- Impact

- 10,820

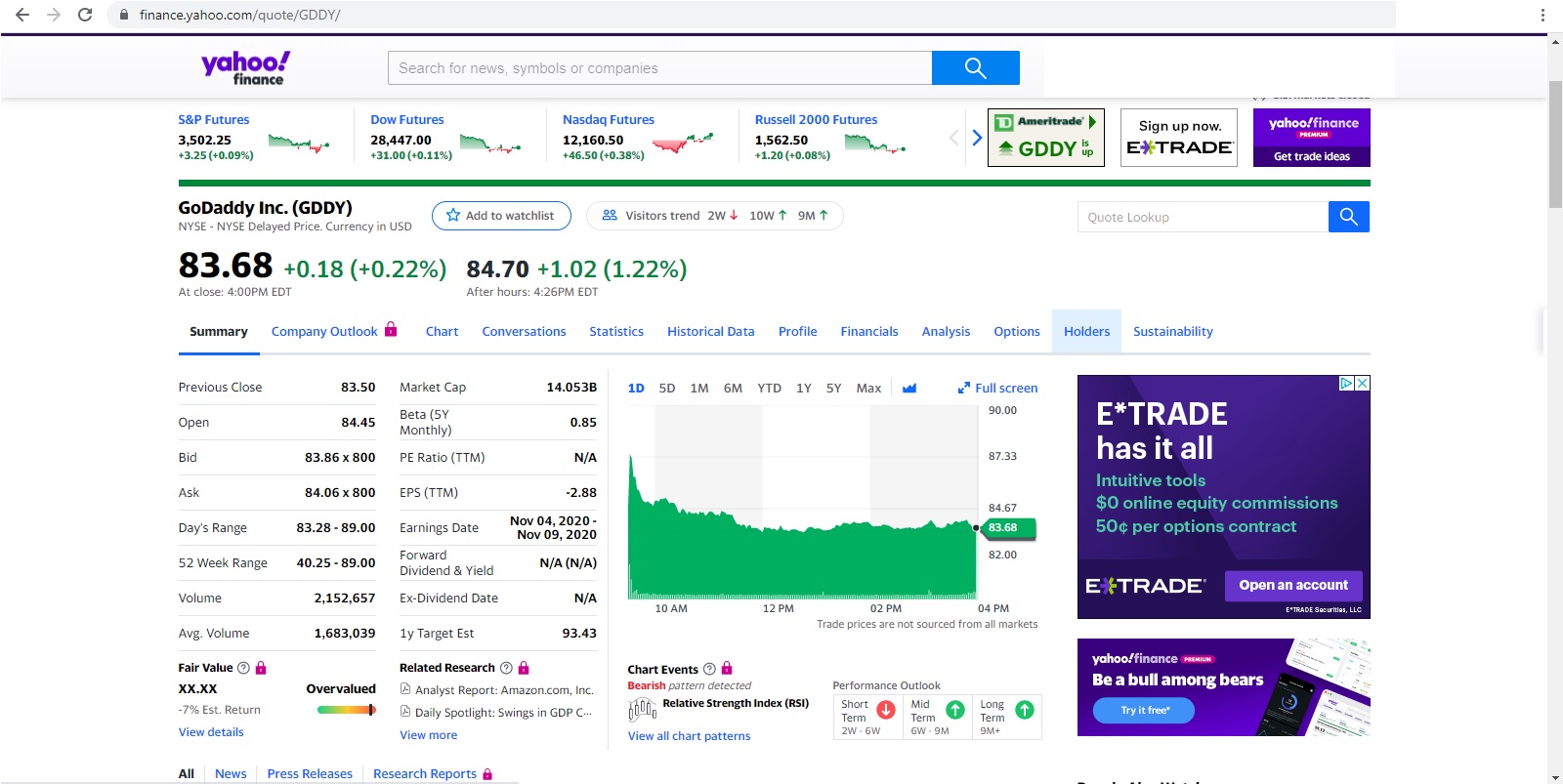

So out of curiosity did a check on Godaddy stock and found out Godaddy's marketcap is $14.053 billion? Am I seeing this right? I never realized this. I figured "maybe" $600-$700 million tops but $14.053 billion? That's insane.

Must be all those expired domains they auctioned off! You know. The ones you researched and allowed to expired and go into redemption? The ones you couldn't sell for even $20 at auction at Godaddy auctions? but somehow sold for $1200 at expired auction at Godaddy auctions? lol Yup those domains.

I'm assuming also this valuation is in part because almost all websites on the planet are hosted by them.

Until of course Wix came into the picture. It seems Wix is now overtaking them as the world largest hosting provider.

https://www.techradar.com/news/wix-edges-past-godaddy-to-become-worlds-biggest-web-hosting-company

Wix now has a marketcap of $15 billion?

Must be all those expired domains they auctioned off! You know. The ones you researched and allowed to expired and go into redemption? The ones you couldn't sell for even $20 at auction at Godaddy auctions? but somehow sold for $1200 at expired auction at Godaddy auctions? lol Yup those domains.

I'm assuming also this valuation is in part because almost all websites on the planet are hosted by them.

Until of course Wix came into the picture. It seems Wix is now overtaking them as the world largest hosting provider.

https://www.techradar.com/news/wix-edges-past-godaddy-to-become-worlds-biggest-web-hosting-company

Wix now has a marketcap of $15 billion?