When it comes to domain investment, no matter who you are, an experienced domain investor or just a new domainer, asset allocation when you investing domain names can never been ignored.

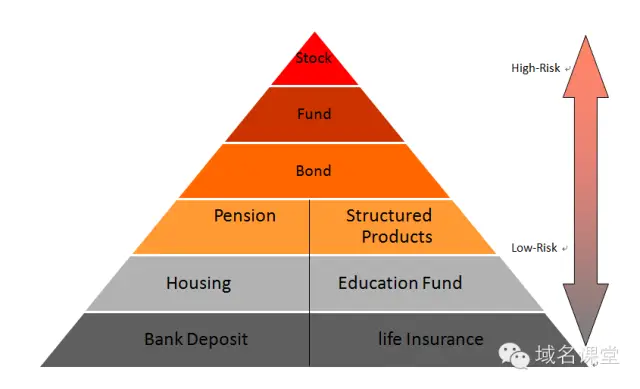

First of all, let's take a look at the risks of public financial managements. Blind investment is not acceptable! We should know the risks before we enter the market.

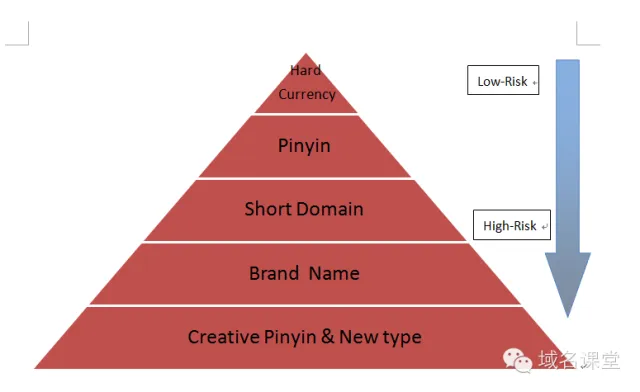

Accordingly, there is a similar risk chart in domain investment (not the only standard).

The Classification of Risks

Hard currency domain could be traded easily and its value is relatively stable, which could be a long-term choice. Hard currency domains are usually NNN.COM or LLL.COM. However, in the context of the current market, We think that it seems that NNNN.COM can be regarded as hard currency.

Pinyin couldn’t be ignored either, such as baihe.com,meili.com. They are priced more than seven figure fee. However, its liquidity is not good as hard currency domains, so if you have money pressure, it is better to choose domain which has stronger liquidity.

Short domain name contains hybrid characters and other suffixes except .com, such as LL. CC, b2.COM. Brand name domain is at higher risk, such as jingdong.com, damai.com. Generally the cost is not low and usually it has a long investment cycle. There are chances that the brand domain may not be chosen by end-user. So the risk is relatively bigger and this kind of domain is suitable for the investors who are able to burden the risk.

Creative pinyin domain, such as letuan.com, is undoubtedly creative. However it has missed the golden period of group buying, therefore the value of this kind of domain fluctuates with the market.

The Domain Asset Allocation

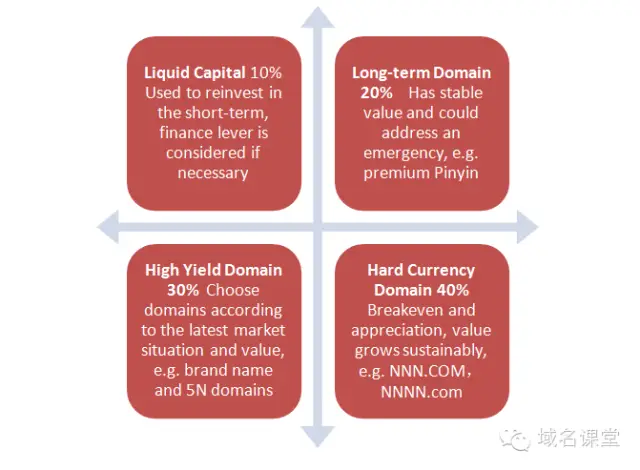

After get acknowledged the basic information, standard & poor's family assets diagram is widely accepted and applied as family asset allocation plan. Though it is not almighty, the fundamental approaches can be applied!

The 4321 rule can be applied to the domain asset allocation.

The goal of domain investment determines your domain asset allocation!

If you are risk-preference investor and your investment target is short-term profit, then you could follow the market trend and decrease the long-term investment assets;

if you are conservative investor and your investment target is steady long-term investment, then you can increase the proportion of hard currency domains.

You can adjust your asset allocation plan according to your own investment goals, in the meantime keeping the 4321 rule in mind.

Make sure your liquid capital is enough to adjust assets allocation when needed and try your best to achieve your investment goals.

This article only talks about the framework of asset allocation. In fact, there is more specific content in domain asset allocation and each part can be further discussed. If you look into the data, you will find there are a lot of discovery which will directly affect the overall income. If you are interested in more information on this topic, please leave a message and we will continue on further discovering on this topic.

Find more Articles with English version in our wechat subscription- the ID is "DNclass".

First of all, let's take a look at the risks of public financial managements. Blind investment is not acceptable! We should know the risks before we enter the market.

Accordingly, there is a similar risk chart in domain investment (not the only standard).

The Classification of Risks

Hard currency domain could be traded easily and its value is relatively stable, which could be a long-term choice. Hard currency domains are usually NNN.COM or LLL.COM. However, in the context of the current market, We think that it seems that NNNN.COM can be regarded as hard currency.

Pinyin couldn’t be ignored either, such as baihe.com,meili.com. They are priced more than seven figure fee. However, its liquidity is not good as hard currency domains, so if you have money pressure, it is better to choose domain which has stronger liquidity.

Short domain name contains hybrid characters and other suffixes except .com, such as LL. CC, b2.COM. Brand name domain is at higher risk, such as jingdong.com, damai.com. Generally the cost is not low and usually it has a long investment cycle. There are chances that the brand domain may not be chosen by end-user. So the risk is relatively bigger and this kind of domain is suitable for the investors who are able to burden the risk.

Creative pinyin domain, such as letuan.com, is undoubtedly creative. However it has missed the golden period of group buying, therefore the value of this kind of domain fluctuates with the market.

The Domain Asset Allocation

After get acknowledged the basic information, standard & poor's family assets diagram is widely accepted and applied as family asset allocation plan. Though it is not almighty, the fundamental approaches can be applied!

The 4321 rule can be applied to the domain asset allocation.

The goal of domain investment determines your domain asset allocation!

If you are risk-preference investor and your investment target is short-term profit, then you could follow the market trend and decrease the long-term investment assets;

if you are conservative investor and your investment target is steady long-term investment, then you can increase the proportion of hard currency domains.

You can adjust your asset allocation plan according to your own investment goals, in the meantime keeping the 4321 rule in mind.

Make sure your liquid capital is enough to adjust assets allocation when needed and try your best to achieve your investment goals.

This article only talks about the framework of asset allocation. In fact, there is more specific content in domain asset allocation and each part can be further discussed. If you look into the data, you will find there are a lot of discovery which will directly affect the overall income. If you are interested in more information on this topic, please leave a message and we will continue on further discovering on this topic.

Find more Articles with English version in our wechat subscription- the ID is "DNclass".