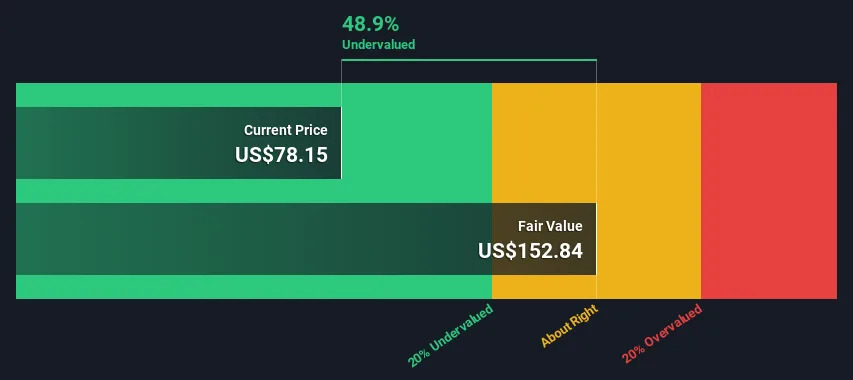

GoDaddy Inc. (NYSE:GDDY) Shares Could Be 49% Below Their Intrinsic Value Estimate

Current price $80 ( it goes $2 up on Friday, after publication)

How far off is GoDaddy Inc. (NYSE:GDDY) from its intrinsic value? Using the most recent financial data, we'll take a look at whether the stock is fairly priced by projecting its future cash flows and then discounting them to today's value. We will take advantage of the Discounted Cash Flow (DCF) model for this purpose. Believe it or not, it's not too difficult to follow, as you'll see from our example!

The Calculation

We are going to use a two-stage DCF model, which, as the name states, takes into account two stages of growth. The first stage is generally a higher growth period which levels off heading towards the terminal value, captured in the second 'steady growth' period. In the first stage we need to estimate the cash flows to the business over the next ten years. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.Generally we assume that a dollar today is more valuable than a dollar in the future, and so the sum of these future cash flows is then discounted to today's value:

Present Value of 10-year Cash Flow (PVCF) = US$11b

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (2.0%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 9.0%.

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is US$24b. In the final step we divide the equity value by the number of shares outstanding. Relative to the current share price of US$78.2, the company appears quite undervalued at a 49% discount to where the stock price trades currently. Valuations are imprecise instruments though, rather like a telescope - move a few degrees and end up in a different galaxy. Do keep this in mind.

SWOT Analysis for GoDaddy

Strength- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings and cashflows.

- No major weaknesses identified for GDDY.

- Annual earnings are forecast to grow faster than the American market.

- Trading below our estimate of fair value by more than 20%.

- Total liabilities exceed total assets, which raises the risk of financial distress.

- Revenue is forecast to grow slower than 20% per year.

All text here:

finance.yahoo.com/news/godaddy-inc-nyse-gddy-shares-134055707.html

p.s. For me it's looks very strange that no Weakness at all at SWOT ( maybe GoDaddy paid for that article ? )

Last edited: