A wholesale domain name transaction refers to a domain investor acquisition. For example one investor buying a domain name from another here on NamePros, or an investor acquiring a domain name in an expired domain auction.

A retail transaction is a sale to the business, organization or individual who will be the final user of that domain name. Wholesale prices need to be much lower than retail, in order to allow for holding costs, a profit margin, and the possibility that the acquired domain name will never sell.

Typical sell-through rates indicate that most domain names will not sell to an end user for many years, if ever. Sometimes the domain investor abandons the domain name before it sells, and the domain name changes hands in a wholesale transaction, either before or after expiration.

This article looks at how many wholesale transactions, on average, occur for each retail sale.

The Numbers

The NameBio database includes both wholesale and retail transactions. While venue and price provide indicators of which sales are likely retail, no dividing line will be perfect. In this analysis, I use the simplified model that domain sales at prices of $201 and above are considered retail, and others are categorized wholesale transactions.

Under wholesale transactions, I include sales between $100 to $200 from the public part of the NameBio database, as well as sales under $100 accessible through a NameBio membership plan. I looked at two years of NameBio data, for the period ending April 29, 2020, although all results are expressed in per year values.

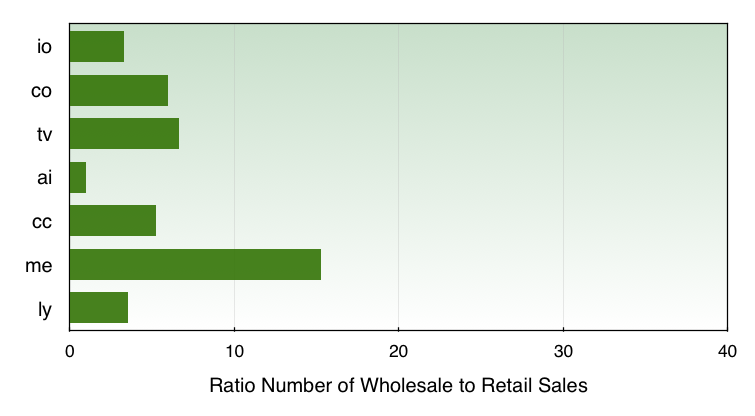

The wholesale to retail sales ratios for the more common general-purpose country code extensions are shown below. The ratios range from about 1 to 15. It should be kept in mind that the statistics are much more limited, and possibly less meaningful.

Keep In Mind

The $200 cutoff is probably inappropriate for some extensions. For example, there are probably more

Due to the venues that report, NameBio is almost certainly more efficient tracking wholesale transactions. Therefore, the actual ratio of wholesale to retail sales would be less than calculated here.

Also, keep in mind that hand registration acquisitions did not enter this analysis. If included as a wholesale transaction, hand registrations would increase the ratio.

The ratios reported here are applicable to the universe of domain names being sold. Your personal ratio can be very different, of course.

I did this largely as an exercise, wondering how often domain names change hands between investors. If you track your own ratio of wholesale acquisitions to retail sales, the ratios presented here can be used for comparison purposes. The ratio of wholesale acquisitions to retail sales could be another number to track in your portfolio.

A high ratio of wholesale to retail sales can be viewed two ways. It might mean that domain investors are abandoning that extension, and putting up more domains at wholesale prices, or simply letting them expire. Alternatively, it could mean that investors see a bright future for the extension, and are making wholesale acquisitions to be well placed for future retails sales.

Liquidity in domain names has received a lot of attention of late. The analysis here supports the idea that some extensions are much more frequently traded between domain investors. What domain investors more readily purchase, it seems, does not perfectly track retail interest.

The Domnomics book by jmcc presents data showing the number of domain names that have been held 2, 3, 4, etc. times by different owners. A small percentage of domain names have been held by ten different domain investors.

Please share your views in the comments section.

Thanks to Michael for the NameBio data I used in researching this article.

A retail transaction is a sale to the business, organization or individual who will be the final user of that domain name. Wholesale prices need to be much lower than retail, in order to allow for holding costs, a profit margin, and the possibility that the acquired domain name will never sell.

Typical sell-through rates indicate that most domain names will not sell to an end user for many years, if ever. Sometimes the domain investor abandons the domain name before it sells, and the domain name changes hands in a wholesale transaction, either before or after expiration.

This article looks at how many wholesale transactions, on average, occur for each retail sale.

The Numbers

The NameBio database includes both wholesale and retail transactions. While venue and price provide indicators of which sales are likely retail, no dividing line will be perfect. In this analysis, I use the simplified model that domain sales at prices of $201 and above are considered retail, and others are categorized wholesale transactions.

Under wholesale transactions, I include sales between $100 to $200 from the public part of the NameBio database, as well as sales under $100 accessible through a NameBio membership plan. I looked at two years of NameBio data, for the period ending April 29, 2020, although all results are expressed in per year values.

- Across all extensions, there are about 377,000 wholesale transactions per year, compared to about 62,000 retail sales. Note that sales from many venues are not included in the NameBio database, and therefore the real numbers would be substantially larger in both categories.

- Due to the dominance of

.com, the numbers are not much different for.comonly. Just over 84% of retail sales are.comwhile about 85% of the wholesale sales are.com. - The ratio of wholesale to retail sales numbers across all extensions averages about 6.1. In other words, on average, for each retail sale, there were about 6.1 wholesale transactions.

- While by number most transactions are wholesale, by dollar volume, 90% are retail.

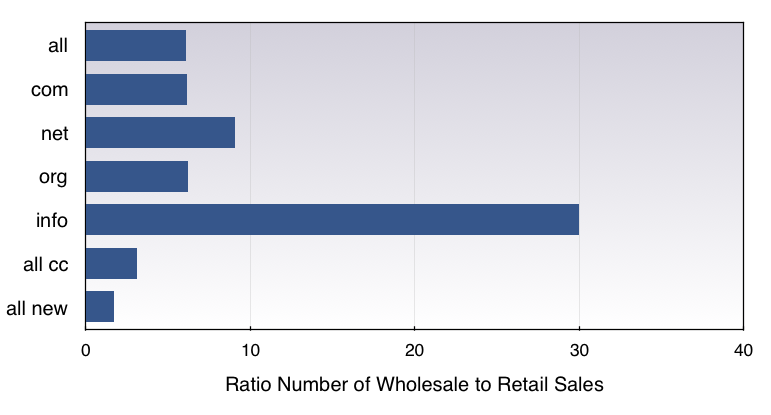

- I looked at how the wholesale to retail ratio varied by domain extension, obtaining the results shown below. The ratio of wholesale to retail transactions is similar in

.comand.orgat just over 6. - The wholesale to retail ratio is about 9 for

.net. - The ratio of wholesale to retail transactions is much higher in

.infoat about 30. - Taken as a whole, there are fewer wholesale transactions for each retail sale in country code extensions, with an average ratio of about 3.1.

- In new extensions, the ratio is even lower, with only 1.7 wholesale transactions for each retail sale. That is partly influenced by registry sales. The shorter time since public availability also plays a role.

The wholesale to retail sales ratios for the more common general-purpose country code extensions are shown below. The ratios range from about 1 to 15. It should be kept in mind that the statistics are much more limited, and possibly less meaningful.

- The

.meextension has the highest ratio, with slightly more than 15 wholesale transactions for each retail sale. The vast majority of the wholesale transactions are at prices less than $100. - The

.aiextension is different from any other extension, with almost equal retail and wholesale sales numbers. Almost all of the “wholesale” transactions, about 730 per year, are between $100 to $200, whereas in most extensions the pattern is most wholesale sales at prices less than $100. I think what we are seeing here is that many NameBio-reported sales in.aiare wholesale, and the $200 dividing line is inappropriate for the extension. - In a few other extensions, there are probably many retail sales less than the $200 cutoff I assumed.

- In the

.coextension there are about 1540 sales per year at prices less than $100, another 170 between $100 and $200, and nearly 290 retail sales per year. - Almost 90% of the wholesale

.tvsales are at prices less than $100, while the overall ratio of wholesale to retail is 6.6, not much different than for the legacy extensions.

Keep In Mind

The $200 cutoff is probably inappropriate for some extensions. For example, there are probably more

.info and .me retails sales that dip below this cutoff, while many .ai wholesale acquisitions may be above that cutoff.Due to the venues that report, NameBio is almost certainly more efficient tracking wholesale transactions. Therefore, the actual ratio of wholesale to retail sales would be less than calculated here.

Also, keep in mind that hand registration acquisitions did not enter this analysis. If included as a wholesale transaction, hand registrations would increase the ratio.

The ratios reported here are applicable to the universe of domain names being sold. Your personal ratio can be very different, of course.

I did this largely as an exercise, wondering how often domain names change hands between investors. If you track your own ratio of wholesale acquisitions to retail sales, the ratios presented here can be used for comparison purposes. The ratio of wholesale acquisitions to retail sales could be another number to track in your portfolio.

A high ratio of wholesale to retail sales can be viewed two ways. It might mean that domain investors are abandoning that extension, and putting up more domains at wholesale prices, or simply letting them expire. Alternatively, it could mean that investors see a bright future for the extension, and are making wholesale acquisitions to be well placed for future retails sales.

Liquidity in domain names has received a lot of attention of late. The analysis here supports the idea that some extensions are much more frequently traded between domain investors. What domain investors more readily purchase, it seems, does not perfectly track retail interest.

The Domnomics book by jmcc presents data showing the number of domain names that have been held 2, 3, 4, etc. times by different owners. A small percentage of domain names have been held by ten different domain investors.

Please share your views in the comments section.

- Are you surprised by these ratios?

- Do you compute your own ratio of wholesale acquisitions to retail transactions?.

- Do you think we trade domain names too often, or too seldom?

- I used $200 as the dividing line. What value would you have used?

Thanks to Michael for the NameBio data I used in researching this article.

Last edited: