- Impact

- 8,557

[Fox Business] Julia Limitone Fox BusinessDecember 6, 2018

The world’s largest cryptocurrency is beginning to wind down and is close to becoming worthless, according to a Santa Clara University finance professor.

Bitcoin soared above $19,000 at its peak a year ago, only to fall sharply. It’s currently hovering around $3,600 level, according to Coindesk.

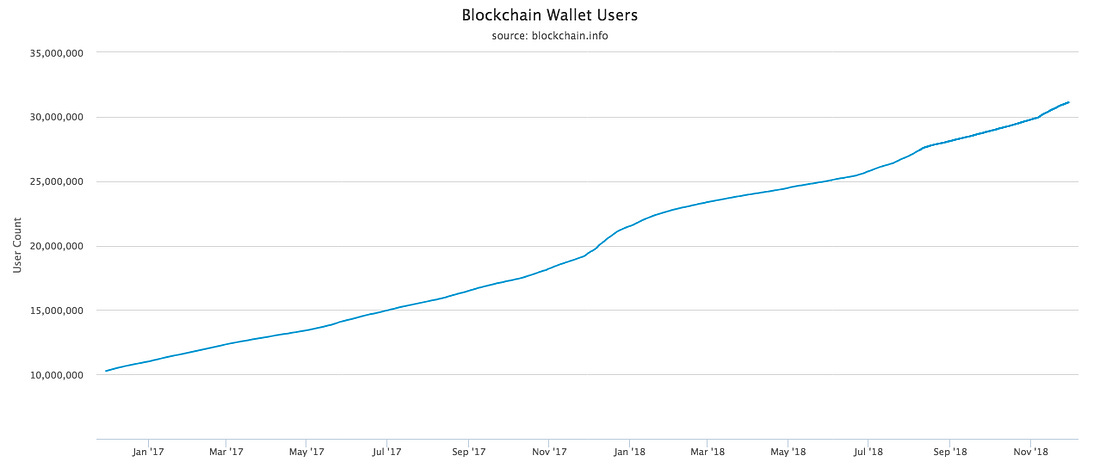

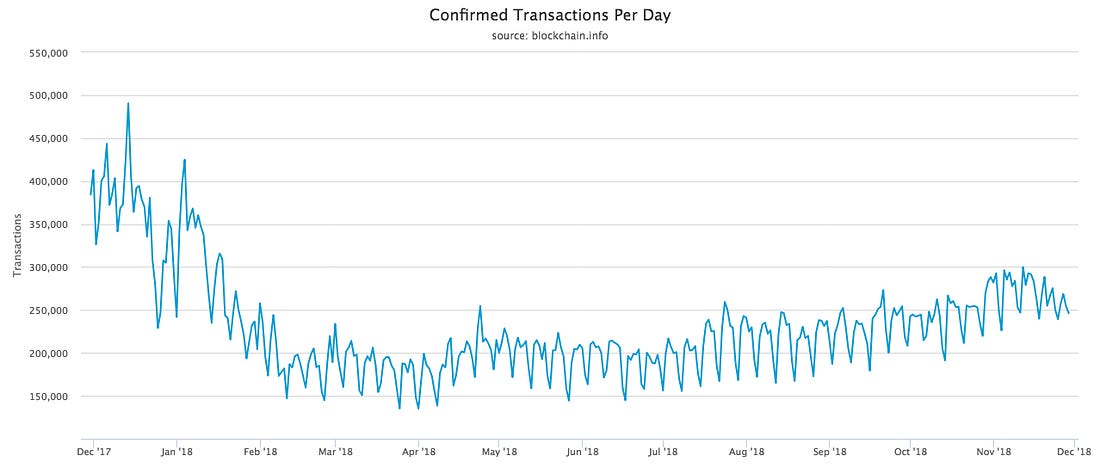

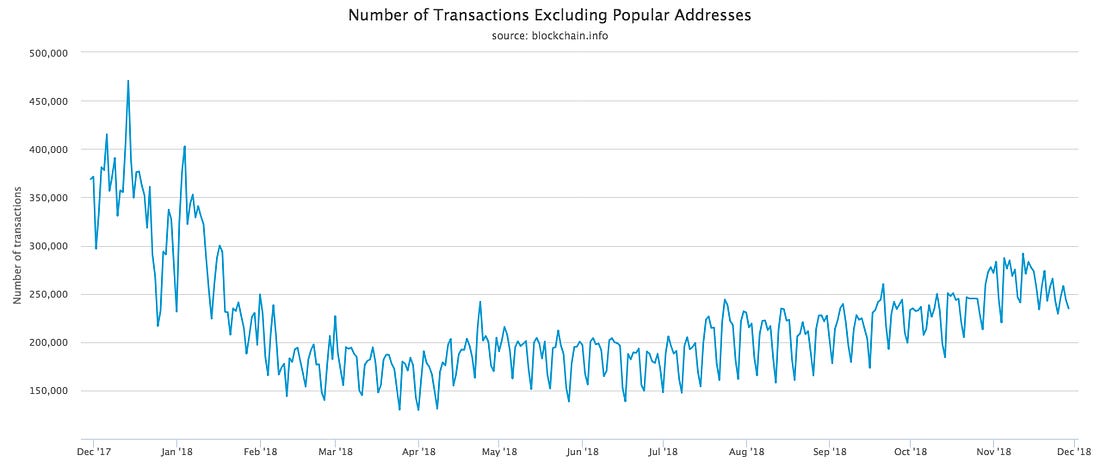

“Fundamentally bitcoin has not lived up to its hype,” Atulya Sarin said to FOX Business’ Stuart Varney on Thursday. “Primarily if you look up all the activity around bitcoin it’s mostly around creating. It doesn’t seem to have too many use cases.”

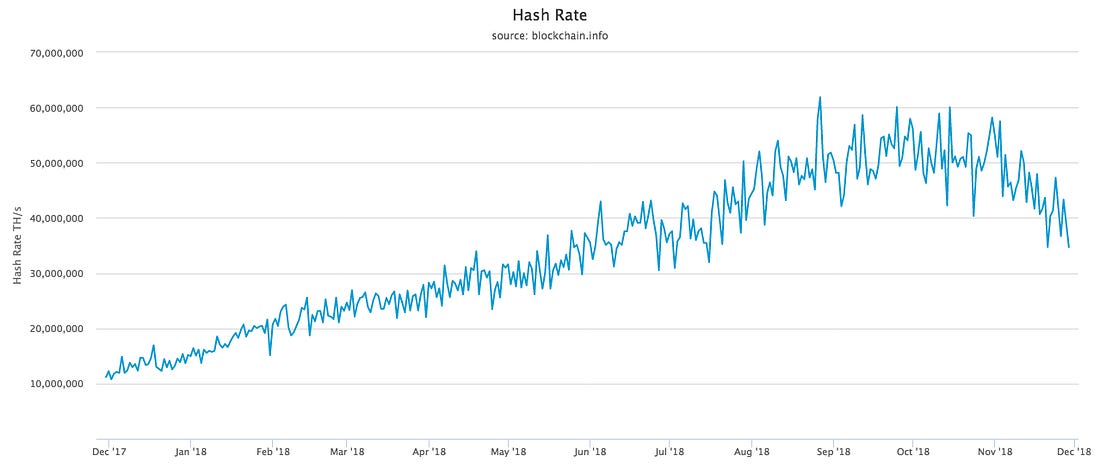

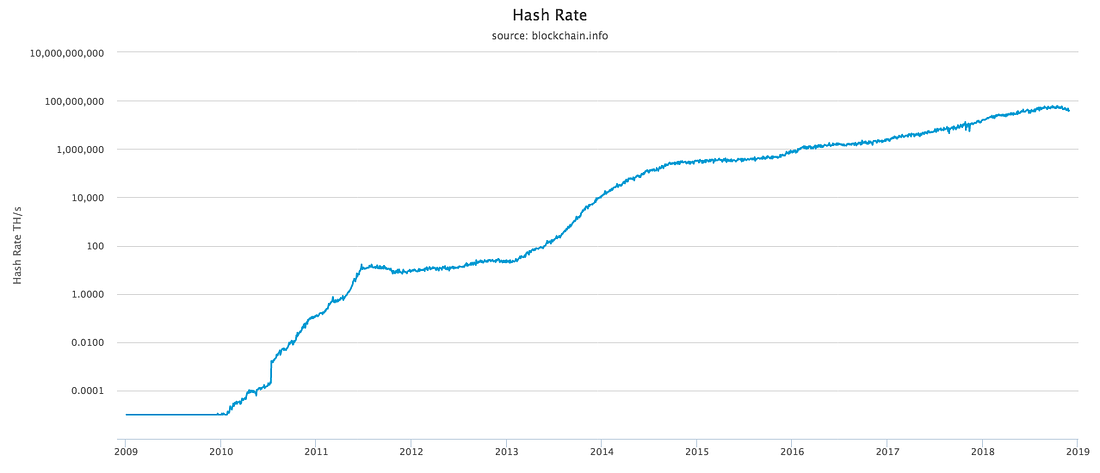

Unlike paper money, which is backed by a central bank which decides when to print and distribute money, bitcoin is issued through mining which uses computational power to maintain a record of who owns the cryptocurrency. Without it, no transactions would be possible.

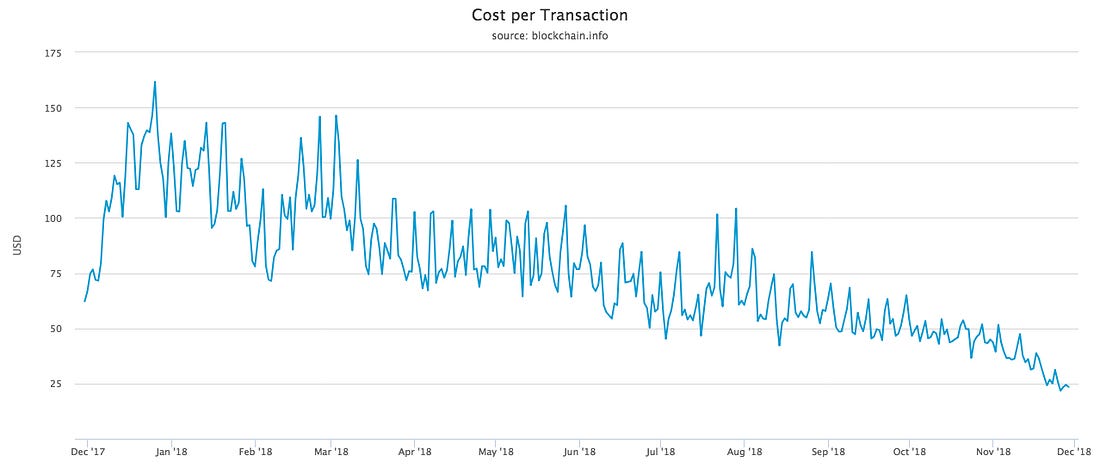

Sarin said right now the problem is that it costs more to mine bitcoin than to actually own it -- and “that’s not sustainable.”

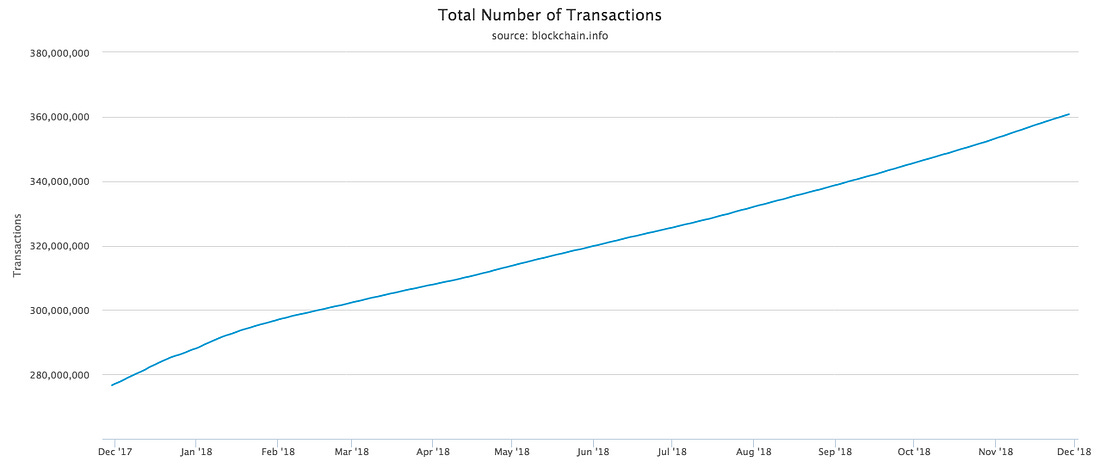

“If there is no transaction happening and there’s no record of who owns what then all you have is a set of numbers and all those numbers are worthless,” he said.

https://finance.yahoo.com/news/why-bitcoin-virtually-worthless-finance-165126365.html

What do you guys think?

Are Crypto Domains still worth it?

The world’s largest cryptocurrency is beginning to wind down and is close to becoming worthless, according to a Santa Clara University finance professor.

Bitcoin soared above $19,000 at its peak a year ago, only to fall sharply. It’s currently hovering around $3,600 level, according to Coindesk.

“Fundamentally bitcoin has not lived up to its hype,” Atulya Sarin said to FOX Business’ Stuart Varney on Thursday. “Primarily if you look up all the activity around bitcoin it’s mostly around creating. It doesn’t seem to have too many use cases.”

Unlike paper money, which is backed by a central bank which decides when to print and distribute money, bitcoin is issued through mining which uses computational power to maintain a record of who owns the cryptocurrency. Without it, no transactions would be possible.

Sarin said right now the problem is that it costs more to mine bitcoin than to actually own it -- and “that’s not sustainable.”

“If there is no transaction happening and there’s no record of who owns what then all you have is a set of numbers and all those numbers are worthless,” he said.

https://finance.yahoo.com/news/why-bitcoin-virtually-worthless-finance-165126365.html

What do you guys think?

Are Crypto Domains still worth it?

Last edited: