When seeking names on the buyer requests section at NamePros, or filtering a list of expiring names for consideration, domain investors often use filters to make the size of the list manageable. For example, they may seek only names with a certain minimum age, maximum length, or minimum GoDaddy appraisal value.

In the NamePros Blog analysis Does Domain Name Age Matter, I looked at how useful domain age was as a filter. The correlation was very weak, although it was true that the vast majority of names that sold at retail sales prices of $2000 and up, were aged by a number of years. Just to stress, it is not that age makes a name more valuable, but simply that names that are more valuable tend to also be aged.

Therefore, domain age can be a useful filter, although some good names will be excluded when an age filter is employed.

In this study, I used the same set of domain name sales, but looked at the GoDaddy Appraisal value for each name, to see if automated appraisal value was a useful filter.

The Experiment

I wanted a selection of mainly retail sales at a single venue over a variety of prices. I used the same set of sales employed in the age study. A selection of Sedo

To get a dataset of manageable size, but with domain names with a variety of prices, I selected the first 25 sales starting at various price points from $2000 to $50,000 – see the details in the earlier study. There were a total of 189 sales used in the in the analysis, that sold at prices from $2000 to $1.6 million.

I used the free GoDaddy Domain Appraisal instrument to get an appraisal value for each domain name. That was done recently (early March 2023). Some automated appraisals, for example Estibot, reset values after a sale is reported. To my knowledge, GoDaddy do not seem to do that, and by using Sedo sales data makes it even more unlikely. The fact that no appraisal was exactly the same as the sale price, and few were even close to the sale price, supports the fact that their algorithm does not reset values by NameBio reported sale of that exact name.

How Sales Prices and GoDaddy Valuations Compared

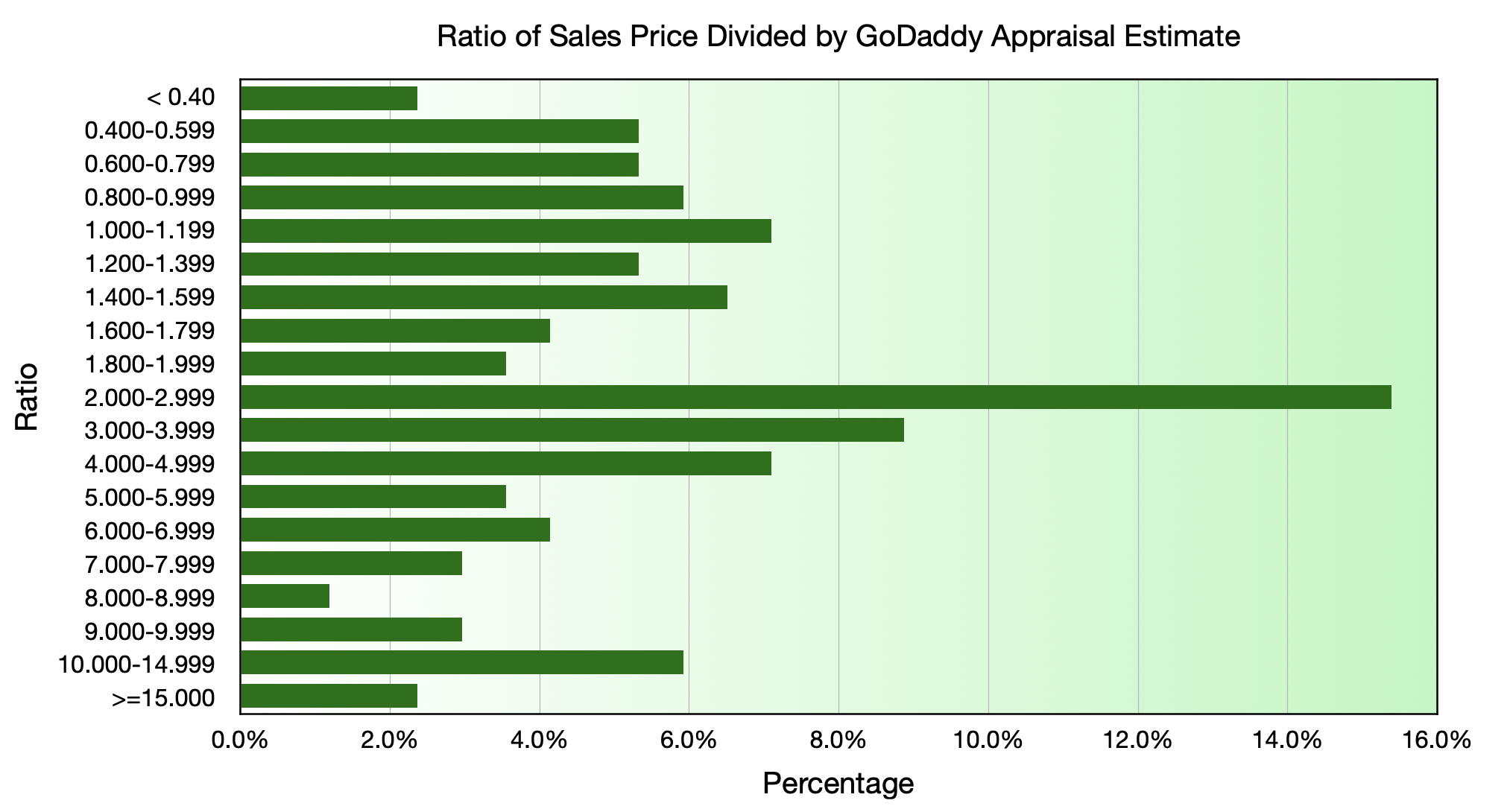

The majority of Sedo sales in this sample sold at prices well in excess of the GoDaddy Appraisal value. For each sale I calculated the ratio of the sales price divided by the appraisal value, with results shown in the graph below.

Only 18.9% sold at a value less than the appraisal estimate.

A name with an appraisal of $524 sold at $25,000, and another name with an appraisal of $4951 sold at $125,000, a ratio of more than 25x.

There were 15 names, from the 189, that had a GoDaddy appraisal of >$25,000, so precise ratios could not be calculated for these sales. In all cases, the sales of these names were at more than $25,000.

GoDaddy Appraisal did get some values about right. For 41.4% of the sales, the sales price was within a factor of 2 of the appraisal value, that is a ratio between 0.5 and 2.0.

Note that the results of the agreement will depend on the sales data used. I suspect if one looked at sales of $2000 and less the agreement between sales price and appraised value would be significantly better.

Correlation

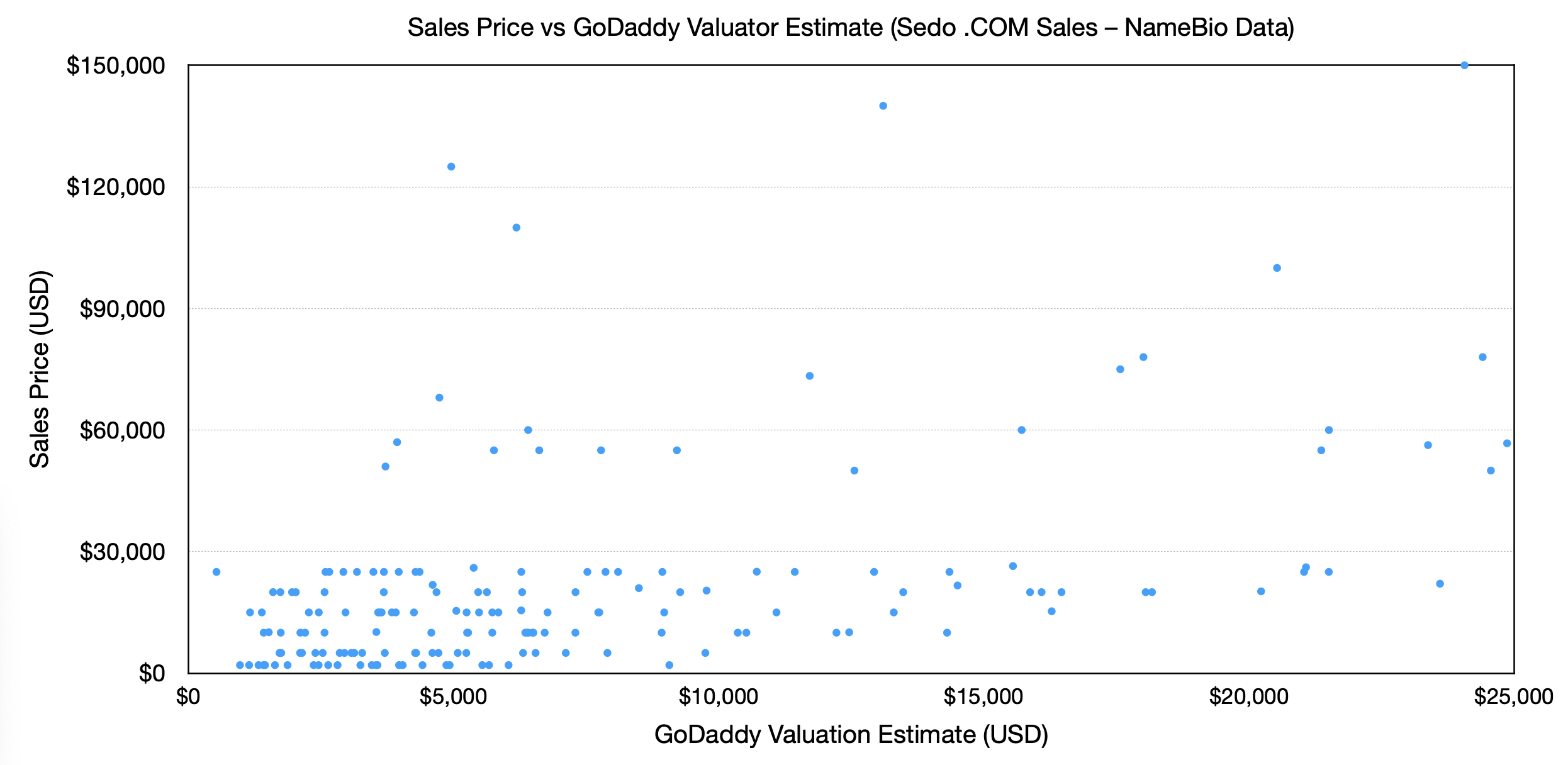

Shown below is a plot of the sales price versus the GoDaddy appraisal value. Note that 7 sales were off the scale of the graph.

The apparent grouping of data is because of the way the data was selected, sales at about $2000, $5000, $10,000, $15,000 and so on. This was done to have a manageable number of sales, but at a variety of price points.

There is a correlation between sales price and appraised value, but it is very weak. The R2 value is just 0.215, a bit better than the correlation of price with domain age found in the previous analysis, but in a scientific sense it is a poor correlation.

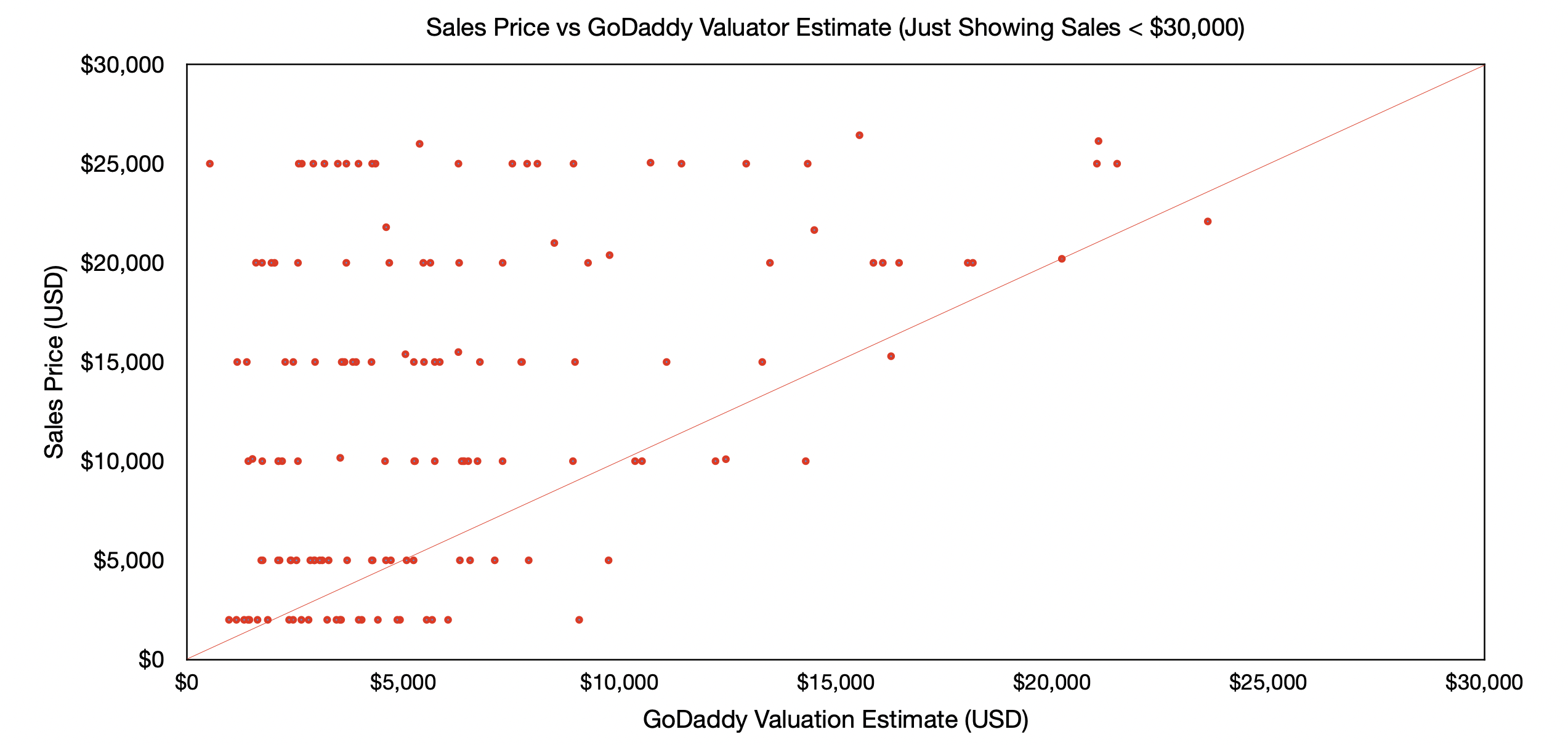

To better see the region where most of the data is clustered, I plotted only the data up to $30,000 below. The graph has a line showing equality of sales price and appraisal value, and you can see the majority of sales are on one side.

Use of Appraisal Value for Filtering

So, how does using appraised value work as a filter? If we regard this dataset as typical, if you limited consideration to names with $2000 and up appraisal value, you would eliminate 19 of the names, about 10% . The highest sales price in the excluded names would be $25,000, with 10 of the excluded sales in the 5-figure range.

If you set a more rigid filter with $2500 and up appraisals, you would exclude 13.8% of the names that sold $2000 and up.

An even more rigid filter, only names with an appraisal of $4000 and more, would eliminate 23.3% of the names that sold $2000 and up, including several $25,000 sales.

Keep in mind that this is not a random sampling, but one that weights higher value sales more heavily. Also, all sales are from Sedo, rather than a mix across multiple sales venues.

Only you can decide if the worthwhile names that are excluded are an acceptable cost to a much shorter list of names to consider.

My sincere thanks for NameBio as the source of data for this analysis. Also, appreciation to Sedo for making much of their sales data open to the community. And thanks to GoDaddy for making their appraisal tool freely available.

In the NamePros Blog analysis Does Domain Name Age Matter, I looked at how useful domain age was as a filter. The correlation was very weak, although it was true that the vast majority of names that sold at retail sales prices of $2000 and up, were aged by a number of years. Just to stress, it is not that age makes a name more valuable, but simply that names that are more valuable tend to also be aged.

Therefore, domain age can be a useful filter, although some good names will be excluded when an age filter is employed.

In this study, I used the same set of domain name sales, but looked at the GoDaddy Appraisal value for each name, to see if automated appraisal value was a useful filter.

The Experiment

I wanted a selection of mainly retail sales at a single venue over a variety of prices. I used the same set of sales employed in the age study. A selection of Sedo

.com sales over a variety of price points were used. Sales data was as reported in NameBio. The data is mainly from 2022 and a few from late 2021.To get a dataset of manageable size, but with domain names with a variety of prices, I selected the first 25 sales starting at various price points from $2000 to $50,000 – see the details in the earlier study. There were a total of 189 sales used in the in the analysis, that sold at prices from $2000 to $1.6 million.

I used the free GoDaddy Domain Appraisal instrument to get an appraisal value for each domain name. That was done recently (early March 2023). Some automated appraisals, for example Estibot, reset values after a sale is reported. To my knowledge, GoDaddy do not seem to do that, and by using Sedo sales data makes it even more unlikely. The fact that no appraisal was exactly the same as the sale price, and few were even close to the sale price, supports the fact that their algorithm does not reset values by NameBio reported sale of that exact name.

How Sales Prices and GoDaddy Valuations Compared

The majority of Sedo sales in this sample sold at prices well in excess of the GoDaddy Appraisal value. For each sale I calculated the ratio of the sales price divided by the appraisal value, with results shown in the graph below.

Only 18.9% sold at a value less than the appraisal estimate.

A name with an appraisal of $524 sold at $25,000, and another name with an appraisal of $4951 sold at $125,000, a ratio of more than 25x.

There were 15 names, from the 189, that had a GoDaddy appraisal of >$25,000, so precise ratios could not be calculated for these sales. In all cases, the sales of these names were at more than $25,000.

GoDaddy Appraisal did get some values about right. For 41.4% of the sales, the sales price was within a factor of 2 of the appraisal value, that is a ratio between 0.5 and 2.0.

Note that the results of the agreement will depend on the sales data used. I suspect if one looked at sales of $2000 and less the agreement between sales price and appraised value would be significantly better.

Correlation

Shown below is a plot of the sales price versus the GoDaddy appraisal value. Note that 7 sales were off the scale of the graph.

The apparent grouping of data is because of the way the data was selected, sales at about $2000, $5000, $10,000, $15,000 and so on. This was done to have a manageable number of sales, but at a variety of price points.

There is a correlation between sales price and appraised value, but it is very weak. The R2 value is just 0.215, a bit better than the correlation of price with domain age found in the previous analysis, but in a scientific sense it is a poor correlation.

To better see the region where most of the data is clustered, I plotted only the data up to $30,000 below. The graph has a line showing equality of sales price and appraisal value, and you can see the majority of sales are on one side.

Use of Appraisal Value for Filtering

So, how does using appraised value work as a filter? If we regard this dataset as typical, if you limited consideration to names with $2000 and up appraisal value, you would eliminate 19 of the names, about 10% . The highest sales price in the excluded names would be $25,000, with 10 of the excluded sales in the 5-figure range.

If you set a more rigid filter with $2500 and up appraisals, you would exclude 13.8% of the names that sold $2000 and up.

An even more rigid filter, only names with an appraisal of $4000 and more, would eliminate 23.3% of the names that sold $2000 and up, including several $25,000 sales.

Keep in mind that this is not a random sampling, but one that weights higher value sales more heavily. Also, all sales are from Sedo, rather than a mix across multiple sales venues.

Only you can decide if the worthwhile names that are excluded are an acceptable cost to a much shorter list of names to consider.

My sincere thanks for NameBio as the source of data for this analysis. Also, appreciation to Sedo for making much of their sales data open to the community. And thanks to GoDaddy for making their appraisal tool freely available.

Last edited: