Based on my experience...

1. Do you think this is a common practice that founders circulate a list of names for private discussion?

Yup! With my startups, I used to make lists of domains just like this along with their prices. Then I would pass it around for feedback if needed.

2. If so, is there an advantage to having an appropriate BIN price from outset, since they may not even consider following up Make Offer?

Yes, absolutely. Unless it was a domain I was super attached to, I eventually stopped reaching out to owners because it would end up wasting everyone's time. Make Offer owners had very high expectations and everyone thought they were great negotiators so it was hard to ever come to a consensus. BIN listings made it super easy to rank/compare names and move forward quickly.

Time and

money are the two most valuable things for a new business so BINs make a ton of sense from that perspective.

3. I wonder what other factors they consider most of the time. I note the reference re a similar name that Google own and also re the .org being hand-register available of one of the names.

It all depends on each founder's mindset and priorities. This is why nobody can ever come to an agreement on what works best. Some of these factors include:

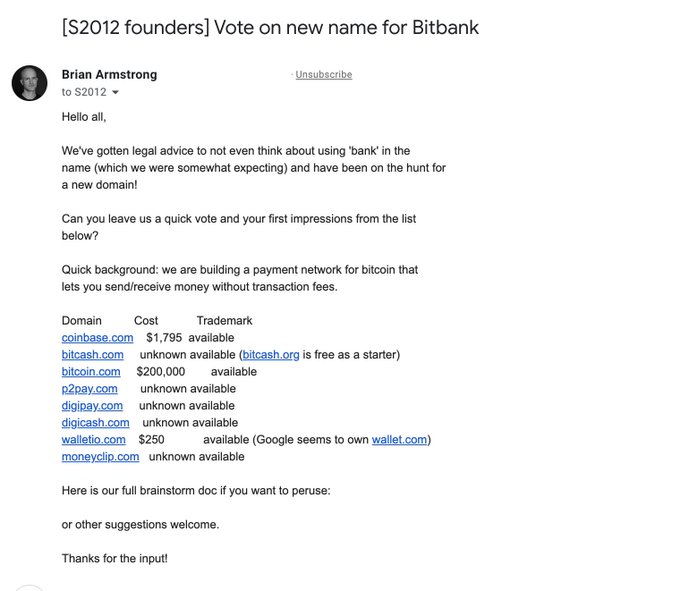

Brandability: New entrepreneurs typically don't care about the brand potential of their company name because they're laser focused on their idea and often lack marketing experience so they go with whatever name sounds cool to them. Experienced entrepreneurs focus more on the brandability because they understand the value of a brand so they go for short/catchy/memorable/generic names. Generic names also allow companies to expand beyond their initial target market if needed. In fact, if Coinbase had gone with Bitcoin.com, it would've been tougher to expand into altcoins.

Availability: .com is always the most desired. However, if it's not available some entrepreneurs temporarily go with another extension to save money at first thinking they can always buy the .com later on if their business succeeds (

pro: put the money you would've spent on the domain to work elsewhere to grow the business, con: the domain may not be available or the price may skyrocket if the owner finds out about the success in the future). When a large company like Google owns a domain, it's best to move on because (1) they'll never sell and (2) they most likely acquired the domain for their own project which could potentially clash with yours.

Trademark: New entrepreneurs often skip this process and deal with it at a later time when their business is large enough at which point they'll either succeed in obtaining a trademark or end up changing their company name. More experienced entrepreneurs tend of focus on getting a trademark right away to avoid headaches down the road.