket domain name sales, the vast majority are in the

Other Major Legacy Extensions

In 2020 the average prices in

The number of

The

Additional Legacy Extensions

Country Code Extensions Have Strong 2020

Considering country code extensions as a whole, 2020 was strong compared to 2019, and 2019 had itself been a good year for country code extensions. There were 22.9% more sales in country code extensions reported in NameBio in 2020 compared to 2019. The total dollar volume was also up, by 23.2%.

There was almost no change from 2019 in average price for a country code domain sale, $1686 in 2020. The higher average prices in country code extension sales may partially be explained by a higher ratio of retail to wholesale transactions.

I also looked at a number of country code extensions individually. I highlight some of the results below.

Generic Country Code Performance

Many domain investors are interested in the generic extensions such as

New Domain Extensions

Taken as a whole, aftermarket sales of new domain extensions were up 17.1% in numbers, but sales volume dropped by 33.5% to just over $2.3 million. It seems that there were fewer registry premium sales being reported to NameBio. Many of the extensions had just a handful of reported sales. Here are details on a few extensions.

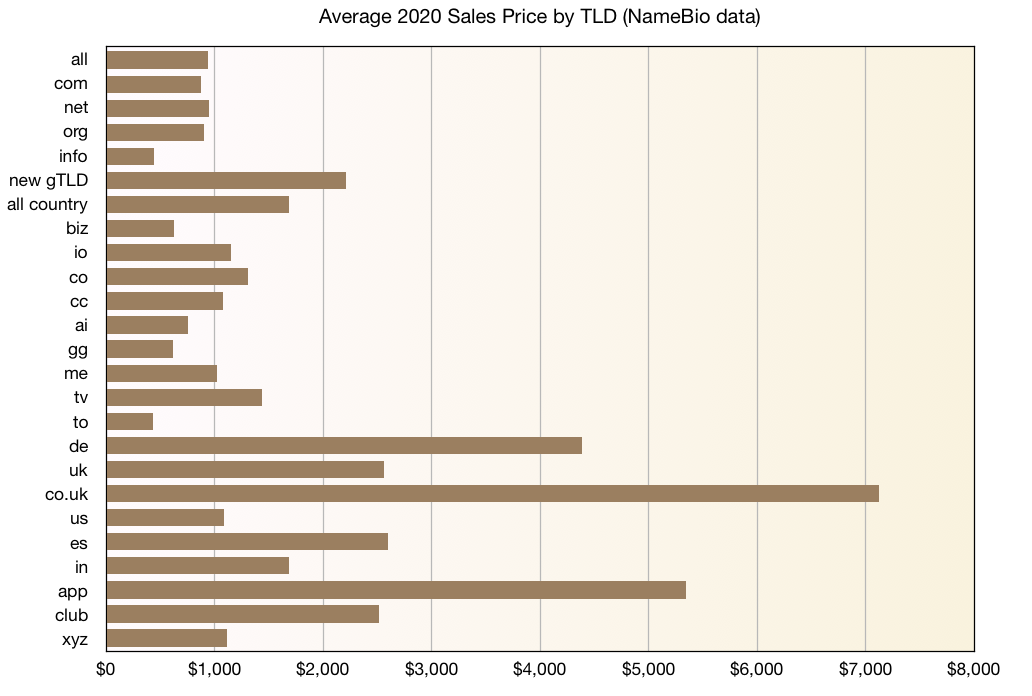

Average Prices

I put together the average prices for a number of different extensions in the following graph. While this is interesting, and in some cases surprising, keep in mind that these are not graphs of retail prices only, and that the fraction of retail to total prices almost certainly varies across the different extensions.

Sales Volumes

The dominance of

Comparisons With Previous Years

If you want to compare data presented here with previous years, here are links to the NamePros Blog posts from a year ago when I considered data from 2015 though 2019. The first article looks at trends in sales volume, while the second article covers average prices.

The trend of decreasing prices in

Keep In Mind

It is important to keep the following points in mind.

Here are some things that emerged from the analysis that surprised me.

My sincere thanks to the people who created and maintain NameBio. The superb interface makes analyses such as this easy to do using their data.

The Big Picture

If we look across all extensions, there were more sales in 2020 than in 2019, about 127,500 versus 108,800, but the average price dropped from $1389 to $936. As a result, the dollar sales volume went down by 21% in 2020. Keep in mind that the average price is a mix of two populations, wholesale and retail sales.

While the average price is very sensitive to a few large sales, and the number of sales may be strongly influenced by an increase in wholesale transactions, some view the total dollar volume a better indicator of strength. I look at individual extensions in more detail below, but here are the percentage changes from 2019 to 2020 in the dollar volume for some of the key top level domains, TLDs.

While some of these changes may seem dramatic, keep in mind that it is just from one year to the next, and by no means all sales are in NameBio. In several of the categories, while the average price and sales volume are down, the number of domain names sold actually increased strongly. This was true for

com and new generic top-level domains, new gTLDs.Sales in

.com If we consider

.com only, the number of reported aftermarket sales increased by 16.9% in 2020, but the average price dropped from $1396 to $874, resulting in a 26.8% drop in dollar sales volume.The average price is heavily influenced by major sales. There were fewer high-value sales in 2020 – just one over $1 million, and 3 others over $500,000, at least as reported in NameBio.

Looking at all aftermarket domain name sales, the vast majority are in the

.com top level domain. This changed only slightly from 2019 when about 85.6% of all sales were in .com, compared to 85.3% of all sales in 2020. Note these are percentages in terms of number of sales. The results are slightly different for sales volumes.Other Major Legacy Extensions

In 2020 the average prices in

.net and .org at $945 and $899 were very similar to .com. Unlike .com however, prices increased in 2020 in these extensions however. There was a 11.8% increase in .net average price and a 7.2% .org average sales price increase.The number of

.net sales increased by 19.1%, while the dollar volume was also up, by 33.2%. While the number of sales in these extensions are far fewer than in .com, so are the number actively for sale.The

.org extension has been gradually trending up for some time. In 2020 there was an increase of 14.4% in number of .org sales reported and a 22.6% increase in total dollar volume.Additional Legacy Extensions

- The

.infoTLD had 396 reported sales in 2020 with an average sales price of $438. Although the average price and dollar volume are both down, the number of sales was up. - The number of sales in the

.bizextension was up 16.7%, along with a 57.8% increase in sales volume. This was pushed by a 35.3% average price increase, although the 2020 average price of $625 was still significantly less than.com,.netand.org. - The

.proextension almost doubled number of reported sales, although that was still just 44. The average price of $1289 in 2020 was more than for the legacy extensions. - While we tend to think of the

.mobiextension as largely dormant, it still has web traffic and there were 35 aftermarket sales in the extension during 2020, with an average sales price of $479. The number of sales was up slightly, although average price and volume were down.

Country Code Extensions Have Strong 2020

Considering country code extensions as a whole, 2020 was strong compared to 2019, and 2019 had itself been a good year for country code extensions. There were 22.9% more sales in country code extensions reported in NameBio in 2020 compared to 2019. The total dollar volume was also up, by 23.2%.

There was almost no change from 2019 in average price for a country code domain sale, $1686 in 2020. The higher average prices in country code extension sales may partially be explained by a higher ratio of retail to wholesale transactions.

I also looked at a number of country code extensions individually. I highlight some of the results below.

- With 607 sales, an average sales price of $4387 and a dollar volume of $2.66 million in 2020, the

.deextension had another strong year. The number and volume were both up more than 30%, and average price dipped less than 2%. - Perhaps surprisingly, the average sales price on a

.usdomain sale in 2020 was $1084, slightly higher than for the major legacy extensions. The number of sales increased from 145 to 153. Dollar volume was up by 40% in.usin 2020 compared to 2019. - The

.ukextension had a strong 2019, but both the number of sales and dollar volume were down by more than 70% in 2020. However, the.co.ukextension saw a 36.4% increase in number of sales and the dollar volume more than doubled to $1.28 million. - The

.inextension for India more than tripled in terms of number of sales, going from 55 to 190. The average price dipped somewhat, but it was still strong at $1689 in 2020. - The number of

.mxsales reported on NameBio is modest, but grew from 12 sales in 2019 to 60 in 2020. While the average.mxprice dropped, at $1071 it is still higher than for the legacy extensions. The sales volume in.mxis up 57.1% in 2020 compared to 2019. - Numerous European country codes had a strong 2020. Of particular note, Spain’s

.eswent from 39 to 108 sales, although volume was down by about 10%. Italy’s.itextension grew 54% in sales numbers and more than doubled sales volume, propelled by an average sales price per domain name of $7649 in 2020. - The number of sales in Canada’s

.cawas only 37, compared to 23 in 2019, but the average sales price was $7960. - Compared to the size of the economy, not many

.cnsales get reported to NameBio, just 25 in 2020, although the average price was $3657.

Generic Country Code Performance

Many domain investors are interested in the generic extensions such as

.io, .co, .ai, .tv, etc. In general these had a strong 2020. Here are some highlights.- The number of sales in

.iowas up almost 40%, while the total dollar volume increased by 52.1%. The average sales price in 2020 for.iowas $1198. - There was a dramatic increase in the number of sales in

.co, 438 in 2019 to 1087 in 2020. While the average price dipped significantly, it was still a respectable $1313 in 2020. - While the number of sales, average price and total volume were all down in

.tv, with 187 sales in 2020 and an average sales price of $1440,.tvis still a strong extension. - It was another solid year for

.me, with 40.5% increase in number of sales and 58.0% increase in sales volume. The average price was $1023 in 2020. - The

.aiextension was not as strong as I expected. The number of sales was 1385 in 2020, more than many TLDs, but that was down from 2202 in 2019. The average price of $754 suggests that many of the transactions continue to be wholesale. - The

.ggextension took off in 2020, going from 30 to 172 sales. The average price actually dipped though, to $618 in 2020. - While some venture capital businesses have used

.vcdomain names for awhile, the number of sales in the aftermarket is still limited, 77 in 2020 compared to 27 in 2019. - Not much change in

.lyin price, number of sales or volume. - The

.ccextension finds use particularly in cycling, churches and China, although some use in many other sectors such as cryptocurrency. The number of sales in.ccwere up about 12% in 2020, and the sales volume was up 3.7%. The average sales price in 2020 was $1081 - While how auctions are handled may partially explain it, the repurposed

.toextension saw 624 sales in 2020 compared to just 84 the previous year. The average price was modest at $434, though, indicating that many were domainer acquisitions.

New Domain Extensions

Taken as a whole, aftermarket sales of new domain extensions were up 17.1% in numbers, but sales volume dropped by 33.5% to just over $2.3 million. It seems that there were fewer registry premium sales being reported to NameBio. Many of the extensions had just a handful of reported sales. Here are details on a few extensions.

- Probably the strongest extension in the aftermarket is

.app. The number of sales grew by 73.2% while sales volume grew by 54.8%. The average sales price in.appin 2020 was $5343. - The

.xyzextension was much stronger in 2020 than in 2019, returning to activity of previous years, but this time propelled by aftermarket domainer sales rather than registry premium sales. The number of sales was up by almost a factor of 6, while the sales volume increased by a factor of just under 5. There were 97 sales of.xyzin 2020 at an average sales price of $1118. - While still a minor player in the reported aftermarket sales,

.onlinehad more sales in 2020, although the average price dipped substantially to $748. - The

.clubextension continues to do well, both in aftermarket sales and in real-world use. The number of sales was up by 35.6% in 2020, while sales volume was up by 30.0%. The average sales price was also strong, $2519.

Average Prices

I put together the average prices for a number of different extensions in the following graph. While this is interesting, and in some cases surprising, keep in mind that these are not graphs of retail prices only, and that the fraction of retail to total prices almost certainly varies across the different extensions.

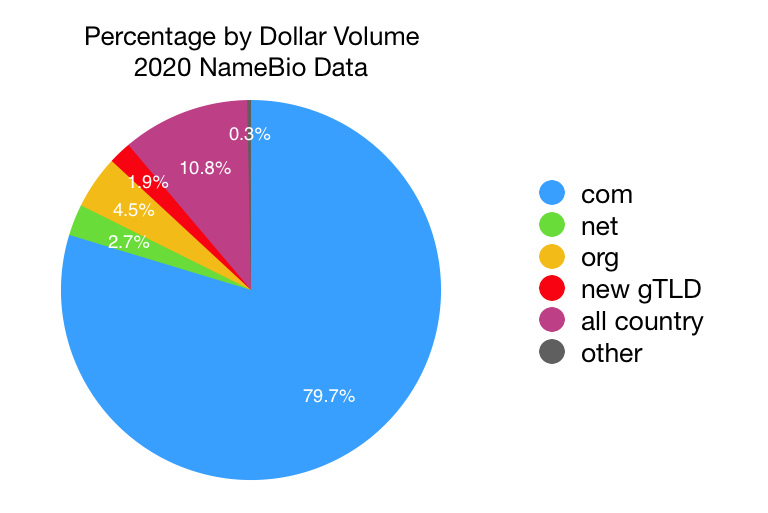

Sales Volumes

The dominance of

.com continues. The graph below shows the dollar volume by extension. While .com accounts for 85.3% of all sales by number, even when we do it by dollar volume, .com is responsible for 79.7% of all sales. Taken as a whole, country codes account for 10.8% of 2020 domain name sales dollar volume. Everything else combined provides less than 10% of the dollar volume of all domain name sales in 2020.Comparisons With Previous Years

If you want to compare data presented here with previous years, here are links to the NamePros Blog posts from a year ago when I considered data from 2015 though 2019. The first article looks at trends in sales volume, while the second article covers average prices.

The trend of decreasing prices in

.com is potentially worrying, but I think can be explained by an increasing percentage of wholesale transactions. That also explains the larger number of sales in .com. I look at how prices have changed in the last decade in next week’s NamePros Blog post, including extracting just a measure of the retail prices.Keep In Mind

It is important to keep the following points in mind.

- Sales from some key parts of the market, such as the brandable marketplaces, are not included in NameBio. Since those sales are predominantly

.com, that might be enough to have changed the picture significantly. - While an increase in sales volume is usually regarded as a positive, it is possible that it is a reflection of investors deciding to liquidate their long-term holdings in that extension.

- Some sales are reported to NameBio well after the date of the sale. That probably means that the 2020 data is slightly lower than it really should be. Undoubtedly, if you check the data in a few months the precise numbers will have changed slightly.

- There have been changes in reporting of premium sales by registries, and it seems that less are now being reported to NameBio.

- Remember that only a minority of sales are in NameBio, and in some cases the numbers reported in an extension are relatively small. Therefore the percentage change may not be very meaningful.

Here are some things that emerged from the analysis that surprised me.

- I was surprised that the average sales prices in

.netand.orgwere slightly higher than.com. - it surprised me that there was a significant increase in the number of

.netsales. - It somewhat surprising that the average price of a sale in a new extension,

.coor many other country codes was significantly higher than in.comsales. - The drop in number of sales, and modest average sales price, of

.aisurprised me. - I had realized that

.cowas having a strong year, but surprised that the number of sales more than doubled in 2020. - The

.toextension does not get much attention, but the number of sales in 2020 in the extension, at least as reported in NameBio, was higher than in.defor example. Seen another way, it had about the same number of sales as.uk,.co.uk,.us,.cnand.ggextensions combined. - The very high average sales prices in extensions like

.caat $7960 and.itat $7649 surprised me. - I presume that the low numbers of

.cnsales are due to underreporting to NameBio of venues where most sales in the extension are happening. Nevertheless, I was surprised at the few reported sales from the country code of such a major economy.

My sincere thanks to the people who created and maintain NameBio. The superb interface makes analyses such as this easy to do using their data.

Last edited: