- Impact

- 40,991

In a recent NameTalent post an analysis is made of how profitable domain name investment is on average. The starting premise is:

For example, if your net profit (i.e. after costs considered) on a domain name is expected to be $1500 and your probability of selling in any one year is 1/100, then the investment is profitable if your annual holding costs are less than $15.

I used sales data and number of domains listed for sale to estimate the probability of a sale. I did this for all extensions together (and data for the last year), but the market is so dominated by .com that .com alone numbers would not be much different.

A correction factor must be applied for the fraction of total sales that NameBio stats represent. I used a factor of 5 (i.e. 20% of total sales are on NameBio). With this factor it suggests that the chance of any one domain name selling in one year is 1/73. So if your portfolio is 350 you would sell about 5 domain names per year.

In the initial work I used the NameBio average selling price. There are arguments that NameBio may under-estimate average prices (wholesale price bias), or that by including the super premium sales it may over-estimate the value expected by a typical domain name investor and we should use the median price.

For costs I assumed commissions at 10%, other selling costs, and a cost for the time the domainer puts into handling the name. Note that while I take into account most types of costs, things like a portion of Efty memberships or web hosting costs are included with renewal fees in the annual costs, rather than applied in the net profit line. Clearly it could be done either way, as long as consistent.

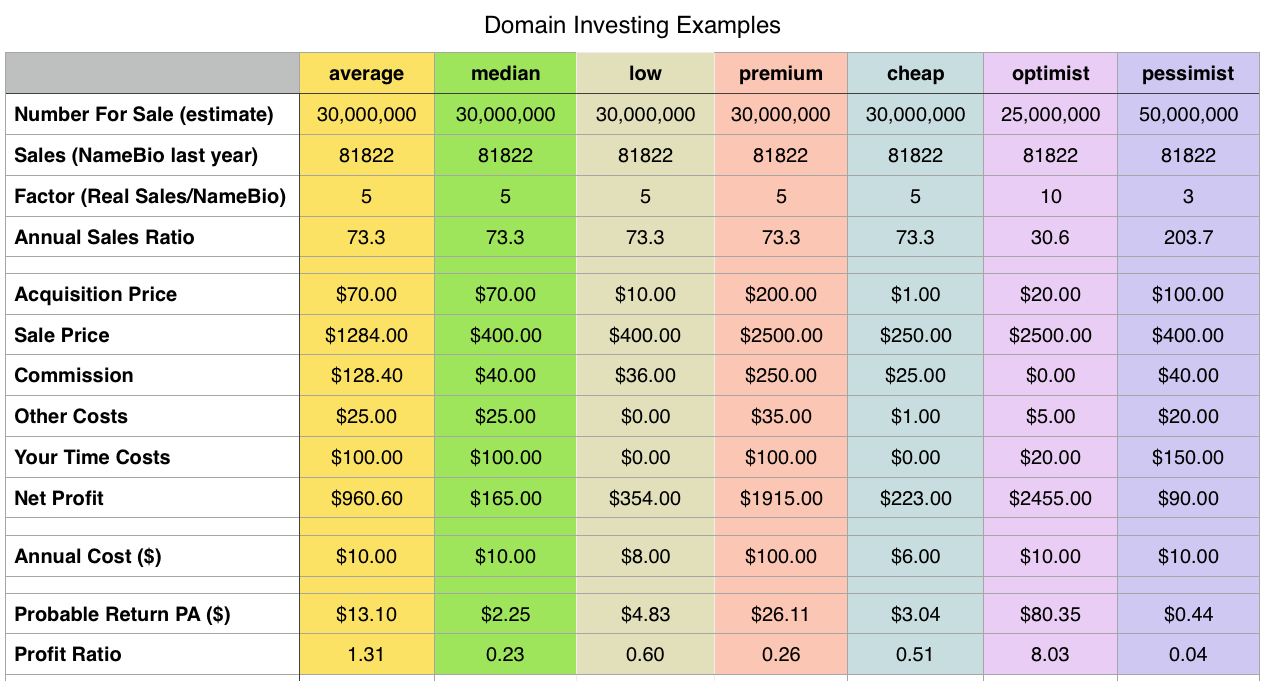

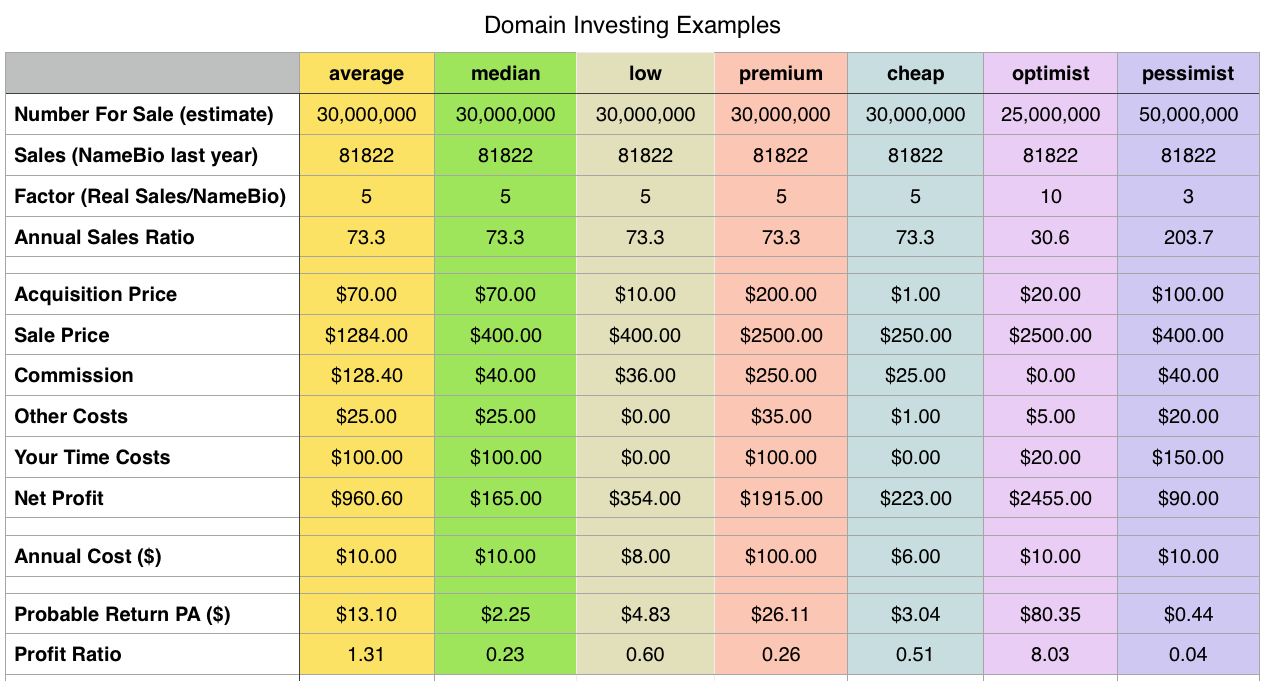

I applied this relationship using several different models as shown in the table of results below.

The first (yellow) average model is my best estimate. I assume that you buy the domain at $70, sell at NameBio average, pay 10% commission and $25 other costs (this includes a portfolio averaged cost for things like legal, financial, art, evaluation fees, etc.). Arbitrarily I assume that you should get $100 for the time you put into handling acquiring, promoting, maintaining and selling (maybe 4 hr at $25 per hour). You also gain by any profit in bottom line. I assumed a pretty aggressive $10 annual cost assuming you have some sort of volume discount on renewal and have a big enough portfolio that your web costs are small (or you use only marketplaces). The final row in the table gives you the net ratio - e.g. in this situation it suggests profitability with a 1.31 ratio (below 1 means you lose money, on average).

Under median I kept most things the same but I assume that you sell at the median, rather than mean, price. The NameBio stats don't allow you, anymore, to calculate it for the entire large dataset, but when I do it individually each day it is usually in the $275 to $400 range. I used the upper value. Here we see things are not profitable.

The low model assumes you buy at reg fee, sell at median price, reduce commission to 9% and keep other costs and the cost for your time at $0. Even at this not quite profitable.

Premium is meant to apply to a premium ngTLD or premium country code situation. Assume somewhat arbitrarily you buy at $200 with $100 annual (mainly renewal) fee. Here assume that you sell at about double the average price, $2500.

Some of us start in domain investing by hand registering some inexpensive ngTLDs. The cheap model simulates this. I assume that you buy at $1 and manage (perhaps with multi-year discounts) to keep renewal at $6. But you only sell at $250 and don't value your time. The probability of sale should probably be reduced, which would make the situation even less favourable.

The optimist and pessimist models are meant to look at what might be the bounds of the likely models. Optimist assumes that really only 10% of sales are in NameBio, you sell at about double NameBio average, you sell directly without commissions and don't add much for your time. The result is very optimistic with a ratio of 8 . For pessimistic, well pretty pessimistic

. For pessimistic, well pretty pessimistic  .

.

You can read the full post at NameTalent at this link:

https://nametalent.com/2018/10/is-domain-name-investing-profitable/

Keep in mind that these are probabilistic arguments for the domain business as a whole. Clearly many successful investors will do better than this, while a number will do worse. Also, I totally accept that some of the numbers (like the NameBio correction factor) are uncertain.

Thanks for reading!

Bob

"A domain investment will be profitable if the probability that the domain name sells in any given year multiplied by the net profit on the sale of that domain name is more than your annual holding costs associated with the domain name."

For example, if your net profit (i.e. after costs considered) on a domain name is expected to be $1500 and your probability of selling in any one year is 1/100, then the investment is profitable if your annual holding costs are less than $15.

I used sales data and number of domains listed for sale to estimate the probability of a sale. I did this for all extensions together (and data for the last year), but the market is so dominated by .com that .com alone numbers would not be much different.

A correction factor must be applied for the fraction of total sales that NameBio stats represent. I used a factor of 5 (i.e. 20% of total sales are on NameBio). With this factor it suggests that the chance of any one domain name selling in one year is 1/73. So if your portfolio is 350 you would sell about 5 domain names per year.

In the initial work I used the NameBio average selling price. There are arguments that NameBio may under-estimate average prices (wholesale price bias), or that by including the super premium sales it may over-estimate the value expected by a typical domain name investor and we should use the median price.

For costs I assumed commissions at 10%, other selling costs, and a cost for the time the domainer puts into handling the name. Note that while I take into account most types of costs, things like a portion of Efty memberships or web hosting costs are included with renewal fees in the annual costs, rather than applied in the net profit line. Clearly it could be done either way, as long as consistent.

I applied this relationship using several different models as shown in the table of results below.

The first (yellow) average model is my best estimate. I assume that you buy the domain at $70, sell at NameBio average, pay 10% commission and $25 other costs (this includes a portfolio averaged cost for things like legal, financial, art, evaluation fees, etc.). Arbitrarily I assume that you should get $100 for the time you put into handling acquiring, promoting, maintaining and selling (maybe 4 hr at $25 per hour). You also gain by any profit in bottom line. I assumed a pretty aggressive $10 annual cost assuming you have some sort of volume discount on renewal and have a big enough portfolio that your web costs are small (or you use only marketplaces). The final row in the table gives you the net ratio - e.g. in this situation it suggests profitability with a 1.31 ratio (below 1 means you lose money, on average).

Under median I kept most things the same but I assume that you sell at the median, rather than mean, price. The NameBio stats don't allow you, anymore, to calculate it for the entire large dataset, but when I do it individually each day it is usually in the $275 to $400 range. I used the upper value. Here we see things are not profitable.

The low model assumes you buy at reg fee, sell at median price, reduce commission to 9% and keep other costs and the cost for your time at $0. Even at this not quite profitable.

Premium is meant to apply to a premium ngTLD or premium country code situation. Assume somewhat arbitrarily you buy at $200 with $100 annual (mainly renewal) fee. Here assume that you sell at about double the average price, $2500.

Some of us start in domain investing by hand registering some inexpensive ngTLDs. The cheap model simulates this. I assume that you buy at $1 and manage (perhaps with multi-year discounts) to keep renewal at $6. But you only sell at $250 and don't value your time. The probability of sale should probably be reduced, which would make the situation even less favourable.

The optimist and pessimist models are meant to look at what might be the bounds of the likely models. Optimist assumes that really only 10% of sales are in NameBio, you sell at about double NameBio average, you sell directly without commissions and don't add much for your time. The result is very optimistic with a ratio of 8

You can read the full post at NameTalent at this link:

https://nametalent.com/2018/10/is-domain-name-investing-profitable/

Keep in mind that these are probabilistic arguments for the domain business as a whole. Clearly many successful investors will do better than this, while a number will do worse. Also, I totally accept that some of the numbers (like the NameBio correction factor) are uncertain.

Thanks for reading!

Bob