Pricing of domain names is hard. If you price too high, your sell-through rate may go down. If you price too low, you leave money on the table. But what is the right price point? While various automated appraisal systems are available, they disagree wildly on almost all names, and few have confidence in them.

Should you have fixed prices, or include a make offer option as well? Should you even show prices, or use make offer exclusively? What about price on request?

Should you employ ‘shoot the moon’ pricing on some domain names? Or even on all of your portfolio?

Are there price levels that will sharply reduce the number of potential buyers? Are impulsive purchases discouraged above some dollar value?

Do the price endings matter – e.g. is it better to end prices in 00, 88, 99 or something else?

So many questions! This article does not attempt to answer most of those questions, but instead has a narrower focus: What is the minimum price that you need to charge in order to be profitable overall?

Many retail purchasers ask why a domain name that only cost $10 to $20 to acquire sells for $2000 or more. It is, of course, because most domain names held by investors will either never sell, or sell only after very long hold times. The prices on the names that do sell need to be higher to offset costs associated with those that do not sell.

Some Assumptions

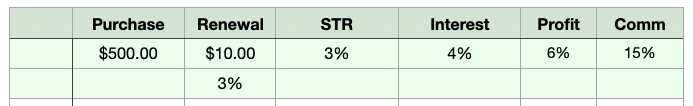

Before we try to answer the question of minimum price in order to not lose money overall, we need to make some assumptions. I prepared a spreadsheet to look at scenarios for this article, and the top, in green, are the starting points you need to enter.

Let’s run through what each means:

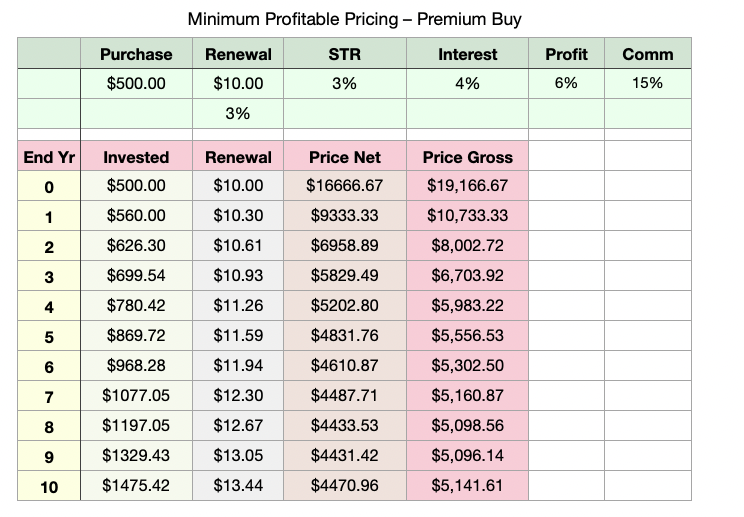

For the first simulation, I assumed a wholesale acquisition at $500 including registration costs. I assume it is a .com, with a $10.00 current renewal fee. The sell-through rate industry wide for .com is almost certainly less than 1%, but for a premium name purchased at $500 it would be higher. I used 3% in the model. The results are shown below:

The left column gives each year over a 10-year period. Note that the line references the end of that year, so the 0 line goes from 0 to almost 1 year, the 1 line from 1 to almost 2 yr, and so on.

At the outset you paid $500, not yet any additional renewals, so year 0 the invested cost is the $500, and you simply multiply $500 by 100/STR (with STR expressed as a percentage) to get the required net price. Even at a 3% STR, odds are that during the year only 3 out of 100 domain names sell. Therefore, to match those odds, one needs a return of about $16,667 on each name that sells to make it overall profitable, according to the assumptions. But the buy now asking price needs to take into account commission, which moves the price to almost $19,200.

Note that I used a simplified net+15% to suggest a gross price. If your commission was the full 15%, this slightly underestimates the price you would need to ask, since the commission rate is calculated on the final figure. This does not affect any calculations except the gross column, and given the wide range of effective commissions within the industry, the simplified method seems sufficient. Thanks to @poweredbyme for the clear explanation of the difference between the two in the discussion below.

However, the $19,200 price is deceptive for a more substantial reason, as it essentially assumes you only hold the domain name a year, even after paying that substantial acquisition cost. We need to look at more years to see what the pricing should really be, as explained in the next paragraph.

What happens as time goes on? After another year you have a bit more effectively invested in the domain name. You have $500 + $10 (we assume you renew just before the $10 renewal is increased), but also those 4% interest and 6% profit target amounts. It works out to $560. To find the net minimum price by the end of year 1 we have had almost 2 full years. Remember that in my terminology end year 1 means end of the year that goes from 1 to 2 years.

By the way, unless market conditions change, it is not that the probability of selling goes up, just that you have had more years for the name to possibly sell.

The process continues each year. You can see in the Renewal column that the $10 grows to $13.44 per year under the 3% assumption. The 4% interest on tied up resources, and 6% profit, begin to add up, with an effective invested amount of $1475 after ten years. I have applied the expected profit in the invested column. In some ways that is not directly invested money, of course, although it is based on time you could have put into something else.

Since we had a big initial cost, according to this model, it takes a few years for the price to stabilize. The minimum asking price, assuming the 15% commission, needs to be in the $5000 to $5500 range for this scenario.

I have not built into the model an exit scenario – that is what would be the liquid value of the domain name that could partially recoup the investment if you decide to abandon the name. If I had taken that into account, the minimum price could be a bit lower. Nor have I assumed any income from monetized parking.

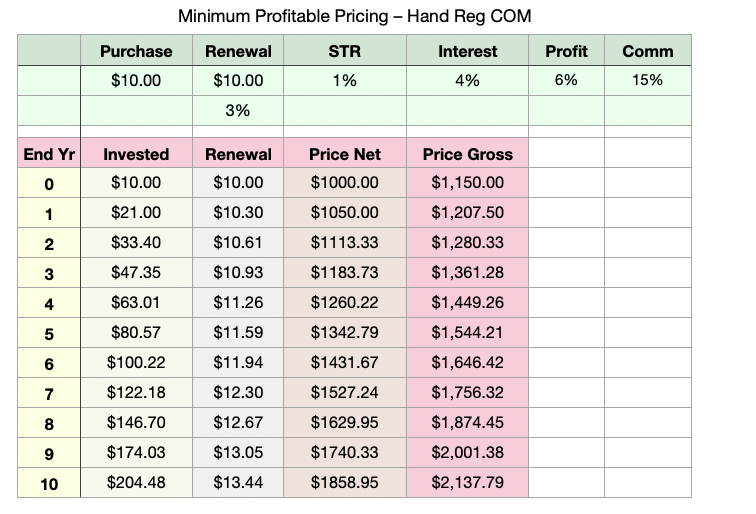

The Hand Registration Model

For the next model, I assume that you hand registered a .com domain at $10, and that you have a lower STR since the name is not as desirable as the $500 acquisition name considered earlier. I assume a 1% STR. Everything else is the same as in the previous model, with the results shown below.

Considering the 1% STR you would need to ask a minimum retail price of $1150 for the name during the first year, growing to about $2140 by the final year of the simulation. In practice, you would probably ask more than that in year one, and only increase prices more slowly.

Note that this does not tell you what price you should ask, simply what minimum price you need to average across a portfolio of similar names if you are to be profitable, with the assumptions used.

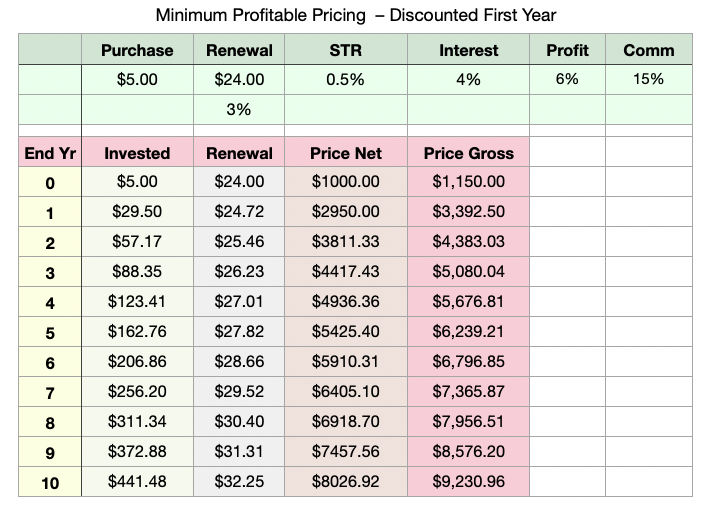

Discounted First Year Domain Name

In some country-code extensions, such as .co, and in many new extensions, there are sharp discounts in the initial registration. I ran a model assuming a $5 first year then $24 per year renewal, similar to .co. I assumed the STR is a bit lower, 0.5%, for a hand registered .co.

Because of that low initial cost, we can be profitable at $1150 pricing, but only if we assume you are going to only hold the name for a year.

If you are planning to hold the name longer, those renewal costs take a toll, and you will need to price in the $5000 to $9300 range

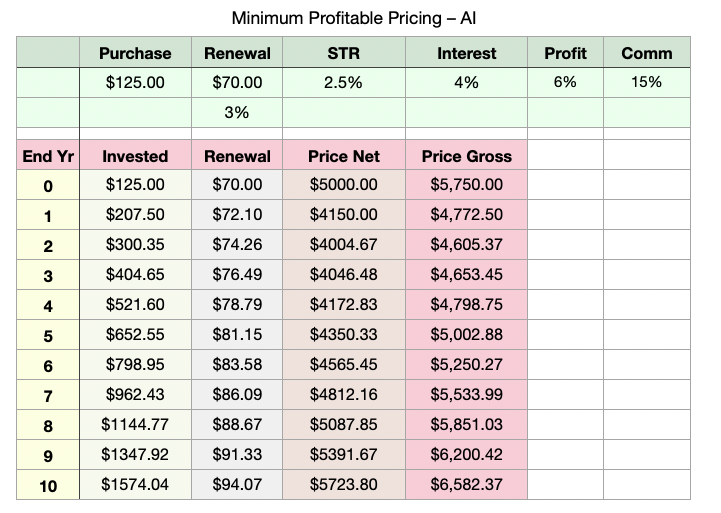

AI Model

The .ai country code is one of the hottest TLDs, after .com, this year. I have no idea what a reasonable STR would be, but I put together a simulation assuming a $125 acquisition and $70 per year renewals and a 2.5% STR.

As can be seen, at least for those parameters, one needs to think of retail pricing in the $5000 to $6000 range.

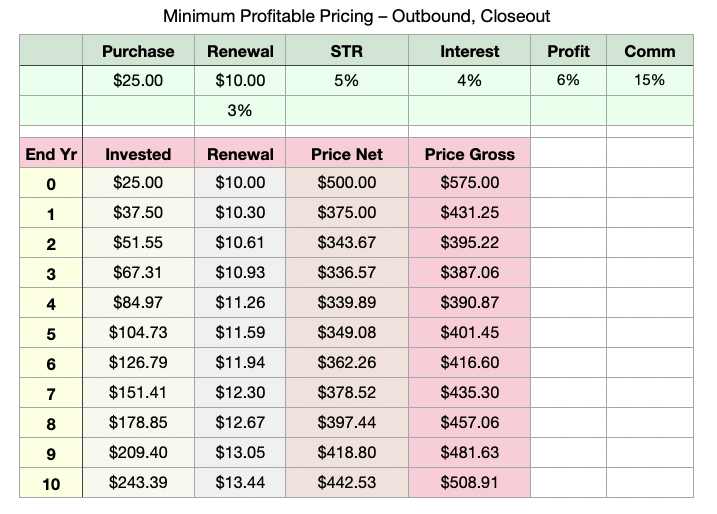

Outbound Selling

With skillful, targeted outbound, and with the right names, you can probably achieve a higher STR. I wanted to model that to get a fell for the ballpark pricing needed.

In this scenario I assumed you could bump the STR to 5%. I assumed that you bought the domains at $11 closeout + $14 registration cost for a net cost of $25. Other assumptions were the same as in earlier models.

One can see that one can price in the $500 range and be profitable in this model, but only if you can achieve the assumed STR and keep acquisition costs low.

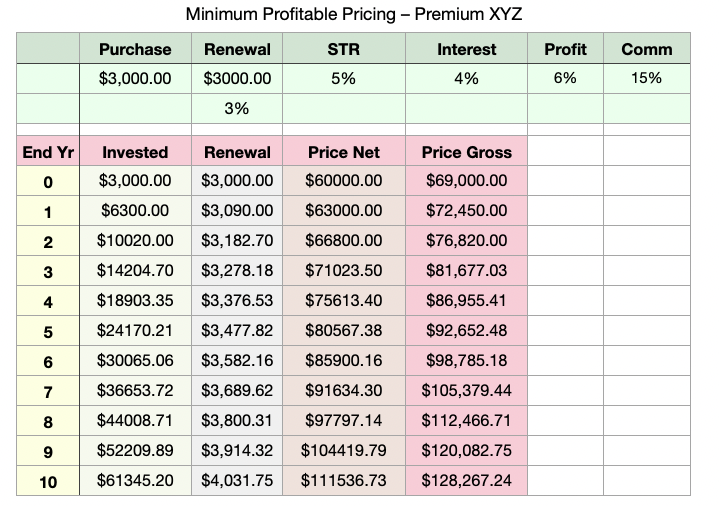

Premium Domain Acquisition

Most new extensions price some of the best domains at premium. This helps the registry, that has the costs of the initial application and ongoing costs and fees, to be profitable. While a premium annual fee may not make much difference to an end user, to the investor it is huge, as the model below shows.

Most .xyz domain names are sold and renew at standard rates, but a numbere of the best terms now carry premium prices. There are several tiers, including a tier that does not have premium renewal. You can download the full xyz premium list with prices here. For the model I assume a name with a $3000 original cost and the same renewal fee.

Most of the names priced at this premium level are highly sought terms, so the STR is expected to be much higher than a standard fee name in that extension. I assumed a 5% STR. You can see it would only make sense as an investor if you have confidence the 5% STR is realistic, and that you feel confident the retail price could be in the range $70,000 to $128,000. Over the past three years, NameBio show 7 .xyz sales at $100,000 plus.

A Few Thoughts

The model shows that what many investors do instinctively is supported by the results of these models. Many price brandable hand registration names in the range around $2000 to $3000, and that is about right. When one pays hundreds to acquire a name, it should be a name that is likely to sell for $5000 plus. One can cut prices more with outbound, but only if you can achieve a strong STR.

Higher renewal costs in TLDs such as some new extensions, .io, and .ai must be kept in mind as one sets pricing. Nevertheless, some investors have been more than profitable in these niches.

With new extension, or other discounted first year, there is a strong argument to consider some holds as single year only. The model shows that you could price much more aggressively if that is your plan.

Multi-year promotions offer investor advantages. When you are hand registering a name always check if a registrar has advantageous 2 year or longer registrations. For example, at Dynadot you can currently register .xyz for two years for $8.99 total, but if you only register one year at $1.99 the renewal will be $12.99. Namecheap also offer two year deals on a number of TLDs. Dynadot have great multi-year .cc pricing for fresh registrations. Now and then there are 5 and 10 year deals offered for some new extensions.

The model assumes that you pay renewals year by year. By renewing prior to price increases, costs could be somewhat reduced.

This article has not covered minimum pricing for situations when you have decided to definitely not renew a domain name and are liquidating the asset. Nor has it considered minimum selling prices in terms of replacement costs. Those will be taken up in a future NamePros Blog article.

By the way, there is a more sophisticated and precise way to combine probabilities in the multi-year scenario. One should really consider the probability the name did not sell in each year, and combine those probabilities. Except in high STR for many years, the difference is small, so I simplified it for these models. It matters most for STR of 5% or more in later years.

A few NamePros threads discussions related to this topic:

Play With The Model

There is nothing particularly complex with the simple model, but if you want to try it for your own parameters, the link below is an Excel version that you can download. I created the original in Mac Numbers, but it seems to have ported correctly to Excel.

Simply enter your parameters for each of the green section variables, and the table should update with results.

Updates:

Nov. 9, 2023 I added a section with links to some of the other NamePros discussions that have considered the question of profitability in a quantitative manner.

Nov. 9, 2023 I specifically pointed out that a simplified method was used in the calculation for the gross price column, and strictly speaking, as pointed out by @poweredbyme the asking price would need to be slightly higher. No other columns are impacted, and given that the commissions in our industry vary so extensively, I think the simplified treatment is adequate. The difference would be about $25 on a $1200 name.

Should you have fixed prices, or include a make offer option as well? Should you even show prices, or use make offer exclusively? What about price on request?

Should you employ ‘shoot the moon’ pricing on some domain names? Or even on all of your portfolio?

Are there price levels that will sharply reduce the number of potential buyers? Are impulsive purchases discouraged above some dollar value?

Do the price endings matter – e.g. is it better to end prices in 00, 88, 99 or something else?

So many questions! This article does not attempt to answer most of those questions, but instead has a narrower focus: What is the minimum price that you need to charge in order to be profitable overall?

Many retail purchasers ask why a domain name that only cost $10 to $20 to acquire sells for $2000 or more. It is, of course, because most domain names held by investors will either never sell, or sell only after very long hold times. The prices on the names that do sell need to be higher to offset costs associated with those that do not sell.

Some Assumptions

Before we try to answer the question of minimum price in order to not lose money overall, we need to make some assumptions. I prepared a spreadsheet to look at scenarios for this article, and the top, in green, are the starting points you need to enter.

Let’s run through what each means:

- Purchase is the price you paid for the domain name, including any renewal fees you had to pay up front. For example, let’s say you buy a GoDaddy closeout on day 3. Although the fee is $30, you also need pay a year renewal. If you had a Basic Discount Club membership that adds about $14, so you would enter $44, not $30, as the acquisition cost.

- Renewal This is the current renewal rate, at the registrar that you plan to use. There is just below an entry for the average annual percentage increase. For .com model runs, I assumed $10.00 with a 3% pa increase rate. That is less than the average over recent years, but more than the long term rate of increase.

- Sell-Through Rate (STR) One can calculate a sell-through rate after the fact for your portfolio. For example, if you sold 3 domains from a portfolio of 100 domain names during the last 12 months, that is a 3% STR. Looking ahead, you need to use past results, your own and others, to predict a future STR for individual names.

- Interest You have money tied up in your domain investments, and we are no longer in a near zero rate interest environment. Depending on whether you borrowed money for your investments, or used money that could otherwise be earning interest, one should assume some interest rate. I used 4% in most of the model runs. You may wish to use a higher or lower interest rate.

- Profit You are taking a risk on domain name investments, and doing the work of finding, listing, promoting and managing domain names, and should expect some level of return. I, somewhat arbitrarily, used 6% in the data runs. Some might prefer to unify these two columns, and say you want an overall return of 10%, rather than think of it as 4% interest plus 6% profit.

- Commission To relate the up-front price to the return seen by the investor, some assumption of commission rate is needed. I used 15% in the models. If you sell directly you could use a lower figure, but probably not zero, as you would still have costs related to payment transactions and possibly escrow-type costs.

For the first simulation, I assumed a wholesale acquisition at $500 including registration costs. I assume it is a .com, with a $10.00 current renewal fee. The sell-through rate industry wide for .com is almost certainly less than 1%, but for a premium name purchased at $500 it would be higher. I used 3% in the model. The results are shown below:

The left column gives each year over a 10-year period. Note that the line references the end of that year, so the 0 line goes from 0 to almost 1 year, the 1 line from 1 to almost 2 yr, and so on.

At the outset you paid $500, not yet any additional renewals, so year 0 the invested cost is the $500, and you simply multiply $500 by 100/STR (with STR expressed as a percentage) to get the required net price. Even at a 3% STR, odds are that during the year only 3 out of 100 domain names sell. Therefore, to match those odds, one needs a return of about $16,667 on each name that sells to make it overall profitable, according to the assumptions. But the buy now asking price needs to take into account commission, which moves the price to almost $19,200.

Note that I used a simplified net+15% to suggest a gross price. If your commission was the full 15%, this slightly underestimates the price you would need to ask, since the commission rate is calculated on the final figure. This does not affect any calculations except the gross column, and given the wide range of effective commissions within the industry, the simplified method seems sufficient. Thanks to @poweredbyme for the clear explanation of the difference between the two in the discussion below.

However, the $19,200 price is deceptive for a more substantial reason, as it essentially assumes you only hold the domain name a year, even after paying that substantial acquisition cost. We need to look at more years to see what the pricing should really be, as explained in the next paragraph.

What happens as time goes on? After another year you have a bit more effectively invested in the domain name. You have $500 + $10 (we assume you renew just before the $10 renewal is increased), but also those 4% interest and 6% profit target amounts. It works out to $560. To find the net minimum price by the end of year 1 we have had almost 2 full years. Remember that in my terminology end year 1 means end of the year that goes from 1 to 2 years.

By the way, unless market conditions change, it is not that the probability of selling goes up, just that you have had more years for the name to possibly sell.

The process continues each year. You can see in the Renewal column that the $10 grows to $13.44 per year under the 3% assumption. The 4% interest on tied up resources, and 6% profit, begin to add up, with an effective invested amount of $1475 after ten years. I have applied the expected profit in the invested column. In some ways that is not directly invested money, of course, although it is based on time you could have put into something else.

Since we had a big initial cost, according to this model, it takes a few years for the price to stabilize. The minimum asking price, assuming the 15% commission, needs to be in the $5000 to $5500 range for this scenario.

I have not built into the model an exit scenario – that is what would be the liquid value of the domain name that could partially recoup the investment if you decide to abandon the name. If I had taken that into account, the minimum price could be a bit lower. Nor have I assumed any income from monetized parking.

The Hand Registration Model

For the next model, I assume that you hand registered a .com domain at $10, and that you have a lower STR since the name is not as desirable as the $500 acquisition name considered earlier. I assume a 1% STR. Everything else is the same as in the previous model, with the results shown below.

Considering the 1% STR you would need to ask a minimum retail price of $1150 for the name during the first year, growing to about $2140 by the final year of the simulation. In practice, you would probably ask more than that in year one, and only increase prices more slowly.

Note that this does not tell you what price you should ask, simply what minimum price you need to average across a portfolio of similar names if you are to be profitable, with the assumptions used.

Discounted First Year Domain Name

In some country-code extensions, such as .co, and in many new extensions, there are sharp discounts in the initial registration. I ran a model assuming a $5 first year then $24 per year renewal, similar to .co. I assumed the STR is a bit lower, 0.5%, for a hand registered .co.

Because of that low initial cost, we can be profitable at $1150 pricing, but only if we assume you are going to only hold the name for a year.

If you are planning to hold the name longer, those renewal costs take a toll, and you will need to price in the $5000 to $9300 range

AI Model

The .ai country code is one of the hottest TLDs, after .com, this year. I have no idea what a reasonable STR would be, but I put together a simulation assuming a $125 acquisition and $70 per year renewals and a 2.5% STR.

As can be seen, at least for those parameters, one needs to think of retail pricing in the $5000 to $6000 range.

Outbound Selling

With skillful, targeted outbound, and with the right names, you can probably achieve a higher STR. I wanted to model that to get a fell for the ballpark pricing needed.

In this scenario I assumed you could bump the STR to 5%. I assumed that you bought the domains at $11 closeout + $14 registration cost for a net cost of $25. Other assumptions were the same as in earlier models.

One can see that one can price in the $500 range and be profitable in this model, but only if you can achieve the assumed STR and keep acquisition costs low.

Premium Domain Acquisition

Most new extensions price some of the best domains at premium. This helps the registry, that has the costs of the initial application and ongoing costs and fees, to be profitable. While a premium annual fee may not make much difference to an end user, to the investor it is huge, as the model below shows.

Most .xyz domain names are sold and renew at standard rates, but a numbere of the best terms now carry premium prices. There are several tiers, including a tier that does not have premium renewal. You can download the full xyz premium list with prices here. For the model I assume a name with a $3000 original cost and the same renewal fee.

Most of the names priced at this premium level are highly sought terms, so the STR is expected to be much higher than a standard fee name in that extension. I assumed a 5% STR. You can see it would only make sense as an investor if you have confidence the 5% STR is realistic, and that you feel confident the retail price could be in the range $70,000 to $128,000. Over the past three years, NameBio show 7 .xyz sales at $100,000 plus.

A Few Thoughts

The model shows that what many investors do instinctively is supported by the results of these models. Many price brandable hand registration names in the range around $2000 to $3000, and that is about right. When one pays hundreds to acquire a name, it should be a name that is likely to sell for $5000 plus. One can cut prices more with outbound, but only if you can achieve a strong STR.

Higher renewal costs in TLDs such as some new extensions, .io, and .ai must be kept in mind as one sets pricing. Nevertheless, some investors have been more than profitable in these niches.

With new extension, or other discounted first year, there is a strong argument to consider some holds as single year only. The model shows that you could price much more aggressively if that is your plan.

Multi-year promotions offer investor advantages. When you are hand registering a name always check if a registrar has advantageous 2 year or longer registrations. For example, at Dynadot you can currently register .xyz for two years for $8.99 total, but if you only register one year at $1.99 the renewal will be $12.99. Namecheap also offer two year deals on a number of TLDs. Dynadot have great multi-year .cc pricing for fresh registrations. Now and then there are 5 and 10 year deals offered for some new extensions.

The model assumes that you pay renewals year by year. By renewing prior to price increases, costs could be somewhat reduced.

This article has not covered minimum pricing for situations when you have decided to definitely not renew a domain name and are liquidating the asset. Nor has it considered minimum selling prices in terms of replacement costs. Those will be taken up in a future NamePros Blog article.

By the way, there is a more sophisticated and precise way to combine probabilities in the multi-year scenario. One should really consider the probability the name did not sell in each year, and combine those probabilities. Except in high STR for many years, the difference is small, so I simplified it for these models. It matters most for STR of 5% or more in later years.

A few NamePros threads discussions related to this topic:

- @Ategy was one of the first to share detailed models generated with a spreadsheet. See for example this 2020 discussion Turning $10,000 into $1 million after 6 years.

- In 2018 I started a discussion Is Domain Name Investing Even Profitable? that looked at several models with different assumptions around average price and STR.

- @william included an example in his discussion Is Your Time Worth Anything?

- Multi-year models were projected under various assumptions in the NamePros Blog article: Scaling Up A Domain Name Portfolio.

Play With The Model

There is nothing particularly complex with the simple model, but if you want to try it for your own parameters, the link below is an Excel version that you can download. I created the original in Mac Numbers, but it seems to have ported correctly to Excel.

Simply enter your parameters for each of the green section variables, and the table should update with results.

Updates:

Nov. 9, 2023 I added a section with links to some of the other NamePros discussions that have considered the question of profitability in a quantitative manner.

Nov. 9, 2023 I specifically pointed out that a simplified method was used in the calculation for the gross price column, and strictly speaking, as pointed out by @poweredbyme the asking price would need to be slightly higher. No other columns are impacted, and given that the commissions in our industry vary so extensively, I think the simplified treatment is adequate. The difference would be about $25 on a $1200 name.

Attachments

Last edited: