Advice 101 for beginners and newcomers.

Stop looking like an amatuer

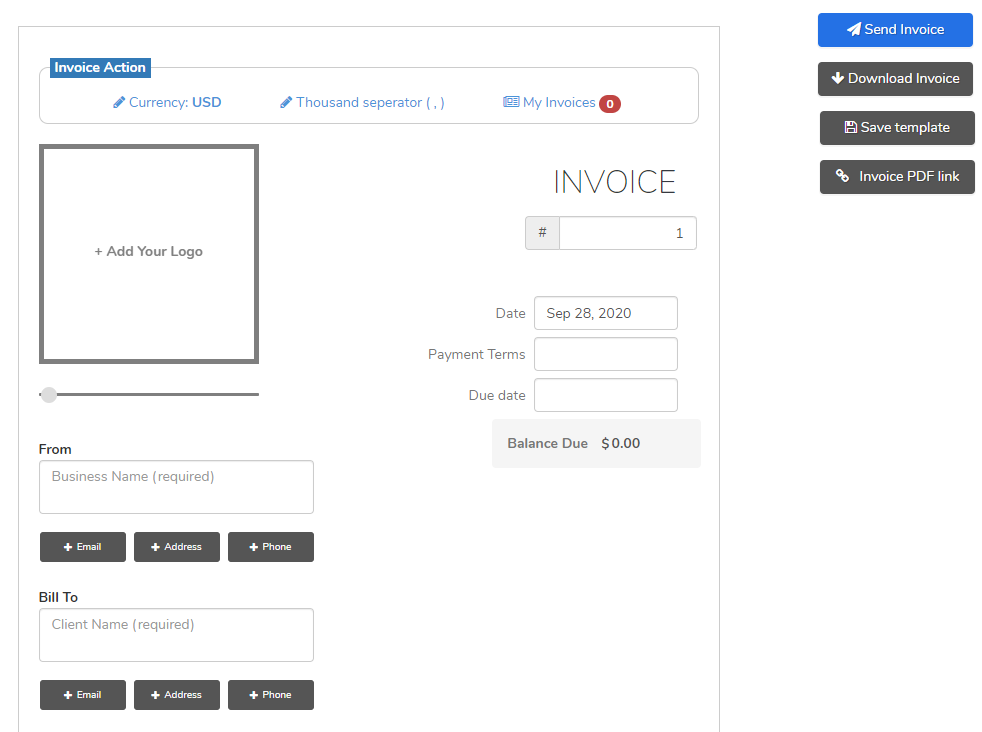

Here is a free tool for you to generate a bill of sale.

https://invoice.org/

NOW FOR THE IMPORTANT STUFF....

1. Generate an invoice (Bill of sale)

2. Get complete name and address of purchaser.

3. Make sure you put down the name of the sold domain.

4. Get a signature

5. ABSOLUTELY make sure you put down the method of payment and any reference number to it.

6. If possible get the godaddy (or other) account number of the client you are transferring the domain to.

Information is your friend, the more information you put on a bill of sale the greater the odds for recovery should something untoward happen with your transaction.

Lastly...

If you sell domains for more than a hobby please make sure to charge tax. Charging sales tax is your friend because you can claim back all the taxes on your expenses. Selling domains and not collecting taxes is like asking for an audit. Collect the tax and take advantage of claiming back the tax you spend on your expenses.

Of course I assume nobody is silly enough to not claim the profit on their income tax, that part goes without saying. All forms of payment are monitored and reported to the tax man. In certain countries even crypto currencies are now specifically named in the tax laws.

----------------------------------------

Hope it helps somebody

Your friendly neighborhood MapleDots

Stop looking like an amatuer

Here is a free tool for you to generate a bill of sale.

https://invoice.org/

NOW FOR THE IMPORTANT STUFF....

1. Generate an invoice (Bill of sale)

2. Get complete name and address of purchaser.

3. Make sure you put down the name of the sold domain.

4. Get a signature

5. ABSOLUTELY make sure you put down the method of payment and any reference number to it.

6. If possible get the godaddy (or other) account number of the client you are transferring the domain to.

Information is your friend, the more information you put on a bill of sale the greater the odds for recovery should something untoward happen with your transaction.

Lastly...

If you sell domains for more than a hobby please make sure to charge tax. Charging sales tax is your friend because you can claim back all the taxes on your expenses. Selling domains and not collecting taxes is like asking for an audit. Collect the tax and take advantage of claiming back the tax you spend on your expenses.

Of course I assume nobody is silly enough to not claim the profit on their income tax, that part goes without saying. All forms of payment are monitored and reported to the tax man. In certain countries even crypto currencies are now specifically named in the tax laws.

----------------------------------------

Hope it helps somebody

Your friendly neighborhood MapleDots

Last edited: