As the saying goes, "there are no permanent friends, only permanent interests." In Internet industries, it is quite common that opponents become partners.

In early 2015, surprisingly Didi and Kuaidadi announced that they reached a commercial combination on Valentine's Day. Following on that, 58.com and ganji.com also achieved merger; Meituan.com and dianping.com constituted into "CIP"(China Internet Plus Holding Ltd.). Such mergers and acquisitions staged one after another, which once again show that only benefit is the most important thing.

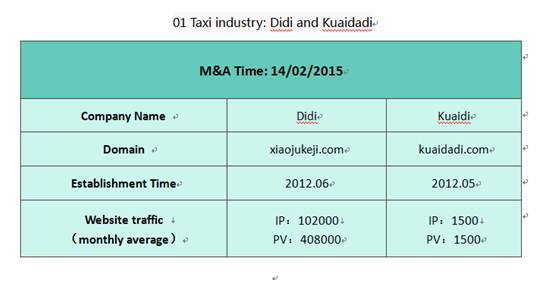

People began to know Didi and Kuaidadi in the "subsidy fight" in 2014. At that time, they spent around 2 billion CNY to compete with each other. What we had never thought about is that the competitors started to work hand in hand on Valentine's Day 2015.

People began to know Didi and Kuaidadi in the "subsidy fight" in 2014. At that time, they spent around 2 billion CNY to compete with each other. What we had never thought about is that the competitors started to work hand in hand on Valentine's Day 2015.

After the merger, they still kept their business seperately. However, Didi later was renamed into "DIDICHUXING", and they still use its Pinyin domain, xiaojukeji.com. At the same time the relative didichuxing.com/.cn/.com.cn domain have been protected.

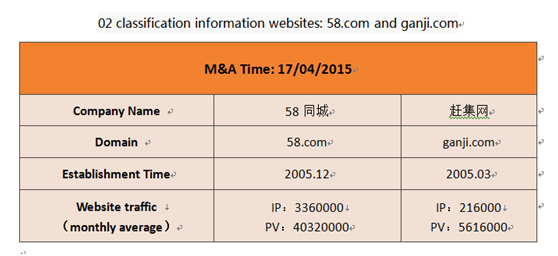

If the emerge of Didi and Kuaidadi has not surprised you, how about the acquisition about 58.com and ganji.com? On April 17th, 2015, 58.com announced to took strategic stakes on ganji.com which also represented these two famous Chinese classification information Websites have combined into one. After the merger, 58.com and ganji.com remain independent and their official domain names did not change. However some businesses are split up, like Guazi second-hand car, Doumi part-time job. They launched the domain name guazi.com, doumi.com for websites. These two Pinyin domains’ patterns are pretty good. Domains of other combined business are also valuable, such as "结婚(marriage)"-- “jiehun.com.cn”, "合租(joint rent)"--” hezu.com”, "到家(going home)"-- daojia.com, etc.

If the emerge of Didi and Kuaidadi has not surprised you, how about the acquisition about 58.com and ganji.com? On April 17th, 2015, 58.com announced to took strategic stakes on ganji.com which also represented these two famous Chinese classification information Websites have combined into one. After the merger, 58.com and ganji.com remain independent and their official domain names did not change. However some businesses are split up, like Guazi second-hand car, Doumi part-time job. They launched the domain name guazi.com, doumi.com for websites. These two Pinyin domains’ patterns are pretty good. Domains of other combined business are also valuable, such as "结婚(marriage)"-- “jiehun.com.cn”, "合租(joint rent)"--” hezu.com”, "到家(going home)"-- daojia.com, etc.

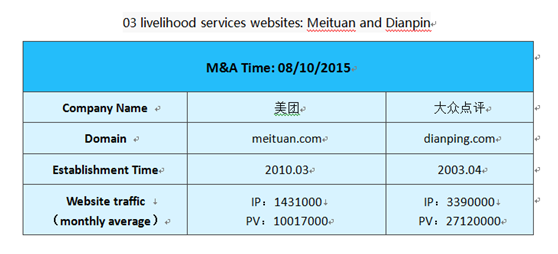

It just takes a vacation for Meituan and Dianpin to become partners. Meituan declared to establish a new company with Dianping after National Day holiday, which arouse speculations on their new company name. People think it might be “xinmeida” and relative domains such as mtdp.com, xinmeida.com and meituandianping.com have already been registered. Recently they finally unveiled its new company name - CIP (China Internet Plus Holding Ltd) and the domain name cip.com is still in privacy protection.

It just takes a vacation for Meituan and Dianpin to become partners. Meituan declared to establish a new company with Dianping after National Day holiday, which arouse speculations on their new company name. People think it might be “xinmeida” and relative domains such as mtdp.com, xinmeida.com and meituandianping.com have already been registered. Recently they finally unveiled its new company name - CIP (China Internet Plus Holding Ltd) and the domain name cip.com is still in privacy protection.

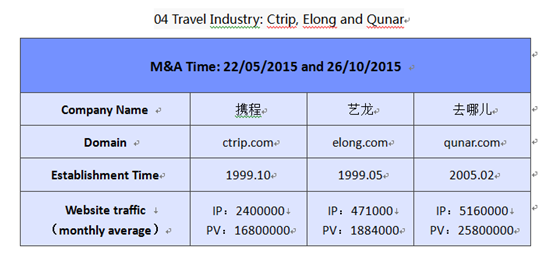

After the merger of 58.com and ganji.com, the public think the similar merger and acquisition could also appear between Ctrip and Qunar. And things happened just as people suspected.

After the merger of 58.com and ganji.com, the public think the similar merger and acquisition could also appear between Ctrip and Qunar. And things happened just as people suspected.

Although they have merged, they are operated independently and their domain names are still retained. Though Ctrip.com and elong.com are not really Pinyin domains, they are special. In fact, Ctrip owns Pinyin domain xiecheng.com; Elong changed from yilong.com to elong.com and only Qunar sticks to its Pinyin domain name qunar.com.

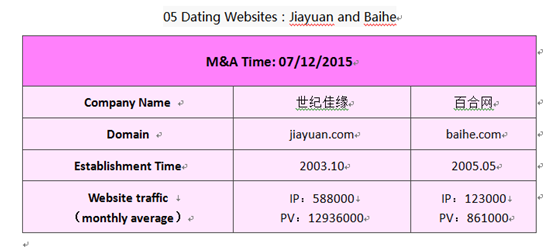

Usually mergers and acquisitions happen in a situation when the smaller company purchased by bigger company, but Baihe is an exception. In terms of the domain name, the two dating sites choose Pinyin domain name jiayuan.com and baihe.com. For the protection of the relevant extension, jiayuan owns jiayuan.cn, but jiayuan.com.cn is not under its protection. Baihe hasn’t got the baihe.cn/.com.cn.

Usually mergers and acquisitions happen in a situation when the smaller company purchased by bigger company, but Baihe is an exception. In terms of the domain name, the two dating sites choose Pinyin domain name jiayuan.com and baihe.com. For the protection of the relevant extension, jiayuan owns jiayuan.cn, but jiayuan.com.cn is not under its protection. Baihe hasn’t got the baihe.cn/.com.cn.

Why M&As Occur So Frequently?

With the fierce competition in the business battlefield, mergers and acquisitions are inevitable.

In 2015, we have witnessed a lot of mergers. They drawn people’ attention for they are both leaders in respective areas. However due to an overlap in the vast majority of their businesses, they still operate independently after mergers. In the market today, the competition between companies cut down their profits and investors are splashing the cash behind these companies. If they incorporate, it’s not only money saving but also monopolization achieving. Thus it is wise to choose M&As when the financial market growth decelerates.

In early 2015, surprisingly Didi and Kuaidadi announced that they reached a commercial combination on Valentine's Day. Following on that, 58.com and ganji.com also achieved merger; Meituan.com and dianping.com constituted into "CIP"(China Internet Plus Holding Ltd.). Such mergers and acquisitions staged one after another, which once again show that only benefit is the most important thing.

After the merger, they still kept their business seperately. However, Didi later was renamed into "DIDICHUXING", and they still use its Pinyin domain, xiaojukeji.com. At the same time the relative didichuxing.com/.cn/.com.cn domain have been protected.

Although they have merged, they are operated independently and their domain names are still retained. Though Ctrip.com and elong.com are not really Pinyin domains, they are special. In fact, Ctrip owns Pinyin domain xiecheng.com; Elong changed from yilong.com to elong.com and only Qunar sticks to its Pinyin domain name qunar.com.

Why M&As Occur So Frequently?

With the fierce competition in the business battlefield, mergers and acquisitions are inevitable.

In 2015, we have witnessed a lot of mergers. They drawn people’ attention for they are both leaders in respective areas. However due to an overlap in the vast majority of their businesses, they still operate independently after mergers. In the market today, the competition between companies cut down their profits and investors are splashing the cash behind these companies. If they incorporate, it’s not only money saving but also monopolization achieving. Thus it is wise to choose M&As when the financial market growth decelerates.