- Impact

- 4,398

Hi,

I am currently doing a research on optimal domains pricing, the goal of the research is to:

Here is a sneak peak of what I got so far:

However the results I got are inconclusive, and I need more accurate data.

To get more accurate results I am asking Namepros community to help me collect more data, and for that I have created the following Survey:

https://freeonlinesurveys.com/s/OqGsfT2s

* The survey is totally anonymous there is no way to tell who sent it.

* The survey is for all extensions and not specific to .com

* The results of the study will be published at Namepros, I believe the results will be insightful for all of us.

* Contribution will be greatly appreciated especially from big portfolio sellers and from marketplaces that have enough data.

@Sedo @GoDaddy @DAN.COM @LaszloSchenk @GrantP @James Iles @DaaZ @aoxborrow

@AbdulBasit.com

@bmugford

@Recons.Com

@JudgeMind

@xynames

@twiki

@Acroplex

@Bob Hawkes

@Name Trader

@MadAboutDomains

@tonyk2000

@ResoluteDomains

@Leo Angelo

@Nikul Sanghvi

@TERADOMAIN

@Yusupbabay

...and all others please contribute.

Thanks

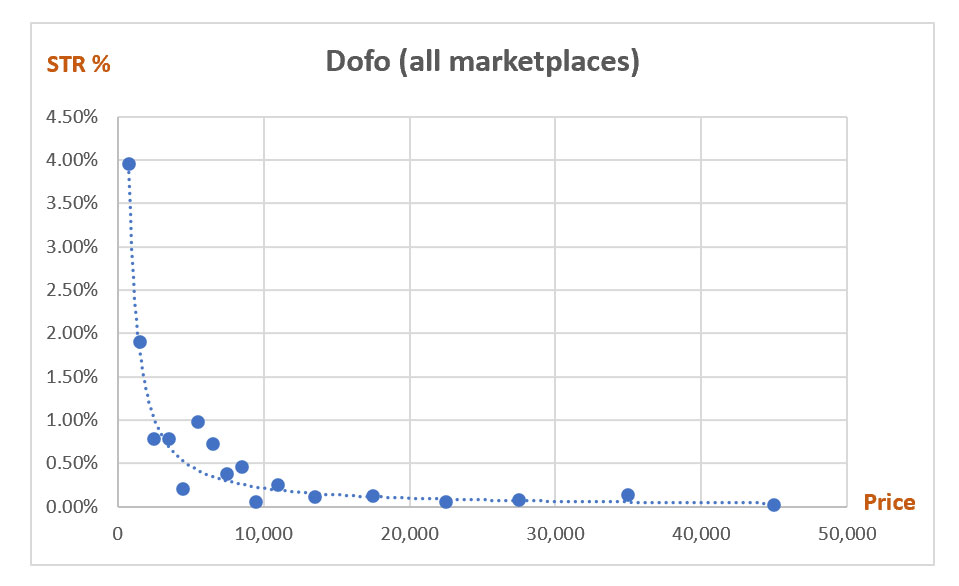

I am currently doing a research on optimal domains pricing, the goal of the research is to:

- Determine sell through rate (STR) for different pricing ranges

- Derive a formula for the relationship between STR and Domain Price

- Using formula from #2 we can make simulation for different pricing scenarios to find optimal pricing strategy

- Ultimately deriving a domain pricing formula (in a separate future study).

Here is a sneak peak of what I got so far:

However the results I got are inconclusive, and I need more accurate data.

To get more accurate results I am asking Namepros community to help me collect more data, and for that I have created the following Survey:

https://freeonlinesurveys.com/s/OqGsfT2s

* The survey is totally anonymous there is no way to tell who sent it.

* The survey is for all extensions and not specific to .com

* The results of the study will be published at Namepros, I believe the results will be insightful for all of us.

* Contribution will be greatly appreciated especially from big portfolio sellers and from marketplaces that have enough data.

@Sedo @GoDaddy @DAN.COM @LaszloSchenk @GrantP @James Iles @DaaZ @aoxborrow

@AbdulBasit.com

@bmugford

@Recons.Com

@JudgeMind

@xynames

@twiki

@Acroplex

@Bob Hawkes

@Name Trader

@MadAboutDomains

@tonyk2000

@ResoluteDomains

@Leo Angelo

@Nikul Sanghvi

@TERADOMAIN

@Yusupbabay

...and all others please contribute.

Thanks

Last edited: