Domain name sales of value $100,000 or more represented only 0.10% of all publicly-recorded

Study I used the NameBio searchable database for all 2018

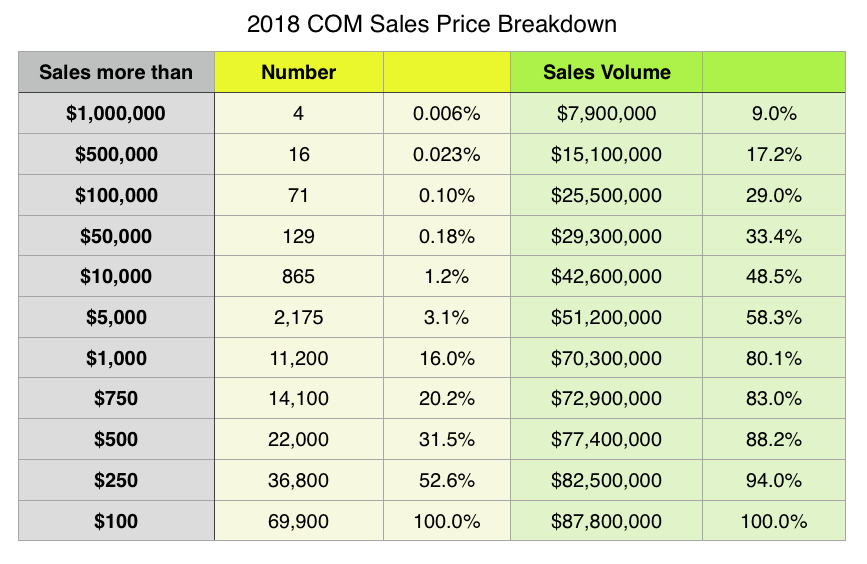

Each line in the table includes sales of that dollar volume or more. For example, there were 129 sales at prices of at least $50,000 accounting for a total sales volume of $29.3 million. Those constituted only 0.18% of the total number of sales but 33.4% of the total dollar volume of sales.

Key Points Here are highlights from the analysis.

Keep in Mind It should be stressed that not all venues report to NameBio. Sales that take place at DAN, Afternic, Efty sites, smaller Sedo sales, and most brandable marketplace sales are not included, nor are many private sales. Some time ago, NameBio outlined in a NamePros thread the sales venues that are included in the database. Also keep in mind that the database includes both wholesale transactions between domain investors and retail sales to end users.

It is hard to predict the potential bias due to the sales venues represented in the database. While many high-value sales are not publicly reported, there is also a bias against lower-priced sales based on the Sedo sales reporting and the venues that do not report to NameBio at all.

Small Value Sales The NameBio subscription plans allow one to look at sales of less than $100. I took a look at how including them would change the results. In 2018, there were 168,600

Final Thoughts It is clear that a small number of high-value domain sales account for most of the sales volume pie. The vast majority of domain sales are at much more modest prices, however.

This analysis provides guidance of the pricing levels that are accepted by most domain buyers and account for the vast majority of domain sales.

While the average sales price is an important metric, keep in mind how much it is influenced by the few high-value sales. For example, in 2019 so far, the average sales price of $1459 drops to only $925 if the single $30 million sale of voice.com is removed. The top three sales of 2019 represent more than 41% of the total sales volume at this point in the current year. This means that while my earlier post showed that the first half of 2019 was strong in both numbers and average prices, the latter would change dramatically had a few large-value sales not taken place.

The drop in median domain prices from 2018 to 2019 is potentially important, and I plan to look into median price trends in a future post.

—

Thanks to @Michael Sumner, CEO of NameBio, for creating and maintaining the domain sales resource that makes analyses such as this one possible!

.com sales in 2018, but they accounted for almost 30% of the dollar volume of sales for the year. While average sales prices can be useful, they mask the fact that most sales are at much more modest prices. The typical .com sale, at least as publicly recorded, was about $265 in 2018..com sales of $100 and greater. While I considered including all domain extensions, it seemed wise to restrict the analysis to the more homogenous dataset of just .com sales. I used the full calendar year 2018, rather than say the most recent 12 months, to have a dataset that is pretty stable from additions and deletions. The .com sales for 2018 include 69,896 domain sales.Each line in the table includes sales of that dollar volume or more. For example, there were 129 sales at prices of at least $50,000 accounting for a total sales volume of $29.3 million. Those constituted only 0.18% of the total number of sales but 33.4% of the total dollar volume of sales.

- The top 0.1% of

.comsales represent 29% of the sales dollar volume for the year. - Only 16% of

.comsales are at prices of $1000 or more. - Almost 69% of sales occur at prices of $500 or less (even when we exclude all sales less than $100).

- Half of all

.comdomain sales in 2018 (>$100) were at sales prices of less than $265. - For the same year, the average

.comprice was $1256. The average price is highly influenced by a small percentage of high-value sales.

.com price of $265 in 2018 dropped significantly to only $227 during 2019 year-to-date. I am not sure of the reasons for this change, but it appears to be statistically significant.It is hard to predict the potential bias due to the sales venues represented in the database. While many high-value sales are not publicly reported, there is also a bias against lower-priced sales based on the Sedo sales reporting and the venues that do not report to NameBio at all.

.com domain sales at prices of less than $100, with an average price of $25. If we lump together sales of all value, there were in total about 238,500 .com sales in 2018, but the median price was just under $24. The majority of .com sales are between domain investors, or sales from expired domain auctions, and at very modest prices.This analysis provides guidance of the pricing levels that are accepted by most domain buyers and account for the vast majority of domain sales.

While the average sales price is an important metric, keep in mind how much it is influenced by the few high-value sales. For example, in 2019 so far, the average sales price of $1459 drops to only $925 if the single $30 million sale of voice.com is removed. The top three sales of 2019 represent more than 41% of the total sales volume at this point in the current year. This means that while my earlier post showed that the first half of 2019 was strong in both numbers and average prices, the latter would change dramatically had a few large-value sales not taken place.

The drop in median domain prices from 2018 to 2019 is potentially important, and I plan to look into median price trends in a future post.

—

Thanks to @Michael Sumner, CEO of NameBio, for creating and maintaining the domain sales resource that makes analyses such as this one possible!