Should a domain investor invest only in

There seems a common consensus that, after

Mainly .COM Sells

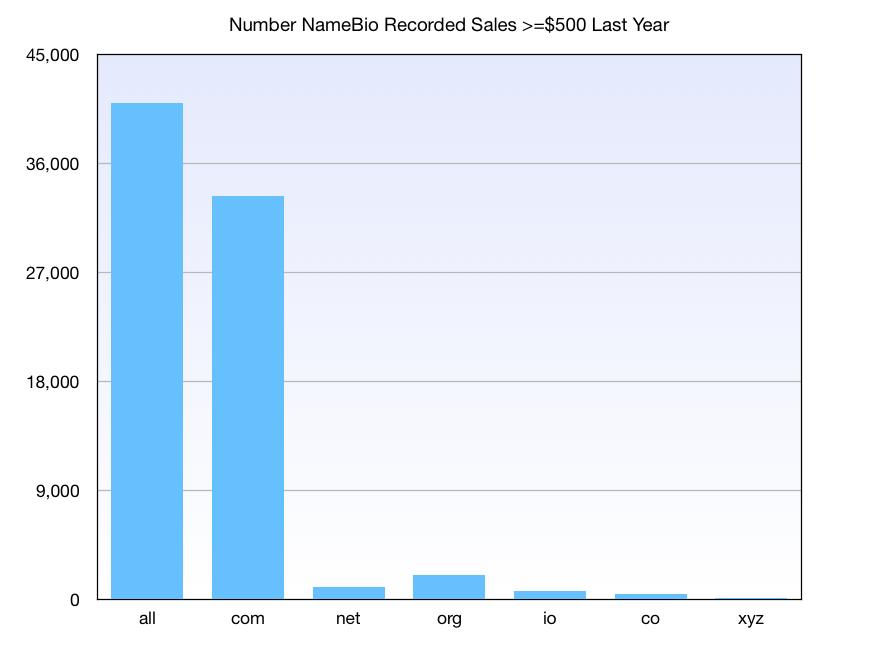

To focus on recent trends, I only looked at the last 12 months of data. NameBio is the best source for domain name sales data. To concentrate on sales at significant prices, and to downplay domainer acquisitions or liquidation sales, for this analysis I only considered sales of $500 or more.

So what does that show? The vast majority of sales are in

But It Is Mainly .COM That Are For Sale

I used Dofo to look at the domain names that are listed for sale across all of the major marketplaces. That is a lot of domain names – 26,091,975 the day I checked. Here is how they break down by domain extension.

The

Which Art Gallery To Sell At?

Let’s say you are a conventional artist, and trying to decide which art gallery in your city to sell your work at. There is a huge multi-location gallery with an active online presence. It sells 10,000 works per year. You also have the option of a small local gallery that sells 100 works per year. Choice of which to use is pretty obvious, right?

Not so fast. Let me add that the big gallery has 200,000 pieces of art listed for sale across their locations, while the small gallery has only 400. If you are listing, the odds that your work will sell, the probability, matters. At the big gallery, there is about 1 chance in 20 a listed artwork will sell at the end of one year, while at the small gallery it is 1 chance in 4.

Percentage That Sell

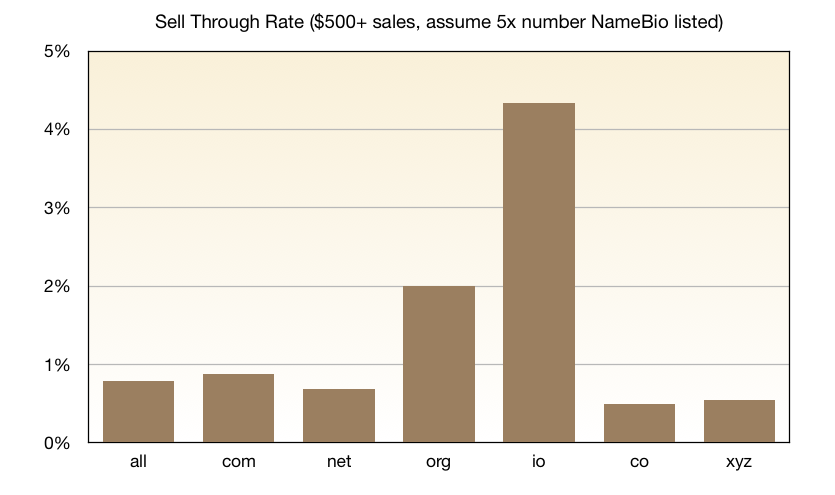

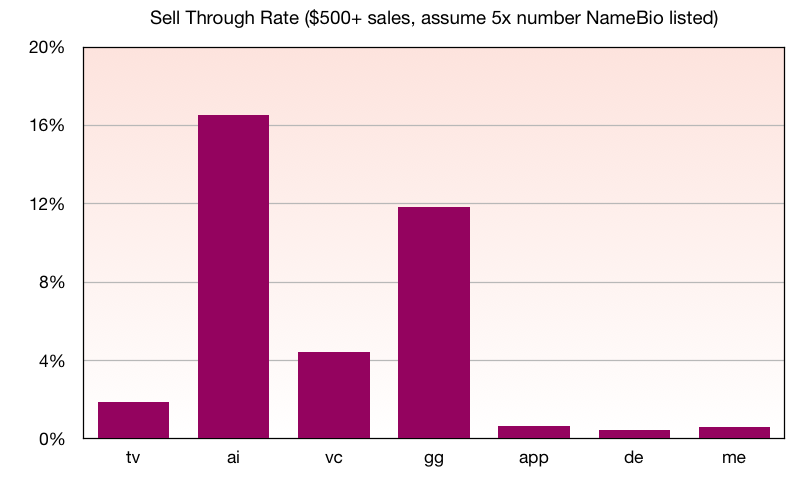

So let’s look at the data from the first two graphs as a percentage of the names listed for sale that sell in each extension. When we calculate that percentage for a portfolio, we call it the sell-through rate (STR). Here we are treating the data as though the entire domain name ‘industry’ is one portfolio, an industry-wide sell-through rate.

Now before I calculate that, I should adjust for the domain names that sold, but never were reported to NameBio. That is a significant factor in retail sales, as Sedo sales less than $2000, most sales at Afternic and Dan, and the majority of sales from the brandable marketplaces, do not get reported. That is a lot of unreported sales.

We really don’t know the factor, but I suspect that only something like 20% of the sales above $500 are in NameBio, so I fairly arbitrarily multiplied the number of reported sales in each extension by a factor of 5 to account for sales not listed in NameBio. It is possible that the correction factor should be different by extension, and that would impact the following results.

Shown below are the industry-wide sell-through rates by extension, with the 5x correction factor, and only considering sales at $500 or more.

Viewed this way, the chance your domain name sells does not depend as strongly on extension, at least for these TLDs, as you might think. Both

Your Domain Name Probably Won’t Sell This Year

One obvious point should be stressed. Across all 19 million

Now this does not necessarily apply to you. Your domains might be much more desired than the industry average, or you may be more effective getting your names noticed. But on average this is the situation, even assuming that 4 out of every 5 sales are not in NameBio, and having corrected for that.

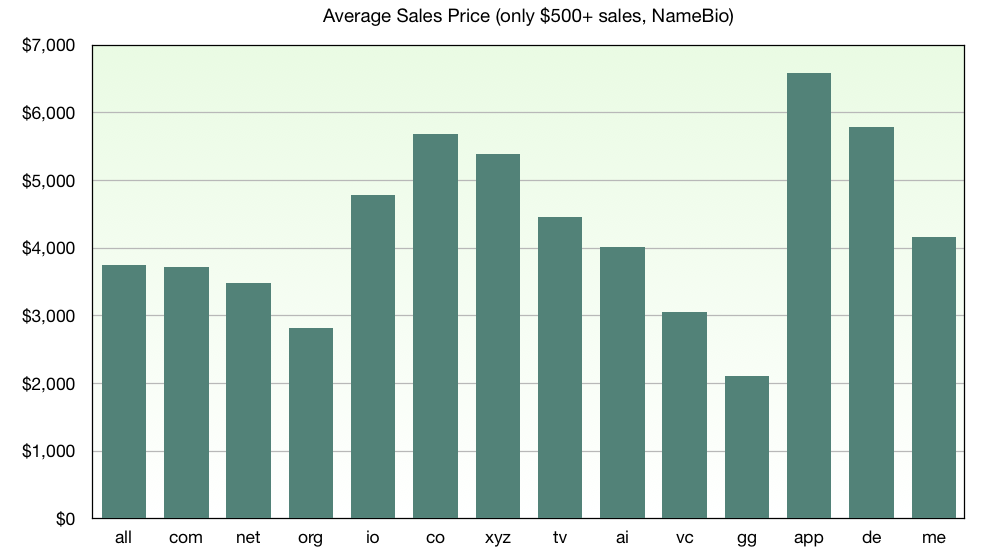

Average Sales Price Matters

Let’s go back to the art gallery example. There is one factor that I left out earlier. The average sales price matters. If one gallery, on average, sells work at a much higher price, even if the rate of sales at that gallery was less, it might still be the best place to sell at.

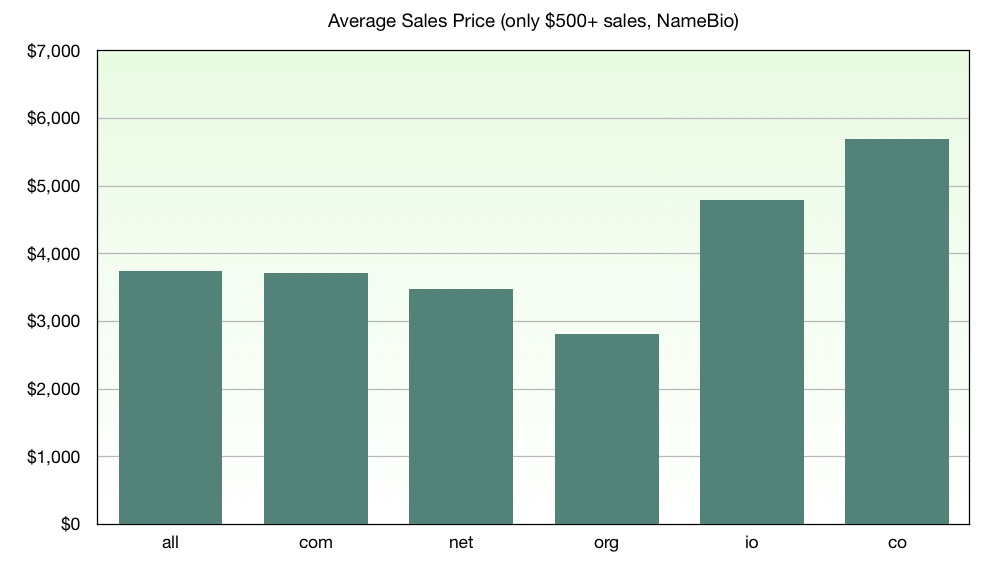

This is important for domain extensions too, so for each TLD I looked at the average sales price. Note this is only for domain names that sold at $500 or more. The overall average price would be substantially lower, as most sales reported in NameBio are just a few hundred dollars.

The average prices are, perhaps surprisingly, somewhat similar across these TLDs. The

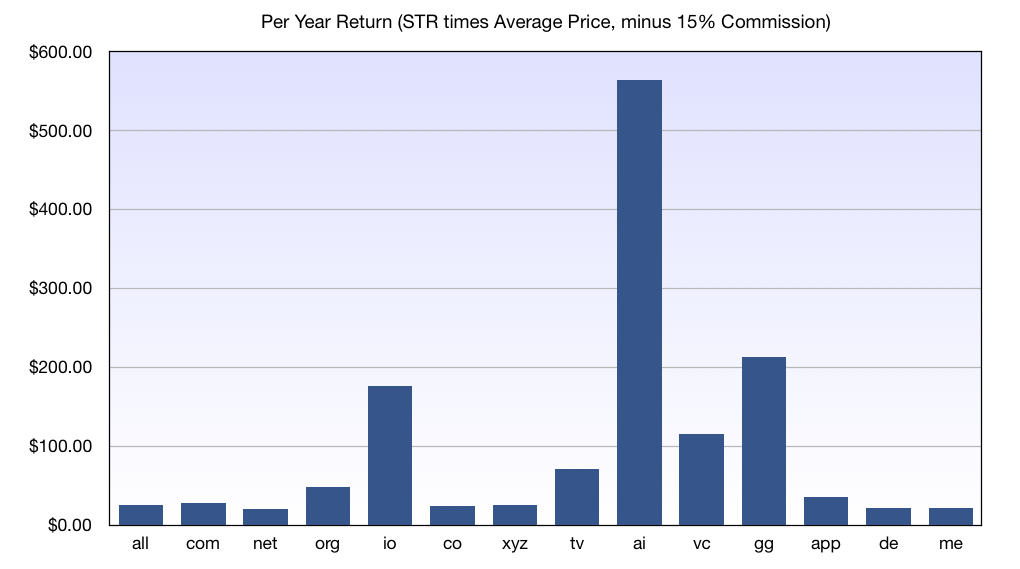

Per Year Return

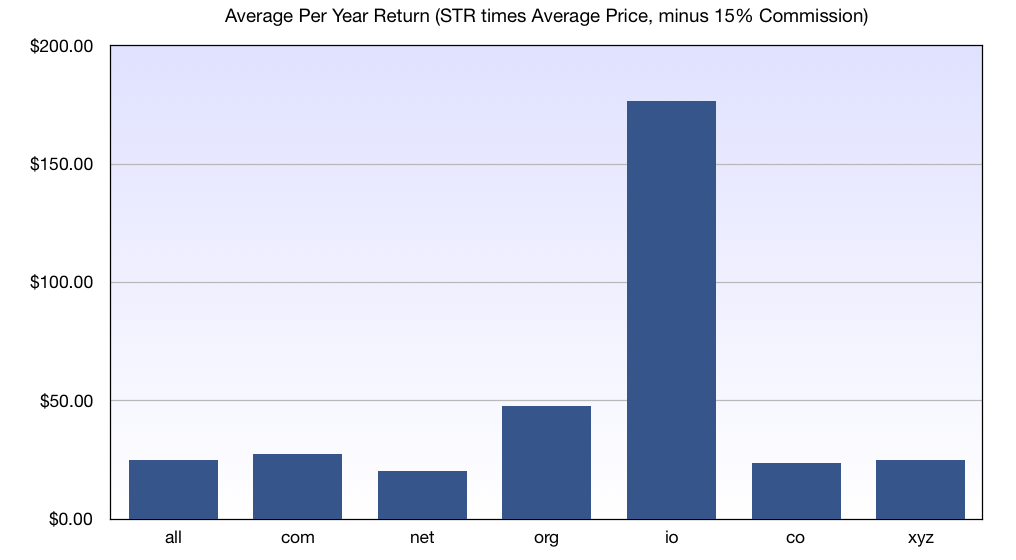

Now let’s combine the percentage that sell and the average price data by multiplying the two to obtain an average per domain name annual return. Most domain names, in any given year, will yield nothing, at least if parking is not considered, but a few will have a big net return, so this number is the average across the portfolio.

In calculating this I reduced the average sales price to account for an average 15% commission, to obtain a net return. Commission rates range from 0% to 35%, but the exact commission assumed will have no impact on the relative values in what follows.

Other than

Overall Ratio

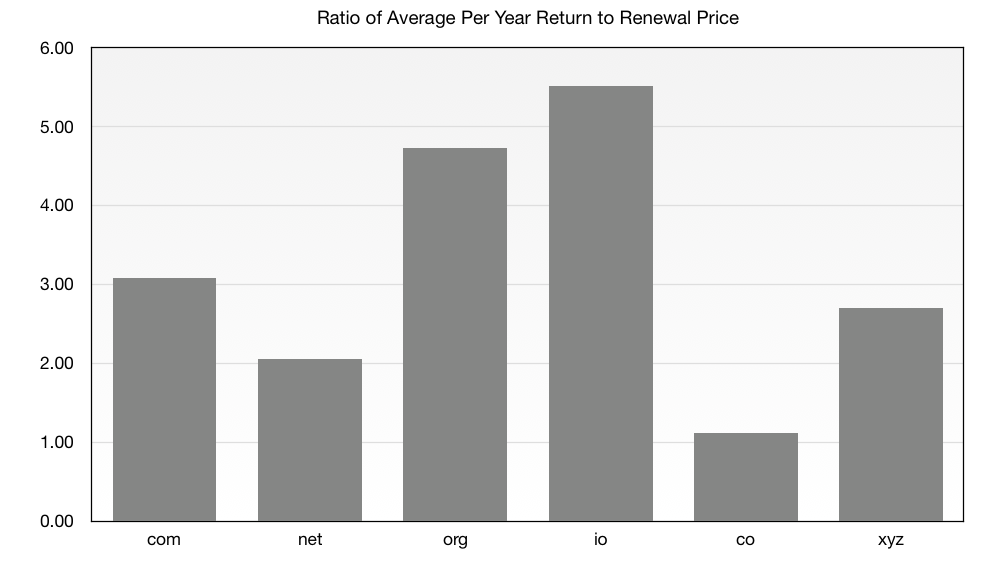

While

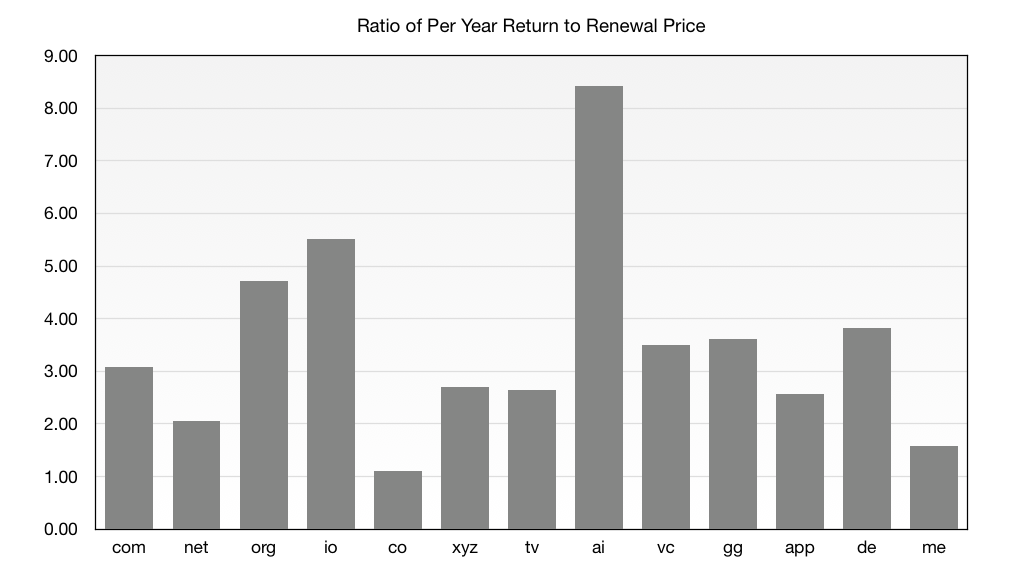

For each TLD, I went to TLD-list and obtained the third-lowest renewal rate for the extension. I did that, rather than take the lowest, since often the lowest has some restrictions, or is at a little-known registrar.

I then calculated the ratio of the average per year return to the average annual holding cost, as indicated by renewal cost, to obtain an overall ratio that takes into account the number of sales, number listed for sale, average sales price, unreported sales, commission, and holding cost. Here are the results, with a higher ratio meaning better.

While

What About Other Extensions

I did a similar analysis on a number of other, more specialized, extensions that are commonly held by domain name investors. Here are the TLDs that I added, with their computed sell-through rates. Note that the scale on the graph is different, but the methodology is the same.

Next, are the results for average sales prices with both the original and added extensions included.

The average annual return per domain for the larger group of TLDs is shown below. The

It is expensive to hold

Some Final Thoughts

Please don’t simplify the message of this article as invest in

Also, keep in mind that the data set is limited for some extensions, and therefore considerable uncertainty in derived measures. The

Also, some of the extensions, like

While many types of domain names sell for good prices in

It remains good advice to invest in what you know.

But keeping an open mind, and looking at data, is also helpful, in my opinion.

Thanks to NameBio, TLD-list and Dofo for the data upon which this study is base.

.com? I went looking for an answer in recent domain name sales data.There seems a common consensus that, after

.com, among general purpose extensions with investment potential are .net, .io, .org, .co and .xyz. There is not agreement on the order of the top level domains (TLDs) after .com. Mainly .COM Sells

To focus on recent trends, I only looked at the last 12 months of data. NameBio is the best source for domain name sales data. To concentrate on sales at significant prices, and to downplay domainer acquisitions or liquidation sales, for this analysis I only considered sales of $500 or more.

So what does that show? The vast majority of sales are in

.com, about 33,300 of the 41,000 sales. But It Is Mainly .COM That Are For Sale

I used Dofo to look at the domain names that are listed for sale across all of the major marketplaces. That is a lot of domain names – 26,091,975 the day I checked. Here is how they break down by domain extension.

The

.com data so dominates both graphs that it is difficult to discern much more. There does seem to be a few interesting aspects, such as .org seems to sell more frequently than .net, even though there are more .net domain names listed for sale. Which Art Gallery To Sell At?

Let’s say you are a conventional artist, and trying to decide which art gallery in your city to sell your work at. There is a huge multi-location gallery with an active online presence. It sells 10,000 works per year. You also have the option of a small local gallery that sells 100 works per year. Choice of which to use is pretty obvious, right?

Not so fast. Let me add that the big gallery has 200,000 pieces of art listed for sale across their locations, while the small gallery has only 400. If you are listing, the odds that your work will sell, the probability, matters. At the big gallery, there is about 1 chance in 20 a listed artwork will sell at the end of one year, while at the small gallery it is 1 chance in 4.

Percentage That Sell

So let’s look at the data from the first two graphs as a percentage of the names listed for sale that sell in each extension. When we calculate that percentage for a portfolio, we call it the sell-through rate (STR). Here we are treating the data as though the entire domain name ‘industry’ is one portfolio, an industry-wide sell-through rate.

Now before I calculate that, I should adjust for the domain names that sold, but never were reported to NameBio. That is a significant factor in retail sales, as Sedo sales less than $2000, most sales at Afternic and Dan, and the majority of sales from the brandable marketplaces, do not get reported. That is a lot of unreported sales.

We really don’t know the factor, but I suspect that only something like 20% of the sales above $500 are in NameBio, so I fairly arbitrarily multiplied the number of reported sales in each extension by a factor of 5 to account for sales not listed in NameBio. It is possible that the correction factor should be different by extension, and that would impact the following results.

Shown below are the industry-wide sell-through rates by extension, with the 5x correction factor, and only considering sales at $500 or more.

Viewed this way, the chance your domain name sells does not depend as strongly on extension, at least for these TLDs, as you might think. Both

.io and .org have a higher rate than .com, while .net, .co and .xyz are somewhat less. Your Domain Name Probably Won’t Sell This Year

One obvious point should be stressed. Across all 19 million

.com domain names listed for sale, there is only a 0.88% chance that any particular domain name will sell within a 12 month period. Viewed another way, if your domain names are as good as the industry-wide average quality, for every 114 domain names in your .com portfolio, on average, 1 will sell for $500 or more after one full year. Now this does not necessarily apply to you. Your domains might be much more desired than the industry average, or you may be more effective getting your names noticed. But on average this is the situation, even assuming that 4 out of every 5 sales are not in NameBio, and having corrected for that.

Average Sales Price Matters

Let’s go back to the art gallery example. There is one factor that I left out earlier. The average sales price matters. If one gallery, on average, sells work at a much higher price, even if the rate of sales at that gallery was less, it might still be the best place to sell at.

This is important for domain extensions too, so for each TLD I looked at the average sales price. Note this is only for domain names that sold at $500 or more. The overall average price would be substantially lower, as most sales reported in NameBio are just a few hundred dollars.

The average prices are, perhaps surprisingly, somewhat similar across these TLDs. The

.io and .co prices are a bit higher, on average, while .org are slightly lower. Per Year Return

Now let’s combine the percentage that sell and the average price data by multiplying the two to obtain an average per domain name annual return. Most domain names, in any given year, will yield nothing, at least if parking is not considered, but a few will have a big net return, so this number is the average across the portfolio.

In calculating this I reduced the average sales price to account for an average 15% commission, to obtain a net return. Commission rates range from 0% to 35%, but the exact commission assumed will have no impact on the relative values in what follows.

Other than

.io, most of the other TLDs studied are not greatly different in per year return.Overall Ratio

While

.io is looking good, that extension is also expensive to hold, at least compared to legacy TLDs or .xyz. That factor should be incorporated into the analysis. For each TLD, I went to TLD-list and obtained the third-lowest renewal rate for the extension. I did that, rather than take the lowest, since often the lowest has some restrictions, or is at a little-known registrar.

I then calculated the ratio of the average per year return to the average annual holding cost, as indicated by renewal cost, to obtain an overall ratio that takes into account the number of sales, number listed for sale, average sales price, unreported sales, commission, and holding cost. Here are the results, with a higher ratio meaning better.

While

.io and .org come out slightly better, and .co worse, there are a few things to consider.- No account has been made for differences in acquisition costs.

- Some TLDs have more stability over a long period. In other words, the risk is not constant across the TLDs studied.

- I have not taken into account that

.coand.xyzare deeply discounted first year, so the ratio for holding a single year would be much more favourable in these extensions than shown. - While the per year return data suggests that, in the long run, average investment in every TLD studied has a net profit, that is largely due to using the average price which is highly inflated by a small number of very high sales. That quality of domain names, such as high-value dictionary words in

.com, is not reflected in many portfolios. - Also, I have not taken into account other holding costs, or the value of your time spent in domain name investing.

- It is possible that the ratio of unreported sales is very different across extensions.

What About Other Extensions

I did a similar analysis on a number of other, more specialized, extensions that are commonly held by domain name investors. Here are the TLDs that I added, with their computed sell-through rates. Note that the scale on the graph is different, but the methodology is the same.

Next, are the results for average sales prices with both the original and added extensions included.

The average annual return per domain for the larger group of TLDs is shown below. The

.ai extension is the outlier, since it has both a very high industry-wide sell-through rate and a high average sales price.It is expensive to hold

.ai, however, so while it still does well in the overall ratio, it is not quite as much outside the norm.Some Final Thoughts

Please don’t simplify the message of this article as invest in

.ai and .io, or dump your .co. While I think the data is worth considering, it should just be one aspect to take into account. As noted earlier, I see a higher risk associated with investment in most of the extensions other than .com.Also, keep in mind that the data set is limited for some extensions, and therefore considerable uncertainty in derived measures. The

.vc numbers are encouraging, but are derived from just 84 sales over $500 in the 12 months studied. The .app results depend on even fewer, 61 sales.Also, some of the extensions, like

.xyz have completely different results than would have been present just one year earlier. While many types of domain names sell for good prices in

.com, every other extension has a narrower appeal, meaning that one must understand not just what makes a good domain name, but what makes a good domain name in that extension. It remains good advice to invest in what you know.

But keeping an open mind, and looking at data, is also helpful, in my opinion.

Thanks to NameBio, TLD-list and Dofo for the data upon which this study is base.