The IRS is supposed to come out with revised crypto guidance in the next several months. At the moment a crypto position such as bitcoin, ethereum, litecoin, etc is like a stock. One can buy crypto and hold (realizing appreciation) without having to pay taxes until the position is sold. The sale of a crypto position is what triggers a tax liability (long or short term depending on holding period of one year or less). However, due to the volatility of cryptocurrencies, sometimes people want to take profits. But before selling one needs to consider not only the tax implications but how far down that crypto price would have to fall before you would buy it again. Maybe you would have been better off just holding for the long term (because it may not correct that much).

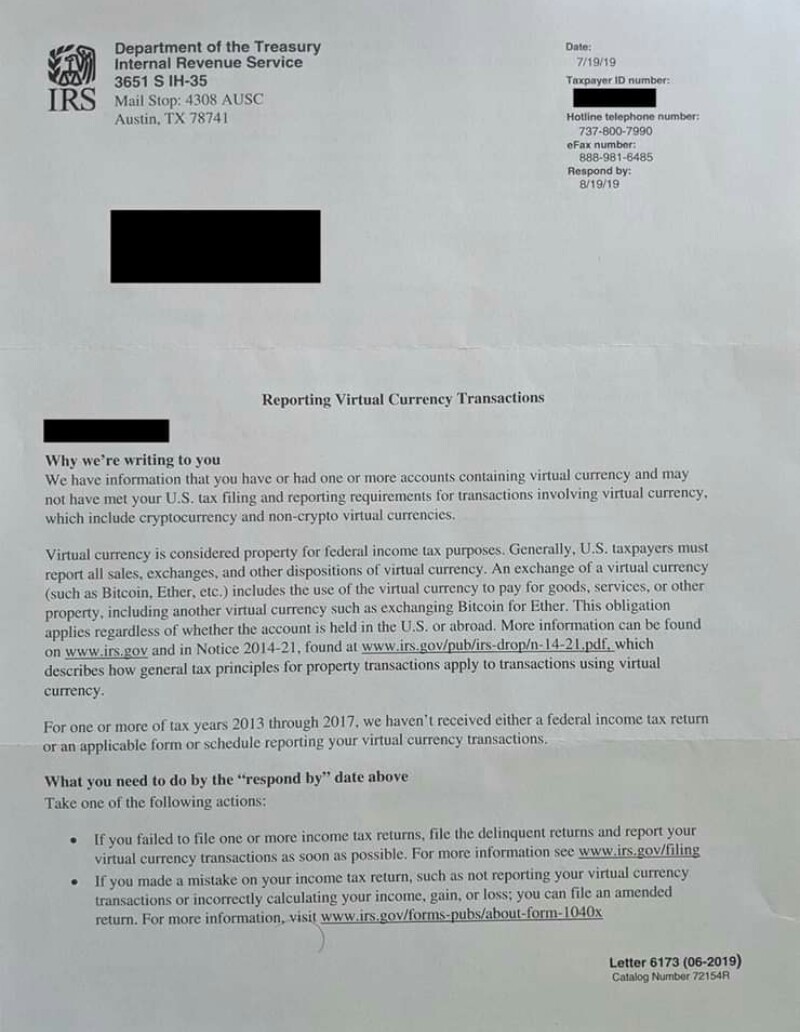

One thing that I find unfair about the current tax law is that it does not consider swaps into other currencies as like kind exchanges. Many exchanges have bitcoin or ethereum trading pairs and the only means of acquiring many alt coins is to acquire bitcoin or ethereum first. So for example if you acquired bitcoin at $5000 several months ago and wanted to exchange it for an equivalent amount of Cardano, doing so would trigger a tax liability on the difference in your acquisition price $5000 and the price at the date of the exchange. However, the conversion would not yield cash proceeds to allow you to pay the tax liability. Very unfair in my opinion given that like kind exchange treatment is allowed for real estate transactions. As well, under current current law, using bitcoin to make retail purchases such as electronics would also generate a tax liability based on the appreciation from the acquisition date. So the law stifles innovation because it makes using crypto for normal transactions impractical. No one wants to have a multi-page schedule C as a result of numerous small-dollar crypto retail purchases.