Diverse opinions have been expressed, on NamePros and elsewhere, on whether the domain aftermarket has recently dropped.

Certainly there are reasons for a possible decline.

Also, the explosive advances in artificial intelligence, along with no-code techniques, make it much faster and easier to get an online service active. Some suggest that this may usher in a golden age for domain name demand.

I took a look at the data to see if it suggests an aftermarket downturn of late. Here is what I found.

Retail Sales Numbers

While NameBio includes a wealth of domain name sales data, at time of writing over 4.2 million sales and a total of more than $2.4 billion, the majority of the sales are wholesale acquisitions by investors via the various auction venues.

The two venues that are primarily retail, and that also have a large number of sales in the NameBio database, are BuyDomains and Sedo.

BuyDomains do not directly report their sales to NameBio, but they list recent sales on their homepage. NameBio obtain the data in this way. This feed is clearly not all sales at BuyDomains, and may well be less than half of all BuyDomain sales. For example, while they have domains listed for prices under $1000, only sales above $1000 get in the sales feed. It is not clear what fraction of the sales above $1000 are publicly reported. The BuyDomains inventory is mainly .com, and some other legacy extensions, and primarily buy-it-now priced in the $$$$ range.

Sedo report, through a data feed, sales of $2000 and up, provided the buyer or seller has not paid a supplementary fee to have the price remain private. There are also Sedo sales in the NameBio database from Sedo auctions, and many of these are less than $2000. Since the auction purchases would mainly be investor acquisitions, I only included Sedo data for sales at prices of $2000 and up. Compared to BuyDomains, Sedo sales represent a more diverse set of names, and wider price points.

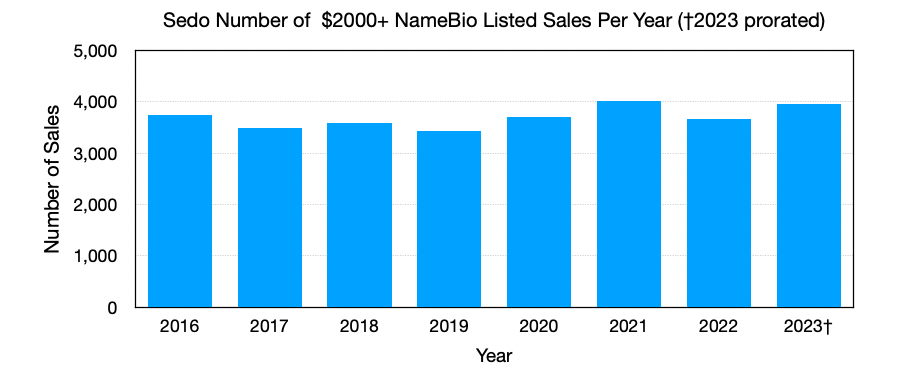

Plotted below are the number of Sedo sales per year from 2016 until the present. For 2023, I prorated the number of sales so far, assuming that the rate in the first 94 days will hold for the rest of the year.

As can be seen, the Sedo number of sales data is remarkably constant, with no trend indicating a recent decline.

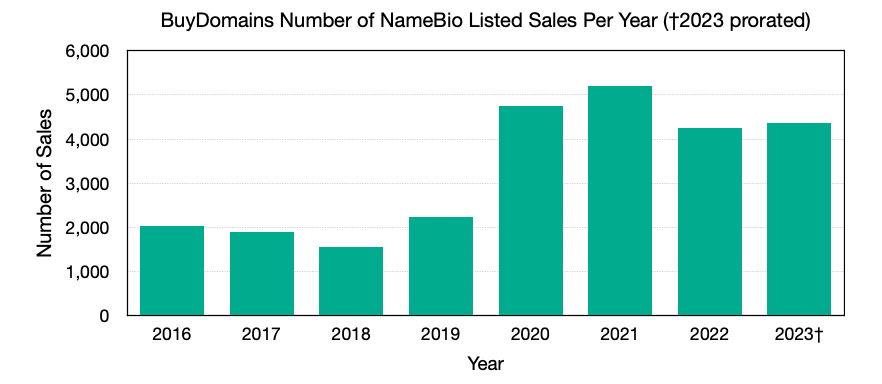

I then looked at similar data, number of sales per year, using BuyDomains data that in NameBio.

There is a really interesting jump in BuyDomains sales starting in 2020. Was it that BuyDomains were very well set for pandemic-changed economic conditions? Or, did they possibly significantly increase their domain portfolio size at that time? Alternatively, perhaps they did something that made them more successful in selling domain names. Another possibility is that they simply started reporting a higher percentage of sales in their public feed.

While 2020 and 2021 were the highest years at BuyDomains, for number of sales, the drop from the peak in 2021 is not pronounced.

What About Dollar Volume?

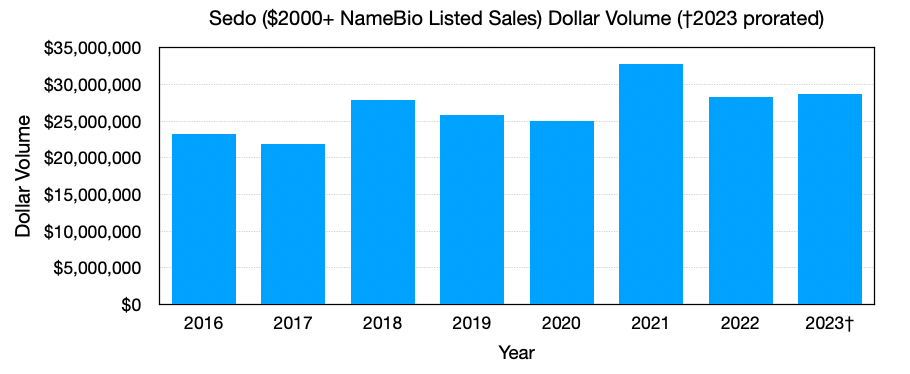

While number of sales is interesting, it is only part of the story. The average price is also important, so the dollar volume, that combines the two, is perhaps a better measure of the aftermarket health. Shown below is the dollar volume per year using the Sedo data.

While 2021 was the peak year, there is little indication in the Sedo data of significant changes from year to year.

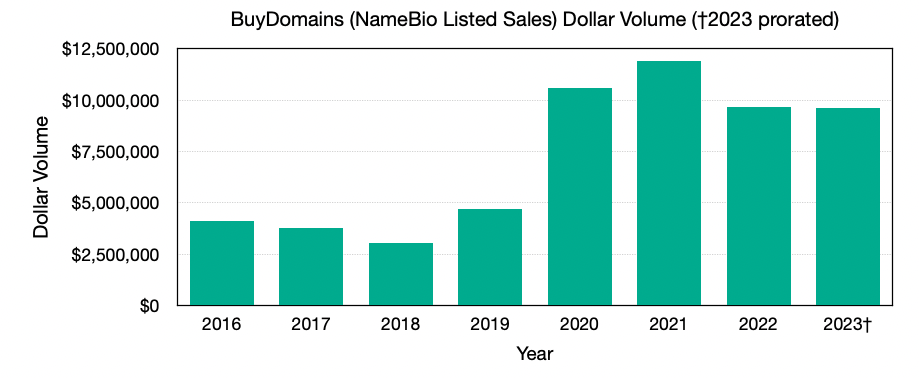

The BuyDomains data also suggests that 2022 and early 2023 are not much different from each other, although slightly down from 2021 and 2020.

What About Recent Months?

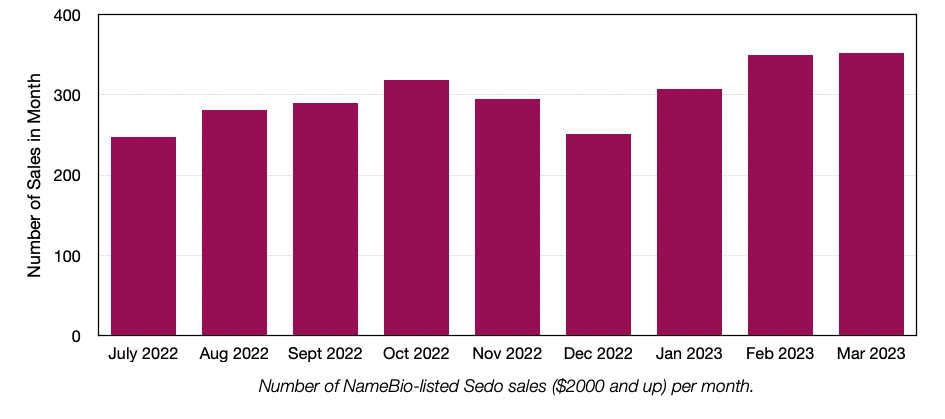

But has something different been happening very recently? I downloaded and divided the NameBio data for Sedo into monthly totals for the past 9 full months, again using only sales of $2000 or more.

There is some indication that the number of sales per month has been gradually increasing, although one would need to look at more years in detail to know if this is simply natural annual business cycle trends, or small number fluctuations. There certainly is no indication of a worsening in recent years.

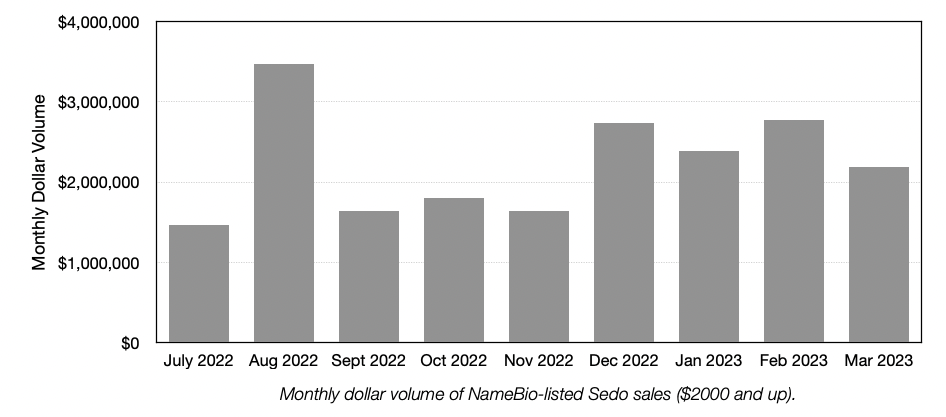

But what about dollar volume for the Sedo data, does that indicate a recent drop?

The last few months have been pretty constant, and all but one of the monthly periods fall within one standard deviation of the mean value.

Months with high dollar volume are readily explained by outlier sales. For example, in August 2022 the $1.6 million

Final Thoughts

It seems to me that there is no indication of a drop in the retail domain name aftermarket, at least as reflected in Sedo and BuyDomains data.

It is possible that the high end of the market, sales that often do not get publicly reported, is down.

Also, if there was a sharp downturn in the low end of the market, names at $500 and less, this analysis would have missed it.

There could be drops in certain types of names, or names for particular sectors or niches, or regions, or perhaps for different segments of the market. I think the varying reports on whether the market is recently up, down or about constant are due to these factors.

What have you observed? Please comment below.

My sincere thanks for NameBio as the source of data for this analysis. Also, appreciation to Sedo for making much of their sales data open to the community through their sales feed.

Certainly there are reasons for a possible decline.

- There is considerable business uncertainty.

- With inflation rising, the cost for a business or individual to finance premium domains is higher.

- Governments are overextended, and there may be less support for business initiatives.

- Some of the sectors that have seen particular growth in recent years, such as cryptocurrencies and NFTs, have had challenges.

- The tech giants are struggling, with significant layoffs.

- The decentralized name markets may cause a slowing of interest in traditional domains, or at least create confusion and uncertainty.

Also, the explosive advances in artificial intelligence, along with no-code techniques, make it much faster and easier to get an online service active. Some suggest that this may usher in a golden age for domain name demand.

I took a look at the data to see if it suggests an aftermarket downturn of late. Here is what I found.

Retail Sales Numbers

While NameBio includes a wealth of domain name sales data, at time of writing over 4.2 million sales and a total of more than $2.4 billion, the majority of the sales are wholesale acquisitions by investors via the various auction venues.

The two venues that are primarily retail, and that also have a large number of sales in the NameBio database, are BuyDomains and Sedo.

BuyDomains do not directly report their sales to NameBio, but they list recent sales on their homepage. NameBio obtain the data in this way. This feed is clearly not all sales at BuyDomains, and may well be less than half of all BuyDomain sales. For example, while they have domains listed for prices under $1000, only sales above $1000 get in the sales feed. It is not clear what fraction of the sales above $1000 are publicly reported. The BuyDomains inventory is mainly .com, and some other legacy extensions, and primarily buy-it-now priced in the $$$$ range.

Sedo report, through a data feed, sales of $2000 and up, provided the buyer or seller has not paid a supplementary fee to have the price remain private. There are also Sedo sales in the NameBio database from Sedo auctions, and many of these are less than $2000. Since the auction purchases would mainly be investor acquisitions, I only included Sedo data for sales at prices of $2000 and up. Compared to BuyDomains, Sedo sales represent a more diverse set of names, and wider price points.

Plotted below are the number of Sedo sales per year from 2016 until the present. For 2023, I prorated the number of sales so far, assuming that the rate in the first 94 days will hold for the rest of the year.

As can be seen, the Sedo number of sales data is remarkably constant, with no trend indicating a recent decline.

I then looked at similar data, number of sales per year, using BuyDomains data that in NameBio.

There is a really interesting jump in BuyDomains sales starting in 2020. Was it that BuyDomains were very well set for pandemic-changed economic conditions? Or, did they possibly significantly increase their domain portfolio size at that time? Alternatively, perhaps they did something that made them more successful in selling domain names. Another possibility is that they simply started reporting a higher percentage of sales in their public feed.

While 2020 and 2021 were the highest years at BuyDomains, for number of sales, the drop from the peak in 2021 is not pronounced.

What About Dollar Volume?

While number of sales is interesting, it is only part of the story. The average price is also important, so the dollar volume, that combines the two, is perhaps a better measure of the aftermarket health. Shown below is the dollar volume per year using the Sedo data.

While 2021 was the peak year, there is little indication in the Sedo data of significant changes from year to year.

The BuyDomains data also suggests that 2022 and early 2023 are not much different from each other, although slightly down from 2021 and 2020.

What About Recent Months?

But has something different been happening very recently? I downloaded and divided the NameBio data for Sedo into monthly totals for the past 9 full months, again using only sales of $2000 or more.

There is some indication that the number of sales per month has been gradually increasing, although one would need to look at more years in detail to know if this is simply natural annual business cycle trends, or small number fluctuations. There certainly is no indication of a worsening in recent years.

But what about dollar volume for the Sedo data, does that indicate a recent drop?

The last few months have been pretty constant, and all but one of the monthly periods fall within one standard deviation of the mean value.

Months with high dollar volume are readily explained by outlier sales. For example, in August 2022 the $1.6 million

call.com sale was added. In December 2022 the pair of sales, $500,000 each, of rebate.com plus rebates.com made a month that would otherwise have been on the low side into one of the best.Final Thoughts

It seems to me that there is no indication of a drop in the retail domain name aftermarket, at least as reflected in Sedo and BuyDomains data.

It is possible that the high end of the market, sales that often do not get publicly reported, is down.

Also, if there was a sharp downturn in the low end of the market, names at $500 and less, this analysis would have missed it.

There could be drops in certain types of names, or names for particular sectors or niches, or regions, or perhaps for different segments of the market. I think the varying reports on whether the market is recently up, down or about constant are due to these factors.

What have you observed? Please comment below.

My sincere thanks for NameBio as the source of data for this analysis. Also, appreciation to Sedo for making much of their sales data open to the community through their sales feed.