These are the ICANN registrar totals and monthly changes, total renewed and total new registrations, total , deletions (deleted no grace), transfer gain and total transfer loss for Epik from the most recent reports (November 2022 / 202211) to Septeber 2020.

Month - Registrar - Total - Change - Renewed - New - Deleted - Gain - Loss

| 202211 | Epik, Inc. | 767,293 | -13,003 | 33,911 | 13,777 | 12,984 | 1,767 | 14,246 |

| 202210 | Epik, Inc. | 780,296 | -12,258 | 38,559 | 10,942 | 11,330 | 2,548 | 15,339 |

| 202209 | Epik, Inc. | 792,554 | -15,611 | 57,622 | 10,364 | 12,009 | 11,193 | 15,976 |

| 202208 | Epik, Inc. | 808,160 | 20,323 | 47,675 | 19,074 | 8,442 | 11,770 | 9,513 |

| 202207 | Epik, Inc. | 787,837 | 2,496 | 38,648 | 10,132 | 7,858 | 7,990 | 6,670 |

| 202206 | Epik, Inc. | 785,341 | 4,555 | 31,504 | 10,825 | 10,191 | 6,525 | 3,156 |

| 202205 | Epik, Inc. | 780,786 | 7,829 | 35,480 | 10,858 | 7,589 | 9,128 | 2,890 |

| 202204 | Epik, Inc. | 772,957 | 15,257 | 32,751 | 19,875 | 7,123 | 7,711 | 4,574 |

| 202203 | Epik, Inc. | 757,700 | 9,791 | 35,317 | 11,757 | 7,278 | 7,856 | 3,606 |

| 202202 | Epik, Inc. | 747,909 | 9,871 | 32,497 | 9,540 | 8,128 | 10,503 | 2,832 |

| 202201 | Epik, Inc. | 738,038 | 8,542 | 50,657 | 10,115 | 11,287 | 19,148 | 1,972 |

| 202112 | Epik, Inc. | 729,496 | 15,536 | 37,898 | 12,837 | 12,066 | 14,544 | 5,931 |

| 202111 | Epik, Inc. | 713,960 | 14,578 | 27,317 | 15,334 | 10,473 | 18,891 | 4,581 |

| 202110 | Epik, Inc. | 699,382 | 15,421 | 27,453 | 13,170 | 11,914 | 17,449 | 7,258 |

| 202109 | Epik, Inc. | 683,961 | 19,973 | 41,039 | 12,570 | 12,327 | 30,060 | 5,798 |

| 202108 | Epik, Inc. | 663,987 | 10,876 | 41,311 | 15,077 | 25,245 | 23,841 | 5,116 |

| 202107 | Epik, Inc. | 653,105 | 2,065 | 33,079 | 10,091 | 20,882 | 17,198 | 6,364 |

| 202106 | Epik, Inc. | 651,046 | -2,436 | 40,290 | 10,308 | 15,509 | 6,294 | 5,035 |

| 202105 | Epik, Inc. | 653,482 | -1,197 | 41,140 | 10,009 | 11,867 | 5,705 | 4,002 |

| 202104 | Epik, Inc. | 654,679 | -9,930 | 31,581 | 12,028 | 6,483 | 7,384 | 5,723 |

| 202103 | Epik, Inc. | 664,609 | -22,033 | 26,218 | 12,437 | 9,265 | 8,106 | 6,880 |

| 202102 | Epik, Inc. | 686,642 | -6,713 | 27,640 | 8,405 | 51,296 | 8,581 | 10,753 |

| 202101 | Epik, Inc. | 693,351 | 4,127 | 41,922 | 8,928 | 13,895 | 18,327 | 11,420 |

| 202012 | Epik, Inc. | 689,224 | -15,110 | 25,503 | 10,437 | 19,494 | 5,221 | 10,185 |

| 202011 | Epik, Inc. | 704,334 | -36,000 | 25,841 | 11,998 | 36,349 | 3,958 | 13,360 |

| 202010 | Epik, Inc. | 740,334 | -5,696 | 26,229 | 26,104 | 25,404 | 4,939 | 4,072 |

| 202009 | Epik, Inc. | 746,030 | 16,176 | 27,309 | 12,715 | 13,911 | 5,554 | 3,565 |

It is still a subtantial registrar. Apart from being able to pay employees and operating costs, it has to be able to pay for new registrations and renewals. Most of the domain names are in the .COM gTLD and that's a good thing. The renewal rates in .COM tend to be quite strong. The renewal rates in the new gTLDs are often low.

Most of Epik's registrations are using off-registrar hosting. They are not hosted on Epik's nameservers. As Epik has focused its market on the domainer market, it would be safe to say that many of them are on sales and auction websites. The problem with the domainer market is that apart from the premium regs, the renewal rate in the more speculative registrations (which go straight on to the sales sites) tends to be low. If they cannot be sold within a year, they are dropped.

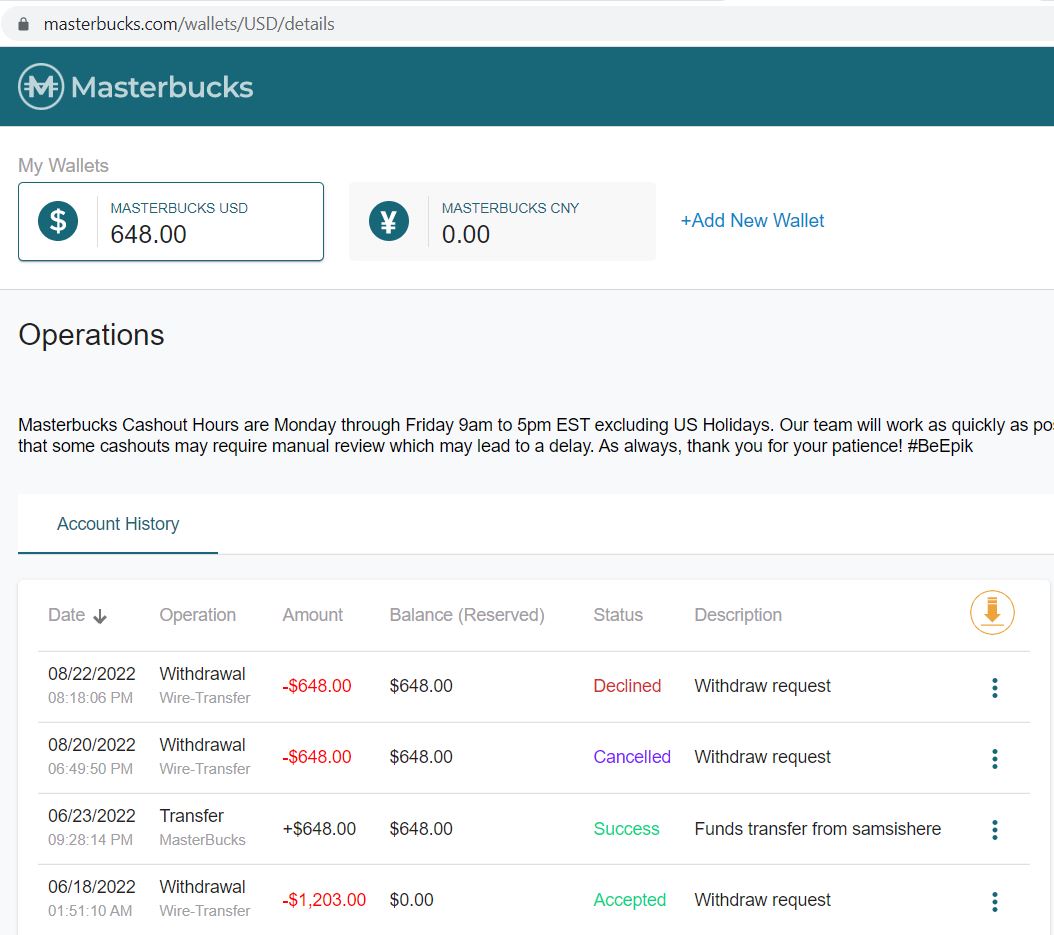

The domain name market is a complex one and there are many factors that can make or break a registrar. Brian Royce was basically thrown in at the deep end. His comments about domainers showed that he was unaware of Epik's position in the market's ecology. It is not a diversified registrar like the large players and is largely focused on gTLDs. Its treatment of people over the Masterbucks issue would be unacceptable in any other industry. The problem with a lot of the expectations about Epik failing catastrophically and immediately is that Epik has a large momentum in terms of renewals.

The transfer loss (domain names transferred out to another registrar) ramp up after August 2022. The renewals and new registrations (the lifeblood of any registrar) are stable. ICANN has a three month delay on publication of the reports so the December 2022 reports will be published on 01 April 2023. There is an interesting spike in transfer losses just after the hack but it seems quite limited in effect. Transfer gains didn't collapse during the months after the hack. What makes the November 2022 and October 2022 transfer gains different is that they are much lower.

Regards...jmcc