Afternic recently provided data insights from the 2022 sales year. While precise numerical values are not given, graphical results are presented for total dollar volume, average price, sell-through rate and average revenue per domain. This allows one to compare the performance of different extensions.

Total dollar volume was released for the the 20 TLDs with the highest dollar volumes during the year, while the other measures were provided for the top 10 from that list.

Afternic data is not normally included in NameBio. When I do an analysis based on NameBio data, I often wonder how it would have changed if Afternic data had been included. In this article I look at corresponding measures using NameBio to the data recently released by Afternic.

Most Domain Sales Are COM

Afternic showed sales volume, for 2022, in the following graph where the size of the square corresponds to volume. The huge blue square is .com, while the other top TLDs are the rectangles shown on the right. Most domain sales are in .com.

The labels are difficult to read on the original, but after .com, the next three, not that different in volume from each other, are .org, .net and .co in the Afternic data.

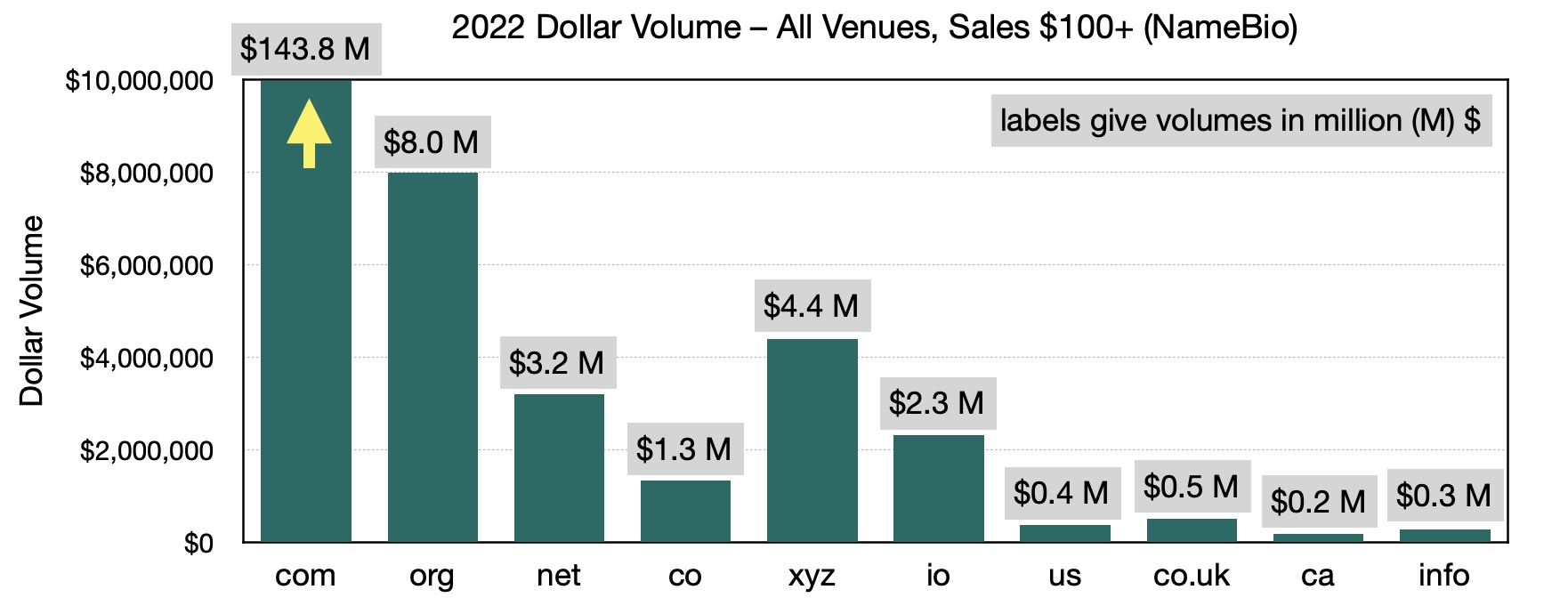

I took the top 10 extensions from the Afternic data, and looked up the 2022 dollar volumes using NameBio, with results shown below. Note that .com would be far off the graph scale, with $143.8 million in total sales volume, compared to about $8.0 million for second place .org.

While the two datasets agree that .com dominates and .org comes next, after that there are differences. In the NameBio data .xyz comes next, followed by .net, .io and then .co. Also, .us and .ca are much smaller in NameBio compared to the Afternic data. Some other extensions, like .de, do far better in the NameBio data.

The Afternic Top 20

Based on 2022 Afternic sales data, here are the top 20 extensions in order.

In both datasets .com dominates. In the NameBio data for 2022, 81.4% of the entire volume is due to .com.

While one can certainly invest only in .com, that does not mean there are not opportunities in other extensions.

An important point is that the vast majority of names listed for sale are also in .com. In the next section we look at the ratio of sales to listings.

Sell-Through Rate

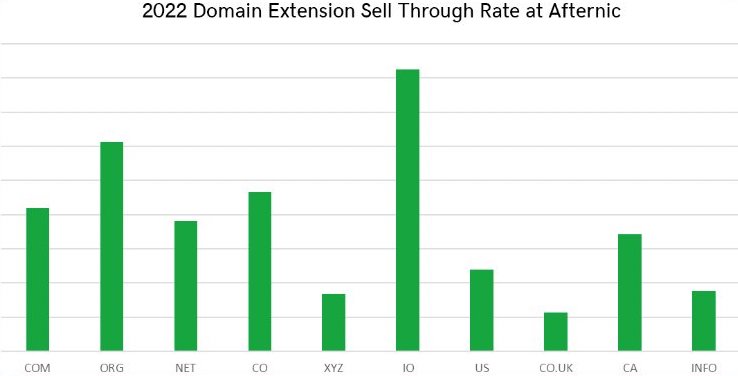

Afternic shared sell-through rate (STR) data for their top 10 extensions. While we don’t have numerical values, the lengths of the columns provide a relative measure.

In the Afternic data, .io has the best STR, followed by .org, .co and then .com.

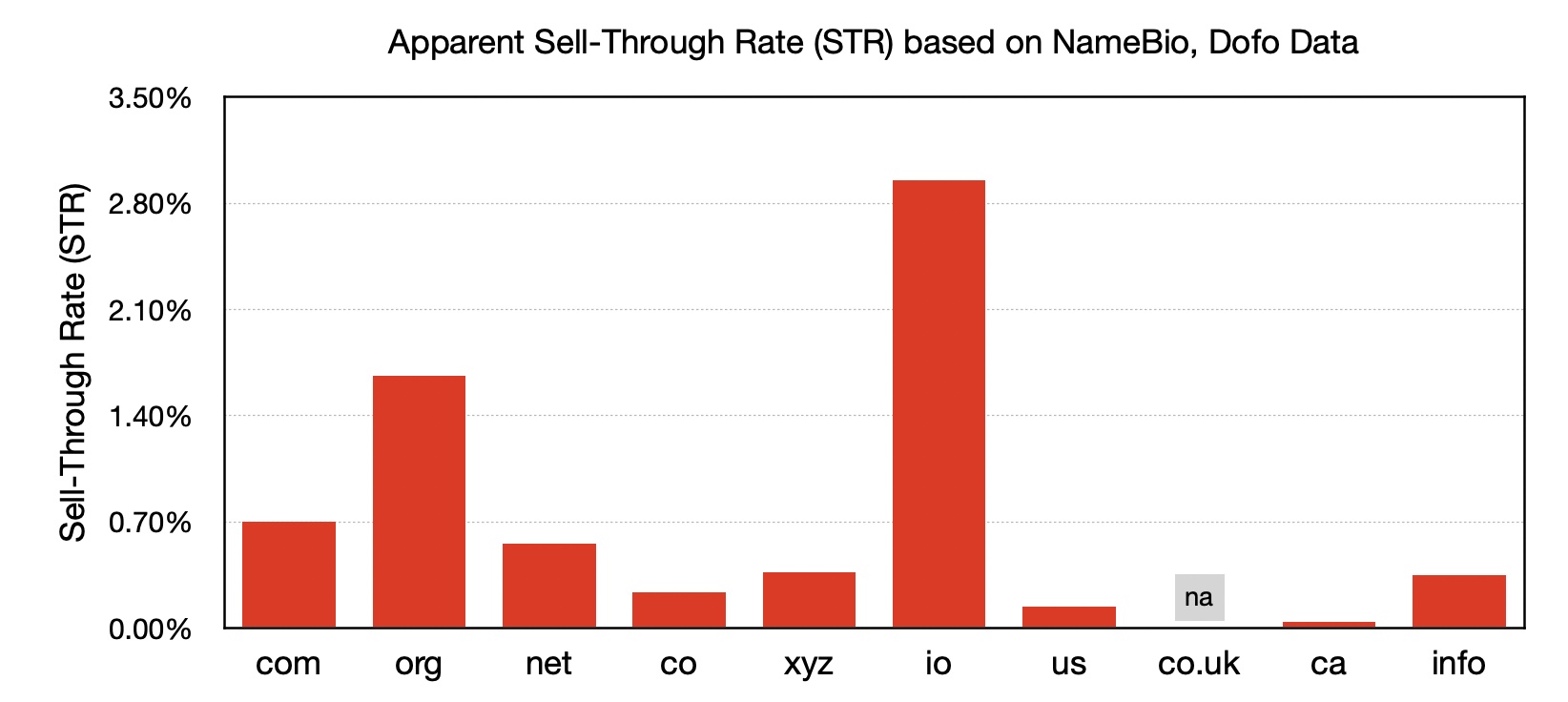

I looked at the 2022 STR using NameBio sales data and Dofo data for the number of sales listings for each TLD. While Dofo no longer exists, I had computed and saved the data from an earlier analysis. The results are shown below.

The NameBio data is consistent with the Afternic data in that .io has the best STR, with .org next. There is also agreement that .com is better than .net. In contrast to the Afternic data, .co is lower in STR in the NameBio-Dofo data. I was not able to get the number of .co.uk listings from Dofo, so that value is not given.

Average Price Matters, But Challenging To Interpret

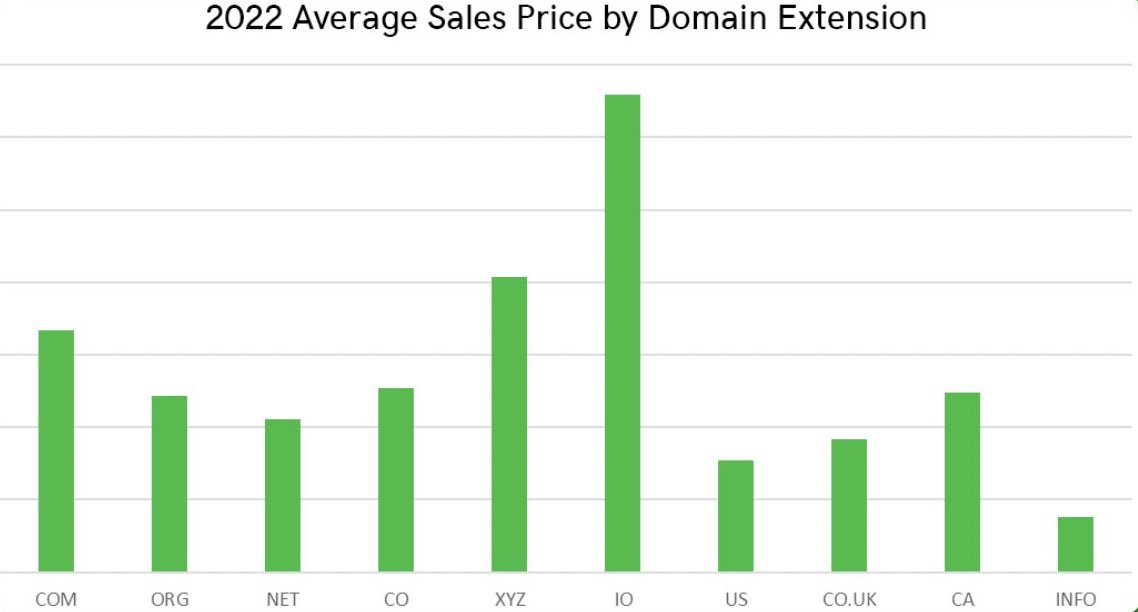

While the sell-through rate is important, average price is also a key metric. Afternic presented average prices for the top 10 extensions.

in the Afternic data, .io has the highest average prices, followed by .xyz and then .com. Average prices for .co, .org and .ca are very similar to each other.

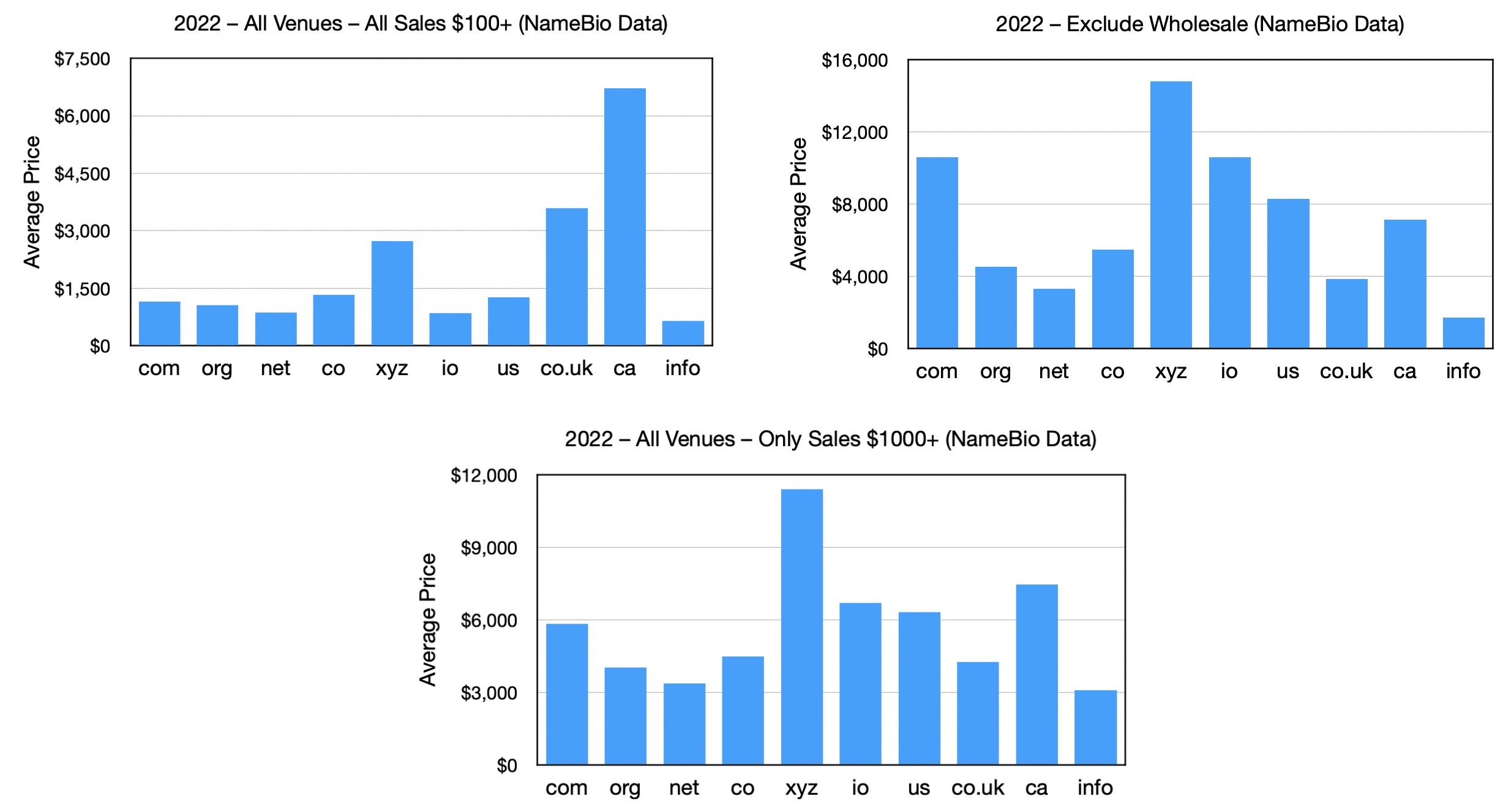

What about the NameBio data? Average prices vary widely according to the selection criteria. If I simply use all sales $100 and up, one obtains the data on the top left.

But that dataset is dominated by wholesale acquisitions, especially auction sales. If I exclude all auction sites, and a few other venues known mainly for wholesale acquisitions, the average prices change to the values shown in the top right graph. Note that the scales are different on the three graphs.

To stress how dominated raw NameBio data for legacy extensions is with auction and other wholesale transactions, the top right graph is based on 7091 .com sales compared to about 124,600 in the top left overall distribution. The top right graph is based on private sales in NameBio, as well as Afternic (not many), BuyDomains, DomainMarket, Sedo and Uniregistry.

In the retail-only NameBio data, .xyz has the top average price, with .io and .com next, almost equal to each other. This is somewhat different from the Afternic data, that had .io first, followed by .xyz then .com.

Another way to concentrate on retail sales is to set a price minimum. If I look only at NameBio sales $1000 and up, I obtain the bottom graph. This still shows .xyz with the highest average price, with many other extension not that different from each other. A higher efficiency of reporting of high-value .xyz sales may be part of what we are seeing.

The main message from this data, though, is that average price values are very sensitive to the details of the filters used. The next section looks at a more robust measure, the average revenue per domain.

Revenue Per Domain

In January in the NamePros Blog, I introduced a simple measure that I called Dollar Volume Per Listing (DVPL). This is simply the average dollar return per domain in a portfolio, or a subset of a portfolio, such as a particular extension.

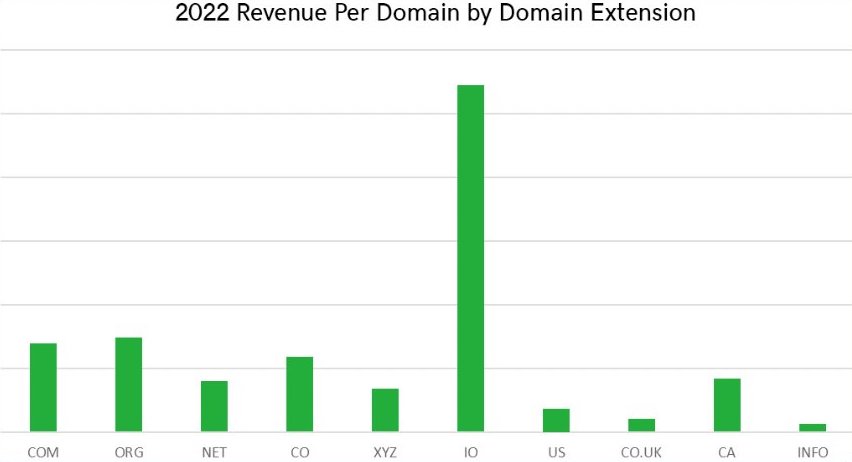

The Afternic Revenue Per Domain (RPD) is similarly calculated, with 2022 results for the top ten extensions shown below.

The .io extension clearly dominates the Afternic data in terms of the Revenue Per Domain metric, with a value just over 3x that of .com or .org. According to Afternic Revenue Per Domain, .xyz trails .com, .org and .co, and is slightly lower than .net.

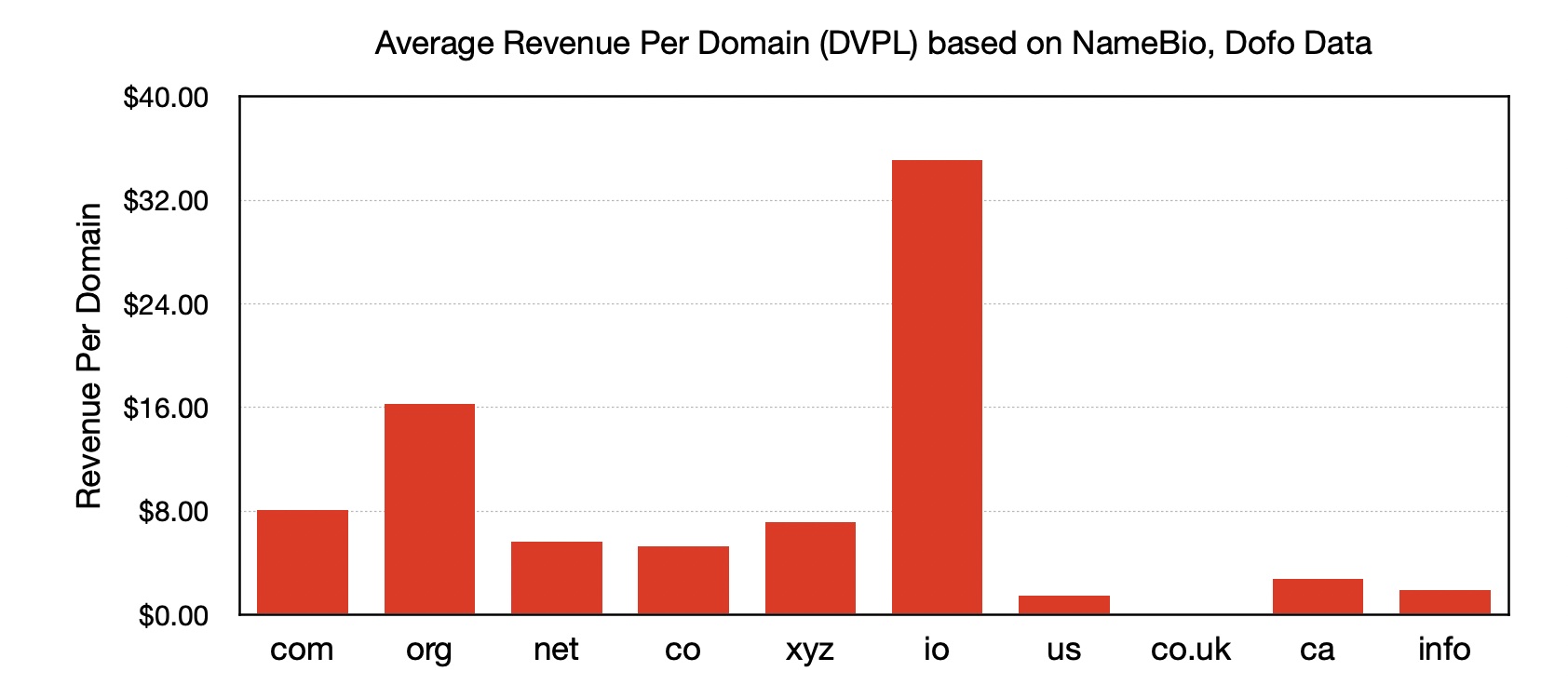

Let’s compare this to the values I obtained for NameBio sales data and Dofo listings data. Note that these were calculated using an average of 2021 and 2022 sales data, so are not exactly comparable to the Afternic data.

Again .io dominates, with a significantly higher DVPL than the other nine extensions. The NameBio+Dofo data indicates that .org is significantly higher than .com in Revenue Per Domain, and .xyz slightly leads .net and .co.

It should be kept in mind that the annual holding cost for .io is just over 3x times that for .com, while .co is about 2x.

Michael Cyger’s Insights

Recently industry expert @Michael Cyger interpreted the Afternic data. After noting the obvious domination of .com in terms of total sales volume, he provided this perspective on .io:

Next, he looked at .xyz.

He returned to the quality issue in his concluding comments.

As well as the obvious need for memorable words that make good brands, he commented on the importance of short words, both in terms of length and number of syllables.

Here is the link to his full commentary on social media. The commentary was repeated in his free weekly newsletter - you can subscribe and see the latest newsletter here.

My Thoughts

Here are some things that struck me while researching this topic.

The Afternic data usually gets reported here on NamePros. Follow @James Iles. Also, Afternic tweet new data releases – their official account is Afternic if you are on that platform.

I would first like to thank Afternic for providing the data. Also, thanks to @James Iles who answered several questions I had regarding interpretation. My sincere thanks to NameBio for the sales data used in this article, and to Dofo for listings data accessed earlier. Thanks to @Michael Cyger for the insights he provided on interpreting the data, and for permission to quote for this article.

Total dollar volume was released for the the 20 TLDs with the highest dollar volumes during the year, while the other measures were provided for the top 10 from that list.

Afternic data is not normally included in NameBio. When I do an analysis based on NameBio data, I often wonder how it would have changed if Afternic data had been included. In this article I look at corresponding measures using NameBio to the data recently released by Afternic.

Most Domain Sales Are COM

Afternic showed sales volume, for 2022, in the following graph where the size of the square corresponds to volume. The huge blue square is .com, while the other top TLDs are the rectangles shown on the right. Most domain sales are in .com.

The labels are difficult to read on the original, but after .com, the next three, not that different in volume from each other, are .org, .net and .co in the Afternic data.

I took the top 10 extensions from the Afternic data, and looked up the 2022 dollar volumes using NameBio, with results shown below. Note that .com would be far off the graph scale, with $143.8 million in total sales volume, compared to about $8.0 million for second place .org.

While the two datasets agree that .com dominates and .org comes next, after that there are differences. In the NameBio data .xyz comes next, followed by .net, .io and then .co. Also, .us and .ca are much smaller in NameBio compared to the Afternic data. Some other extensions, like .de, do far better in the NameBio data.

The Afternic Top 20

Based on 2022 Afternic sales data, here are the top 20 extensions in order.

- .com

- .org

- .net

- .co

- .xyz

- .io

- .us

- .co.uk

- .ca

- .info

- .me

- .cc

- .de

- .tv

- .shop

- .app

- .pro

- .eu

- .fr

- .club

In both datasets .com dominates. In the NameBio data for 2022, 81.4% of the entire volume is due to .com.

While one can certainly invest only in .com, that does not mean there are not opportunities in other extensions.

An important point is that the vast majority of names listed for sale are also in .com. In the next section we look at the ratio of sales to listings.

Sell-Through Rate

Afternic shared sell-through rate (STR) data for their top 10 extensions. While we don’t have numerical values, the lengths of the columns provide a relative measure.

In the Afternic data, .io has the best STR, followed by .org, .co and then .com.

I looked at the 2022 STR using NameBio sales data and Dofo data for the number of sales listings for each TLD. While Dofo no longer exists, I had computed and saved the data from an earlier analysis. The results are shown below.

The NameBio data is consistent with the Afternic data in that .io has the best STR, with .org next. There is also agreement that .com is better than .net. In contrast to the Afternic data, .co is lower in STR in the NameBio-Dofo data. I was not able to get the number of .co.uk listings from Dofo, so that value is not given.

Average Price Matters, But Challenging To Interpret

While the sell-through rate is important, average price is also a key metric. Afternic presented average prices for the top 10 extensions.

in the Afternic data, .io has the highest average prices, followed by .xyz and then .com. Average prices for .co, .org and .ca are very similar to each other.

What about the NameBio data? Average prices vary widely according to the selection criteria. If I simply use all sales $100 and up, one obtains the data on the top left.

But that dataset is dominated by wholesale acquisitions, especially auction sales. If I exclude all auction sites, and a few other venues known mainly for wholesale acquisitions, the average prices change to the values shown in the top right graph. Note that the scales are different on the three graphs.

To stress how dominated raw NameBio data for legacy extensions is with auction and other wholesale transactions, the top right graph is based on 7091 .com sales compared to about 124,600 in the top left overall distribution. The top right graph is based on private sales in NameBio, as well as Afternic (not many), BuyDomains, DomainMarket, Sedo and Uniregistry.

In the retail-only NameBio data, .xyz has the top average price, with .io and .com next, almost equal to each other. This is somewhat different from the Afternic data, that had .io first, followed by .xyz then .com.

Another way to concentrate on retail sales is to set a price minimum. If I look only at NameBio sales $1000 and up, I obtain the bottom graph. This still shows .xyz with the highest average price, with many other extension not that different from each other. A higher efficiency of reporting of high-value .xyz sales may be part of what we are seeing.

The main message from this data, though, is that average price values are very sensitive to the details of the filters used. The next section looks at a more robust measure, the average revenue per domain.

Revenue Per Domain

In January in the NamePros Blog, I introduced a simple measure that I called Dollar Volume Per Listing (DVPL). This is simply the average dollar return per domain in a portfolio, or a subset of a portfolio, such as a particular extension.

The Afternic Revenue Per Domain (RPD) is similarly calculated, with 2022 results for the top ten extensions shown below.

The .io extension clearly dominates the Afternic data in terms of the Revenue Per Domain metric, with a value just over 3x that of .com or .org. According to Afternic Revenue Per Domain, .xyz trails .com, .org and .co, and is slightly lower than .net.

Let’s compare this to the values I obtained for NameBio sales data and Dofo listings data. Note that these were calculated using an average of 2021 and 2022 sales data, so are not exactly comparable to the Afternic data.

Again .io dominates, with a significantly higher DVPL than the other nine extensions. The NameBio+Dofo data indicates that .org is significantly higher than .com in Revenue Per Domain, and .xyz slightly leads .net and .co.

It should be kept in mind that the annual holding cost for .io is just over 3x times that for .com, while .co is about 2x.

Michael Cyger’s Insights

Recently industry expert @Michael Cyger interpreted the Afternic data. After noting the obvious domination of .com in terms of total sales volume, he provided this perspective on .io:

Note that RPD is revenue per domain, STR is sell-through rate, and ASP is average sales price.Domains in the .io TLD lead the way on RPD, STR and ASP, but domains in the .io TLD have low volume. This suggests that there were some very large .io outlier sales in 2022.

Next, he looked at .xyz.

He then commented that Swetha (@DNGear) has both high quality .xyz names and many of them, and that explains her strong sales record during this period.Although .xyz has a high ASP, its RPD is low. So that implies that you shouldn't buy 10,000 random .xyz domains because your RPD will be low. But if you have a lower quantity with higher quality, both your RPD and ASP should be high.

He returned to the quality issue in his concluding comments.

Quality is key in non- .com TLDs. Quality sells. And if you have quality in large quantity, you'll sell more.

As well as the obvious need for memorable words that make good brands, he commented on the importance of short words, both in terms of length and number of syllables.

If you're buying alternative extensions, try to focus on single words that are one syllable like Wrap, Bolt, Move and Keys. Then expand to single words that are two syllables like Profile, Pixels, Pluto and Chroma. Then expand to single words that are three syllables like Capital, Conduit, Momentum and Artemis.Two words can be good too, just not as high of an ASP. And try to find words that companies would want for their brand name.

Here is the link to his full commentary on social media. The commentary was repeated in his free weekly newsletter - you can subscribe and see the latest newsletter here.

My Thoughts

Here are some things that struck me while researching this topic.

- With tens of millions of domain name listings, Afternic has a lot of sales data, and even with the restriction of relative instead of numerical data, there is much to be learned from the data shared.

- It was encouraging that many of the trends were similar in this comparison of NameBio data with Afternic. This helps validate that analyses based on NameBio data probably adequately represent the overall market most of the time.

- But there were differences too. It seems that Afternic do better with .us and .ca, while Sedo, responsible for much of the NameBio retail data, sells various European country codes more effectively.

- The differences in .co surprised me a bit, with the extension doing significantly better in the Afternic data.

- The analysis with different selection factors convinced me that average price, by itself, will vary widely with outlier sales and different retail dividing lines. We should be wary of reading too much into average price data.

- The total dollar volume, though, is much less sensitive to the precise cutoff for retail sales.

- If one looks at the top 20 Afternic extensions, it is interesting that .shop is one new gTLD that made the list along with .xyz, .club, and .app. I would not have predicted .shop on top 20 list, and it does not seem to carry over to the NameBio data. So if selling .shop domains, it seems that Afternic listing may be important.

- Both datasets substantiate the inroads that .xyz has made, but it is important to keep in mind that the overall .xyz STR is not that high, an indicator that many investors have names that do not sell in that extension.

- The .org extension continues to shine, with solid metrics in both datasets.

- As @Michael Cyger commented, especially in extensions other than .com, quality, usually represented by short single words that would make a great brand, is key.

- Both sets of data are missing many sales. Most brandable marketplace sales are missing, and probably the majority of private sales.

The Afternic data usually gets reported here on NamePros. Follow @James Iles. Also, Afternic tweet new data releases – their official account is Afternic if you are on that platform.

I would first like to thank Afternic for providing the data. Also, thanks to @James Iles who answered several questions I had regarding interpretation. My sincere thanks to NameBio for the sales data used in this article, and to Dofo for listings data accessed earlier. Thanks to @Michael Cyger for the insights he provided on interpreting the data, and for permission to quote for this article.

Last edited: