About a week ago I received the following message from domain name investor JudgeMind.

I decided to take a closer look at a larger data set to see if we could learn more about who is driving up those auction prices. Surely it is relevant information to know who is bidding in the high-value auctions. This is what I found.

The Research

When auctions are won by domain investors, it seems reasonable that in most cases the name will be listed for sale again fairly promptly. The exceptions would be cases of domain names strategically held off the market, or accidental delay or for other reasons.

A name that is acquired by, or for, a specific end user would be expected to normally be developed, or used for redirection, before too long. There will be exceptions for domain names intended for uncertain long-term projects, or acquired for defensive purposes. In these cases the domain name will remain unused for an extended period.

I decided to restrict my attention to sales from the GoDaddy Auctions venue only, and to just analyze

For each domain name, I saw if the name resolved to a website, and if it did, how it was being used. I assigned use to one of the following categories:

How Are $4000+ Domain Names Being Used 6-12 Months After Sale?

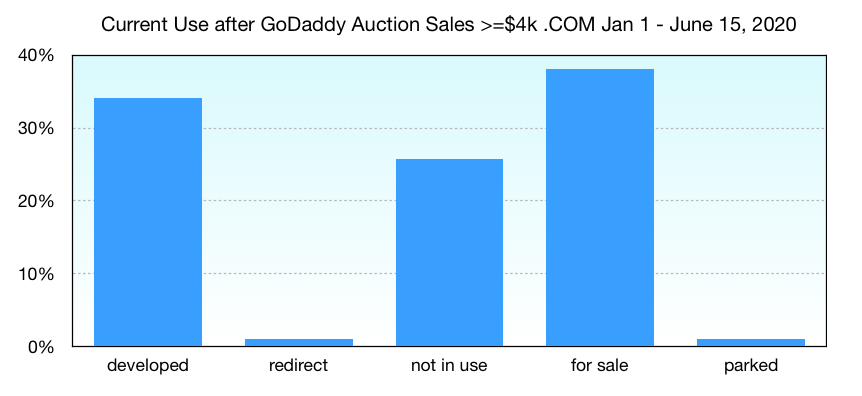

There were 381 GoDaddy Auction sales at prices of $4000 or more during the Jan 1 – June 15, 2020 period, an average of 2.3 per day. The average price paid was $10,024.

There were 60 sales of numeric names, 26 alphanumeric, and the rest were letters only. Five name contained a hyphen, although several contained multiple hyphens such as

The names ranged in length from 2 to 26 characters, with an average of length 8.2. I show the current end use in the following graph.

Here are the key points I took from the 2020 use data.

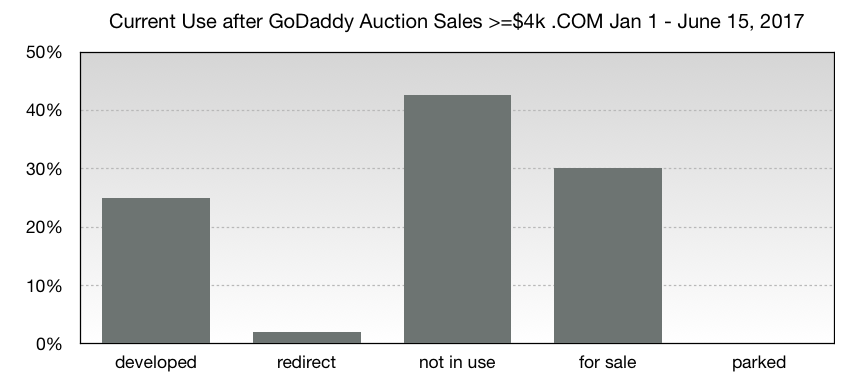

I did a similar survey of current use of

There were 96 sales in this set, a much lower rate of sale, of which 10 were numeric names and 5 alphanumeric, with the rest letters only.

What About Names Sold Less Than Two Months Ago?

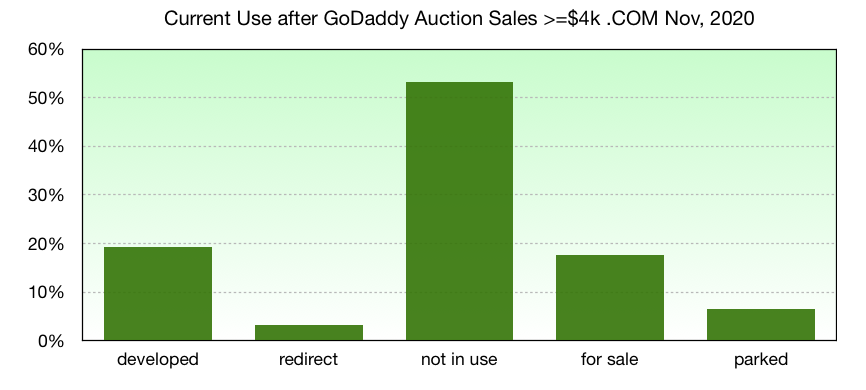

While the sample size is much smaller, a look at names sold just a month or two ago can be instructive. One would expect very few of these to have been listed and sold again, and already developed. Here is what I found in data from $4000 plus

Final Thoughts

It would have been interesting to look at sales with lower prices, such as $1000 plus, although the dataset would be much larger with significant time required to check current status. Even the 539 sites I checked for the data in this article took a number of hours. In theory the process could readily be automated with a script.

A deeper look into archived history and what whois information is available, might have further differentiated the purchaser. It would also be interesting to look at some of the other auction sites and different extensions.

However, based on what I did look at, these are my perceptions.

Thanks to JudgeMind for making the suggestion that was the basis for this article.

I would, once more, like to sincerely express my appreciation to NameBio. Their site makes an analysis such as this possible.

If you have an idea that you would like me to follow up for a potential article, please feel free to message me.

Throughout 2020 I’ve been watching the prices of auctions at venues like GoDaddy soar to new highs. Prices are now almost out of reach for the average investor. Seeing this shift in the auction prices made me dig in a bit as to why, why are the auction prices so high? I started looking at auctions ended 3-6 months ago to see if the name had been developed. My theory is that a lot of these auctions are being won by end users or web dev companies bidding on behalf of their clients. While I didn’t dig deep enough to check Whois data to differentiate between end users and investors, I did discover that quite a few were developed websites. This tells me that there are a lot of end users bidding on expiring auctions.

I decided to take a closer look at a larger data set to see if we could learn more about who is driving up those auction prices. Surely it is relevant information to know who is bidding in the high-value auctions. This is what I found.

The Research

When auctions are won by domain investors, it seems reasonable that in most cases the name will be listed for sale again fairly promptly. The exceptions would be cases of domain names strategically held off the market, or accidental delay or for other reasons.

A name that is acquired by, or for, a specific end user would be expected to normally be developed, or used for redirection, before too long. There will be exceptions for domain names intended for uncertain long-term projects, or acquired for defensive purposes. In these cases the domain name will remain unused for an extended period.

I decided to restrict my attention to sales from the GoDaddy Auctions venue only, and to just analyze

.com domain names that sold at final prices of $4000 or more. I used the NameBio sales database for all data.For each domain name, I saw if the name resolved to a website, and if it did, how it was being used. I assigned use to one of the following categories:

- Developed - something more than a coming soon site is operational.

- Redirection - the domain name redirects to a functional website. If it redirects to a for sale page it would be assigned to that category.

- Not In Use - no website is active, or in a few cases there was a security warning given when access was attempted.

- For Sale - either the domain name has a lander specifically listing it for sale, or a parking page that I knew was used by one of the major marketplaces with some message indicating possibly for sale.

- Parked - these are cases where it was not obvious to me that the parked name was actually for sale, in some cases using zero-click parking.

- Jan 1 – June 15, 2020

- Jan 1 – June 15, 2017

- Month of November 2020

How Are $4000+ Domain Names Being Used 6-12 Months After Sale?

There were 381 GoDaddy Auction sales at prices of $4000 or more during the Jan 1 – June 15, 2020 period, an average of 2.3 per day. The average price paid was $10,024.

There were 60 sales of numeric names, 26 alphanumeric, and the rest were letters only. Five name contained a hyphen, although several contained multiple hyphens such as

wilderness-survival-skills and apps-of-a-feather.The names ranged in length from 2 to 26 characters, with an average of length 8.2. I show the current end use in the following graph.

Here are the key points I took from the 2020 use data.

- 34.1% were already developed, with another 1.0% redirecting to a developed site. This suggested to me that more than one-third, at a minimum, of those winning $4000 plus auctions are not primarily domain investors. Of course, it is possible some were domain investors who are also active developers.

- 38.1% were listed for sale, or appeared to be for sale, plus another 1.0% used in some sort of monetized parking system but not obviously listed for sale. So I think at least about 40% of those winning auctions are still domain investors.

- 25.7% were not in use. This is not surprising, since some of the sales were as recently as 6 months, and none were a full year prior. These probably are a mix of those being held for longer-term development and some that are intended for resale.

- The fraction that were either for sale again, or unused, was much higher in the numeric and alphanumeric domain names.

- A large number of those domain names listed for sale again shared a similar lander. You can see an example of that lander here. I did not delve in deeper to see if this is one investor, or many using a common lander script and image.

- The developed sites ranged from simple blogs and monetized affiliate sales to casino and corporate sites. I saw no clear trends.

I did a similar survey of current use of

.com domain names that sold for $4000 or more in GoDaddy Auctions during the same seasonal period several years earlier, Jan 1 – June 15, 2017. Given the much longer delay, I expected to see more names now developed. What I found was not such a simple picture, however.There were 96 sales in this set, a much lower rate of sale, of which 10 were numeric names and 5 alphanumeric, with the rest letters only.

- Just 25.0% of these sales from 2017 were yet developed, with another 2.3% redirecting to a developed site.

- 30.2% of the domain names auctioned in 2017 were listed for sale currently, or appeared to be for sale. I did not invest the time to use the WaybackMachine to see how many of these had been used in past.

- A surprising 42.7% of the sales from 2017 were not in current use.

- As expected, there was a much lower rate of $4000+ GoDaddy auction sales in 2017, less than one a day.

- Again, I saw no clear trends on the type of sites that had been developed in the 2017 data. Keep in mind that the sample size was small, just 96 sales in total, three-quarters of which were not developed.

- The average price paid was $8782 in the 2017 data, as expected down from the $10,024 average for the same months in 2020.

- The names ranged in length from 3 to 20 characters, with an average length of 8.2, the same as in the 2020 data. One name contained a hyphen.

- As was found in the 2020 data, the numeric and alphanumeric are more likely to be for sale again or unused.

What About Names Sold Less Than Two Months Ago?

While the sample size is much smaller, a look at names sold just a month or two ago can be instructive. One would expect very few of these to have been listed and sold again, and already developed. Here is what I found in data from $4000 plus

.com sales at GoDaddy Auctions from November, 2020.- Most, 53.7%, were not in use when I checked in mid-December.

- I found that 19.4% had been rapidly developed, however, and another 3.2% were used for redirection to a developed site.

- About 17.7% were listed for sale again. Another 6.5% were in a monetized parking system without be clearly for sale.

Final Thoughts

It would have been interesting to look at sales with lower prices, such as $1000 plus, although the dataset would be much larger with significant time required to check current status. Even the 539 sites I checked for the data in this article took a number of hours. In theory the process could readily be automated with a script.

A deeper look into archived history and what whois information is available, might have further differentiated the purchaser. It would also be interesting to look at some of the other auction sites and different extensions.

However, based on what I did look at, these are my perceptions.

- It seems that at least nearly 40% of recent buyers of $4000 plus names at GoDaddy auctions are domain investors.

- Something like 35% or more of the buyers appear to either be end users or developers, however.

- There are a significant number of unused names that could fall into either category.

- It is possible that the pandemic economic conditions may have resulted in an uptick in development activity, and that names are going from sale to development more rapidly.

- If the auctions do have many buyers who are really end users, that has meant that auction prices of late may reflect current retail pricing to a greater extent than previously.

- What are the implications for domain investors of many auctions having participants from outside the investing community?

- I wondered if change in promotion resulted in more end users and developers entering the domain auctions. GoDaddy did have a free auction membership promotion in the early fall. Did that result in more developers entering the auctions?

- There is no doubt that some of the upward push on acquisition prices has simply been due to a dwindling number of available quality names, supply and demand.

- Whatever the causes, the rapid rise in acquisition prices have made the challenge of being profitable as a domain investor even greater.

- One might regard the rapid development of about one-quarter of recently auctioned domain names as positive. It is encouraging to see quality names used.

- On the other hand, it is troubling to me that such a low percentage of high-value names sold in 2017 have found developed use even by 2020.

Thanks to JudgeMind for making the suggestion that was the basis for this article.

I would, once more, like to sincerely express my appreciation to NameBio. Their site makes an analysis such as this possible.

If you have an idea that you would like me to follow up for a potential article, please feel free to message me.

Last edited: