- Impact

- 1,659

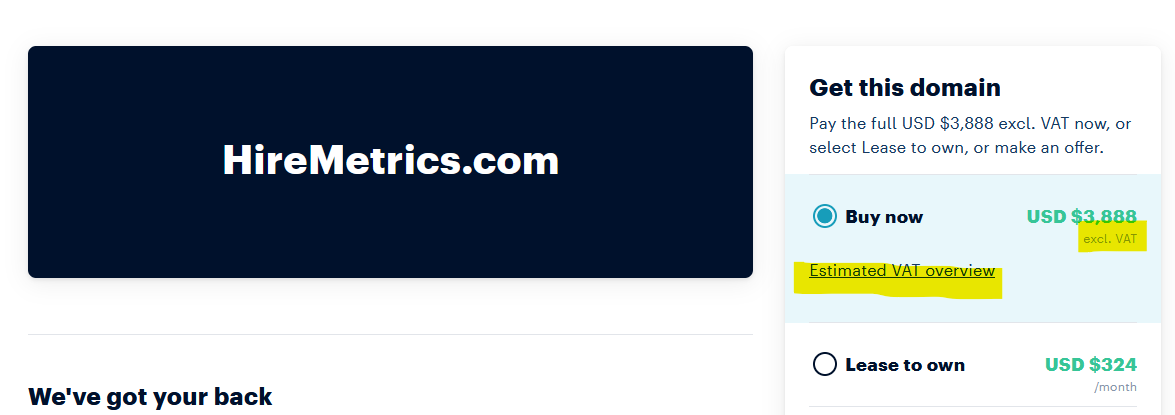

I noticed today that all my DAN landers are showing VAT informations like for example:

I was a bit confued because of the VAT law of my country i'm not allowed to charge any VAT.

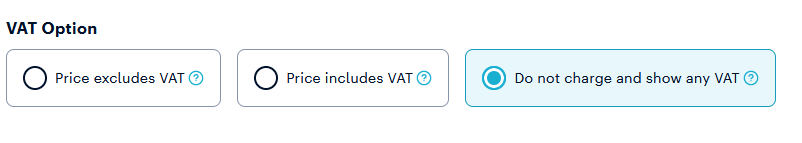

So i checked the settings in my account which are still set the correct way:

And after that i requested their support about that and they told me something interesting:

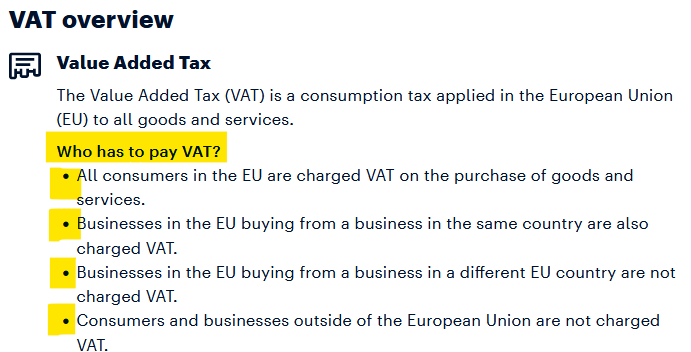

[..]Dan is now listed as the Seller on any transaction. Since we are a Dutch company and VAT registered, we charge VAT to relevant EU buyers.

They changed the way they handle sales like afternic do for severel years now.

DAN acts now as the seller. And when you sell a name you sell it to DAN (and they sell it in their name to the buyer).

So it is not about if YOU are in need to charge VAT to a customer anymore. Its about them now and they are a EU company.

I mean, at one view it's okay for me. Now i only have to use one creditor to send invoices to.

The bad thing is that EU customers will now charged with VAT which they were not before (based on your own situation). Hmm..

Did you knew about that? I haven't read anything about it in their last Newsletters.

I was a bit confued because of the VAT law of my country i'm not allowed to charge any VAT.

So i checked the settings in my account which are still set the correct way:

And after that i requested their support about that and they told me something interesting:

[..]Dan is now listed as the Seller on any transaction. Since we are a Dutch company and VAT registered, we charge VAT to relevant EU buyers.

They changed the way they handle sales like afternic do for severel years now.

DAN acts now as the seller. And when you sell a name you sell it to DAN (and they sell it in their name to the buyer).

So it is not about if YOU are in need to charge VAT to a customer anymore. Its about them now and they are a EU company.

I mean, at one view it's okay for me. Now i only have to use one creditor to send invoices to.

The bad thing is that EU customers will now charged with VAT which they were not before (based on your own situation). Hmm..

Did you knew about that? I haven't read anything about it in their last Newsletters.

Last edited: