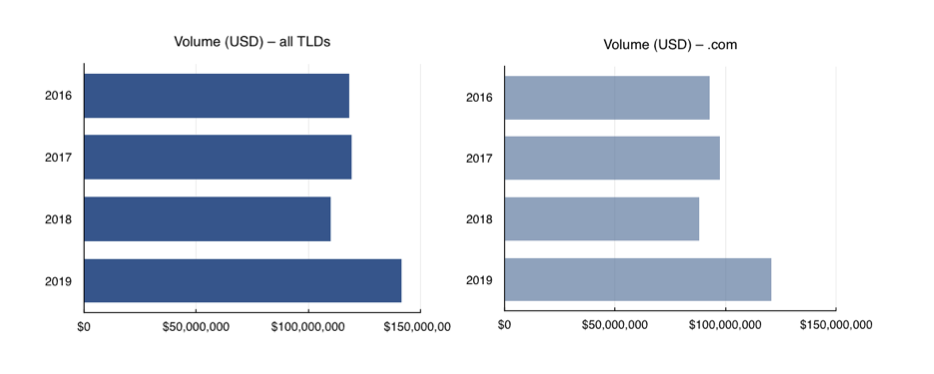

In recent years the total domain name sales volume reported in the NameBio database has ranged from just under $110 million in 2018, to almost $142 million in 2019. This includes results from all domain extensions, but only includes sales of $100 and greater.

The complete sales volume is substantially higher, since many sales venues are not reported to NameBio. Also, it is important to note that the database includes both wholesale and retail domain sales, so some acquisitions by domain investors are included. The sales volume is dominated by the high-value sales, however, so the impact of wholesale transactions is probably minimal.

Over the past four years, the total dollar volume of NameBio-reported domain name sales has been generally constant. While the 2019 value was the highest, if one removed the single sale of

In this report I look at the four-year trend in some of the main domain extensions and categories. In part 2, to be published next week, I will follow up with a look at how NameBio-reported prices have changed over the same time interval.

Since

While 2019 sales volume is up marginally from 2018 for the

In

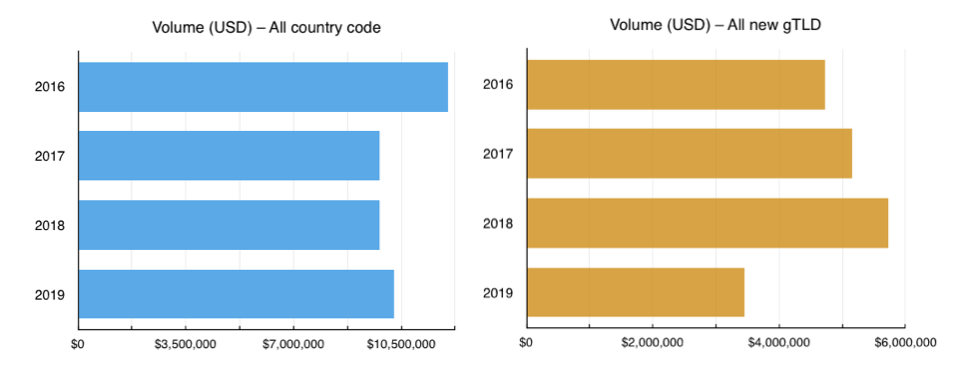

All Country Code Domains

It is likely that many country code extension domain name sales are not reported in NameBio, but if we take them as a whole, the picture is one of fairly constant sales volume. At just over $12 million sales volume, 2016 was the best year, but the 2019 total of slightly over $10 million was better than 2017 and 2018.

All New Domain Extensions

While there have been some encouraging signs in 2019 for new domain extensions, the overall sales volume picture is the lowest of the past four years. Year 2019 ended with over $3.4 million in sales volume in new extensions, compared to $5.7 million in 2018.

The three year trend of rising volume in new extensions has been reversed. About $1.2 million of the drop in volume from 2018 to 2019 is related to lower sales and lack of reporting in

After rising steadily in sales volume from 2016 through 2018, the

The drop in

Sales volume in the

I had noted in my post looking at the first six months of 2019 that

The

While

One of the strongest country code extensions continues to be Germany’s

United Kingdom’s

The drop in

The picture in

I looked individually at a few of the new extensions and present below the picture for

The newer

Other Extensions

I had a look at many other extensions not covered in the graphics. I report on some of them below.

Notes:

I recorded the numbers from NameBio a few weeks after the end of each year. It is possible that later additions,or deletions, to the database may, in some cases, slightly change the totals from those currently in the database. I computed volumes from average prices and numbers, and rounding may in a few cases slightly alter the volume totals. For the written report I rounded figures, but the graphs were generated using the full precision.

If you are depending on any information in this report for investment decisions, you should independently verify data important to you. Nothing in this report should be considered domain investment advice, and is offered for educational information only.

Next week I will report on how prices changed over the four year period.

Hat tip to Michael Sumner, CEO of NameBio, for creating and maintaining the domain sales data resource used for this analysis.

The complete sales volume is substantially higher, since many sales venues are not reported to NameBio. Also, it is important to note that the database includes both wholesale and retail domain sales, so some acquisitions by domain investors are included. The sales volume is dominated by the high-value sales, however, so the impact of wholesale transactions is probably minimal.

Over the past four years, the total dollar volume of NameBio-reported domain name sales has been generally constant. While the 2019 value was the highest, if one removed the single sale of

voice.com for $30 million, the 2019 value would have lagged 2016 and 2017, and been only marginally ahead of 2018.In this report I look at the four-year trend in some of the main domain extensions and categories. In part 2, to be published next week, I will follow up with a look at how NameBio-reported prices have changed over the same time interval.

.COMSince

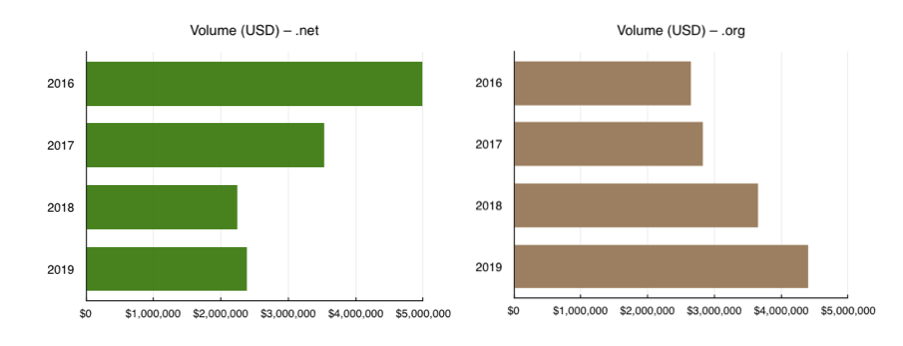

.com sales so dominate the total sales picture, not surprisingly sales volume of .com follows a similar pattern. While 2019 was the top year when the voice sale is included, without that it would have ranked below both 2016 and 2017. Nevertheless the big picture is that the dominance of .com shows no signs of changing substantially..NET and .ORGWhile 2019 sales volume is up marginally from 2018 for the

.net extension, sales are down substantially from 2016.In

.org the picture is rather different, with modest but steady growth in sales volume from 2016 through 2019. Just over $4.4 million in .org sales were reported in NameBio in 2019, compared to about $2.4 million in .net sales.All Country Code Domains

It is likely that many country code extension domain name sales are not reported in NameBio, but if we take them as a whole, the picture is one of fairly constant sales volume. At just over $12 million sales volume, 2016 was the best year, but the 2019 total of slightly over $10 million was better than 2017 and 2018.

All New Domain Extensions

While there have been some encouraging signs in 2019 for new domain extensions, the overall sales volume picture is the lowest of the past four years. Year 2019 ended with over $3.4 million in sales volume in new extensions, compared to $5.7 million in 2018.

The three year trend of rising volume in new extensions has been reversed. About $1.2 million of the drop in volume from 2018 to 2019 is related to lower sales and lack of reporting in

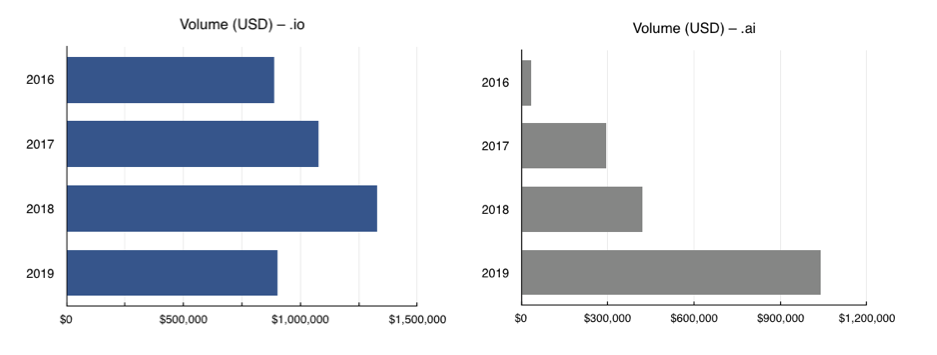

.top..IO and .AIAfter rising steadily in sales volume from 2016 through 2018, the

.io domain extension had a lower sales volume in 2019, placing it back almost at 2016 levels.The drop in

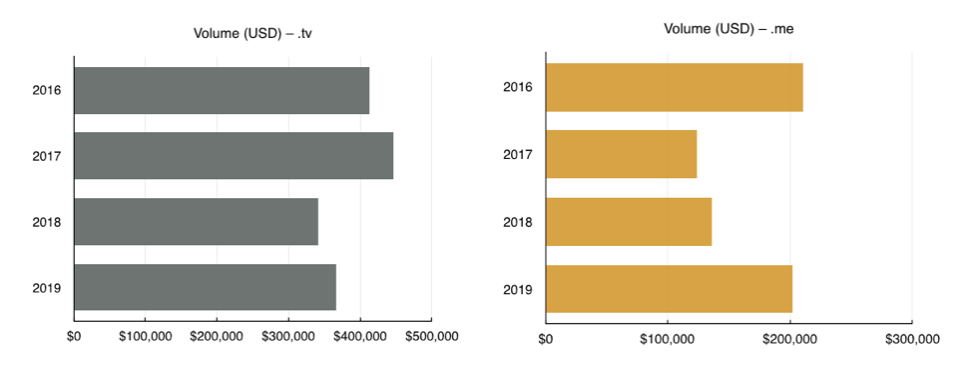

.io, popular for technology companies, may be partially related to a strong growth in .ai among artificial intelligence startups. As the graph shows, .ai sales volume has grown dramatically, and in 2019 exceeded $1 million for the first time. Note that there has been a change in how expired .ai domain names are sold, however..TV and .MESales volume in the

.tv extension is fairly constant over the four year period, with the 2019 total of almost $366,000 up from 2018 although down from both 2016 and 2017.I had noted in my post looking at the first six months of 2019 that

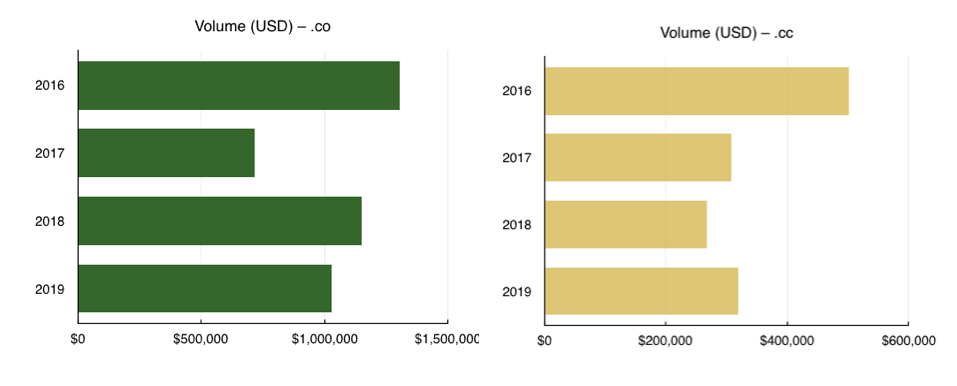

.me was having a good year, at least compared to 2018. That persisted in the year-end totals, with the $202,000 sales volume for 2019 up significantly from the two previous years..CO and .CCThe

.co extension continues wide use as an alternative to .com. Sales volume in the extension was down slightly in 2019, but still topped one million dollars.While

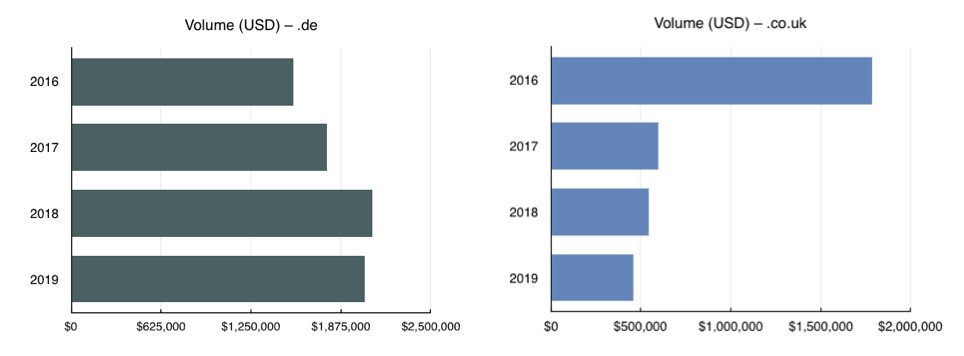

.cc has not quite regained the strength of 2016, at $320,000 volume in 2019, it is up from both 2018 and 2017..DE and .CO.UKOne of the strongest country code extensions continues to be Germany’s

.de. While sales volume edged down from 2018 in the extension, at over $2 million in annual sales volume, it remains one of the strongest extensions.United Kingdom’s

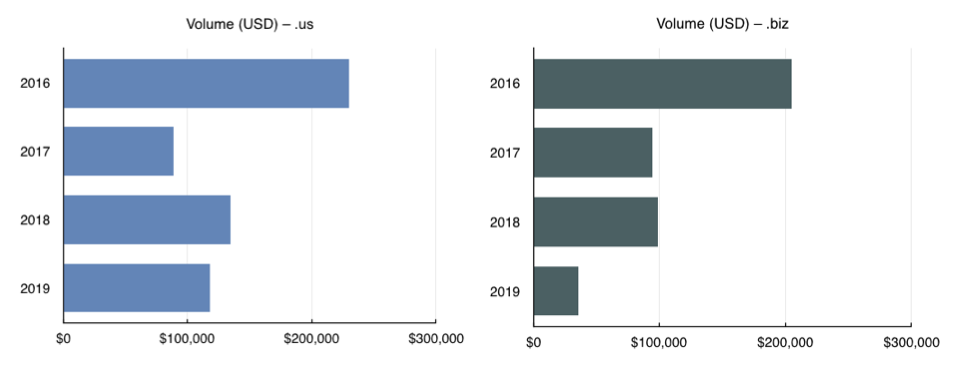

.co.uk has seen lower sales volumes each of the last four years, and finished 2019 at about $459,000. At the same time the .uk extension has grown in sales volume, and in 2019 actually topped .co.uk with about $544,000 in sales volume..US and .BIZThe drop in

.biz sales volume continues, with just over $36,000 in sales volume in 2019. compared to more than $200,000 in 2016.The picture in

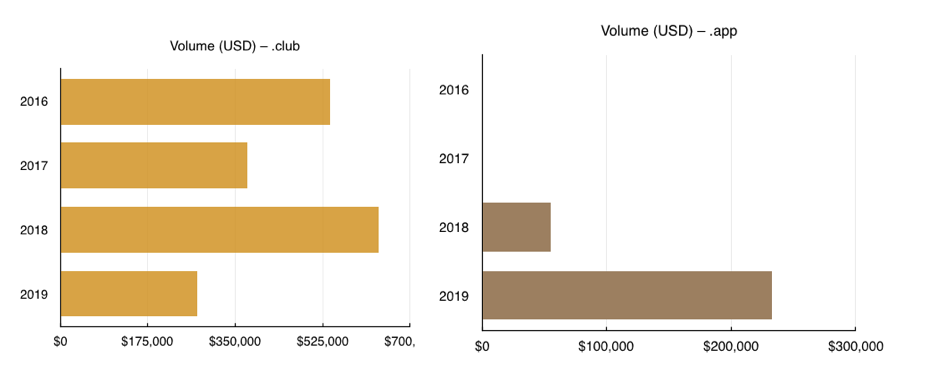

.us is more stable, with the 2019 sales volume total of $118,000 down somewhat from 2018, but up from 2017..CLUB and .APPI looked individually at a few of the new extensions and present below the picture for

.club and .app. While down slightly in 2019, .club is relatively robust over the four year period.The newer

.app extension grew strongly in 2019 sales, accounting for almost $233,000 in sales volume. It will be interesting to see if further growth happens in 2020.Other Extensions

I had a look at many other extensions not covered in the graphics. I report on some of them below.

- The country extension used in the gaming world,

.gg, is up, but still a tiny part of the market, with just over $25,000 in sales volume in 2019. - NameBio-reported sales volume in China’s

.cnis approximately constant at about $128,000. - India’s

.inextension is down slightly at about $130,000 in 2019. - Australia’s

.com.auonly had 11 sales, but accounted for almost $450,000 in volume during 2019. - Another extension with relatively few sales but significant total volume was Canada’s

.ca, at $214,000 in 2019, down slightly from 2018. - It was the best year, in the four covered here, for Switzerland’s

.ch, with about $203,000 in sales volume. - One of the few new extension registries that report regularly to NameBio is

.global. Sales in that extension were down slightly, at about $417,000. - The

.xyzextension had by far its worst year in the four covered, with less than $19,000 in sales volume. - 2019 was a dismal year for

.wswith a sales volume below $3300 in 2019, less than half the 2018 total, and a tiny fraction of the $160,000 in 2017. - Another extension edging slightly downward is

.ly, with a volume of just $58,000 in 2019, although still a significant number and volume of sales.

Notes:

I recorded the numbers from NameBio a few weeks after the end of each year. It is possible that later additions,or deletions, to the database may, in some cases, slightly change the totals from those currently in the database. I computed volumes from average prices and numbers, and rounding may in a few cases slightly alter the volume totals. For the written report I rounded figures, but the graphs were generated using the full precision.

If you are depending on any information in this report for investment decisions, you should independently verify data important to you. Nothing in this report should be considered domain investment advice, and is offered for educational information only.

Next week I will report on how prices changed over the four year period.

Hat tip to Michael Sumner, CEO of NameBio, for creating and maintaining the domain sales data resource used for this analysis.

Last edited: