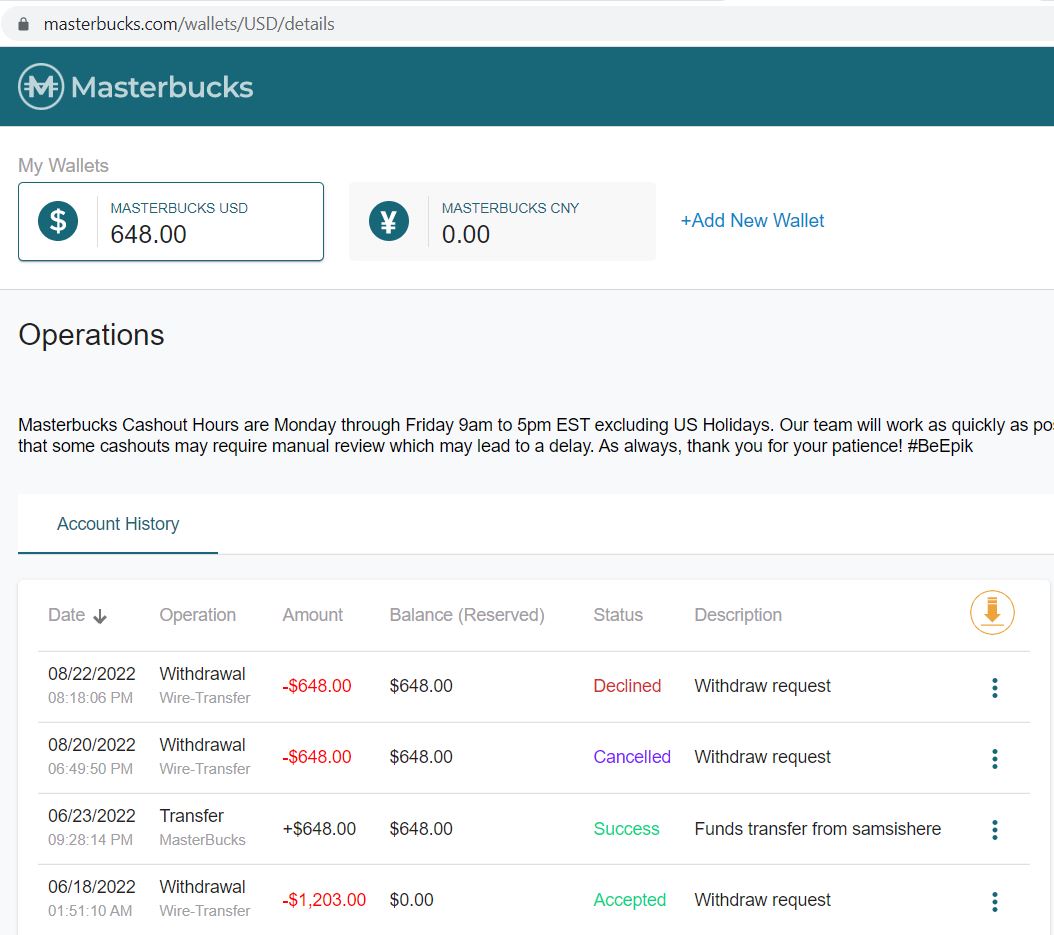

If you include all debt obligations the number is probably astronomical, because outside debt to customers and investors, they likely owe a lot of money for these "acquisitions" which were probably on payment plans.

Brad

Yes. It's also worth noting that many investors may not legally be owed a cent. It all depends on how the investment was structured. Probably the majority of investors in situations like this aren't creditors - they just lose their money.

Some companies go out of business, despite good faith efforts.

They normally file bankruptcy when they have exhausted all reasonable options to pay their bills.

That is not the case here. You have corporate abuse such as commingling escrow funds, and using an internal currency to scam customers out of real money.

They are selling off assets in private transactions.

Where is this money going? It is not going to pay customers back.

That is clearly not good faith.

Anyone connected to Epik as far as executives, investors, and shareholders deserve to be left holding the bag.

The executives got Epik into this problem and continue to operate the scam.

The investors invested in a loser.

It is not acceptable for Epik to pay insiders or continue to fund operations on the backs of scammed customer funds.

Brad

I agree that there is corporate abuse here. There is no doubt about that. And my guess is that they're just fixing up various other debts with the assets they've sold, but no-one really knows. No it's not acceptable to fund the business on the back of scammed customers. That is the very definition of insolvent trading (and in this case, they have been fraudulent).

However I don't quite share your opinion that all investors and shareholders are guilty by association and should suffer as a result. Kathleen's retirement was tied up in her domain, and she has effectively had those funds stolen from her. So, what if I was an investor in Epik and had put my retirement funds in there based on the lies RM told? If there are investors like that I feel for them exactly the same as I feel for Kathleen.

I have investments in a number of companies. I am not rich at all. None of those individual investments amount to $100k, but the cumulative total is well over that. For me, these are hopefully for my retirement. As an investor in these companies, I can only believe what I am told on a pitch deck. Yes, you can attempt to do further research, but for early-stage investments it's nigh on impossible to get much more relevant info than what the company wants to tell you.

Sure, there will be investors in Epik who know what's going on and are party to it. For them, I have no sympathy if they lose money (though the sad situation is that they are the ones most likely to obtain a return one way or the other). But it's also highly likely that there are small investors who have put funds in (which are extremely valuable to them) based on trusting a pack of lies. That's not their fault any more than it would be Kathleen's fault for trusting Epik to do what they originally said. Both have been defrauded IMHO. As you may have guessed, I've lost money on a couple of investments over the years because companies either flat-out lied, or didn't do what they said they were going to do. I know what it feels like to lose money that's intended for your eventual retirement. And I have every bit of sympathy for people in a situation like that.

Yep, sure, there will be some small investors who throw money into an investment without any research or any real thought at all, and maybe you could argue that they deserve what they get if an investment goes south, but that's not always the case...

Just another point of view...